Contributed by: KelliP, FreeTaxUSA Agent, Tax Pro

Life has been hectic, and you now have taxes from previous years that haven’t been filed. Can you e-file the back taxes? That’s a great question—and the answer is, it depends.

How to e-file

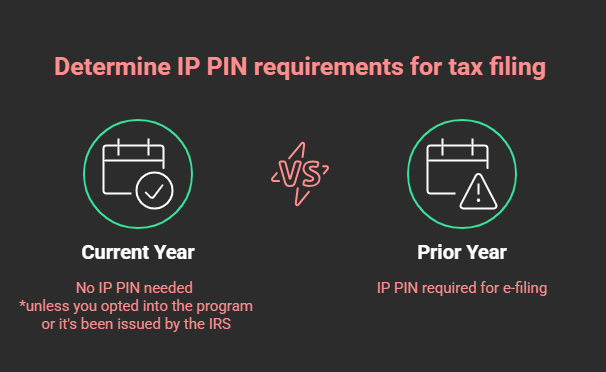

For online filing tax software like FreeTaxUSA, the IRS only allows e-filing for the current year and two previous years. To e-file a prior year return, the IRS requires you to have an identity protection PIN (IP PIN). If you don’t have one, you can request it from the IRS.

Once you opt in to the IP PIN program, the IRS will issue you a new IP PIN each year. This PIN should be included on any tax returns you file during that year. For example, if you file back taxes for 2023 and 2024 in 2025, you must use your 2025 IP PIN on both returns.

💡NOTE : After receiving an IP PIN, the IRS requires you to use it every year when filing your tax return. While opting out is possible, the process can be a hassle and may lead to confusion.

