Contributed by: AndreaS, FreeTaxUSA Agent, Tax Pro

A second home is typically a home that is used by you part of the year. This includes a vacation home or a smaller home in another city you live in occasionally throughout the year for business. It is a home used for personal use that isn’t your main home. When you’re ready to sell a second home, our software is here to help you report it correctly on your return!

What do I need to start?

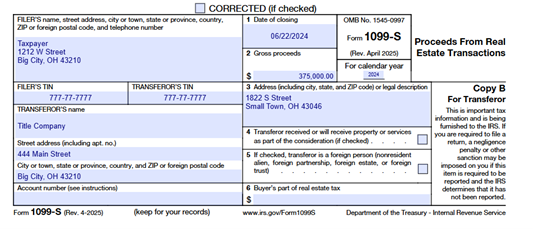

When you sell a second home, you should receive a Form 1099-S. The form should be filled out by the person responsible for closing the sale. This is typically the title company, escrow company, or mortgage broker. If you haven’t received a 1099-S when you’re ready to file your tax return, you may want to contact the company or broker for the form. Your Form 1099-S will look similar to this example and include the date of closing of your sale in Box 1 and the amount of gross proceeds from your sale in Box 2:

How do I enter the information in FreeTaxUSA?

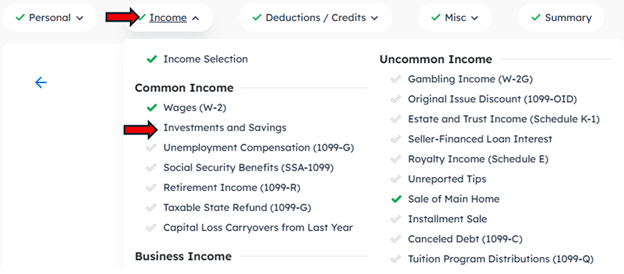

Once you have your tax form, you’ll follow this menu path: Income > Investments and Savings:

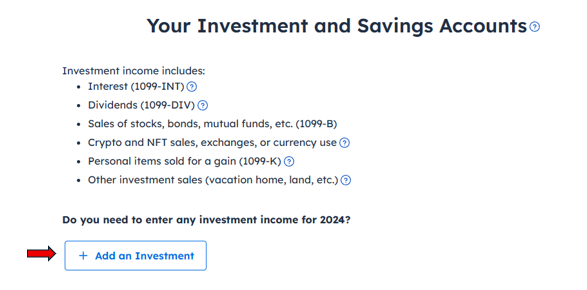

Then select Add an Investment:

There are several different types of investments listed. Select Other Sales to get the correct questions to report the sale of a second home. Then select Save and Continue to enter the information from Form 1099-S.

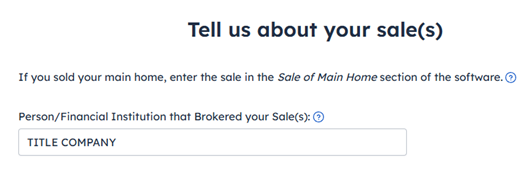

The first screen will ask about the person or financial institution that brokered the sale. This information is found in the box with the Transferor’s name.

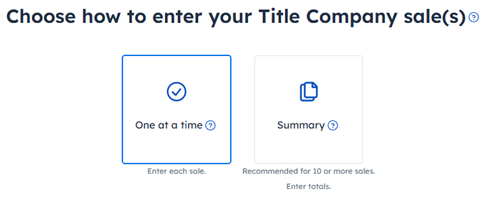

Continue to the next screen and select One at a time and Continue.

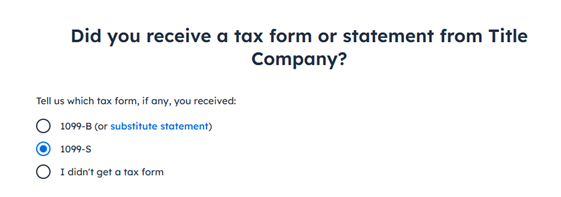

You can now indicate in the software that you received a Form 1099-S. Make your selection and select Continue. You will then be prompted with screens to enter information regarding the sale of your second home.

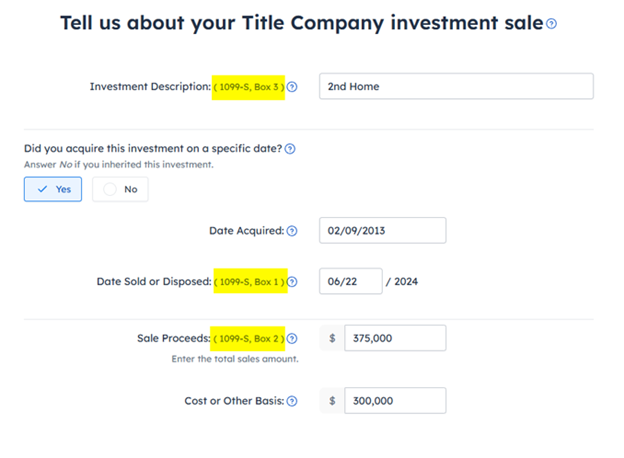

While your form will have most information needed, it won’t have the cost basis and date you acquired or purchased the home. This information should be included in your original purchase or acquisition documents. Using the example Form 1099-S above, you can see how this screen is filled out. In this example, the original cost was $300,000.

