Contributed by: AndreaS, FreeTaxUSA Agent, Tax Pro

Most homeowners don’t need to report the sale of their main home (primary residence) on their tax return. However, there are circumstances when it’s required. In this article, we’ll guide you through the eligibility requirements for the home sale exclusion and explain when you may need to report profits from selling your home on your tax return.

How can I tell if I qualify for the exclusion?

A home is considered an investment. When a home is sold and there is a profit, the profit is a capital gain. Capital gains are treated as income and must be reported on your tax return. If the home is your primary residence, the IRS may allow you to exclude some or all of the profit (gain) from being taxed. This means you won’t have to pay taxes on a portion of the sale if you meet certain requirements.

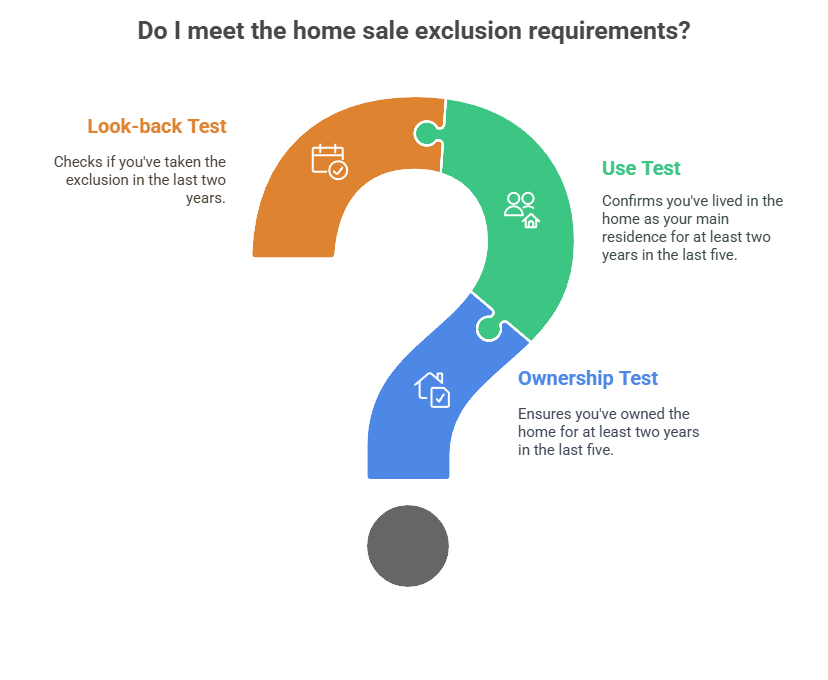

There are three tests to consider to see if you qualify for the exclusion. If you meet all three tests, you qualify for the exclusion:

Ownership test: You, your spouse, or former spouse must own the home for at least two of the last five years, ending on the date of the sale.

Use test: You, your spouse, or former spouse must live in and use it as your main home for at least two of the last five years. The two years don’t need to be continuous, and it doesn’t need to be two years right before the sale. You only need to live in the home for a total of 24 months within five years.

Look-back test: The home exclusion can be claimed only once within two years. If you don’t sell another home for two years prior to the sale, or you have sold another home but didn’t take the exclusion, you will meet the look-back requirement.

If I qualify, how much of the home sale income can I exclude?

If you meet the ownership, use, and look-back tests, congratulations! Now look at your filing status to see how much income (profit) from the sale of the home can be left off your tax return.

- Single, Head of Household or Married Filing Separately: You can exclude up to $250,000 gain from the sale of your home.

- Married Filing Jointly: You can exclude up to $500,000 gain from the sale of your home.

What does this look like?

If an individual who is single purchased a home for $200,000, met all eligibility requirements, and later sold the home for $300,000, the capital gain would be $100,000 ($300,000 - $200,000 = $100,000). Because this amount is below the $250,000 exclusion threshold, it doesn't need to be reported as income on the tax return.

However, if the home was purchased for $200,000, but sold for $600,000, part of the sale would need to be reported and taxed as income on your tax return. In this scenario the capital gain is $400,000 ($600,000 - $200,000 = $400,000). In this case, you qualify for a $250,000 exclusion; therefore, only the excess amount of $150,000 ($400,000 - $250,000 = $150,000) must be reported as a taxable capital gain on your tax return.

