Contributed by: Daniel_L, FreeTaxUSA Agent

If you’ve discovered information on a prior year return needs to be changed, or the IRS has asked you to amend your return, you can easily do so, and FreeTaxUSA can help! Amending your return involves three key steps:

- Report Amendment Information

- Make the changes

- Submit the amendment (Form 1040-X)

💡Note: You don’t need to amend your return if the IRS automatically corrects the error(s). When possible, we recommend waiting for your original to be fully processed by the IRS before submitting an amendment. This avoids unnecessary delays in the processing of your return. Also, when amending a prior year tax return, e-filing may be restricted. You may need to print, sign and date the amendment, and send it by mail.

Starting the amendment

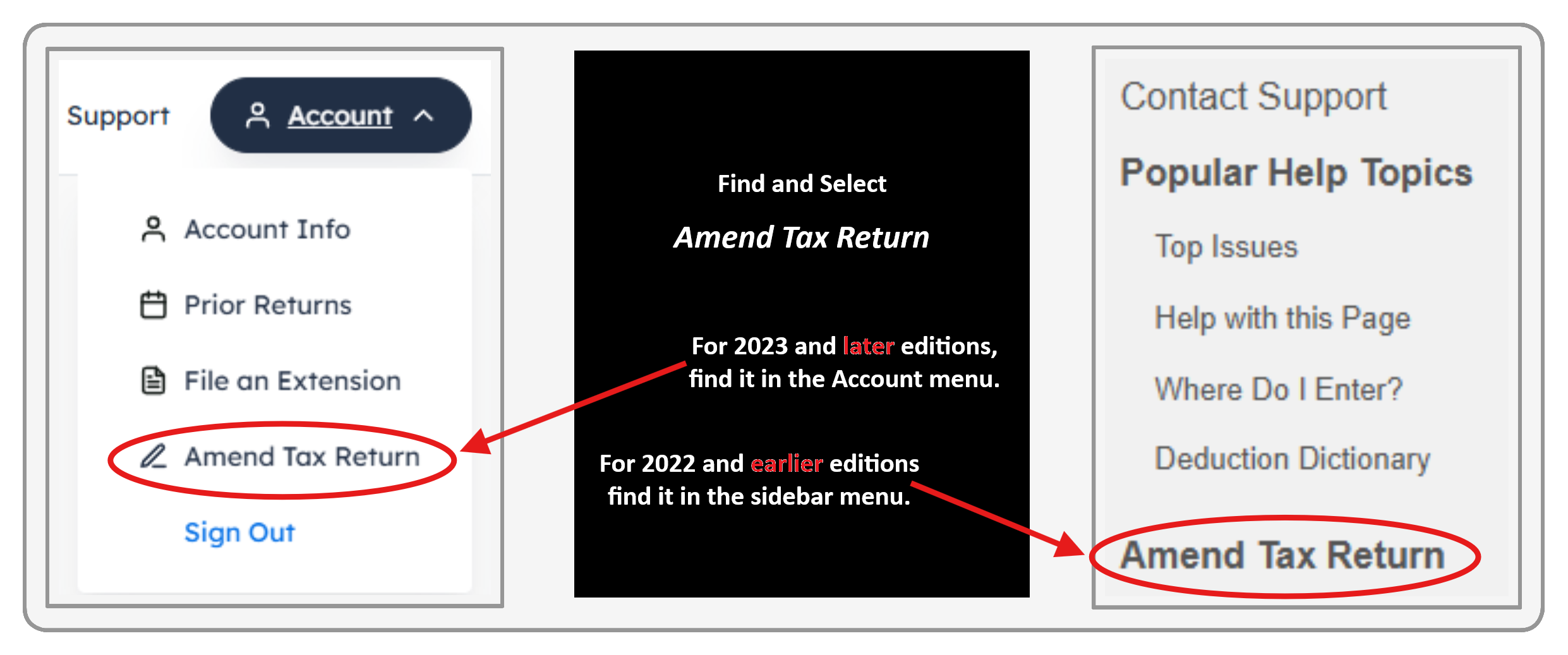

To begin, sign into the FreeTaxUSA edition for the year you need to amend. For tax years 2023 and later, you’ll find Amend Tax Return in FreeTaxUSA’s Account menu. For 2022 and earlier years, look for the link in our sidebar menu.

