Contributed by: AndyS, FreeTaxUSA Agent, Tax Pro

When you receive a Form 1099-R, the retirement company that issues the form doesn’t always calculate the amount in box 2a for you. How do you know what portion of your retirement distribution or payment is taxable?

In many cases, it’s up to you to figure out what amount to report. The type of retirement account the payment came from will help determine what needs to go in box 2a.

Traditional or Roth IRA accounts

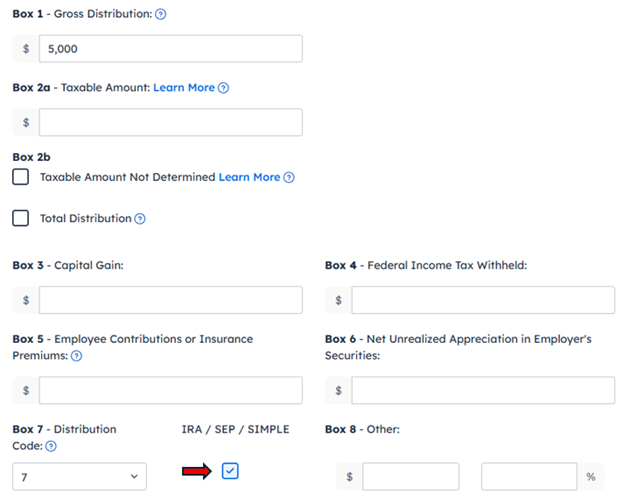

For IRA accounts, box 2a on Form 1099-R is usually left empty. The code in box 7 and your answers to some follow-up questions will help the FreeTaxUSA software determine the taxable amount to be reported on your tax return. You’ll want to make sure your 1099-R input screen matches the form you received. Typically, an IRA account will have the IRA/SEP/SIMPLE box checked. If it’s not, you may need to contact your financial institution to send you a corrected Form 1099-R. Checking that box lets our software know what type of account you have.

Next, be sure to answer the questions on the follow-up screens. You’ll know you’ve visited all the follow-up screens when you’ve moved out of the retirement income section and can select other types of income. Your taxable amount will then be calculated for you and placed on line 4b of Form 1040.

Pension or annuity accounts

A pension includes accounts like a state retirement pension for public service workers, a 401(k) plan, or a 403(b) plan. An annuity is a contract written between you and an insurance company, typically a life insurance company, agreeing to give you set payments based on the premiums you have paid. If your retirement distribution comes from a pension or annuity account and box 2a is left empty, you’ll need to calculate the taxable amount.

What if I used tax deferred dollars to contribute to my pension or annuity?

In most cases, a pension or qualified annuity distribution is fully taxable. This means the amount shown in box 1 of your 1099-R would also be entered into our software for box 2a. Since you received a tax break for the contributions when you earned the income, they are taxed now in the year you received the distribution(s) from the retirement account.

What if I used after-tax dollars to contribute to my pension or annuity?

If you used after-tax dollars, you’ll need to determine how much of your retirement distribution should be taxed. Box 5 of your 1099-R form may have the amount of your nontaxable contributions. However, if the information needed to figure out your taxable portion isn’t on your 1099-R form, the software won’t calculate this for you. You’ll need to do it on your own.

Since you’ve previously paid tax on the contribution amount(s), you aren’t required to pay tax on that part of the distribution income again. However, you’ll be taxed on any interest your account has gained over the investment period included in the distribution. The IRS provides the Simplified Method Worksheet to help you determine how much of your distribution is taxable. All the instructions are written directly on the worksheet, making it easier to work through the calculations.

What will my calculations look like?

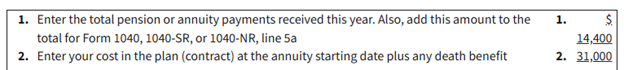

Let’s say you’re 65 years old and have an annuity that you’ve contributed $31,000 to over the years. If you don’t know how much you’ve contributed, your annuity provider can give you that information. You’re entitled to monthly annuity payments of $1,200 and started taking distributions on January 1 of this last tax year ($1,200 x 12 = $14,400 for the year). Your spouse is also 65.

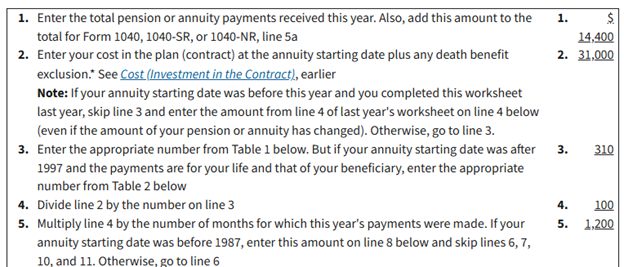

When filling out the Simplified Method Worksheet, you’ll use the total payments received for the year on line 1 and the total amount you’ve contributed on line 2.

