Is state tax filing required?

i only have interest income from savings accounts reporting on 1099-INT. Last year, I filed state tax 2023 in CA with the same source of income.

I relocated and lived in NC in 2024. I did not earn any income in both states other than the interest income from bank savings accounts.

Question: Do I have to file tax for both CA and NC or only NC? Thks

Answers

-

please be noted that the 1099-INT reported under my address in CA, so I am worried if I need to file a CA state tax regardless I relocated to other state.? Please advise.?

0 -

Hi catmtax,

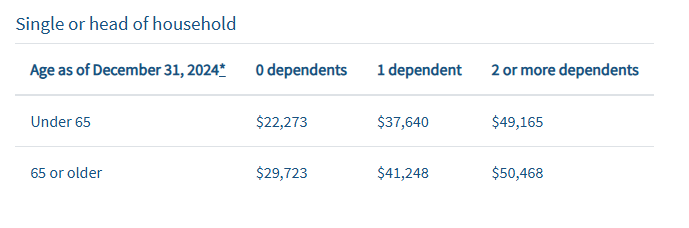

Every state has rules and thresholds for filing requirements. Here is a CA Finance Tax Board (FTB) with "filing requirements" for nonresidents and part-year residents. For example:

Look at the table, find your filing status and situation. If your income from CA sources is higher, then you need to file.

0