Contributed by: Daniel_L, FreeTaxUSA Agent

Welcome to FreeTaxUSA! We’re sorry your tax return needs correcting, but we can help with that even if you filed your original tax return elsewhere.

💡Note: When you’ve previously filed using another service, e-filing may be restricted. You may need to print the amendment and submit it via mail. See Submission at the end of this article for more information.

Before you begin

Do two things before you begin an amendment with FreeTaxUSA:

- Obtain a copy of Form 1040 from the most recent return for the tax year you’re amending—either the original or the latest “as amended” version. Use this to recreate that tax return in our software before generating Form 1040-X.

- Verify FreeTaxUSA supports your tax situation.

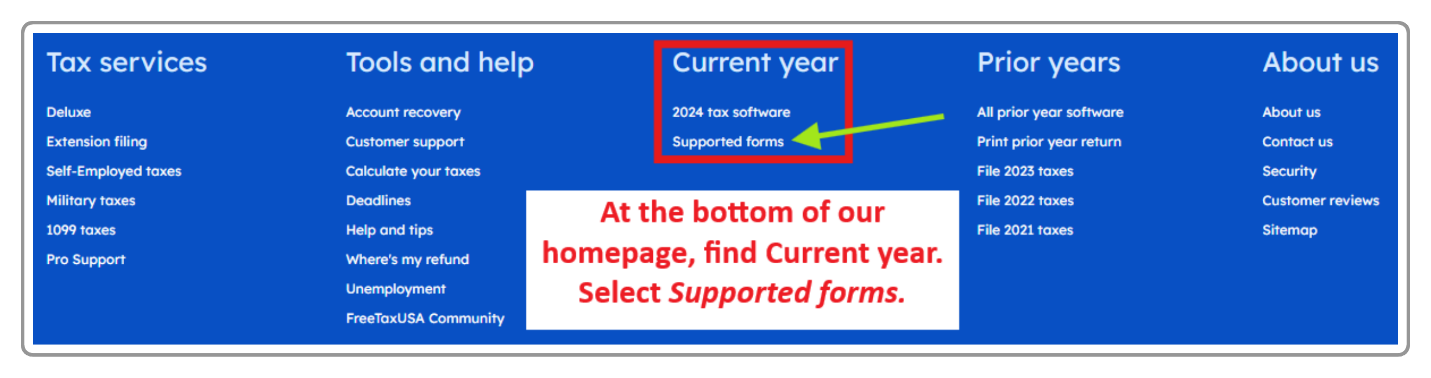

View our supported forms on FreeTaxUSA’s homepage. Supported forms may vary depending on the year you’re filing. For a current year tax return, scroll to the bottom of the page, find, and select Supported forms.

The current year Supported forms screen has access links to Federal and State forms FreeTaxUSA supports.