How you continue the worksheet depends on whether you have a beneficiary. If you don’t have a beneficiary, you’ll use Table 1 to help determine what to enter on line 3.

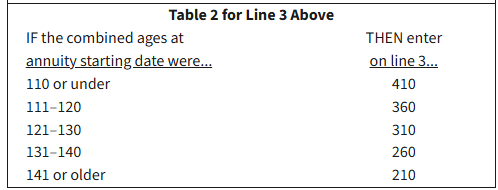

In this example, we’ll assume your spouse is your beneficiary. When you have a beneficiary, you’ll use Table 2 at the bottom of the worksheet to figure the amount for line 3.

Looking at Table 2 based on the ages of you and your spouse (65 + 65 = 130), you’ll enter 310 on line 3.

Next, divide line 2 by line 3 (31,000/310 = 100) and enter the result on line 4. Then multiply line 4 by the number of months you collected payment from your annuity (100 x 12 = 1,200). Enter the result on line 5.

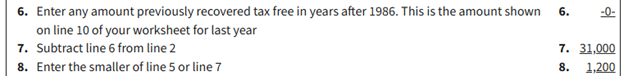

Since this is your first year taking annuity payouts, you won’t have previous tax reporting to look back to and can enter zero on line 6. Next year you’ll have an amount to enter on line 6. Subtract line 6 from line 2 and enter the result on line 7 (31,000 – 0 = 31,000). Now look at line 5 and line 7 to see which number is smaller. In this example, line 5 is smaller, so you’ll enter that amount on line 8.

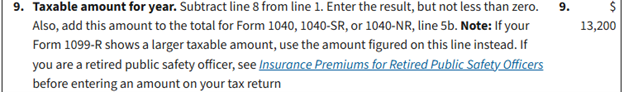

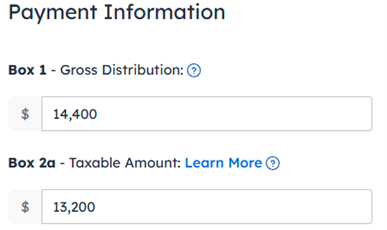

Once you’ve reached this point, it’s time to find the taxable amount of your distributions. Line 1 should be the amount you have in box 1 of your Form 1099-R. Subtract the amount listed on line 8 from the amount on line 1 (14,400-1,200 = 13,200). This is the taxable amount you’ll enter in the software for box 2a of the Form 1099-R.

Note: If you’re a retired public safety officer, there are some additional rules you should be aware of in IRS Publication 575.

Without the additional rules to take into consideration, line 9 will look as follows:

The software entry will look as shown in this graphic:

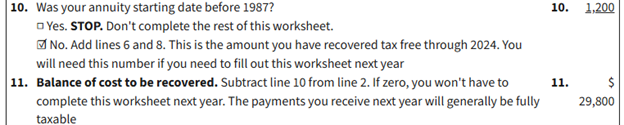

Even though you already know what to enter for box 2a, you’ll want to answer the next two questions on the Simplified Method Worksheet and save it for next year. Your answers will help you complete next year’s worksheet.

Continuing this example, since you started distributions this year, your annuity began after 1987. You’ll add together lines 6 and 8 (0 + 1,200 = 1,200) and enter the result on line 10. For line 11, subtract line 10 from line 2 (31,000-1,200=29,800).

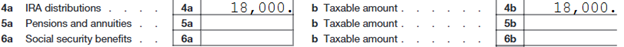

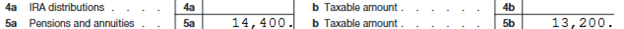

What will this look like on my tax return?

The amount you enter for box 1 of your pension/annuity 1099-R will transfer to line 5a on your tax return (Form 1040), and the amount from box 2a will transfer to line 5b. Only the amount from line 5b will be used to calculate your taxable income.

Things to remember about after-tax pensions and annuities

The IRS requires you to spread out the distribution of the non-taxable amount in your retirement account across several tax years. They won’t let you take all of it out up front, so you need to determine the taxable amount of each distribution using the Simplified Method illustrated in the example above.

Each year, you’ll continue to reduce the nontaxable portion of what you contributed to your pension or annuity until it reaches $0. This is what a ‘balance of cost to be recovered’ means. Once you’ve recovered all previously-taxed contributions (meaning you’ve reached $0), you’ll no longer have a nontaxable amount. The full amount of each subsequent distribution will be taxable.

The Simplified Method Worksheet can seem a little intimidating. While it’s not typical to need to figure your own taxable retirement distribution, it does happen on occasion. When you do need to determine the amount and use the Simplified Method Worksheet, be sure to work through it line by line as described above, and you’ll do great!