Contributed by: KelliP, FreeTaxUSA Agent, Tax Pro and PhillipB, FreeTaxUSA Agent, Tax Pro

Occasionally, taxes aren't filed by the deadline and may remain unfiled for several years. We recommend filing them as soon as possible. FreeTaxUSA supports filing returns for the past seven years. If you have multiple years to file, it’s best to start with the earliest year and move forward. While you’re getting ready to file back taxes, you may be unsure what’s needed and where to start.

Here are a few questions you may be asking:

- Can I file the back taxes?

- What do I need to do before I start preparing an unfiled prior year return?

- Can I e-file my unfiled returns with FreeTaxUSA?

Can I file the back taxes?

The answer is yes, but there are some things to consider.

You only have three years from the original due date of the return to claim a refund. If the return qualifies for a refund, and the deadline to claim it has passed, you may feel like filing isn’t worthwhile. This may be the case if your income was low or no tax was owed. We still recommend filing the return for consistency and record keeping. Just realize you likely won’t get the calculated refund.

If there’s an unfiled return with potential taxes due or audit risks, filing the past-due return is important. That’s the only way to start the statute of limitations, which is the time limit the IRS has to initiate an audit or collect taxes. If you don’t file a return, the statute of limitations never begins, meaning the IRS’s ability to start an audit or collect tax never ends. Thus, it’s recommended to always file a return.

What do I need to do before I start preparing an unfiled prior year return?

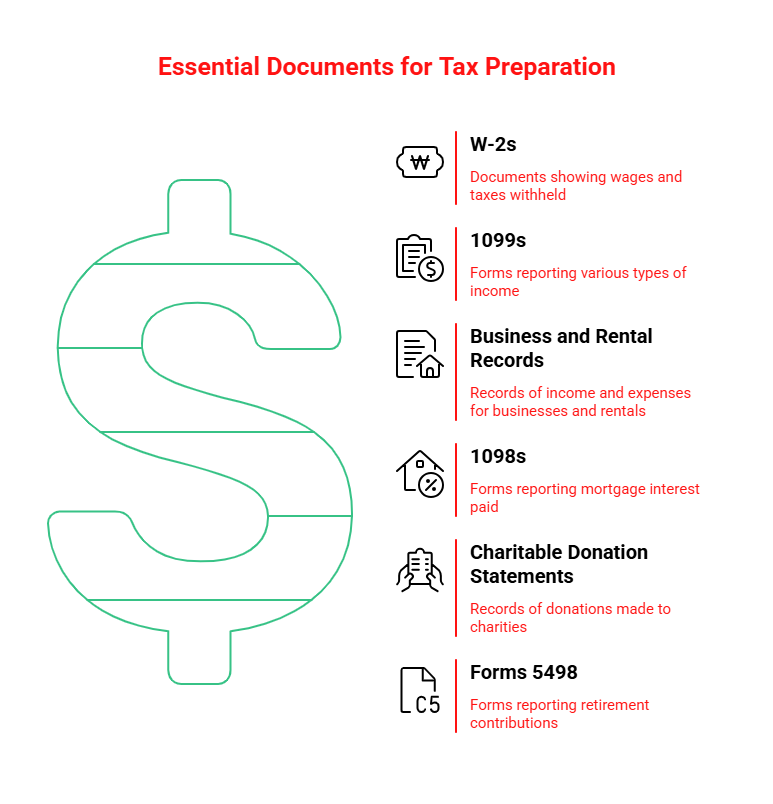

Gather all the income information and forms you’ve maintained. The IRS has a copy of all tax forms issued to you by payers, employers, banks, and lenders. This includes all W-2 and 1099 forms, income and expense records for businesses and rentals, 1098 forms, 1095-A forms, 5498 forms for retirement contributions, etc.

Your IRS account provides helpful information regarding IRS activity on your behalf, such as filing a return on your behalf (called a substitute for return, or SFR). IRS records typically don’t include state and local tax withholding and payer details which are often omitted, blocked out, or incomplete.

Your original documents are the most important versions because these forms have all the payer information, income, and federal and state income tax withholding. Do everything you can to gather that information.

