10% additional tax on interest from immediate annuity.

I'm having a heck of a time getting a definitive answer on the matter described below. My spendthrift daughter inherited some money from an aunt. I convinced her to buy a 10-year-certain immediate annuity that will pay out monthly for 120 months. The immediate annuity was purchased with after-tax dollars (making it nonqualified). Payments started the month after the annuity was purchased. The principal portion of the payment is not taxable but the interest portion is. For her tax-year 2024 1099-R, the box 7 distribution code is 1, meaning 'early distribution, no known exception'. Without entering any exceptions this would result in a 10% penalty (tax) being applied to the interest paid out. On form 5329 there is an exception for substantially equal periodic payments (SEPP). I can't use this exception because my daughter is 35 years old, and it's longer to age 59-1/2 than it is to 10 years (SEPP rule). However, there is another reference on the IRS website in publication 575 stating that immediate annuities are an exception (see text below from Pub 575). There is no exception code given to enter for this that I can find. I've read that insurance companies issuing 1009-Rs often use code 1 in box 7 indicating early distribution even if it's incorrect. So anyway, is the interest from the immediate annuity subject to the 10% tax penalty or not, and is there an appropriate code to use on form 5329?

From Pub 575, see the last bullet point.

Additional exceptions for nonqualified annuity contracts. The tax doesn’t apply to distributions that are:

• From a deferred annuity contract to the extent allocable to investment in the contract before August 14,1982

;• From a deferred annuity contract under a qualified personal injury settlement;

• From a deferred annuity contract purchased by your employer upon termination of a qualified employee plan or qualified employee annuity plan and held by your employer until your separation from service; or

• From an immediate annuity contract (a single premium contract providing substantially equal annuity payments that start within 1 year from the date of purchase and are paid at least annually).

Comments

-

Hi Cobiecat,

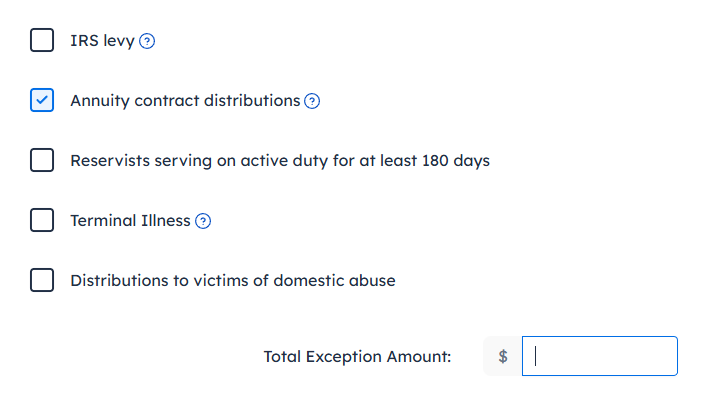

We do have an exception code for your daughter's situation. See the exception, "Annuity contract distributions" at the bottom of the, Do any of these 10% penalty exceptions apply? page. This will print the correct exception code 16 on line 2 of Form 5329. You need to click on the More… at the bottom to get the rest of the exceptions to show.

Then enter the amount of the distribution so the exception is calculated on the Form 5329.

0 -

Fantastic! thank you I'll check it out. I think I had a different problem a few years back where I also missed the 'more' button. My fault obviously.

0