Contributed by: TriciaD, FreeTaxUSA Agent, Tax Pro

A 401(k) plan allows employees to save part of their wages for retirement with benefits like tax-deferred growth and employer matching contributions. Annual contributions to a 401(k) plan are limited. Highly compensated employees (HCEs) are subject to certain rules designed to ensure savings plans are equitable for all employees.

Who is a highly compensated employee?

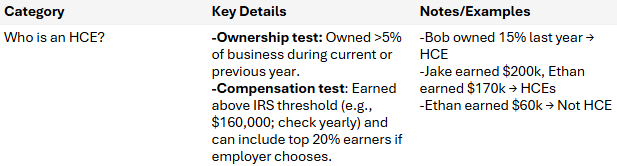

The IRS uses two tests to determine if you're a highly compensated employee (HCE):

- Ownership test: If you owned more than 5% of a business at any point during the current plan year or the previous 12 months (lookback year), you're considered an HCE. This applies even if your ownership exceeded 5% for just part of that period.

- Scenario: Jamie owns 8% of her company, even though she only worked there for half of the previous year. Because her ownership exceeded 5% at any time during this period, Jamie is considered a highly compensated employee for the current plan year--even if her salary isn't particularly high.

- Compensation test: If your compensation exceeds the IRS threshold (e.g., $160,000 for 2025, but check annually for updates) during the lookback year and you're among the top 20% of earners (if the employer elects this group), you're classified as an HCE.

- Scenario: Sam earned $180,000 last year, while his colleague Alex earned $60,000. If the current year IRS compensation threshold for HCE designation is $160,000, Sam is classified as an HCE, while Alex is not.

If your company’s 401(k) plan uses a shorter plan year, the time periods for these rules are adjusted to match the shorter year.

Always refer to the latest IRS compensation limits, as these figures can change yearly due to inflation adjustments.

Contribution limits and non-discrimination testing

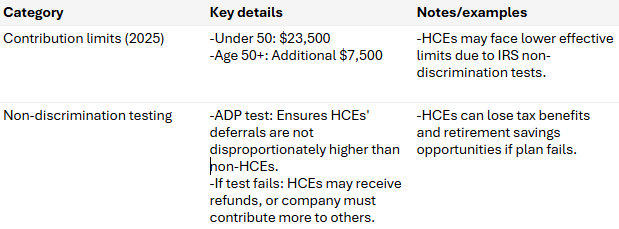

Every year, there’s a set limit for how much you can put into a 401(k) account. For 2025, most people under age 50 can contribute up to $23,500, and people 50 or older can add an extra $7,500. However, if you’re an HCE, you might not be able to put in this much because of special IRS rules. These rules are there to make sure that higher-paid workers can’t put in a much bigger percentage of their pay than everyone else at the company.

One rule, called the actual deferral percentage (ADP) test, compares how much HCEs put into their 401(k)s to what other workers put in. If the test shows that HCEs are putting in a lot more than the rest, the plan fails the test. If that happens, HCEs might have to get some of their 401(k) contributions refunded, or the company might have to put more money into the accounts of other employees. When this happens, HCEs lose some of the tax benefits, and it can make it harder to save for retirement.

- Non-discrimination test example: In a small business, regular employees (non-HCEs) contribute, on average, 4% of their salaries to the company’s 401(k) plan, while HCEs contribute an average of 8%. If the ADP test (discussed later) finds this difference too large, the plan may fail. As a result, some HCEs might have part of their 401(k) contributions refunded to bring averages in line, reducing their pre-tax savings for that year.

Safe harbor to avoid mistakes

Every year, companies with regular 401(k) plans must check that money being saved for regular employees is about the same as what’s saved for owners and HCEs. When more regular employees (called non highly compensated employees, or NHCEs) save for retirement, the rules let HCEs save more, too. Two important checks for this are called the actual deferral percentage (ADP) and actual contribution percentage (ACP) tests:

- ADP test - looks at the percentage of each person’s pay put into their 401(k) plan by themselves, before taxes or with Roth money (but not catch-up contributions for people over 50).

- ACP test - is met if the ACP for eligible HCEs does not exceed the greater of:125% of the ACP for the group of NHCEs, or the lesser of 200% of the ACP for the group of NHCEs, or the ACP for the NHCEs plus 2%.

To avoid failed 401(k) ADP and ACP nondiscrimination problems, consider a safe harbor 401(k) plan. These plans don’t have to follow the ADP and ACP tests if they meet certain rules. Always talk with your plan administrator about who’s an eligible employee and what’s considered pay. Watch out for family members of owners--even if they have a different last name--and double-check everyone’s status each year.

- Scenario: A tech startup adopts a safe harbor 401(k) plan. The company commits to contributing 3% of every employee’s salary to their retirement accounts, regardless of how much employees contribute. Thanks to this, HCEs at the company (like top engineers and managers earning over $160,000) are allowed to contribute the full annual limit without worrying about potential refunds from failed discrimination tests.

If your plan fails the test, fix it quickly. If you wait too long, you may lose tax benefits or have to give back money. Know your plan’s rules and deadlines to stay on track.

Plan strategies for HCEs

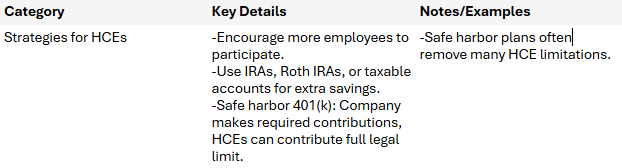

Here are some ways highly paid employees can save more for retirement and follow the rules:

- Get more people to join: Try to get more employees to join your company’s 401(k) plan. If more people join, highly paid workers can usually put in more money.

- Save in other ways: If there’s a limit to how much you can put in your 401(k), you may be able to save money for retirement in other accounts, like an IRA, Roth IRA, or even a regular savings account.

- Safe harbor plans: Some companies use special Safe Harbor 401(k) plans. With these, the company must give a certain amount of money to everyone’s retirement accounts. In return, highly compensated employees can almost always put in the full amount allowed each year.

- Scenario: Maya earns $170,000 and wants to save more for retirement, but her plan has failed non-discrimination testing in the past, limiting her 401(k) contributions. She encourages more of her colleagues to join and contribute to the plan, but she also opens a traditional IRA to make non-deductible IRA contributions, then uses the backdoor Roth strategy to save extra funds, ensuring she doesn’t miss out on retirement savings opportunities.

Key takeaways

401(k) plans are a terrific way to save for retirement, but highly compensated employees have extra rules to follow. By learning about these limits and planning, HCEs can still save as much as possible for retirement and avoid problems with their accounts.

Here are other FreeTaxUSA Community articles related to retirement: