Contributed by: MatthewD, FreeTaxUSA Agent, Tax Pro

Life can throw you curve balls, and you may end up in a situation where you need to file your current year tax return along with a couple past due returns from previous years. You’ll want to get caught up as soon as you can. You may have a refund for one year but owe taxes for others. You wonder: Can you file them all at the same time, or do you have to submit the earliest return first and wait for the IRS to process it before filing the next one?

The answer is: Yes, you can file multiple years at the same time, and FreeTaxUSA can help. However, there are some guidelines to keep in mind as you get started.

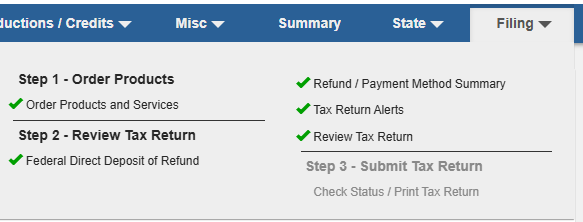

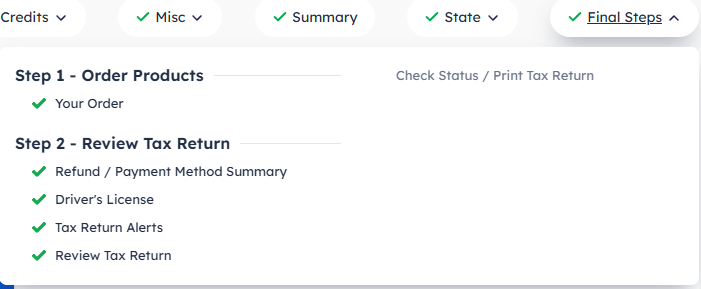

- Start with the earliest year first: FreeTaxUSA generally supports up to seven years of prior year tax returns. By starting with the earliest year (and not signing into the next year until the Final Steps are completed), you’ll ensure that information rolls from the earliest prior year to the next year. This can save you time and help keep your returns accurate--especially if you have tax items like capital loss carryforwards, credits that roll over, or depreciation on business and rental assets.

- Claiming refunds and paying taxes: If you owe taxes for one year and have a refund for the next, the IRS may use that refund to pay any outstanding taxes from other years. Pay what you can, then wait for the IRS to process all of your tax returns and send you a bill so you know how much more you need to pay. If you owe taxes on a prior year, you’ll owe penalties and interest.

- Take your time: Make sure your earliest returns are complete before moving on to the next year. Gather and sort all your financial papers and tax documents by year. You want to avoid needing to amend a return later.

- Statute of limitations on refunds: If you’re due a refund for a particular year, you must file that tax return within three years of its original due date to claim the refund. Otherwise, you’ll lose it. For example, you need to file a 2021 tax return, which was due on April 18, 2022. This means you had until April 15, 2025, to file it and claim the refund. If you’re mailing returns, always send them certified mail with return receipts so you have proof that you filed on time to get the refund.

Getting started

Step 1: To get started, visit the FreeTaxUSA Prior Year page and elect the earliest year you need to prepare. Either create an account or sign in with your existing username and password if you already have an account set up with us.

Step 2: Enter your personal, income, deductions and credits information. Don’t forget to include any credit rollovers, capital loss carryovers, and other carryforwards. You may need to look at the tax return from the prior year to ensure all carryforwards are properly accounted for.

Step 3: Finish your return on the Filing or Final Steps menu. In most cases, you can’t e-file a prior year return. Select the option to print and mail your return, then continue to the Check Status / Print Tax Return page.

Step 4: After you finish the earliest prior year return, the information in your account will be ready to roll over to the next year. Return to the Prior Years page to sign in to the next year and complete each past-due return in chronological order.

Final steps: Print and sign each return. Mailing instructions will be provided on the Check Status/Print Tax Return page each year. You can find the address to mail your federal tax return on the “Where to file paper tax returns” IRS website. You can file the returns at the same time. However, it’s recommended to send each tax return in a separate envelope to help reduce errors and expedite the processing of the returns. If you’re filing a current year return, it can be e-filed.

Taxes due: If possible, pay any taxes due. This will reduce the amount of interest on overdue taxes. You can visit the IRS website to make a payment or apply for a payment plan.

If you have past-due state tax returns, use the same prior year accounts and prepare them along with the federal returns for each year. Use the state forms, the Check Status/Print Tax Return page, or your state website to find the correct mailing address.

Allow at least six weeks for the IRS to process an accurately completed return. You can check the status of your returns using your IRS online account.