Contributed by LynR, FreeTaxUSA Agent, Tax Pro

Among several changes to the tax code, introduced by the One Big Beautiful Bill Act (OBBBA, signed into law July 4, 2025), gambling (or wager) losses took a hit. Starting January 1, 2026, deductible gambling losses are limited to 90% of gambling losses and may not exceed your gambling winnings.

Previous rule

If you’re familiar with the guidelines regarding gambling income, you know the IRS doesn’t allow you to simply reduce your gambling winnings by your gambling losses and report the difference on your tax return. Instead, you must report the full amount of your winnings as income and claim your losses separately as a deduction.

Prior to the OBBBA and continuing through the 2025 tax year, 100% of gambling losses could be deducted up to the amount of gambling winnings received during the same tax year. Consequently, if your losses exceeded your winnings, you could offset all your gambling winnings, resulting in $0 taxable gambling income.

New rule as of 2026

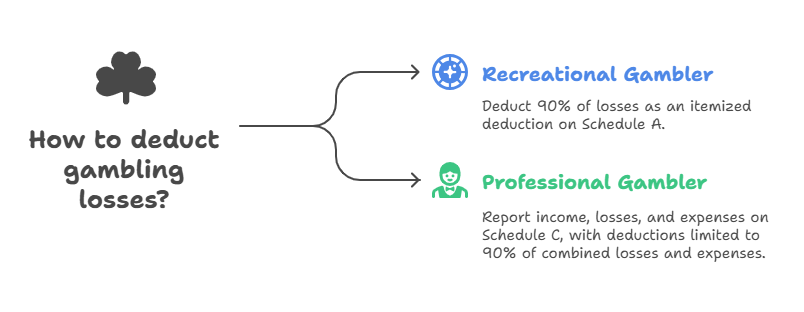

The OBBBA now limits your deductible gambling losses to 90% of your total gambling losses. The losses deducted are limited to your gambling income. The following sections go into more detail on this rule, how to calculate your deduction, and the differences for recreational vs. professional gamblers.

Recreational gambler

If you gamble recreationally, your gambling losses are deductible as an itemized deduction on Schedule A. Gambling losses include “the actual cost of wagers plus expenses incurred in connection with the conduct of the gambling activity, such as travel to and from a casino.” Here are a few examples of how to apply the new tax law:

A: Your gambling winnings for the year were $15,000, and your losses were $10,000. You may take an itemized deduction of $9,000, which is 90% of your gambling losses. Even though your net gambling income was $5,000, your taxable gambling income is $6,000.

B: Your gambling winnings were $15,000, and your losses were $16,000. You can take an itemized deduction of $14,400, which is 90% of your gambling losses. Even though you lost $1,000 gambling, under the 90% loss deduction rule, you'll still be taxed on $600 of your gambling income.

C: Your annual gambling winnings were $15,000, and your losses were $20,000. You can claim a $15,000 gambling loss deduction as an itemized deduction. The 90% rule would allow for an $18,000 deduction. However, the deduction can’t exceed your gambling income of $15,000, so you’re limited to a deduction of $15,000. This results in $0 taxable gambling income.

As a recreational gambler, if your itemized deductions (including deductible gambling losses) are less than the standard deduction, you may choose to take the standard deduction. In that case, you won’t be able to claim any of your gambling losses. Any unused deduction for gambling losses is lost - it can’t be carried forward to the next year.

Professional gambler

If you’re a professional gambler, report your gambling income, losses, and expenses on Schedule C. This means you may claim your gambling losses regardless of whether you itemize or take the standard deduction. For professional gamblers, the 90% rule applies to your overall gambling losses and business expenses. Business expenses may include items such as travel to casinos, overnight hotel stays, and other regular business expenses. When figuring your deductions on Schedule C, they can’t exceed 90% of your combined losses and expenses and are still capped at 100% of your gambling income. Here are a few examples:

A: Your gambling winnings for the year were $100,000. Your expenses from travel and other business expenses total $25,000, and you have gambling losses of $50,000. Your total expenses and losses for the year were $75,000. You may deduct $67,500 on Schedule C for expenses and losses combined.

B: Your gambling winnings for the year were $100,000. Your business expenses were $45,000, and gambling losses were $65,000. Your combined expenses and losses were $110,000. Your net loss as a professional gambler for the year was $10,000. However, you may only claim combined expenses/losses of $99,000, resulting in $1,000 taxable gambling income.

C: Your gambling winnings for the year were $100,000. Your business expenses were $60,000 and gambling losses were $70,000, totaling $130,000. Your overall gambling business loss is $30,000. The 90% rule would allow $117,000 deductible expenses/losses, but you’re limited to deducting only up to your gambling winnings of $100,000. This results in $0 taxable gambling income.

Tax planning for your gambling future

Whether you’re a professional or recreational gambler, you’ll want to consider the impact of this change on your tax bill each year. Beginning in 2026, you could have taxable gambling winnings, even while incurring equivalent losses. Careful recordkeeping and planning will minimize the shock of this change when it comes time to file your tax return. To avoid an unexpected tax bill, you can usually request income tax withholding from the payer, if your winnings don’t automatically trigger withholding. Alternatively, you may want to make an estimated tax payment to cover the expected taxable portion of your winnings.