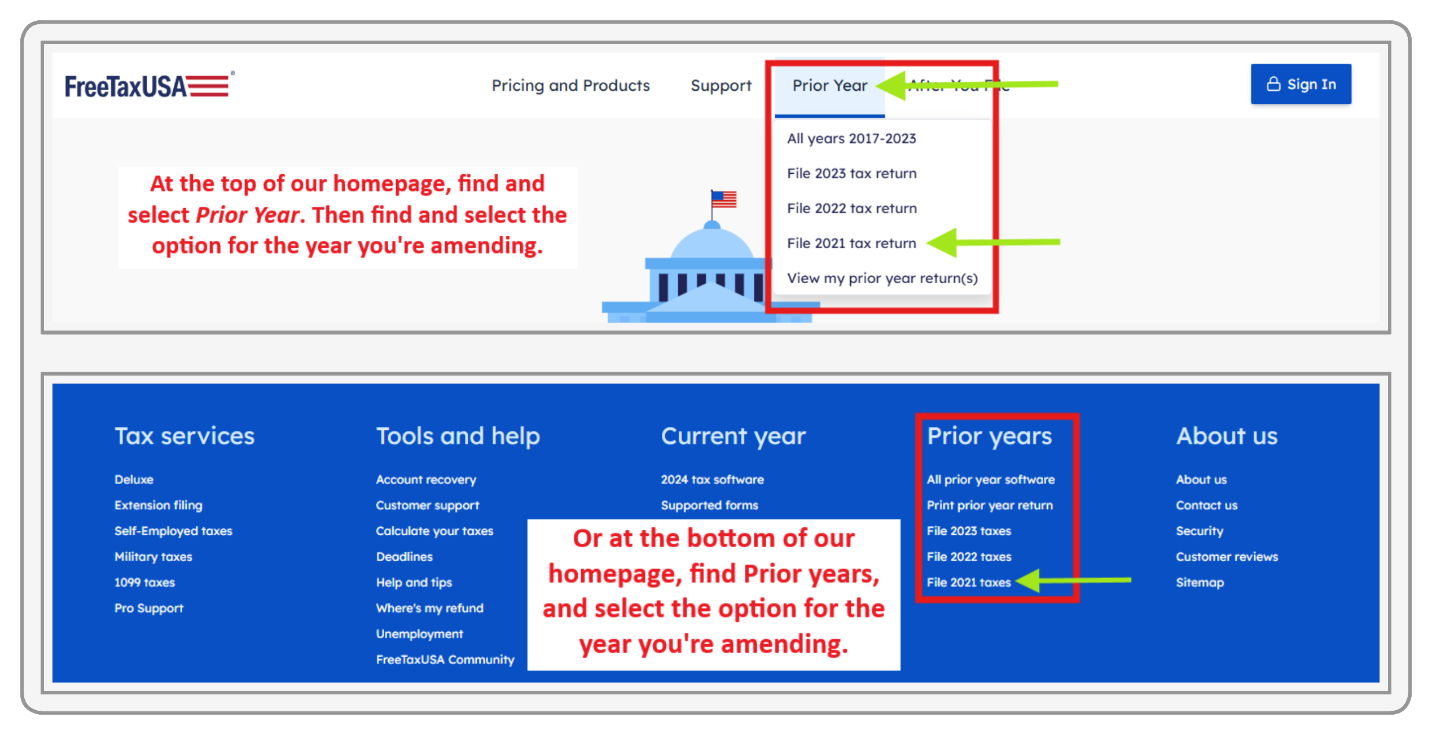

For prior year returns, first select the year at the top or bottom of our homepage as seen here:

On the selected homepage, scroll down to the middle of the page to find the link(s) for supported forms access.

Make sure we support the forms included with your last submitted return and additional forms needed for the amendment.

If you’re amending a state return, check the supported state forms list for each state you need to amend.

For example, if you’re part of an S Corporation and your last return included Form 7203 for Stock and Debt Basis Limitations, or you know you need to include it with your amendment, you won’t find it in our supported forms list. As much as we’d love to help in all situations, we’re unable to amend a return that includes or will require Form 7203.

We must support forms you previously filed and forms you will file with your amendment.

Create an account or login

If you have a copy of your most recently submitted return(s) and FreeTaxUSA software supports your tax needs for the tax year you wish to amend, create an account with us.

Our homepage always connects to the current tax filing year. To start a current year amendment, select the blue Sign In icon in the top right and follow prompts to either create a new account or enter your login credentials (username and password) if you already have an account.

If you need to amend a previous tax year, select the Prior Year option on the homepage, and choose the appropriate year. If you’re already logged into the current year, access prior year software editions in the Account menu. Then follow the prompts to create an account or use your existing login credentials.

💡Note: Each tax year has a separate software edition. After logging in, you’ll see the tax year next to the FreeTaxUSA logo (top left in desktop view). While your login stays the same, you must sign in to each edition separately. Be sure you're in the correct year to amend.

