Contributed by: KelliP, FreeTaxUSA Agent, Tax Pro

At FreeTaxUSA, filing your federal tax return is always free! If you would like to file your state return, we do charge a minimal fee. You also have the option to add our Deluxe or Pro Support upgrades, as well as other products and services.

We offer two payment choices for our services:

- Quickly pay using a debit or credit card.

- Pay using the funds from your refund. With this option, you pay nothing upfront.

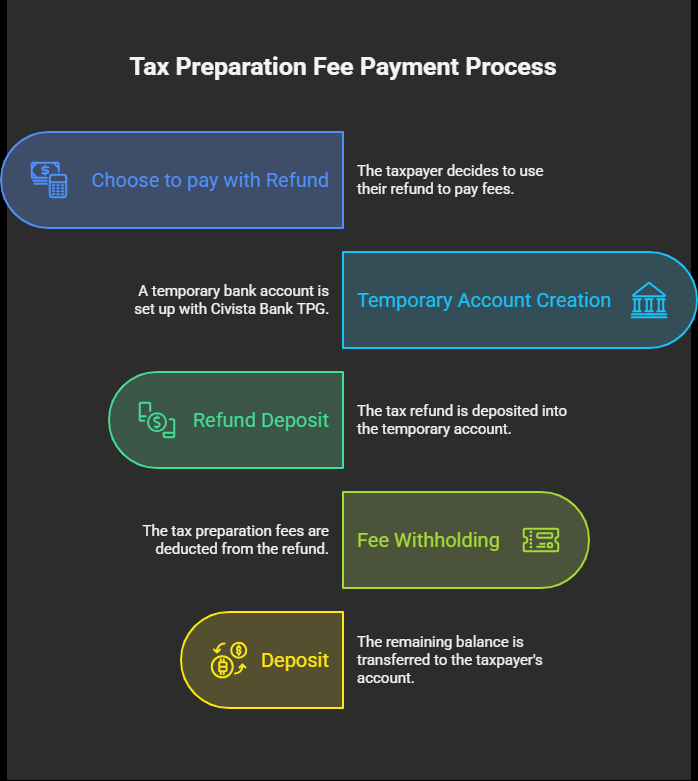

If you would like to pay our fees using your tax refund, this service comes with an additional fee from our third-party banking partner, Civista Bank of the Santa Barbara Tax Products Group (TPG). The payment and fee will come out of your federal or state refund. It generally is taken from the refund that's issued first.

How do you pay with your refund?

To use the option to pay with your refund, you must e-file the return and choose direct deposit as your refund method. The option will show after you’ve selected which products you’d like to include in your order.

💡Note: If you’re filing the return as a paid preparer, you won’t be able to use the pay with refund option. Payment will be required with a debit/credit card.

How it works

After you’ve selected to pay with your refund, you’ll review the agreement provided in the software and “sign” the agreement by entering your name. We recommend reading all the information and printing the agreement for future reference. The agreement will also be available in your account.

Once the agreement has been made, you’ll continue through our software and enter your direct deposit information.

A temporary bank account will be created with TPG.

The TPG temporary bank account information will show on the tax return. This account information is sent to the IRS and state when the return is filed. When the IRS and/or state process the refund, the funds will go to the TPG temporary account first. The order fees will be withdrawn by TPG, then the remaining refund balance will be sent to the bank account you entered for direct deposit. The fees will only be taken once, from the first refund received.

Check the refund status

You can check the status of your federal refund after the return has been filed and accepted.

To check your state refund, you’ll need to go to your state’s Department of Revenue website and select the option to check your refund status.

Once the IRS and/or state show that the refund has been issued, you can go to the TPG website to track the status of your refund with them and see when it will arrive in your bank account.

FAQ’s

Do I have to e-file?

- Yes, you do have to e-file your taxe return in order to pay our fees with your refund.

I’m not receiving a refund; can I still choose this option to pay my tax preparation fees?

- No. To pay for our fees with your refund, you must receive a refund on your federal or state return.

Do I have to select direct deposit?

- Yes. To pay for our fees with your refund, you’ll have to select to receive your refund via direct deposit. You can’t select to receive by paper check in the mail.

- If you don’t have a bank account or don’t want your refund sent to your bank account, you can select our prepaid debit card option.

What if I don’t receive my refund or it is significantly delayed?

- We understand the IRS sometimes takes longer than the expected 21 days to issue a refund. If after a few months the refund hasn’t been issued and our fees still haven’t been paid, we’ll contact you via email. The email will provide a way to pay the fees.

How can I check my refund status?

- To check your federal refund status, go to the IRS website.

- To check your state refund status, go to your state’s Department of Revenue website and select their link for refund status. This can be done by doing a google search using your state abbreviation followed by “DOR” (for example, "NY DOR").

- To check the refund status after the IRS and/or state have issued the refund, go to the TPG website.

What if my return is rejected?

- If your return is rejected, you’ll first need to make the needed change(s) based on the IRS rejection message. Then you can re-submit your return. For this payment option, your return must be e-filed. If you need to mail in your return for any reason, you’ll need to select a different payment option.

How can I check the banking information entered?

- To access the banking information entered, please follow the menu path: Final Steps > Step 3 > Submit Tax Return > Check Status/Print Tax Return

- Scroll to the Federal Tax Return section and click the arrow for "How will I get my refund." Then check the box next to "Show Bank Account Information".

What if I entered the wrong banking information for my account?

- If you haven’t transmitted the tax return yet, simply go back and correct it. However, if the tax return has been transmitted, you won’t be able to update the banking information.

- If the banking information is incorrect, TPG will discover this when they attempt to deposit the refund into the account. The bank will reject the deposit and send the funds back to TPG. TPG will then mail a check to the address listed on the return. An additional fee will be charged by TPG to mail a check.

What account number will be printed on my return?

- When you select to pay our fee with your federal or state refund, you set up a temporary bank account with Civista Bank, a division of the Santa Barbara's TPG group. This bank account information is printed on your federal and state tax return and e-filed to the IRS and your state along with your direct deposit information. The IRS and your state will deposit your refund into the temporary bank account with TPG, our fees will be extracted, and the remainder will be deposited into the direct deposit account you provided. You can check the status of your refund once it’s been sent to TPG here.

Can I use this to pay for my amendment?

- No. The option to pay our fees with your refund is only available when filing the original tax return. To pay for an amended return, you’ll need to pay with a debit or credit card.

I have a PO Box, can I still pay with my refund?

- No. You’ll need to enter a physical street address to pay our fees with your refund. This is a requirement from the bank.

What if I no longer wish to pay for your services using this option?

- If your return hasn’t been e-filed, and you wish to cancel your order and the agreement you signed, you’ll need to follow these steps:

- Go to Final Steps > Your Orders

- Click on “View your order history” located at the bottom of the screen

- Select “Change payment method” next to the “pay with refund fee” order item

- Follow the instructions provided. This will cancel the order and allow you to pay with your debit or credit card.

- If your return has already been successfully e-filed, you won’t be able to change the payment method.

Conclusion

The option of paying for our fees with your refund is very convenient. It’s not a requirement but is an option if you don’t have the funds available now. This option does include an additional service fee charged by TPG, so keep that in mind. Overall, it’s a quick and useful option if desired.