Contributed by: PhillipB, FreeTaxUSA Agent, Tax Pro

Form 8938 was introduced under the Foreign Account Tax Compliance Act (FATCA) in 2010 to help the IRS combat offshore tax evasion. The form serves as a reporting tool for U.S. taxpayers with certain foreign financial assets. Unlike the FBAR (FinCEN Form 114), which is filed with the Financial Crimes Enforcement Network, Form 8938 is submitted directly to the IRS and covers a broader range of assets, including those in non-state U.S. territories. Taxpayers may need to file both forms if they meet the filing requirements for each.

Who must file Form 8938?

Form 8938 is required for U.S. individuals who have an interest in specified foreign financial assets exceeding certain thresholds during the year or at year-end. U.S. individuals include:

- U.S. citizens

- U.S. resident aliens

- Nonresident aliens making an election to be treated as resident aliens for joint filing

- U.S. corporations, partnerships, and trusts

An “interest” in a foreign asset means that income, gains, losses, or distributions from the asset are (or would be) reportable on the taxpayer’s income tax return, even if there is no current-year tax item.

What assets are reportable?

Reportable assets include:

- Financial accounts at foreign financial institutions (any institution outside the U.S. that accepts deposits, holds assets, or trades securities and similar investments)

- Foreign financial assets not held in such accounts, such as:

- Stock or securities issued by non-U.S. persons

- Interests in foreign entities

- Financial instruments or contracts with non-U.S. issuers or counterparties

Filing thresholds

The thresholds for filing depend on your filing status and where you live:

- Living in the U.S.:

- Single or married filing separately: $50,000 at year-end or $75,000 any time during the year

- Married filing jointly: $100,000 at year-end or $150,000 any time during the year

- Living outside the U.S.:

- Single or married filing separately: $200,000 at year-end or $300,000 any time during the year

- Married filing jointly: $400,000 at year-end or $600,000 any time during the year

For more details on reportable assets, refer to the IRS instructions for Form 8938.

How do I include Form 8938 in FreeTaxUSA?

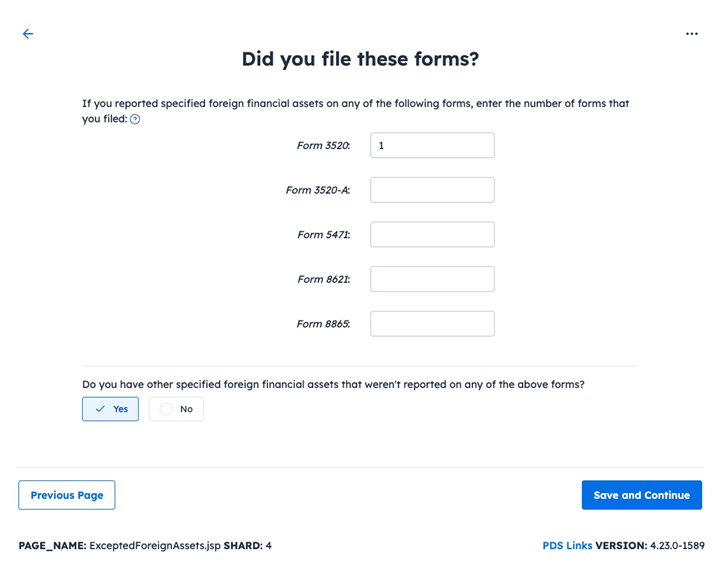

FreeTaxUSA supports e-filing Form 8938. However, if you have foreign financial assets that require Form(s) 3520, 3520-A, 5471, 8621, or 8865, you will need to mail your return with these forms attached and you’ll need to use another software provider or a tax professional to prepare those forms since these forms are not currently supported by FreeTaxUSA.

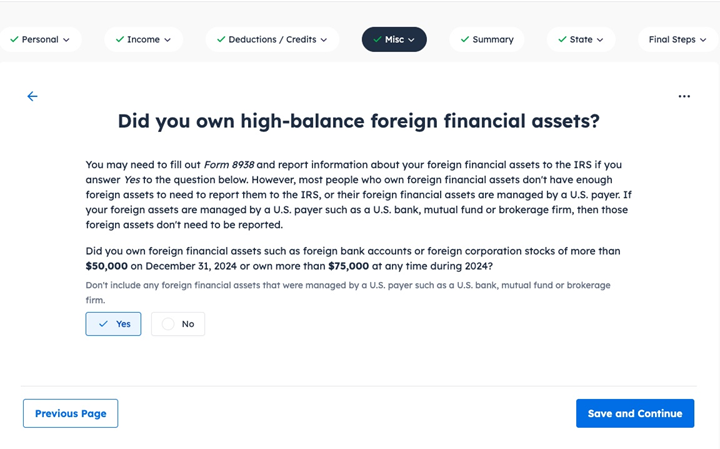

Follow this menu path: Misc > Income section > Foreign Financial Assets.

