Contributed by: Henry, FreeTaxUSA Agent, Tax Pro

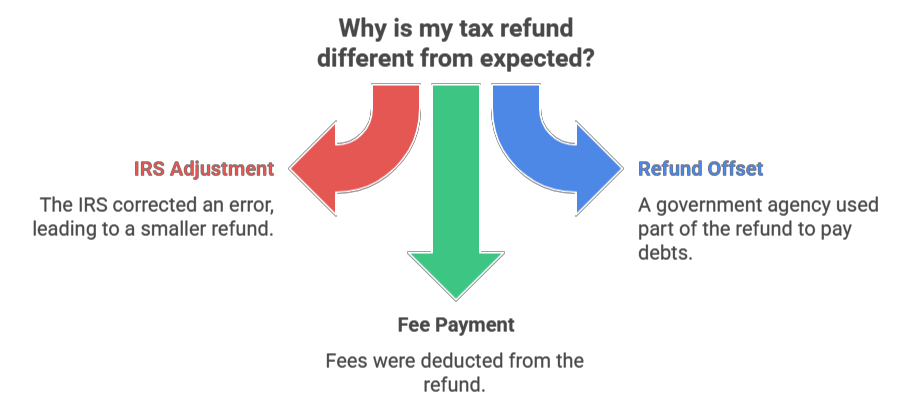

When you prepare your tax return with FreeTaxUSA, our goal is to help you file an accurate tax return while maximizing your refund or minimizing the amount of tax you owe. If you’re due a refund, the IRS will send it to you after they finish processing your tax return. Occasionally, the refund amount you receive from the IRS will differ from the amount shown on your tax return. There are a few reasons why this may happen.

1) The IRS found a mistake on your tax return.

When the IRS receives your tax return, they compare the information you’ve reported to what shows in their system. If they spot an error (such as missing income from a W-2 or 1099), they may adjust your tax return to correct the error. This can lead to a smaller refund.

If an adjustment is made to your tax return, you should receive a notice in the mail advising you of the reason. You’ll have the chance to accept or disagree with the suggested changes; just follow the instructions provided in the IRS notice.

If it’s been a few weeks since you received your refund, and no notification regarding the refund adjustment has come, you should contact the IRS. You can also log in to your individual IRS online account to see if information is available there.

2) Your refund was offset.

A federal or state government agency has possibly taken some of the refund to pay other outstanding obligations (past-due taxes, back child support, overdue student loans, etc.). The IRS makes offsets for past due federal taxes, and you’ll receive a notice from them if this offset applies to you. For all other types of offsets, the Treasury Department’s Bureau of the Fiscal Service handles them, and the Fiscal Service will send you a notice in the mail.

To find out whether your federal tax refund was offset by the Fiscal Service, call the Treasury Offset Program call center at 1-800-304-3107 and select option 1 to hear an automated message for the amount, date and creditor agency or agencies you owe the debt to.

Direct any questions you have about the offset or debt to the agency identified in the offset notice you receive.

3) You paid your FreeTaxUSA fees with your refund.

When using FreeTaxUSA to file your taxes, you can opt to pay our fees with your federal or state refund. If you choose this option, an additional processing fee will be deducted from your refund along with your other order fees.

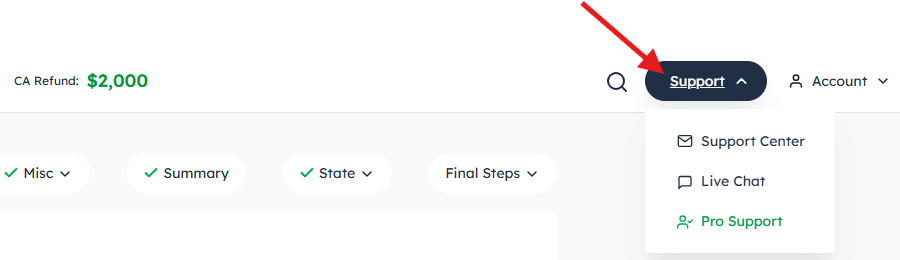

To verify what fees were paid from your refund, sign in to your account and follow the menu path: Final Steps > Step 1 > Your Order. On that page, click on “View your order history.”

Contact FreeTaxUSA Customer Support if you’d like someone to review the charges with you.

Getting help

Our Customer Support agents are eager to help if you have questions. Just keep in mind that the IRS doesn’t give FreeTaxUSA any refund updates once your tax return has been submitted for processing, so Customer Support often won’t have access to information about why you didn’t get your entire refund. Consider the possible explanations discussed in this article to find out who you can contact for more information.