Going through the filing process in FreeTaxUSA

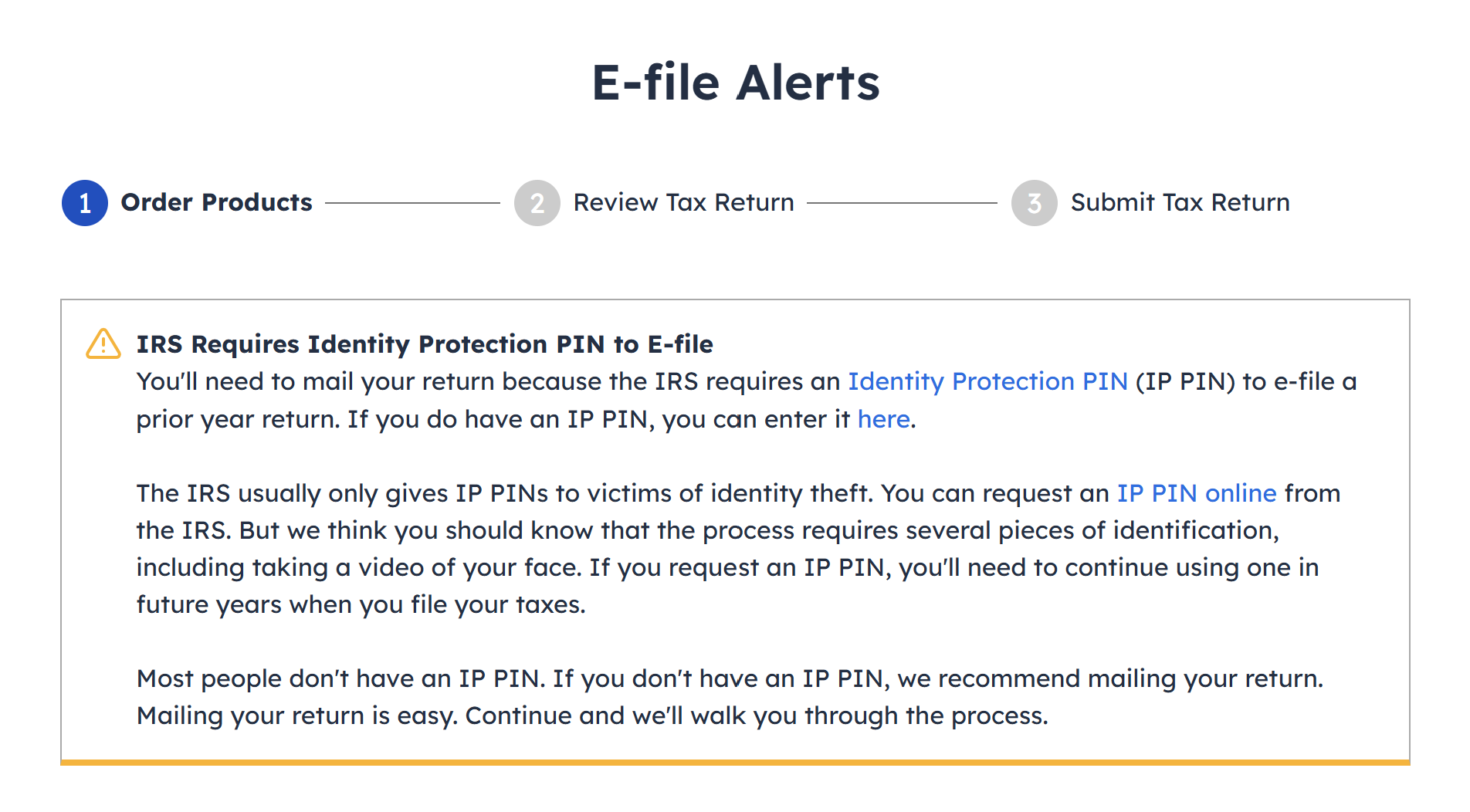

If you’re preparing a prior year return and haven’t entered an IP PIN, you’ll get an alert from the software letting you know you’ll need to print and mail the prior year return. Information is provided explaining why and what you can do.

If you don’t have an IP PIN and prefer not to get one, simply continue past the alert. Mailing instructions will be provided at the end of the Final Steps section.