Generate an exact replica of your last tax return

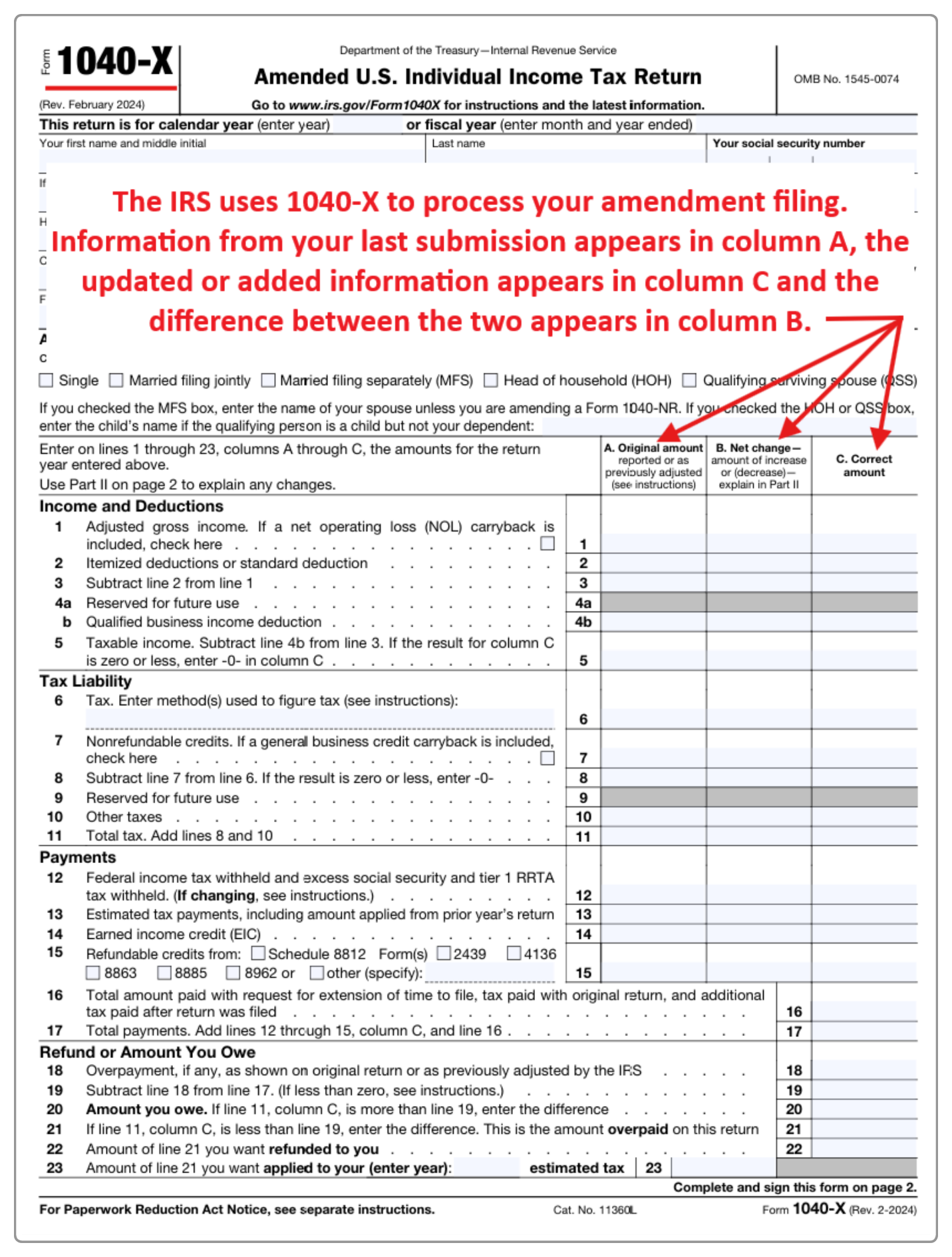

An amendment is an addition to your most recent tax return for the tax year you’re filing. It doesn't replace it. The IRS uses 1040-X to process an amendment. 1040-X lists information from the last filed tax return, new information, and differences between them, as seen here:

Thus, your original return or latest amendment needs to be in our software. We’ll use it to generate column A, and column B cannot be accurate if the replica return isn’t an exact match to what you last filed.

Moreover, the replicated return needs to be an exact copy. DO NOT include amendment information when creating your replica, such as:

- Mistakes or errors

- Missed information

- Information added in error

Enter only the information as you previously reported. DO NOT update it to the correct information until later.

Initially, you must complete each section of our software in order. However, you can navigate within completed sections and to the farthest completed point. If a section doesn’t apply, simply answer accordingly and continue.