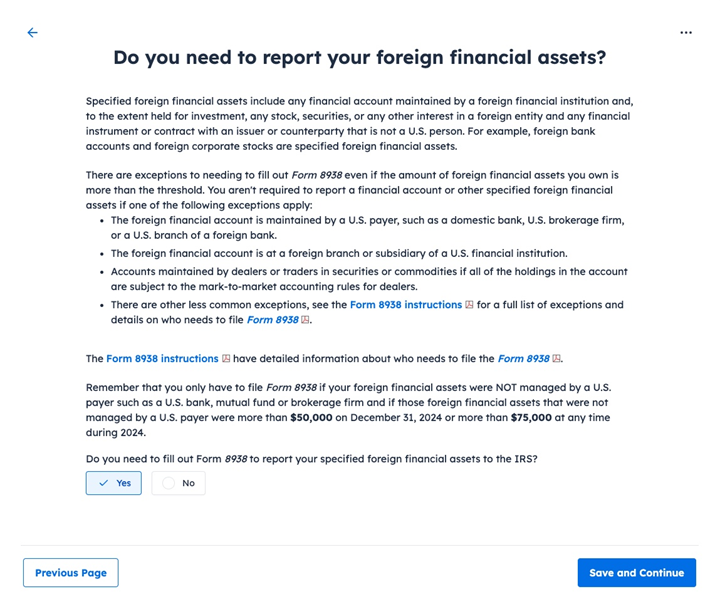

Answer Yes to the initial question and click Save and Continue. The following screen will help you verify if you’re required to file Form 8938. Make sure you review the list of exceptions that are not treated as foreign financial assets before you continue. If you do need to file Form 8938, click yes and then click Save and Continue.

On the screen that follows, you’ll be asked how many Form(s) 3520, 3520-A, 5471, 8621, or 8865 need to be included with your return and whether you have other foreign financial assets besides these that need to be reported. Click Save and Continue after entering what applies to you.

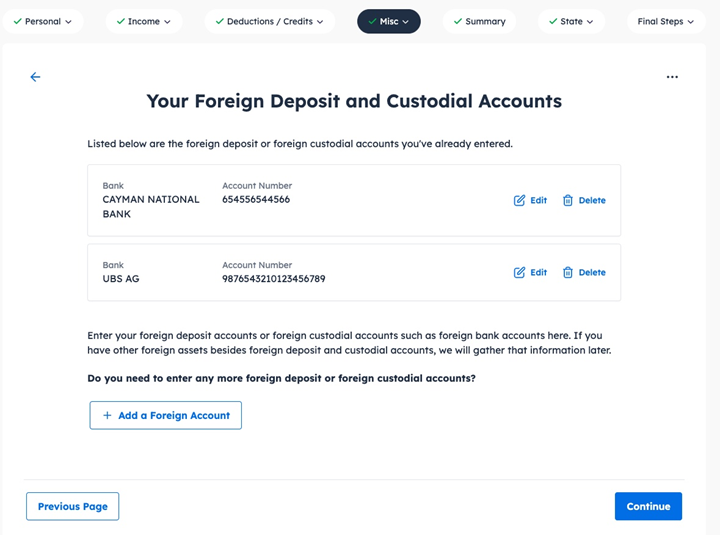

The next screen will allow you to enter the values for all the foreign financial accounts that need to be included with your tax return. Click +Add a Foreign Account

On the screen labeled Foreign Deposit or Custodial Account Information, you’ll need to enter the following information:

- Type of account

- Account number

- Maximum value of the account during the year

- Whether the account was opened or closed during the year

- The foreign currency and exchange rate by which the asset is valued

- The name and address

- The Global Intermediary Identification Number (GIIN) if available.

After you’ve entered all the foreign deposit and custodial account information, you’ll continue to the screen labeled Summary of Foreign Deposit or Custodial Account Tax Items. You’ll need to designate where any income from the foreign financial assets are being reported on your tax return. For example, if your foreign bank account had $1,000 of interest income, you would show the following:

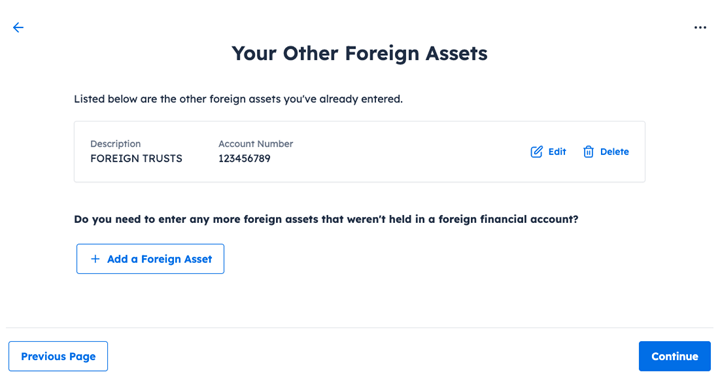

The final section is where you would report the value of any foreign financial assets that are not held in the account of a foreign financial institution. These assets were mentioned earlier, but it would also include interests in foreign trusts reported using Form(s) 3520 and/or Form 3520-A, foreign corporations reported on Form 5471, foreign partnerships on Form 8865, and passive foreign investment companies or qualified electing funds (also known as PFIC) on Form 8621.

Key takeaways

Form 8938, like FinCen Form 114, is an informational document that is used by the IRS to help make sure taxpayers are transparently reporting foreign income and assets on their tax return. Failure to file Form 8938 if you meet the requirements has a penalty of up to $10,000 with the IRS’ first notice of failure to file. If you don’t file the form within 90 days from the first failure to file notice, the penalty increases by $10,000 for each 30-day period the form isn’t filed. The maximum penalty is $50,000.

However, if you failed to file Form 8938, you could request an exception to the penalty if there was reasonable cause and not neglect. If you’ve forgotten to file this form, file it as soon as possible.