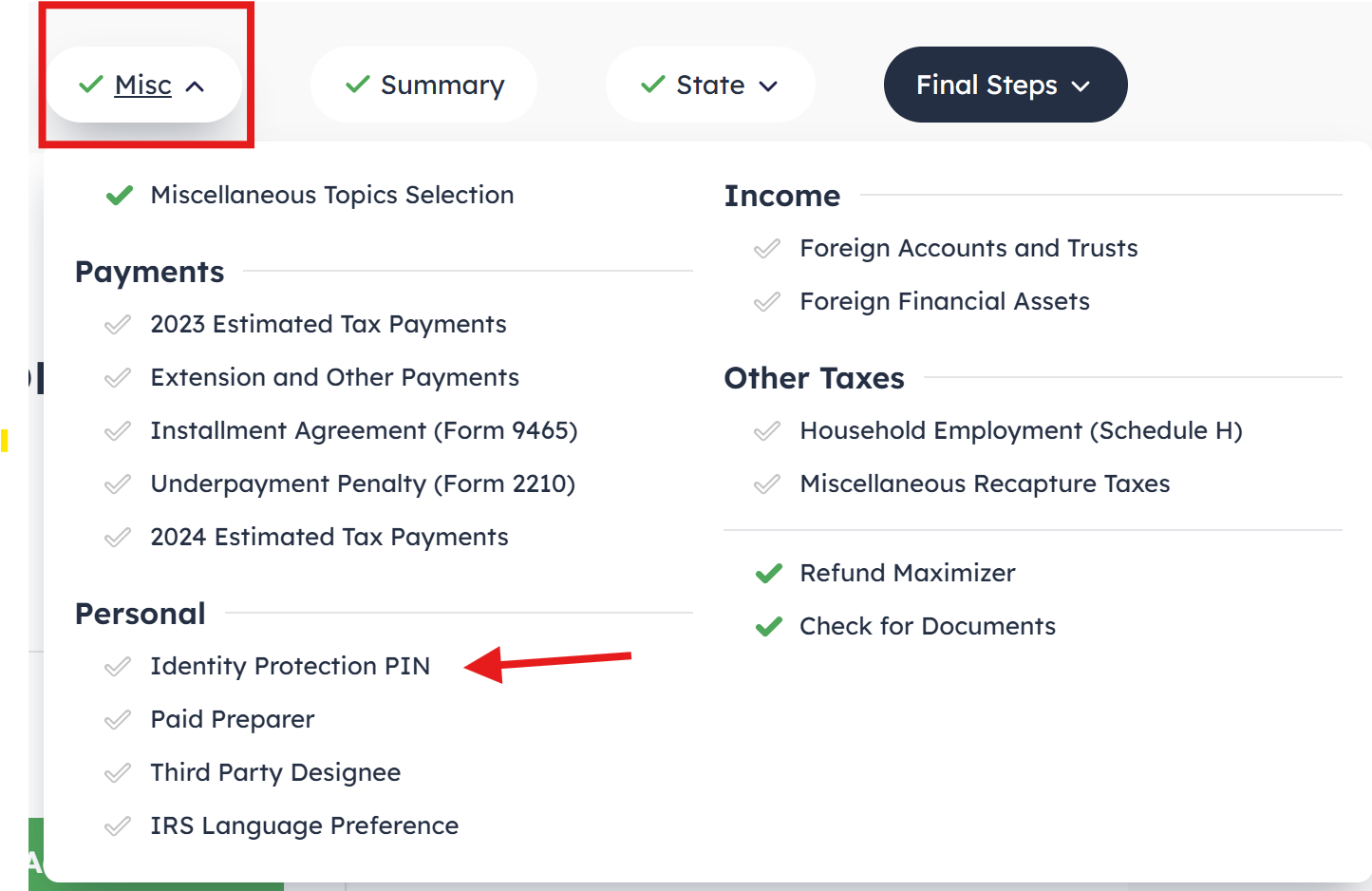

Alternatively, if you do have an IP PIN and wish to e-file, you can enter it in the software by following this menu path: Misc > Personal > Identity Protection PIN.

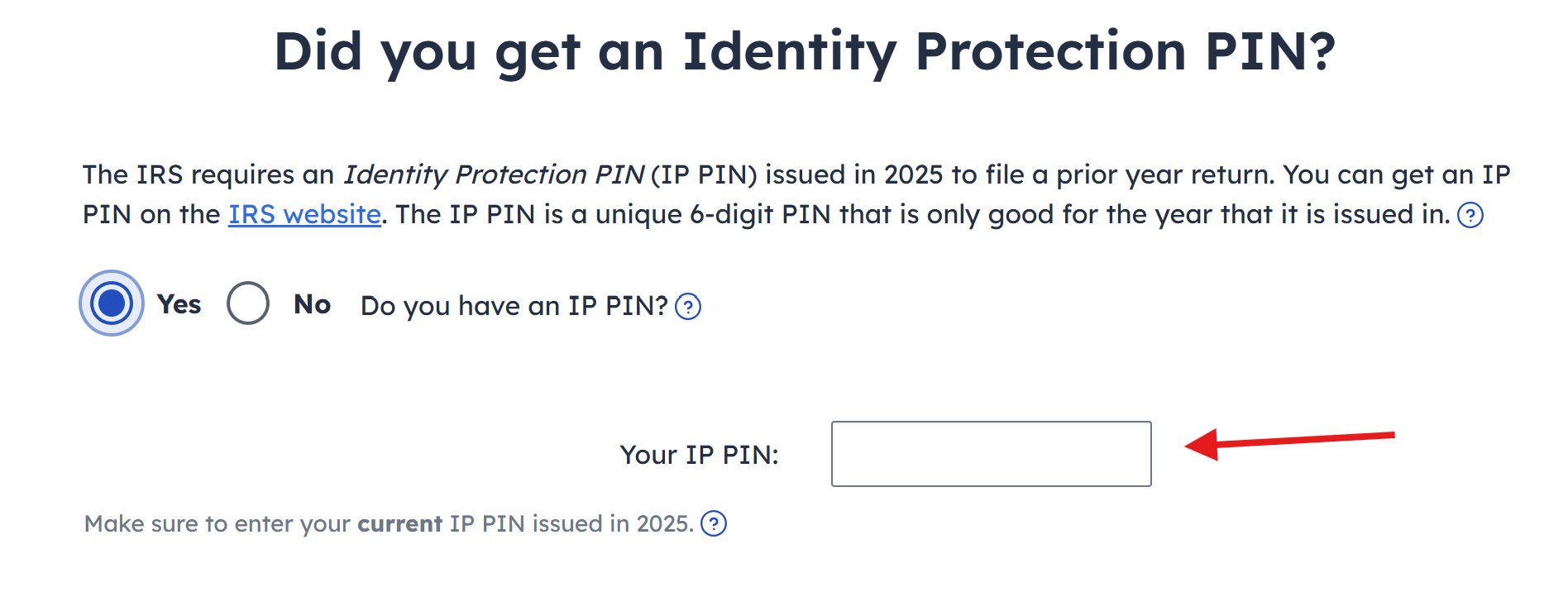

Select Yes when asked if you have an IP PIN. Enter the number and select Save and continue.

