Contributed by: WrenD, FreeTaxUSA Agent, Tax Pro

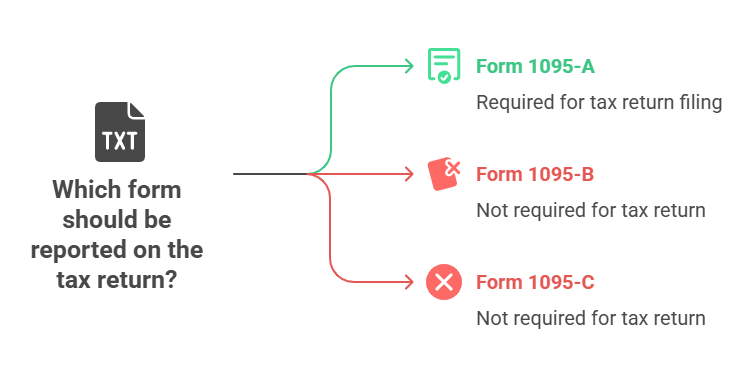

When you have both Form 1095-C (or 1095-B) and Form 1095-A, it means you had health insurance coverage through both an employer-sponsored/private plan or Medicare/Medicaid and the Health Insurance Marketplace during the tax year. Each form serves a different purpose and must be handled correctly to ensure correct tax reporting. Form(s) 1095-C and 1095-B are information only forms and don’t need to be included on your return. Form 1095-A, however, must be included on your return.

Understanding Form 1095-C and Form 1095-A

- Form(s) 1095-B & 1095-C: Provide details about your health coverage or coverage offered to you. They aren’t required to be filed with a tax return and often come later than other tax forms.

- Form 1095-A: Issued by the Health Insurance Marketplace and includes details about your health insurance coverage, such as start and end dates, premium amounts, and Advance Premium Tax Credit (APTC) payments received. The IRS uses this form to verify health insurance coverage obtained through the Marketplace and to reconcile advanced payment of the Premium Tax Credit (PTC) on your tax return.

Note: If you did not receive your 1095-A, you should contact the state or federal marketplace where you enrolled. If your coverage is through the federal Marketplace, information can be found on HealthCare.gov.

What to do when filing

- Keep in your records: Form(s) 1095-A, 1095-B, and/or 1095-C should be with your other tax records. For forms B and C this is all you need to do.

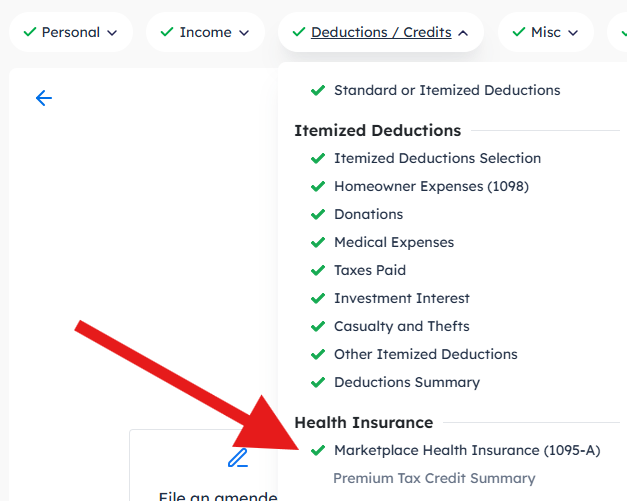

- Report Marketplace coverage: Enter the information from Form 1095-A on your tax return. This form is crucial for reconciling the PTC. In our software, follow this menu path: Deductions/Credits > Health Insurance > Marketplace Health Insurance.

- Reconcile Premium Tax Credit: When you have Marketplace Health Insurance, you typically have advance payment of the APTC which was used to subsidize your monthly premium, lowering your out-of-pocket cost. You must reconcile these payments with the actual PTC you qualify for based on your income. This is done using Form 8962, which calculates the PTC and reconciles it with the APTC received. Our software will calculate this for you.

- Address coverage gaps: While there’s no federal penalty for gaps in coverage, some states do require insurance coverage and may impose a fine for non-coverage.

In summary, keeping your Form(s) 1095 organized, and understanding how they affect your taxes, will help ensure an accurate filing process — especially if you obtained health coverage through the Marketplace. If you need further guidance or have specific questions, be sure to check the IRS website, contact your health insurance marketplace, or reach out to FreeTaxUSA’s customer support.