Contributed by: CorinaE, FreeTaxUSA Agent

There’s a lot to keep up with as a college student and a mountain of important deadlines, whether they’re for applications, assignments, or exams. It’s easy to feel overwhelmed by these deadlines, but one due date you don’t want to miss is the tax filing deadline.

Even if you’re earning a modest income, filing taxes as a college student can be beneficial depending on your situation. It might result in a refund with money that could go towards books, tuition, or your daily coffee run. Whether you’ve just left home or are returning to college later in life, this article will help you approach filing your taxes as a college student.

Determining if you need to file taxes

Generally, if your income is below the standard deduction for your filing status or you’re being claimed as a dependent on your parent’s tax return, you might not be required to file a return. However, filing can still be beneficial to claim a refund of withholding tax from a job or claim an education tax credit.

Here's a couple of questions to help you determine if you would like to or are required to file.

Are you being claimed as a dependent?

Your parents may be able to claim you as a dependent if you’re under age 24, you’re a full-time student (under age 19, if not, 24) and they provide more than 50% of your support no matter how much money you make during the year. If you’re claimed as a dependent, your standard deduction and filing threshold is lower. In addition, your parents will claim your education credit on their return rather than you.

Did you make enough income to be required to file?

The amount of income you make before being required to file a tax return can change each year. If you don’t want to file, double check you don’t need to on this IRS website or use their interactive tool to help you determine if you need to.

When checking if you need to file based on income, remember that if you participated in the gig economy the IRS considers you self-employed for tax purposes. So be aware if you participate in a digital platform such as DoorDash or Uber Eats, or a rideshare platform like Lyft, this income will be considered business income. The threshold for self-employed individuals to be required to file is $400 or more of income, so be sure to check those filing requirements.

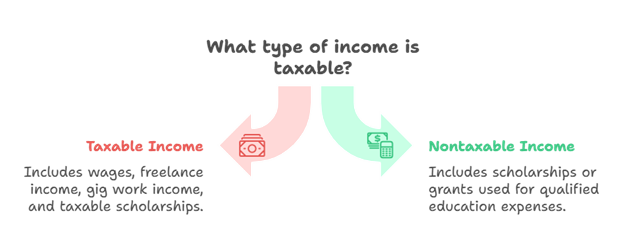

What income is taxable or nontaxable?

Taxable income includes:

- Wages,

- Freelance income,

- Gig work income, and

- Taxable scholarships

Nontaxable income:

- Scholarships or grants used for qualified education expenses.

For tax purposes, qualified education expenses are amounts that you paid for tuition, fees and other related expenses that are required for enrollment or attendance at your college or university.

Accurate reporting of your income ensures compliance and maximizes refunds.

Situations where you may still benefit from filing

- If you had tax withheld and could be due a refund

- You qualify for education credits

Where do I start?First, you’ll want to gather your tax documents and personal information:

- Income Documentation

- W-2s (from employers)

- 1099s (for freelance or gig income)

- Education-Related Forms

- 1098-T (Tuition Statement from college or university)

- Receipts for books and supplies

- Other Financial Documents

- 1098-E (Student Loan Interest Statement from college or university)

- Bank interest statements (if applicable)

- Personal Information

- Social Security Number

- Permanent mailing address (that may be a parent address)

- Bank account information (for direct deposit)

Education credits

The IRS offers education credits to help lower the amount of federal income tax owed, encourage greater participation in higher education, and improve the American workforce.

There are two education credits available: the American Opportunity Tax Credit (AOTC), which applies to undergraduate work only, and the Lifetime Learning Credit (LLC), available each year for postsecondary or job-related education.

View the chart in the back of IRS Publication 970 near the Appendix for more detailed information. There are more restrictions to claiming the AOTC, but it may be more beneficial to you depending on your situation.

To claim either credit, you’ll need Form 1098-T from your school.

American Opportunity Tax Credit (AOTC)

You can claim up to $2,500 per year for qualified education expenses with this credit. If the credit brings the amount of tax you owe to zero, you can have 40 percent of any remaining amount of the credit (up to $1,000) refunded to you.

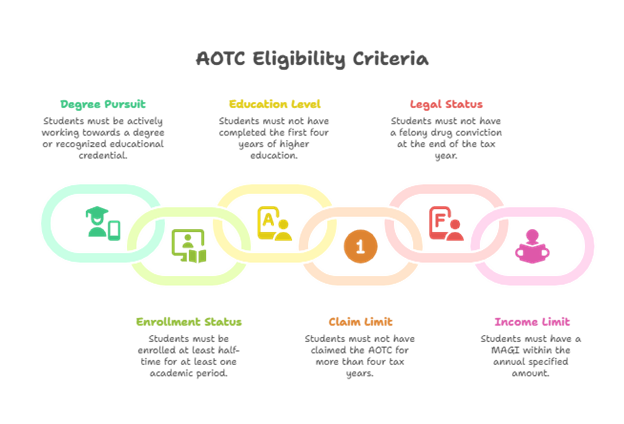

To be eligible for AOTC, a student must:

- Be pursuing a degree (or other recognized education credential),

- Be enrolled at least half time for at least one academic period during the tax year

- Not have finished the first four years of higher education at the beginning of the tax year,

- Not have claimed the AOTC for more than four tax years,

- Not have a felony drug conviction at the end of the tax year, and

- Have Modified Adjusted Gross Income (MAGI) within the annual specified amount (credit may be reduced or unavailable otherwise).