Report amendment information

Next, enter any prior overpayment (refund) or tax paid (tax payment) in the Amendment Information section.

- For federal only amendments: enter the overpayment or tax paid amount

- If amending a state return: enter the overpayment and/or tax paid amount for each state

Most amendments only need either an overpayment or a tax paid entry for each return. In very rare cases where you previously received a refund and made a tax payment for a return, you’ll make an entry in both the overpayment and tax paid fields. If a refund included interest, do not include the interest as part of the overpayment.

Generally, if your last tax return showed a refund, enter the overpayment amount. If your previous refund was adjusted by the IRS, be sure to enter the actual refund amount you received, rather than what’s shown on your tax return or what's prompted on the screen.

If a previously filed tax return showed tax due, make a tax paid entry only if you actually made the payment.

Here are possible options for the overpayment and tax paid fields based on varying situations:

- Your last submission has been processed by the IRS and you received a refund. Enter the exact refund amount received in the overpayment field. If it includes IRS-paid interest (rare and clearly noted in an IRS letter to you), subtract the interest from the total.

- Your last submission has been received, but not yet processed, and your return showed a refund. Enter the refund amount in the overpayment field. The software will prompt you to enter this amount based on the original/last return completed.

- Your last submission showed a balance due. Enter the amount of tax paid with the last submission plus any additional payments made since filing, in the tax paid field. The software will prompt you to enter an amount based on the original/last return filed. You must manually include any additional tax paid later.

💡TIP: If you have an IRS online account, login to verify your last refund (overpayment) or tax payment(s) (tax paid).

Make the changes

Now, use the menus to access the parts of the return needed to edit, delete, or add information depending on your situation.

Two examples:

- If you’re a foster parent and didn’t know you can claim your foster child as a dependent, follow menu path: Personal > Dependents to add the foster child’s information.

- If you had cryptocurrency transactions or sales you forgot to report, follow menu path: Income > Common Income > Investments and Savings and select +Add an Investment to add the information. Prior year editions have similar menu options in the Income menu.

Save changes on every updated page, before using the menus to navigate to your next change.

Submit the amendment

Finally, after completing and saving all changes, go to the Final Steps menu (Filing menu in some prior years) to complete your amendment. If you didn’t upgrade and pay for Deluxe/Pro Support when completing the original return, you’ll pay for amendment preparation here.

Next, provide a brief explanation for the amendment (e.g., claiming a dependent previously missed). Continue to review the amended return. You’ll see two options for viewing your federal amendment and additional view/download links for each state you’re amending.

The updated 1040 (As Amended) link looks like an original return—showing what the federal return would have looked like if all this information had been reported the first time.

