How to estimate 1986 value of inherited silverware to determine capital gains?

In 1986 I inherited quite a few pieces of sterling silver flatware. Recently I sold them for scrap. I haven't been able to find any information on their approximate 1986 value. How do I estimate the capital gains, if any, from the sale, and do I have to document that estimate?

Comments

-

Hello MairsyDoats,

Welcome to the community. The sale of something like silver flatware would be considered the sale of a collectible. When you report the sale, it is reported as a capital gain and sell of an inherited item. Your basis (or cost) is the value at the time it is inherited. To get an estimate, do a web search for "Price of scrap silver in 1986". Were you paid by the ounce of silver? I found that the average price of Silver in 1986 was $7.01 per ounce during 1986. You'll need to figure out a base price of the silver scrap for the amount you were paid.

Report the sale in the Investments and Savings section.

Then Add an Investment. You can use Other Sales to enter the inherited silver flat ware sale. Then report who the sale belongs to (if you are filing Jointly). You'll need to enter a name of a Broker. This could be a pawn shop, precious metals dealer or on-line marketplace.

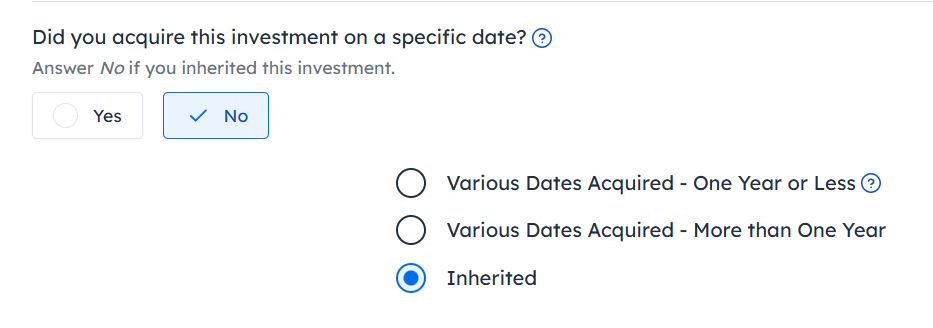

Then you should select to enter "One at a Time", since you likely do not have a consolidated statement. Select that you did not get a Tax Form like a 1099-B. When you start your entry, select No to the question, "Did you acquire this investment on a specific date?" and then check that it was Inherited.

Enter the estimated inherited basis and the price you sold it for. That will report the sale of the collectible on your tax return and list it on Form 8949 and Schedule D.

1 -

Thank you very much, MatthewD. This helps me greatly. I inherited a complete sterling flatware service plus various other pieces. I sold it for scrap, the price quoted as $/gram. I was knocking myself out trying to determine what the value in 1986 would have been as a complete collectible set. But I should instead use the 1986 scrap price. Again, thank you.

0