Contributed by: LynR, FreeTaxUSA Agent, Tax Pro

Have you ever had a bad year when your business lost a lot of money? Or perhaps you’ve lost your home or property in a disaster and insurance didn’t cover the damage. If these losses exceed your other income, you may be able to claim a net operating loss and use the loss to offset future earnings.

What is an NOL?

A net operating loss (NOL) can occur in any tax year when your deductions are greater than your income. An NOL must be caused by deductions from the following:

- Trade or business

- Casualty and theft losses from a federally declared disaster

- Rental property

In some specific situations, certain employees may have an NOL caused by unreimbursed job expenses.

A loss from operating a business is the most common reason for an NOL.

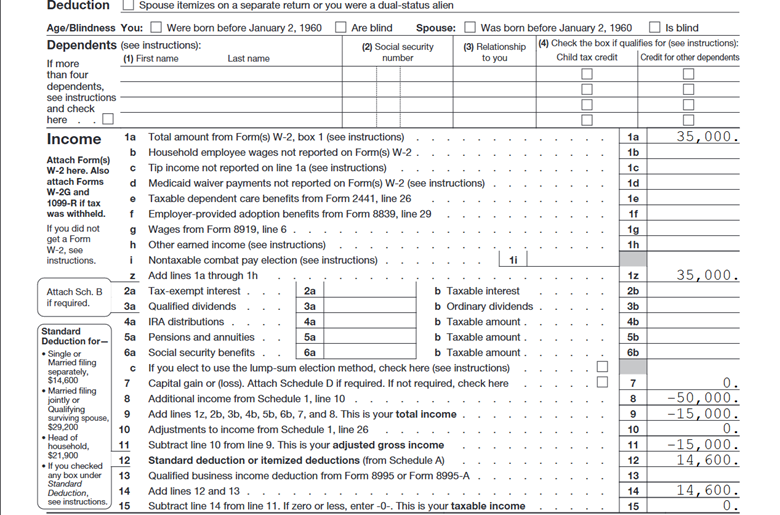

Let’s look at a typical scenario. Beth is trying to get her interior design business up and running. Last year, she started her business and had numerous expenses but didn’t make any money. Her net business loss was $50,000. While she was trying to get this business off the ground, she also held a part-time job at a coffee shop in which she earned $35,000 of wages for the year. As Beth prepares last year’s tax return, her business loss and standard deduction are greater than her wage income, resulting in an NOL for the tax year. Here’s what the first page of her tax return looks like:

As shown in this example, a taxpayer with a negative number on line 11 and/or a 0 on line 15 of Form 1040 is likely to have an NOL.

You have an NOL, what now?

In the year of the loss, simply report all income and losses you have for the year. An NOL occurring in tax years 2021 and after can be carried forward to future year tax returns indefinitely to offset a future year’s taxable income. You’ll need to keep track of your NOL and amounts reported as a deduction on future tax returns.

For business NOLs that originally occurred prior to 2021, different rules apply. View FAQs regarding losses for year 2020 and before at this IRS website.

Reporting an NOL carryforward on your tax return

If you had an NOL on a prior year tax return, an NOL carryforward deduction can be claimed on the subsequent year’s tax return to offset taxable income. However, there are limitations to the amount of the NOL carryforward you can use to offset taxable income. Generally, an NOL carryforward can be applied against up to 80% of the current tax year’s modified taxable income. Any remaining NOL gets carried over to the next tax year (including the 20% not claimed against current year income).

Currently, FreeTaxUSA software doesn’t calculate the NOL or amount you can claim as a deduction on a future tax return. To determine your current tax year’s modified taxable income and NOL carryover deduction, use Form 172.

How to enter an NOL carryover in FreeTaxUSA

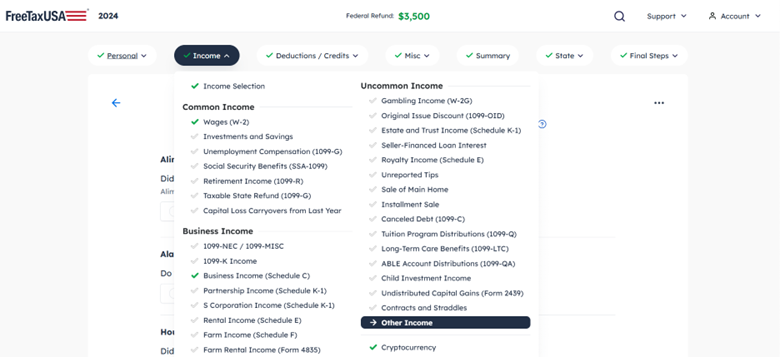

You can claim a prior year NOL as an NOL carryover deduction on a current year’s tax return by going to Income > Uncommon Income > Other Income.

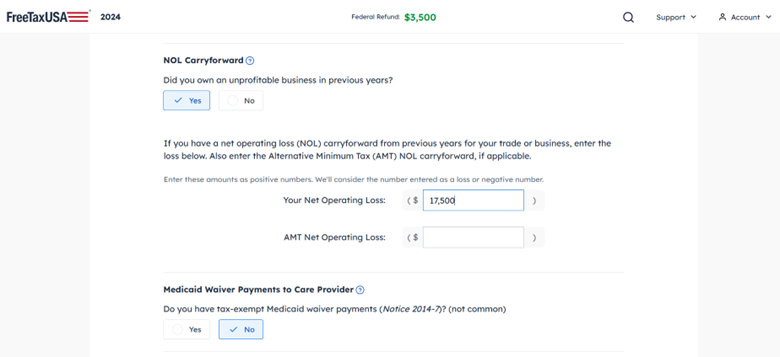

On the Other Sources of Income screen, scroll down to the question regarding NOLs and input the amount you’ll be claiming on this year’s tax return. Remember to take into consideration the 80%-of-taxable-income limit when determining the appropriate amount to enter.

Once you’ve saved your entry, the NOL deduction will be reported on line 8a of Schedule 1 and added to line 8 of Form 1040.

NOL amounts you aren’t able to claim on this year’s tax return can be carried forward indefinitely until you’ve claimed the entire NOL.

What if you have an NOL for multiple years?

If you have an NOL from a prior year and are unable to deduct it on a later year’s return because you have an NOL for that year as well, simply continue to roll both NOLs forward until they can be utilized.

Using our earlier example, Beth had a $15,000 NOL the first year her business was open. The second year, she had an NOL of $5,000. She wasn’t able to claim any of the first year’s NOL on the following year’s tax return since she still had no net taxable income. She’ll have $20,000 to carry forward to future tax returns. The NOLs are carried forward and applied in the same order in which they were incurred, starting with the earliest.

Key takeaways

If you had a business or other type of loss that exceeded your other income in any given tax year, you may have an NOL. An NOL can be carried forward to claim a deduction on future tax returns, offsetting up to 80% of your modified taxable income for the year. Good recordkeeping is crucial when claiming an NOL on your tax return to ensure you’re reporting it correctly and have sufficient documentation if the IRS requests it.