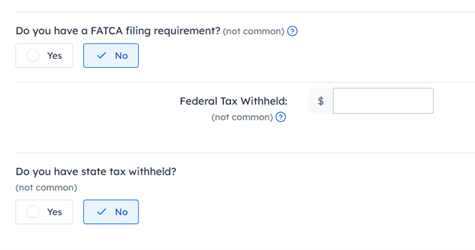

There are additional questions at the bottom of this screen. It’s unusual to provide information to enter in these fields, but make sure to answer them if they apply to you. Then select Continue to move to the next screen.

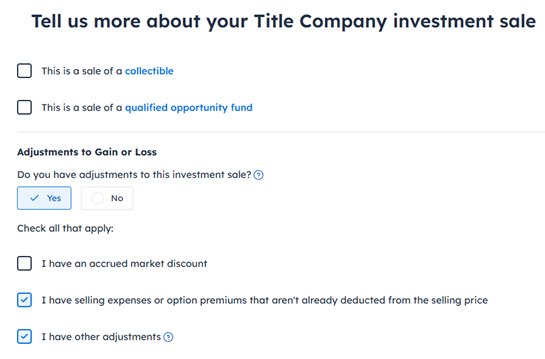

This screen will gather information to determine the gain or loss amount from the sale. While the first two options are not typical for a second home, it’s not unusual to have an adjustment to the sale of a second home.

Typically, adjustments include selling expenses and home improvements while you owned the home. Read more about adjusting your basis and qualifying improvements at this link.

Only enter adjustments if they’re not already figured into the basis or proceeds reported on Form 1099-S.

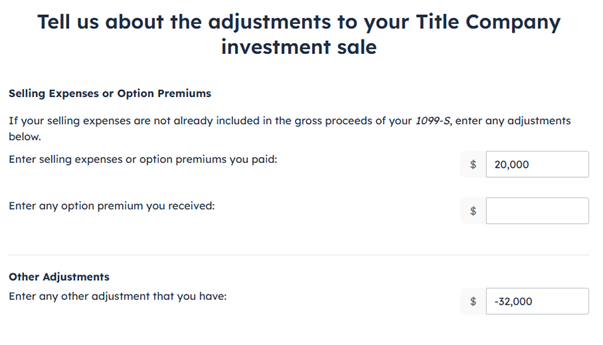

Enter your adjustments on the next screen. Qualifying selling expenses, such as sales commission, advertising or legal fees, will be entered in the first box as a positive number. Qualifying home improvement expenses are entered in the third box ’Other Adjustments‘ and must be entered as a negative number.

Select Save and Continue, and you are done!

What does this look like on my tax return?

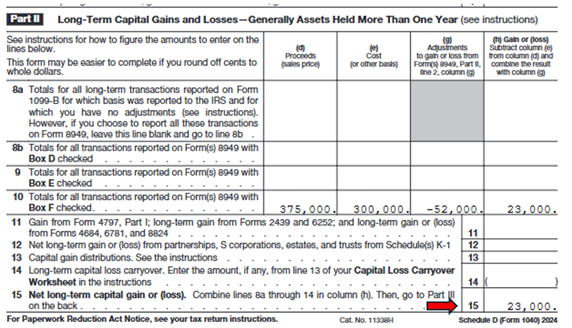

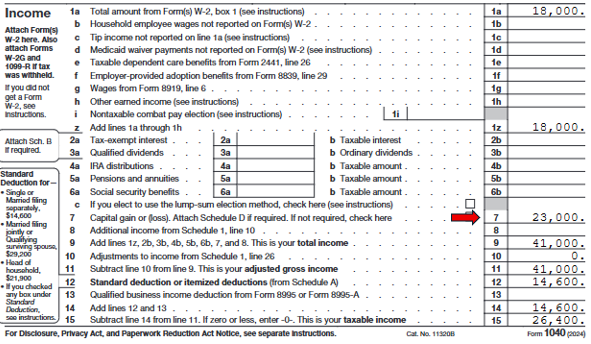

Your home sale entry will be reported on Schedule D and included with your tax return. The Schedule D will show the proceeds (the sale price of the home), cost basis (the purchase price of the home), any adjustments, as well as your capital gain or loss amount.

If you have adjustments, Form 8949 will also be included with your tax return to show the correct code for the adjustments to your capital gain/loss. A capital gain on your sale will result in taxable income. Whereas a loss will offset other capital gains and a portion of other taxable income for the year.

The total capital gain income will then be reported on line 7 of your Form 1040 tax return.

We can help!

Reporting the sale of your second home may seem like a stressful process since it’s not something you are likely to do every year on your tax return. However, we aim to help make the process as smooth as possible. If you run into issues or are unsure of your home sale entries, you can always reach out to our support staff in the Support Center located at the top of the screen in your account.

https://community.freetaxusa.com/kb/articles/90-how-to-enter-a-1099-s-from-the-sale-of-an-inherited-home?