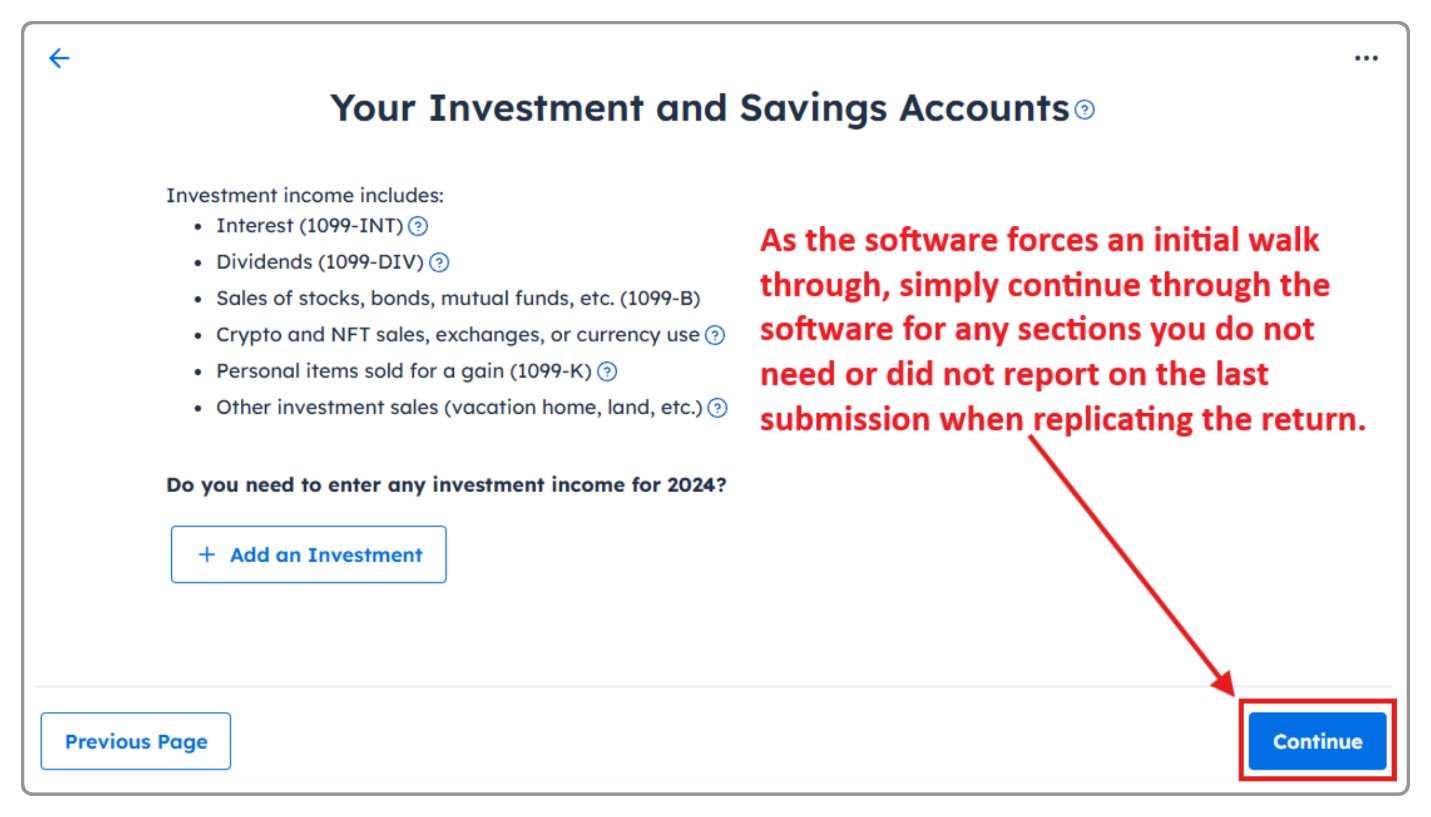

For example, in our Income menu, you may need to enter a W-2, but you don’t have or didn’t include investment income on the last tax return. In FreeTaxUSA, when you reach the Investments and Savings section of the Income menu, you’ll select Continue as shown here:

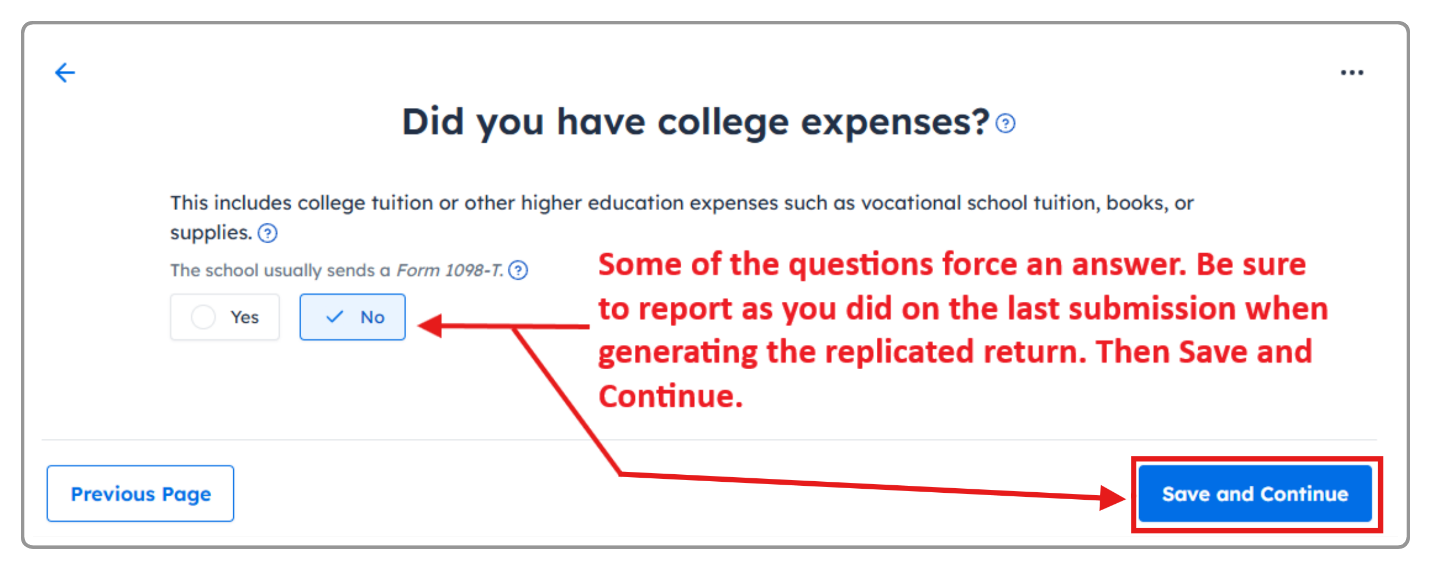

Sometimes you’ll be required to enter information or answer questions before moving forward. For example, if you don’t have or didn’t include college expenses on your last tax return, you’ll be required to select No and Save and Continue as shown here:

When you’ve completed entering information for your replica return, pay for your products and services by following menu path: Filing > Order Products > Your Order.

Original federal returns are always free, but state returns and federal/state amendments are not (unless an upgrade includes free amendments). State returns are automatically added to the cart, and you can add any optional services you’d like, such as account upgrades (i.e., Deluxe, Pro Support, etc.).

If amending your state return, the replicated state return will need to be purchased to complete your state amendment. If you’re not amending your state return, select Remove from Order.

