Contributed by: MatthewD, FreeTaxUSA Agent, Tax Pro

Back in 1978, Congress passed a revenue act creating Flexible Spending Accounts (FSA) to aid employees with medical and dependent care costs.

An FSA allows a person to contribute pre-tax money from wages into a designated savings account to use on qualifying medical and dependent care expenses. The contributions are pre-tax funds, meaning the income is not taxed.

Think of the savings account as money you would have spent anyhow, but instead of spending after-tax money on medical and dependent care, and entering those as itemized deductions and credits on your tax return, you get the benefit of reducing your taxable income upfront and having more money for your regular medical and dependent care costs.

Essentially, you increase your spendable income and save on taxes.

Plan ahead or lose it

The FSA contributions are only available during the current tax year; from January through December. If you don’t spend the FSA money during the calendar year, you forfeit it to your employer. This principle is known as “use-it or lose-it".

With an FSA, you must plan ahead to avoid losing your hard-earned money. At the beginning of the year, calculate how much you think you will spend on dependent care costs for the year and estimate your medical costs. Then work with your payroll or HR department to withhold a set amount from each paycheck.

End-of-year options

By the end of the year, you should have spent all your FSA money. Knowing that you will lose it under the “use it or lose it” rule, what options are available if you haven’t spent it all? Certain employers may provide an extended grace period of up to two and a half months following the conclusion of the plan year to utilize remaining funds; however, this provision is dependent upon the specific terms of your company's plan.

Some employers allow a carryover option, enabling participants to transfer a specified amount of funds into the next plan year. The IRS sets this limit annually; for plan years beginning in 2025, the maximum carryover amount is $660. Employers may not offer both a grace period and a carryover simultaneously and are not required to provide either option.

Tax reporting

FSA contributions are not reported for tax purposes. Employee contributions to an FSA are made with pre-tax money and excluded from box 1 wages on your W-2, reducing both your taxable income and total tax. Some employers may report the health FSA contributions in Box 14 for informational purposes. All you need to do is add your W-2 information in FreeTaxUSA software.

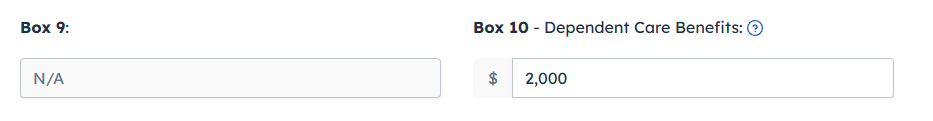

Although similar, if you contributed to a Dependent Care FSA, the annual amount will be reported in Box 10 of your W-2. When you complete the section for Child and Dependent Care Expenses in the software program, this amount will be reported as part of the calculation, which reduces your qualifying child and dependent care expense, since it was a pre-tax contribution.

What if I leave my job?

Unused FSA funds are forfeited to your employer when you leave your job, unless you opt for COBRA insurance. Ask your employer about your options.

Tips

FSA funds are available from day one of your plan year. Payroll deductions and possible employer contributions fund your FSA.

- Plan carefully for unexpected health issues. Factor in regular specialist visits and medication refills when estimating costs such as eye exams and dental care.

- Spread contributions to the plan evenly over the year from your paychecks.

- Plan ahead toward the end of the year and when changing jobs.

Summary

FSA contributions must be used within the current tax year, or the remaining funds are forfeited to your employer under the "use it or lose it" rule. Some employers offer a carryover option, allowing you to transfer money into the next plan year, or a grace period of up to two and a half months after the plan year ends to spend leftover funds. If you leave your job, unused FSA funds are generally forfeited unless you choose COBRA coverage. Planning ahead is essential to avoid losing your contributions.