Contributed by: AndyS, FreeTaxUSA Agent, Tax Pro

There are times when you may need to get ahold of a prior year federal tax return that you filed. This could be because you need it to help you e-file your current year return, you want a copy for your personal records, or you need it to obtain a loan. Whatever the reason you need a copy of tax returns filed in a prior year, you have a few different options to find them!

What if I filed with FreeTaxUSA?

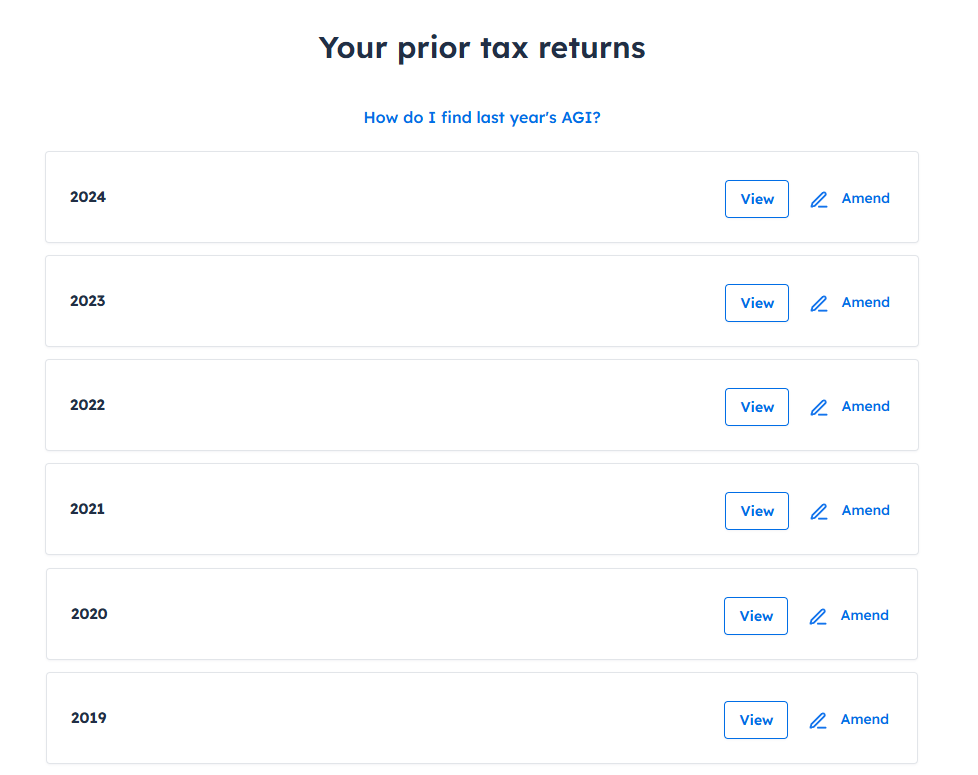

If you filed your prior year tax return with FreeTaxUSA, we keep your old returns in an easy to find location in the current year software. There’s no need to log into each individual year! We archive 6 years of prior returns and printing them is always free.

Here's how to print a copy of your return:

Step 1) Sign in to your account

Step 2) Click on Prior Returns in the Account menu at the top right of your screen.

Step 3) View the return you want to print.

I didn’t file with FreeTaxUSA; can I still get my tax return?

If you didn’t file with FreeTaxUSA or can no longer access your account, you can still get a copy of your tax return - it’ll just take a little more time and effort. There are two ways to request your return. The route you choose will depend on your needs:

- Tax transcript: You can request a tax transcript which will show your entries but doesn’t have each line numbered. This is typically all you need if you’re looking for something like your prior year adjusted gross income to help you e-file your current year tax return.

- Copy of tax return: If you need an actual copy of your tax return, you can request that as well, but it takes a little more time and has a fee attached.

How do I get a transcript?

You can request an IRS transcript of your tax return from the IRS website. The transcript includes items from your tax return as it was originally filed and will typically meet lending or immigration requirements. It’s free of charge to request a transcript. You can get it instantly online or within a few weeks if you request it by mail.

There are three ways to request a transcript:

- Visit the IRS website for instant online access to your transcript. Select Return Transcripts.

- Call 1-800-908-9946

- Use Form 4506-T

If you'd like to have a record of any changes made to your original tax return – either by the IRS or through amended tax returns - you can also access those at the same online link in your IRS account under Account Transcripts. If you would rather call the IRS, you can ask for a Tax Account Transcript.

How do I get an actual copy of my tax return?

If you request an exact copy of your tax return from the IRS, it’ll include all schedules and attachments as well as your tax preparation forms (e.g., W-2, 1099, 1098). You'll need to complete Form 4506 to request your copy and include a $30 check or money order per return requested to "United States Treasury". The IRS mailing address based on your resident state and form instructions are included on the same link as Form 4506. You’ll want to plan ahead if you need an exact copy. It can take up to 75 calendar days to receive your documents.