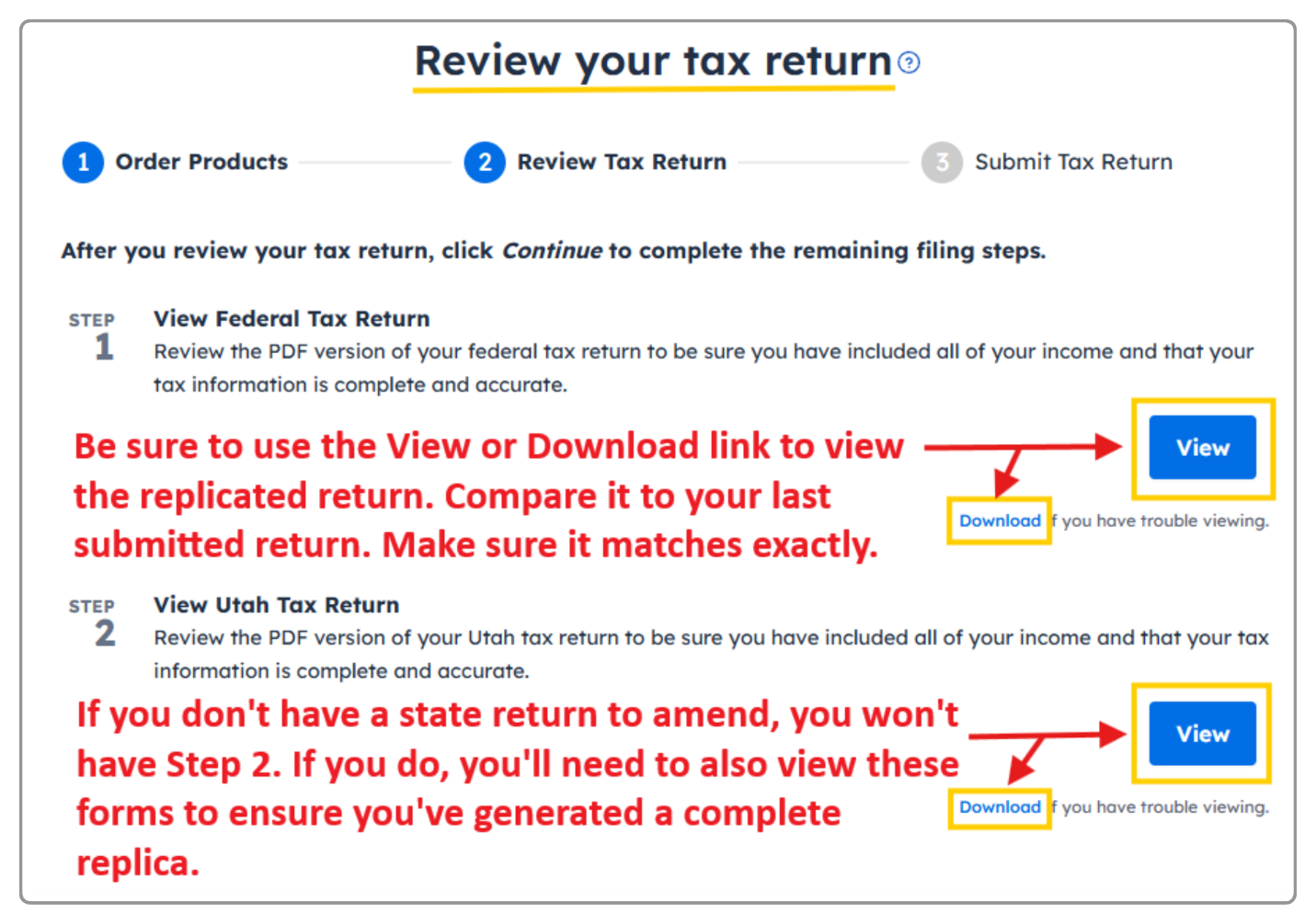

Once you’ve paid for your products and services, continue through the screens to review your returns. The Review Tax Return screen (shown below) has view and download links so you can verify the replica return(s) exactly matches the return(s) you’re amending.

If information doesn’t exactly match what you previously filed, use the menus to navigate to parts of the software that need to be edited to ensure an exact match. Continue to make adjustments until you’ve got an exact replica.

If it doesn’t match and you can’t find the right software entry to adjust it, no problem! Send our Support team an email or with an upgraded account, start a chat. Assuming you were able to verify FreeTaxUSA software supports your tax needs, we can direct you.

Select mail as the filing method for the replica return

Once the replica return matches (i.e., forms, schedules, line amounts, etc.), finalize the return. Since you’ve already filed this return elsewhere, you must select mail as the filing method, so it doesn’t get resubmitted.