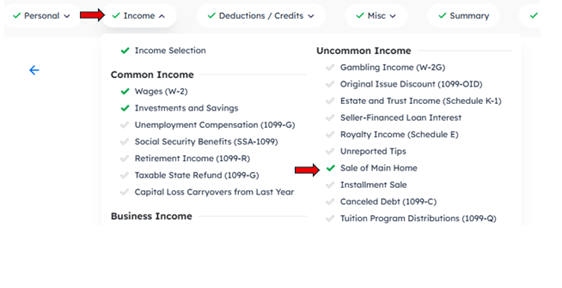

You can begin by entering your home sale under Income > Uncommon Income > Sale of Main Home as seen below:

What if I don’t meet the tests? Am I out of luck?

There are some circumstances where part of the home sale exclusion can be used. There are also some circumstances where you're not eligible to use the exclusion. We'll cover some of the more common situations. You may want to consult a tax professional if your situation is more complicated.

What qualifies for a reduced exclusion?

An unexpected life change that forces you to sell your home may let you exclude some of your income gains. The following are qualifying situations for a reduced exclusion:

- New job: You or a spouse have a new job 50 miles or more away, or it’s 50 miles further from your home than your previous job.

- Injury, illness or disease: If you or a household member experiences significant life changes, it may become necessary to move in order to diagnose, treat, cure, or manage an illness or injury, or to follow a medical recommendation to receive better care.

- Unforeseen circumstances: Nature or man-made disasters, death, divorce, multiple births from the same pregnancy, becoming eligible for unemployment compensation, inability to provide basic living expenses for your household due to a change in employment status, or an involuntary conversion of your home. An involuntary conversion typically happens when a home is condemned or destroyed beyond repair.

- Home business: If the home was used for business or rental purposes, either while you lived there or it was converted to or from personal use to business use, you may be able to claim the exclusion for the percentage of the sale that's associated with the personal use of the home, as long as you meet the ownership, use, and look-back tests. The percentage of the sale linked to business use doesn't qualify.

- Like-kind/1031 exchange: This can potentially be one of those more complicated tax scenarios. Since a like-kind exchange can only be done on business property, this would need to be a business property which is later converted to personal use as your main home. You'll need to resolve several different things with this sale before you can take the home sale exclusion, such as depreciation recapture and the deferred gain or loss on the original exchange. It's recommended to get assistance reporting a like-kind/1031 exchange on your tax return.

- Change in marital status: In the event of divorce or separation, you may qualify for the exclusion when you sell the home. There are additional rules that apply. It’s recommended to read about divorce or separation in Publication 523.

- Surviving spouse: If eligibility tests aren’t met and a spouse recently passed away, the $250,000 exclusion may still be claimed as long as you haven’t remarried. The $500,000 exclusion may be claimed if your filing status is married filing jointly and the additional requirements are met, which are:

- The home is sold within two years of the spouse’s death,

- You aren’t remarried at the time of the sale,

- Neither you nor your late spouse claimed the home sale exclusion within two years before the sale,

- You meet ownership and use requirements.

Some things to keep in mind:

- The exclusion can be claimed once every two years,

- It’s important to consider more than just the purchase price of the home and the final sale amount. The amount you paid for the home is called a basis. If you made qualifying updates to the home while living in it, and saved the receipts for those purchases, that cost can be added to your basis. This helps reduce the profit on the sale of your home. More information about qualifying expenses can be found in Publication 523 with guidelines for adjusting your basis.

- Keep track of selling expenses, such as sales commissions, advertising, or legal fees.

- Extra guidance may be needed in the event of inheriting the home, converting it from a second home, rental, or business, acquiring it through a like-kind exchange, or receiving it in a divorce settlement.

- The sale may need to be reported on your return, even if you qualify to exclude all earnings from the sale, if you were issued a 1099-S. In general, if you're issued a tax form, the IRS will expect it to be reported on your return.

If you're uncertain whether you qualify for the exclusion, our software does a great job of asking questions to determine your eligibility. To enter the sale of a main home (primary residence) in our software, go to Income > Uncommon Income > Sale of Main Home. FreeTaxUSA supports most situations mentioned and can help you report them correctly on your return.