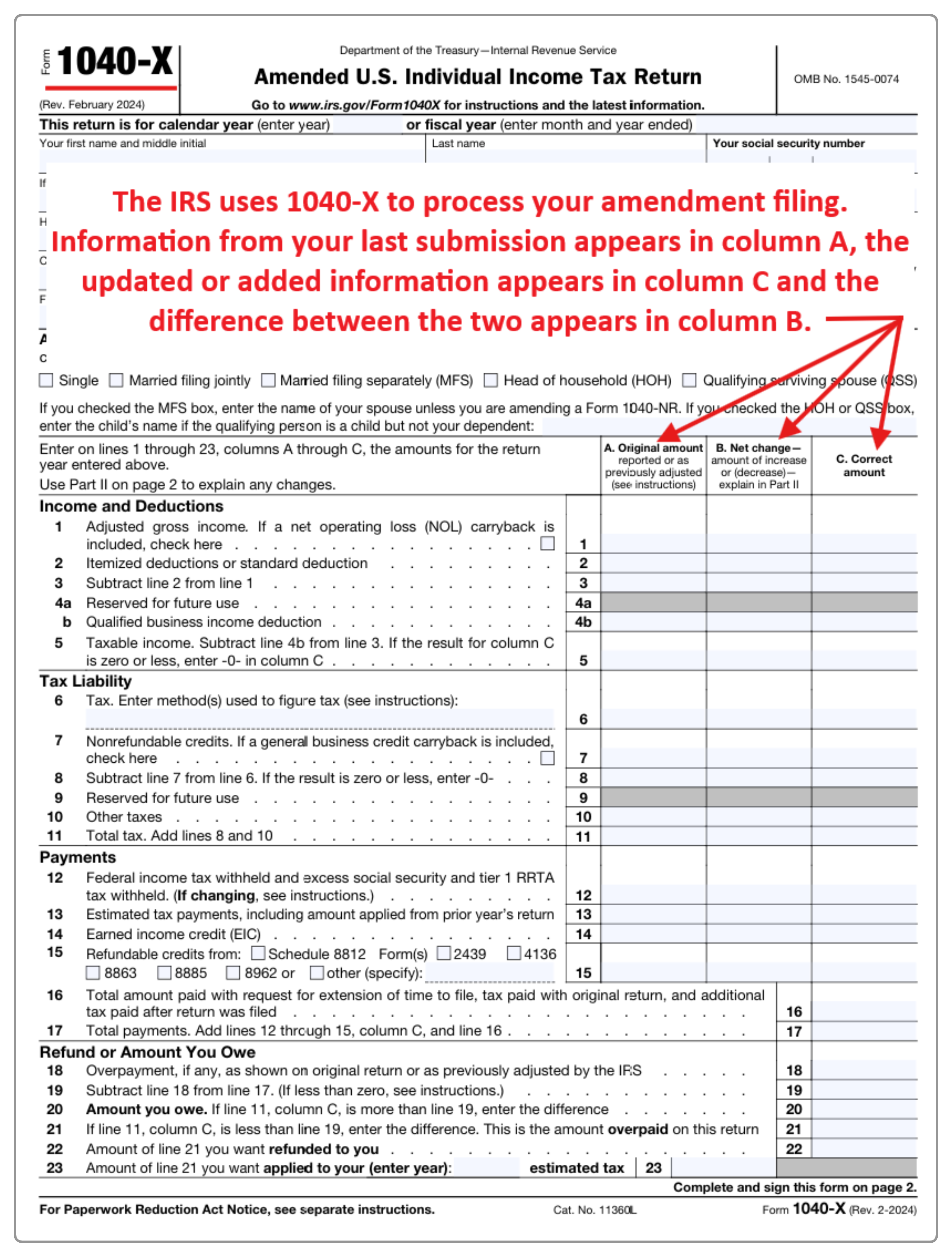

The 1040-X link will show the changes you are reporting with the amendment:

Most states reuse the same tax form with an amendment box marked or other notation. If you’re amending a state return, the view and download links will pull forms that look much like your original submission but now include your updated information.

In FreeTaxUSA, e-filing prior year amended returns depends on IRS and/or state support. Generally, only the two previous tax years can be e-filed, and a 6-digit IRS IP PIN is required. Once you obtain an IP PIN, it must be used for any return filed in the calendar year it was assigned, including your current year return if that isn’t filed yet.

If you prefer not to receive a new IP PIN each year, be sure to opt out of the program.

If you only need to file an amended state return, and not an amended federal return, the state return will need to be mailed.

If mailing your amendment, follow menu path: Final Steps > Submit Tax Return > Check Status/Print Tax Return for the finalized tax forms and mailing instructions. Be sure to sign both the amended return, (Form 1040-X) and the new Form 1040. It may be a good idea to send the amendment via certified mail or get a tracking number for confirmation if you want to verify the IRS or a state receives the submission.

If you’re able to e-file, check your account or watch for an email or text message with amendment status changes. Once accepted, you're done. The IRS or state will process your return and contact you if needed.

Conclusion

Amending a tax return with FreeTaxUSA is a straightforward process when you’ve filed your original with us. By entering accurate amendment information and making changes, you’ll generate a complete and correct Form 1040-X (and state forms if needed). Whether you e-file or mail, be sure to follow the final instructions. And remember—if you’re ever stuck, our Support team is ready to help!

Video Tutorial