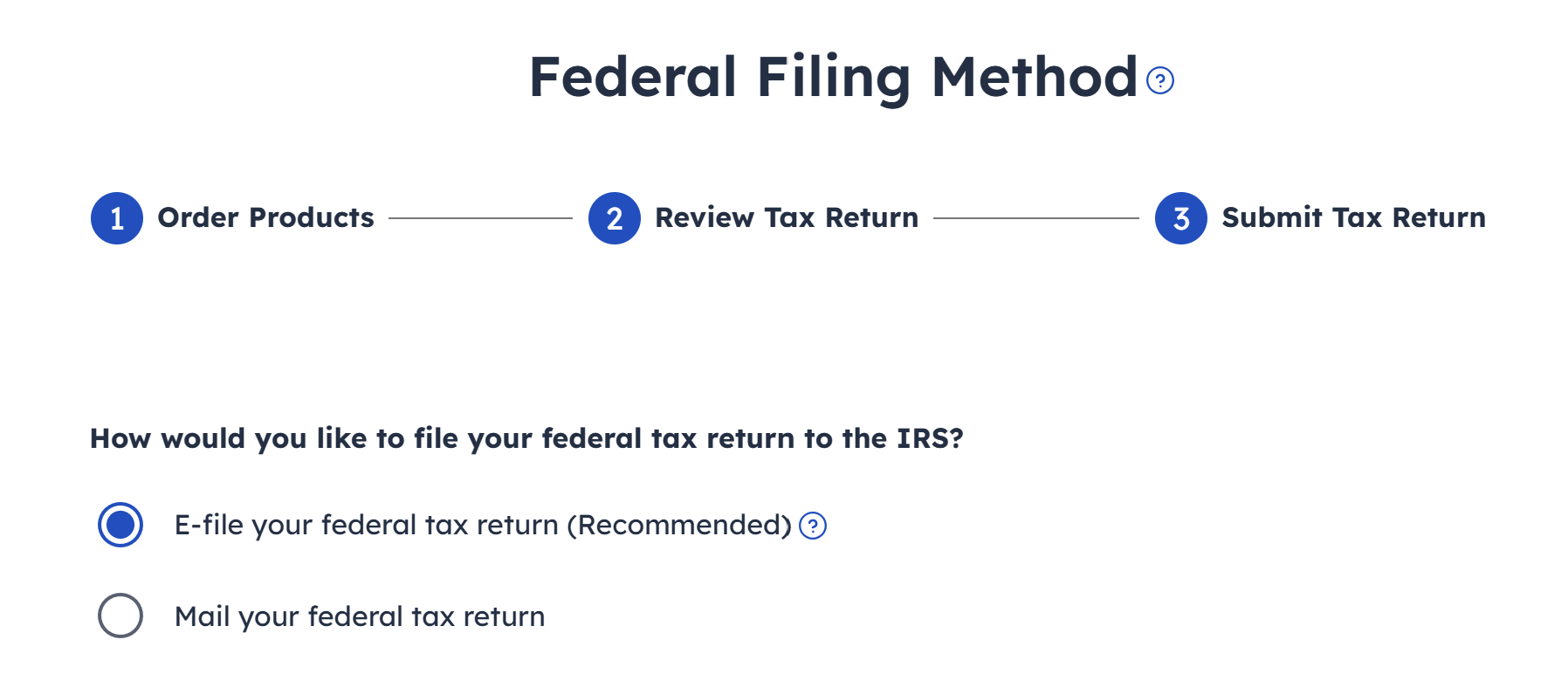

When an IP PIN is entered in the prior year software, you’ll generally be given the option to e-file or print and mail the return.

Select e-file and be sure to continue through the subsequent screens to submit the return for processing.

Conclusion

To e-file a prior year return, it can’t be older than two years, and you must have an IP PIN. If you prefer not to get an IP PIN, you can print and mail the return instead. For returns older than two years, we can help you file by mail for up to seven prior years.

💡NOTE: If you don’t have an IP PIN and request one, you’ll need to wait a minimum of 24-48 hours after the IRS assigns you the IP PIN before e-filing, sometimes longer. This allows the IRS time to update your IP PIN information in their e-filing verification system.