Contributed by: WrenD, FreeTaxUSA Agent, Tax Pro

You’ve probably heard of a Roth IRA — a retirement account where your withdrawals are usually tax-free. But not everyone can contribute directly to a Roth IRA because of income limits.

One workaround is an IRA conversion typically called a backdoor Roth: when you put money into a traditional IRA first and then move it into a Roth IRA.

A mega backdoor Roth is a bigger version of that idea. It uses your 401(k) plan instead of a traditional IRA and can let you move significantly more money into a Roth account each year — sometimes tens of thousands more.

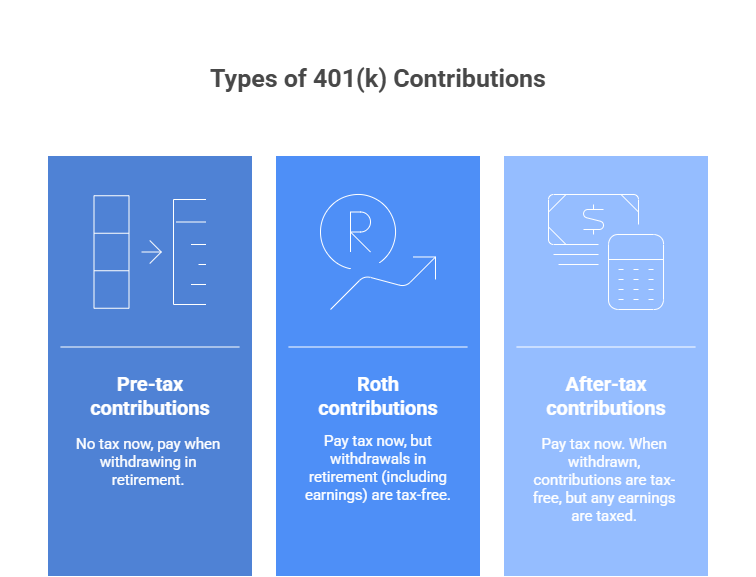

Types of 401(k) contributions

To understand the mega backdoor Roth, it helps to know the difference between three types of contributions that can go into a 401(k).

401(k) contribution limits

In 2025, you can normally contribute up to $23,500 of your own salary into a 401(k) ($31,000 for age 50+ and $34,750 for age 60-63). This limit applies to pre-tax contributions and Roth contributions.

However, the IRS allows a much larger overall limit. This expanded limit accounts for employer contributions and after-tax contributions. The overall limit is $70,000 in 2025 ($77,500 if 50+ and $81,250 for age 60-63). Therefore, the overall total includes:

- Your contributions (pre-tax or Roth)

- Employer contributions (match/profit sharing)

- After-tax contributions

The gap between the $23,500 limit and the $70,000 total is where after-tax contributions and a mega backdoor Roth come into play.

What your 401(k) must allow

Not every 401(k) plan lets you do a mega backdoor Roth. Before you get started, check with your plan provider or HR department to make sure your plan allows two things:

- After-tax contributions: The plan must let you put in extra money after tax, on top of your normal pre-tax or Roth 401(k) contributions.

- Rollovers or conversions: Your plan also must let you move your after-tax money out while you’re still working there. This could be rolling the money into a Roth IRA (called an in-service distribution) or converting it into your plan’s Roth 401(k) account.

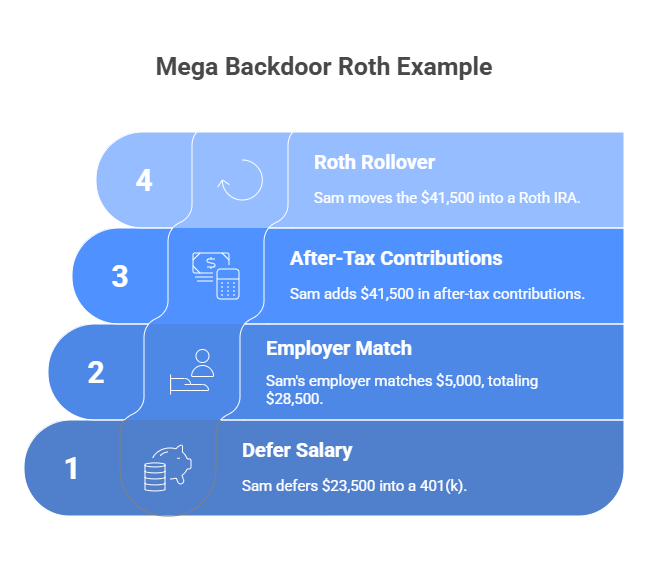

Example: A 35-year-old high earner

Let’s say Sam is 35, earns a high salary, and wants to maximize retirement savings. Sam’s 401(k) plan allows after-tax contributions and Roth rollovers.

- Sam defers $23,500 into a 401(k).

- Sam’s employer matches $5,000, bringing the total to $28,500.

- The overall limit is $70,000, so Sam can add up to $41,500 in after-tax contributions.

- Sam contributes $41,500 in after-tax contributions and moves it into a Roth IRA.

By doing this, Sam ends up with:

- $23,500 in a traditional 401(k).

- $5,000 employer match in the traditional 401(k).

- $41,500 now sitting in a Roth account, growing tax-free.

That’s $41,500 Roth savings in a single year, compared to just $7,000 with a normal Roth IRA contribution (or backdoor Roth).

Things to watch

Earnings on after-tax contributions can be taxable if you wait to convert, so it’s usually best to move the money promptly or use an in-plan Roth conversion if your plan allows it. If you roll these after-tax funds to a Roth IRA while you also have pre-tax IRA money, the IRS pro‑rata rule can make part of the conversion taxable.

Bottom line

A mega backdoor Roth is an advanced retirement strategy that can enable some savers to put far more into Roth accounts than usual. Because plan provisions, tax consequences, and reporting rules vary, you’ll want to confirm whether your 401(k) allows after‑tax contributions and Roth rollovers. Consult a tax planner or financial advisor for personalized guidance. As always, our customer support team is here to help with filing and reporting questions.