Contributed by: AnthonyS, FreeTaxUSA Agent, Tax Pro

Understanding FMLA

The Family and Medical Leave Act (FMLA) is a federal law enacted in 1993 that allows eligible employees to take unpaid, job-protected leave for specific family and medical reasons. During FMLA leave, your health insurance coverage continues under the same terms as if you had not taken time away.

Qualifying reasons for leave

Eligible employees can take up to 12 workweeks of unpaid leave in a 12-month period for the following reasons:

- Birth or placement of a child: To care for a newborn or a child placed with you for adoption or foster care.

- Family member’s serious health condition: To care for your spouse, child, or parent who has a serious health condition.

- Employee’s serious health condition: If you have a serious health condition that makes you unable to perform your job functions.

- Military family leave: For qualifying exigencies related to a family member’s active duty or to care for a covered service member with a serious injury or illness.

Rights and Protections

Under FMLA:

- Job protection: You’re entitled to return to the same or equivalent position after your leave.

- Health insurance continuation: Your employer must maintain your group health insurance coverage during the leave period.

Using FMLA leave

FMLA leave can be taken in a continuous block or, in certain circumstances, intermittently or on a reduced schedule. For example, if you need to attend periodic medical treatments, you may take leave in separate blocks of time.

State-specific paid leave programs

While FMLA provides unpaid leave, some states offer paid family and medical leave programs. For instance, Washington State’s Paid Family and Medical Leave program allows eligible workers to receive a portion of their wages while on leave. Eligibility and benefits vary by state, so it’s important to check your state’s specific provisions.

When Is FMLA paid and when is it not?

FMLA leave under federal law is unpaid — it only guarantees job protection and continued health coverage. However, your FMLA leave may be paid if:

- Your employer provides paid family or medical leave.

- Your state has a Paid Family and Medical Leave (PFML) program that replaces some of your wages.

- You use accrued paid time off (PTO), sick leave, or vacation days during your FMLA leave.

- You have short-term disability insurance that covers your condition.

If none of these apply, your FMLA leave will be unpaid.

⚠️ Tax Note: Payments you receive while on leave, such as state PFML benefits or short-term disability, may be taxable income, depending on how the premiums were paid.

For additional information, see this community article about When to report Paid Family Leave on your tax return.

How to apply for FMLA leave

- Notify your employer: Inform your employer at least 30 days in advance if the need for leave is foreseeable.

- Complete required forms: Your employer may require you to complete certain forms, which outline your rights and responsibilities under FMLA.

- Provide certification: You may need to provide medical certification to support your leave request.

⚠️ Note: If your state offers Paid Family and Medical Leave, there will likely be additional steps you need to take beyond those required by your employer.

Example scenario

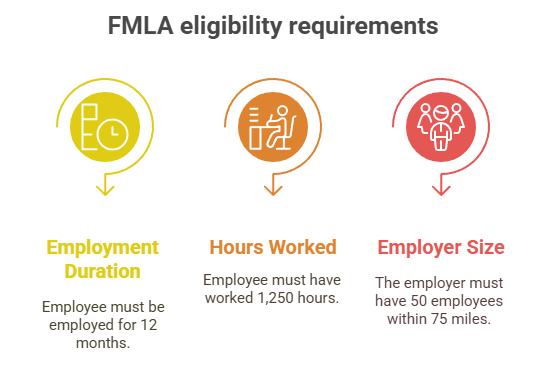

Consider Alex, who has been working full-time at a company with over 50 employees for the past two years. Alex’s spouse is expecting a baby, and Alex wishes to take time off to bond with the newborn. Under FMLA, Alex is eligible to take up to 12 weeks of unpaid leave, with job protection and continued health insurance coverage during this period.

Conclusion

By understanding your rights and responsibilities under FMLA, you can ensure you’re well-prepared to take advantage of this important benefit if the need arises. For more details about FMLA guidelines and how they apply to unique situations, refer to the Department of Labor frequently asked questions webpage.