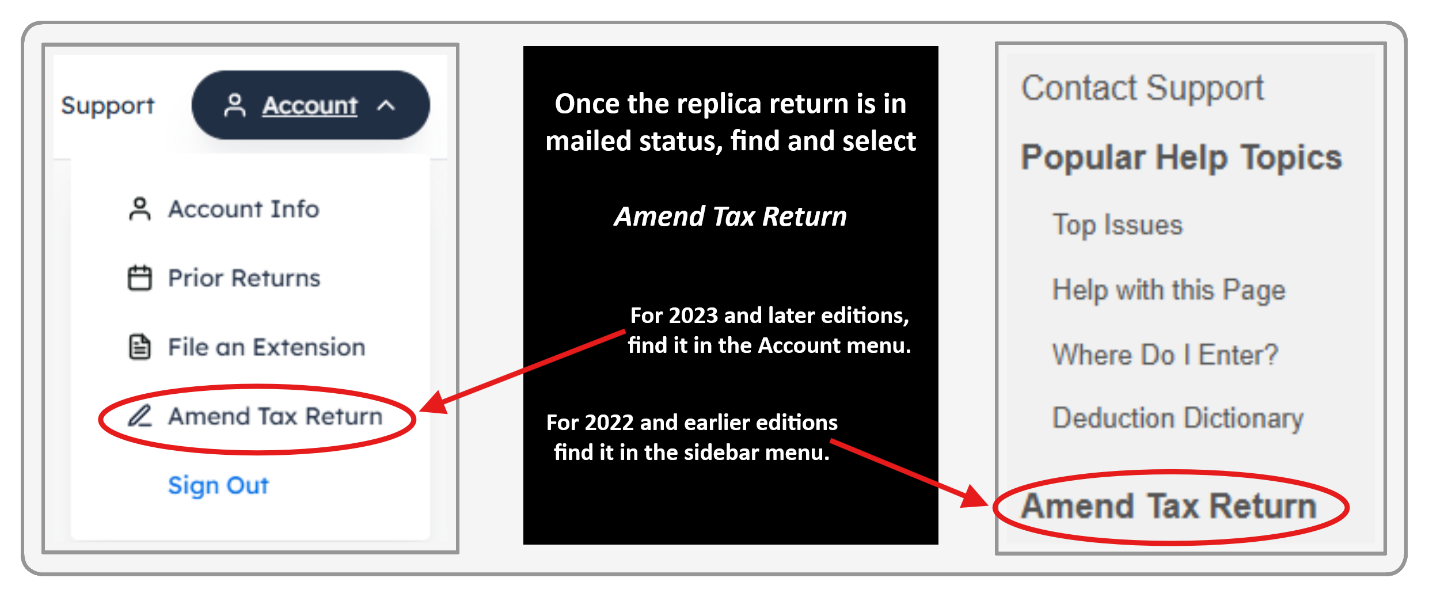

Once you’ve finalized the replica return, you’ll reach our Check Status/Print Tax Return screen. Disregard all instructions to mail the replica return. Now you’re ready to start the amendment. For 2023 and future editions, use the Amend Tax Return link found in the Account menu or for 2022 or older year editions find it in the sidebar menu.

We provide cautionary prompts before starting an amendment. Simply continue through these prompts entering applicable information. The software will take you back to the start of the filing process.

Completing an amendment

There are three key parts to filing an amendment:

- Amendment Information

- Changes (added/deleted/corrected information)

- Submission

Amendment Information

You’ll know you’ve successfully started preparing an amendment when the Personal menu shows Amendment Information.

Accurate amendment information is key to calculating a correct tax balance. You’ll be asked to enter the amount of any prior overpayment and/or taxes paid in the amendment information section. If only filing a federal amendment, you’ll only report federal information. If amending a state return too, you’ll see overpayment and taxes paid fields for each state.

If your last tax return claimed a refund, enter an overpayment amount. An overpayment means you overpaid your taxes and were due a refund. The software asks how much you overpaid, which is the same as the refund you received. Enter your total refund amount from all previously filed tax returns for the year. You may find your refund amount on line 35a of the original return. If you’ve already filed an amendment for the year and claimed an additional refund, add the amount on line 22 of Form 1040-X to get your total overpayment amount.