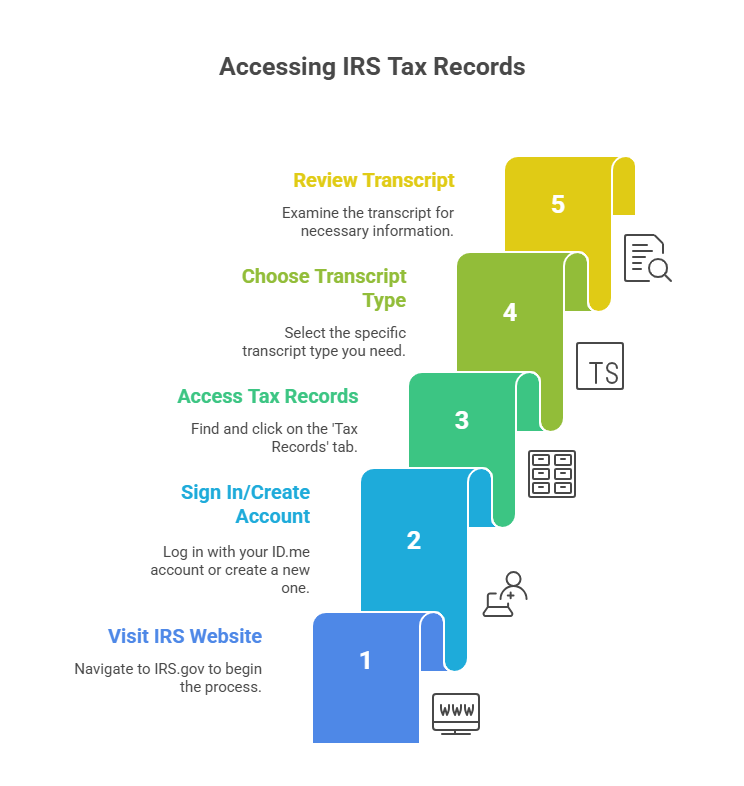

To gather information from the IRS, follow these steps:

- Go to IRS.gov and click Get your tax record.

- Click Sign in to your online account and sign on with your ID.me account if you have one. If you don’t have an ID.me account, you’ll need to create one.

- Go to the Records and Status tab and click Tax Records. Next, click View Transcripts on the Tax Records screen. There will be four kinds of transcripts available:

- Wage & Income: Provides a copy of every W-2, 1099, 1098, and 5498 that the IRS received from the distributor of the form. If you’re missing information from your records, use the IRS transcript to report the missing items. Unfortunately, it doesn’t show state taxes withheld.

- Account Transcripts: Reports when the IRS has mailed notices to you and the type of notices mailed. It’ll also show IRS actions like audits, levies and liens that may have been filed for the tax year.

- Return Transcripts: Provides a line-by-line report on filed returns, along with the IRS’s calculations, if corrections were made.

- Record of Account Transcript: Combines elements of the return and account transcripts.

Can I e-file my unfiled returns with FreeTaxUSA?

Yes, but there are some limitations. The IRS only allows e-filing for the current tax year. However, e-filing of the two prior years is available if an Identity Protection PIN (IP PIN) is obtained from the IRS.

When filing a tax return, you complete the return after the end of the year so you can determine your total income, deductions, and credits for the year. This means if your filing a 2025 tax return, you’ll complete and file it in 2026. In other words, the 2025 tax return is considered the current year’s return, which means the two prior years eligible for e-filing are 2024 and 2023. If you don’t have an IP PIN and prefer not to obtain one, you’ll need to print and mail the 2023 return to the IRS and any state returns you’re filing.

Example #1: You didn’t file your 2023 tax return by the April 2024 deadline. In 2026 you decide to file your 2023 return. If you have an IP PIN you’re still eligible to e-file the 2023 return.

Example #2: You didn’t file your 2019 tax return, and it’s now 2025. In 2025, the 2024 tax return is considered the current year’s return. Therefore, the two prior years eligible for e-filing with an IP PIN are 2023 and 2022. Since it’s now beyond the 2-year limit for e-filing through FreeTaxUSA, you’ll be required to print and mail the 2019 tax return.

How to use FreeTaxUSA

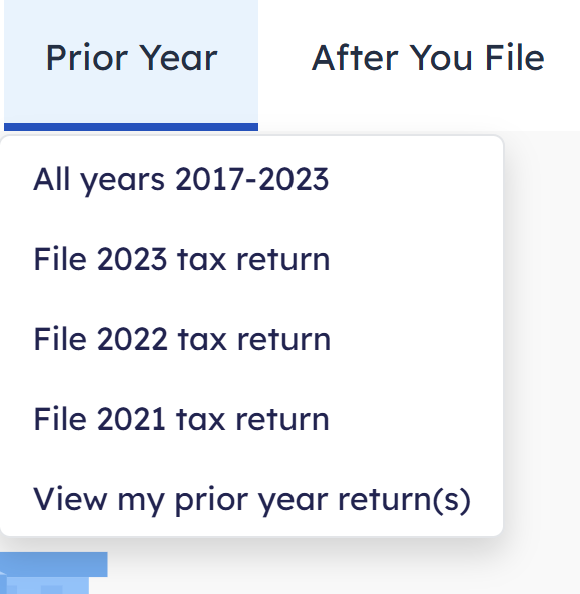

To file back taxes using the software, start by going to our homepage and selecting Prior Year. Then select the year you need and sign in. If you already have an account, use your same username and password. If you haven’t created an account in the software yet, click to start the return and create a sign in.

Continue entering your information for the prior year as prompted. When you’re ready, finalize the return by going through the Filing or Final Steps section of the software.

Conclusion

Filing your tax returns on time is ideal, but you can still file them if it’s late. Be sure to gather all your documents and any additional information you may need. FreeTaxUSA can help you prepare past-due returns for up to seven years. However, e-filing is only available for returns up to two years past their original deadline. If you have questions while preparing your return, our Customer Support team is ready to help!