Contributed by KeriC, FreeTaxUSA Agent, Tax Pro

If you and your spouse lived in different states at any point during the tax year, you may need to file tax returns for multiple states. Since state taxes are based on residency status, some additional steps may be required before filing. Special rules apply for those in the military and their spouses.

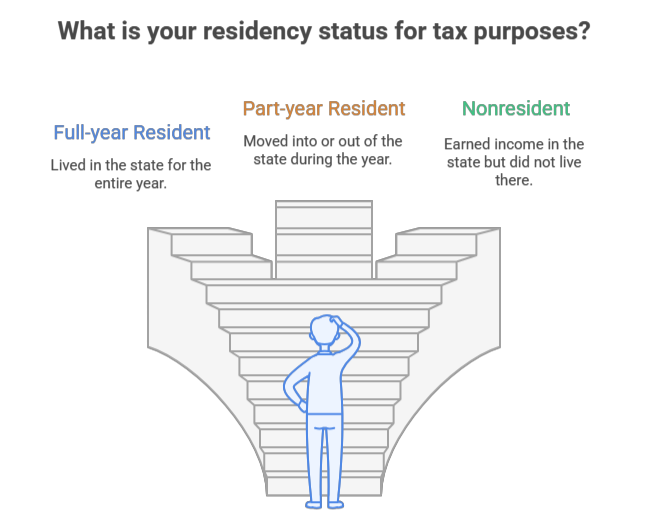

Each spouse will need to determine their residency status for the states of residency in the taxable year, as this will affect your state tax returns and filing requirements.

Each state has its own tax rules regarding residency status. Be sure to check the residency status rules and guidelines for each state. Then, choose your filing status.

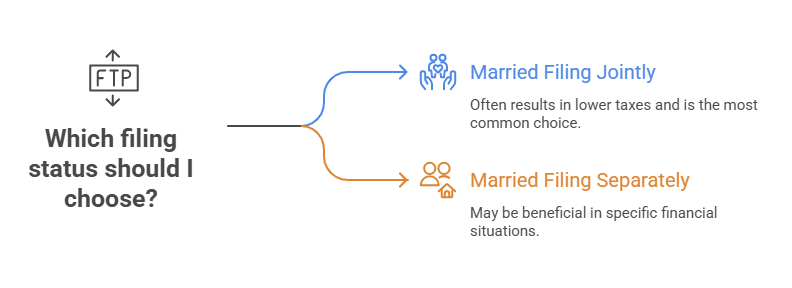

This will influence your state returns. Some states require you to use the same filing status as your federal return even if one spouse didn’t live in the same state. Other states allow a different filing status than what is reported on the federal return.

States that require spouses to use the same filing status as the federal return:

Colorado, Iowa, Idaho, Indiana, Kansas, Louisiana, Minnesota, Missouri, Montana (beginning in 2024), North Dakota, New Mexico, Ohio, Rhode Island, and South Carolina.

States that generally require the same filing status, but have exceptions:

- California

- If you file a joint return for federal purposes, you may file separately for California if either spouse was one of the following:

- An active member of the United States armed forces or any auxiliary military branch during the year.

- A nonresident for the entire year and had no income from California sources during the year.

- Connecticut

- When one spouse is a Connecticut resident and the other is a nonresident, each spouse who is required to file a Connecticut income tax return must file as married filing separately unless they:

- File jointly for federal income tax purposes; and

- Elect to be treated as if both were Connecticut residents for the entire taxable year.

- When one spouse is a Connecticut resident or a nonresident and the other spouse is a part-year resident, each spouse who is required to file a Connecticut income tax return must file married filing separately.

- Georgia

- One spouse is a resident, and the other is a nonresident without any Georgia source income; your Georgia return may be filed jointly or separately with each spouse claiming the appropriate exemptions and deductions.

- Illinois

- If you file a joint federal return and one spouse is a full-year Illinois resident while the other is a part-year resident or a nonresident (e.g., military personnel), you may choose to file “married filing separately.” Don’t recalculate any items on your federal return. Instead, you must divide each item of income and deduction shown on your joint federal return between your separate Illinois returns following the state’s allocation worksheet.

- Maryland

- Married couples who file joint federal returns may file separate Maryland returns when one spouse is a resident of Maryland and the other spouse is a nonresident of Maryland.