If the refund on your original return or a previous amendment was adjusted by the IRS, be sure to enter the refund amount(s) you actually received rather than what shows on your tax forms.

If a previously filed tax return for the year showed taxes due, make a taxes paid entry. Find this amount on line 37 of the original return. If you’ve already filed an amendment for the year and owed additional taxes, add the amount on line 20 of Form 1040-X to get your total taxes paid amount.

In very rare cases where you previously received a refund and made a tax payment, you’ll make an entry in both the overpayment and taxes paid fields.

The IRS recommends waiting until your most recent tax return has been processed before filing an amendment. However, if the tax deadline is approaching, you may need to file the amendment before processing is complete.

Here are possible options for the overpayment and taxes paid fields based on varying situations:

- Your last tax return has been processed and you received a refund.

- Enter the exact refund amount received in the overpayment field. If it includes IRS-paid interest (rare and clearly noted in an IRS letter to you), subtract the interest from the total.

- Your last tax return has been received, but not yet processed, and it claimed a refund.

- Enter the refund amount you claimed in the overpayment field. The software will prompt you to enter this amount based on the replicated return (if you successfully generated an exact match).

- Your last tax return showed you owed taxes.

- Enter the amount of taxes paid with the last return and any additional payments since filing in the taxes paid field.

TIP: If you have an IRS online account, login to verify your last refund (overpayment) or tax payment(s) (taxes paid).

The changes

After entering amendment information, you’ll continue through the software. Use the menus to access parts of the return you need to edit, delete, or add information depending on your situation.

Two examples:

- If you’re a foster parent and didn’t know you can claim your foster child as a dependent, follow menu path: Personal > Dependents to add the foster child’s information.

- If you had cryptocurrency transactions or sales you forgot to report, follow menu path: Income > Common Income >Investments and Savings and select +Add an Investment. Prior year accounts have various, but similar, menu options in the Income menu.

Save all changes (completing a full menu option when necessary), before using the menus to navigate to your next change.

Submission

After completing and saving all changes, go to the Final Steps menu (Filing menu for prior years) to complete your amendment. If you didn’t upgrade and pay for Deluxe/Pro Support when completing the replica, you’ll pay for the amendment preparation here.

Next, provide a brief explanation for the amendment (e.g., claiming a dependent you previously missed like a foster child). Continue through to review the amended return. You’ll see an updated 1040 ("As Amended"), a 1040-X, and state forms (if included). Most states reuse the same tax form with an amendment box marked or other amendment notation.

For current year amendments, you can usually choose to e-file or mail. For state returns, it depends on whether your state allows e-filing and if they allow e-filing from a different service provider than the one used for your original return (many don’t as a fraud deterrent). Also, you must e-file a federal amendment to e-file a state amendment. If filing a state amendment only, it will need to be mailed.

E-filing prior year returns/amendments depends on IRS/state support and requires an IP PIN. Once you obtain an IP PIN, it must be used for any return filed in the calendar year, including your current year return if that isn’t filed yet. If you prefer not to receive a new IP PIN each year, be sure to opt out of the program.

If mailing your amendment, follow menu path: Final Steps > Submit Tax Return > Check Status/Print Tax Return for the finalized tax forms and mailing instructions. We can't track mailed returns, so it may be a good idea to send via certified mail or get a tracking number for confirmation if you want to verify the IRS or a state receive the amended return.

If you e-file, check your account or watch for an email or text message with amendment status changes, such as accepted for processing by the IRS and your state (if applicable). Once accepted, you're done. The IRS or state will process your return and contact you if needed.

Conclusion

Amending a tax return with FreeTaxUSA is a straightforward process—even if you didn’t file your original return with us. By carefully recreating your last tax return, entering accurate amendment information, and making changes, you’ll generate a complete and correct Form 1040-X (and state forms if needed). Whether you e-file or mail, be sure to follow the final instructions. And remember—if you ever get stuck, our Support team is ready to help!

Video Tutorial