Qualified education expenses for the AOTC

Qualified education expenses you enter for AOTC calculations will include tuition (on your 1098-T or otherwise) and certain items you pay for to attend class (such as books, supplies, and equipment).

The amount of adjusted qualified education expenses you can claim for the AOTC is a maximum of $4,000. These are qualified education expenses that aren't covered by nontaxable scholarships.

Lifetime Learning Credit (LLC)

You can claim a credit up to $2,000 per year for tuition and fees required for enrollment and books and supplies you had to purchase directly from the school. This is a nonrefundable credit.

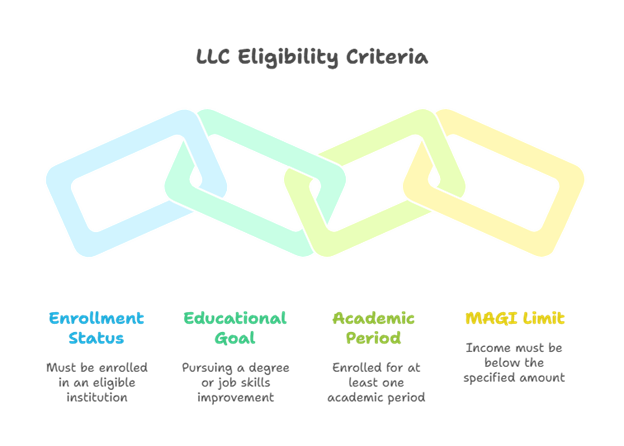

To be eligible for the LLC, a student must be:

- enrolled or taking courses at an eligible educational institution,

- taking higher education course(s) to get a degree, recognized education credential, or get/improve job skills,

- enrolled for at least one academic period beginning in the tax year, and have a MAGI within the annual specified amount (credit may be reduced or unavailable otherwise).

Tuition and fees expense for the LLC

Qualified education expenses you enter for LLC calculations will include tuition (on your 1098-T or otherwise) and certain items you pay for to attend class (such as books, supplies, and equipment) which you were required to buy from the school. An example of this would be a packet that’s only available through the bookstore.

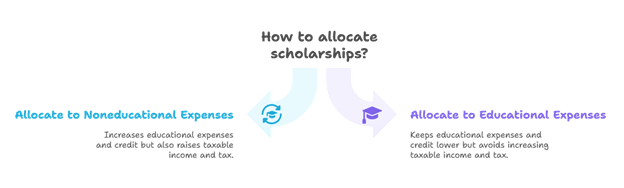

Electing to include scholarships in taxable income

If you elect to allocate all or a portion of your scholarships towards non-educational expenses, you may have the opportunity to increase your education credit. Here’s how this works and things to keep in mind.

When calculating your total qualified education expenses for the credit, scholarships are applied to reduce your expenses. This is because scholarships are generally non-taxable. Here’s an example that assumes Billy is not being claimed as a dependent on someone else’s tax return:

- Billy’s tuition for the year was $15,000. He purchased books and supplies that could only be purchased from his school for classes totaling $500. He received a scholarship of $13,000. In total his expenses are $15,500 ($15,000 tuition plus $500 books and supplies), but they’ll be reduced by the $13,000 scholarship. This means that he has a total of $2,500 of qualified expenses left to calculate his education credit.

Alternatively, you can choose to allocate your scholarships and grants toward non-educational expenses, like room or board, even though the educational institution applies it directly toward tuition.

If you do, you reduce the amount of scholarship money going towards your educational expenses (increase your educational expenses for the education credit).

Scholarships that are allocated to non-educational expenses are also included in your regular income as taxable income. To continue our example from above:

- Without allocating scholarships, Billy’s qualified expenses are $2,500. If he wants to claim his maximum American Opportunity Credit, he may choose to allocate $1,500 of his scholarships toward non-educational expenses. This would increase his qualified expenses to $4,000 for the credit calculation allowing him to claim his maximum credit. This would also increase his taxable income by $1,500 and may affect his total tax for the year.

Depending on your situation, you may want to experiment with the amount of scholarship money you allocate to non-educational expenses to determine what would work best for you individually. Refer to this article in the FreeTaxUSA Community for additional information on this strategy.

Filing tips for first-time student filers

It can be a challenge filing your first tax return. Here, are some tips as you approach this task:

- Don’t guess – Use online tools or free IRS resources to check whether you need to file.

- Be accurate when reporting your dependency status – Check with your parents before you file. If your parents claim you, it will affect what credits and deductions you can claim.

- Be accurate when reporting your education expenses – Refer to information shown on your school tax forms and receipts when entering your information.

- Keep digital and paper records – Save copies of your returns, W-2s, and school tax documents for your records.

Final Thoughts

Filing taxes as a college student might seem intimidating, but with a little organization and the right tools, it can be straightforward—and even rewarding. Taking the time to understand your filing obligations and opportunities could result in a helpful refund, or credit, putting a little extra money back in your pocket. And that's something every student can appreciate.