- Massachusetts

- If one of the spouses doesn’t have a Massachusetts filing requirement because their Massachusetts gross income doesn’t exceed $8,000, an exemption applies where the spouse with Massachusetts income may choose the married filing separate return status.

- Michigan

- If you filed a joint federal return, you must also file a joint Michigan return. Married couples who file separate federal returns may file a separate or joint Michigan return.

- Nebraska

- When one spouse is a resident and the other is a nonresident or part-year resident, taxpayers may elect to file either a married filing jointly return (both spouses are taxed as residents), or married filing separately returns with Nebraska.

- If you file a married filing separately return for Nebraska, it must be calculated as if a married filing separately federal return had been filed.

- New Jersey

- If during the entire tax year one spouse was a resident and the other a nonresident, the resident could file a separate New Jersey return. The resident calculates income and exemptions as if a federal married filing separate return had been filed. You have the option of filing a joint return, but your joint income would be taxed as if you’re both residents.

- New York

- The only exceptions are for certain married couples filing a joint federal return in the following situations:

- One spouse is a New York State resident, and the other is a nonresident or part-year resident. In this case, you must either:

- File separate New York returns using married filing separately filing status; or

- File jointly, as if you’re both New York State residents, using married filing jointly filing status.

- Oklahoma

- This exception applies to married taxpayers who file a joint federal return where one spouse is a full-year Oklahoma resident (either civilian or military), and the other is a full-year nonresident civilian (non-military). The taxpayers must either:

- File Oklahoma married filing separate. The Oklahoma resident, filing a joint federal return with a nonresident civilian spouse, may file an Oklahoma return as married filing separate; or

- File as if both the resident and the nonresident civilian were Oklahoma residents. Use the “married filing jointly” filing status and report all income. A tax credit may be used to claim credit for taxes paid to another state, if applicable. A statement should be attached to the return stating the nonresident is filing as a resident for tax purposes only.

- Oregon

- If you and your spouse file a joint federal return but each of you has a different residency status, you have a choice of two different filing statuses to use for Oregon:

- You and your spouse may file one Oregon return using married filing jointly status; or

- You and your spouse may each file a separate Oregon return using married filing separately status.

- Utah

- A married couple who files a joint federal return may file separate Utah returns only if:

- One spouse is a full-year Utah resident, AND

- The other spouse is a full-year nonresident.

- Virginia

- If one spouse is a Virginia resident and the other is a nonresident, you may not file a joint Virginia return unless you both elect to determine your joint Virginia taxable income as if you’re both Virginia residents.

- Vermont

- When one spouse isn’t a resident of Vermont, two filing options are available if:

- The couple filed their federal return using married filing jointly status;

- The nonresident spouse has no Vermont income; and

- The resident spouse is a full-year Vermont resident. The two filing options are:

- The couple can elect to have the Vermont nonresident treated as a resident of Vermont by filing a joint Vermont return including all income earned by both spouses. In this instance, the couple may be able to claim a credit for taxes paid to another state; or

- The couple can elect to exclude income of the Vermont nonresident spouse by filing the Vermont resident individual’s tax return for Vermont purposes as married filing separately.

- West Virginia

- If one spouse was a resident of West Virginia for the entire taxable year and the other spouse a nonresident for the entire taxable year and they filed a joint federal income tax return, they may choose to file jointly as residents of West Virginia. The total income earned by each spouse for the entire year, regardless of where it was earned, must be reported on the joint return as taxable to West Virginia. No credit will be allowed for income taxes paid to the other state.

- A joint return may not be filed if one spouse changes residence during the taxable year, while the other spouse maintained status as a resident or nonresident during the entire taxable year.

States that don’t require the same filing status as your federal return:

Alabama, Arkansas, Arizona, Washington, D.C., Delaware, Hawaii, Kentucky, Maine, Mississippi, North Carolina, Pennsylvania, and Wisconsin.

Summary

If you and your spouse lived in different states during the tax year, it’s important to determine if multiple state tax returns should be filed, and accurately report each spouse’s residency status, as it directly affects state tax filing requirements and the choice of filing status. State rules and guidelines vary. To avoid inaccurate reporting, review residency criteria and the filing status options for each state on their Department of Revenue website before submitting your returns.