Contributed by KeriC, FreeTaxUSA Agent, Tax Pro

If you’re a nonresident of New York state, you must file a tax return if you meet any of the following conditions:

1) You have New York sourced income from one of the following:

2) You want to claim a refund of taxes paid to New York (NY State, NYC, or Yonkers income taxes)

3) You want to claim refundable or carryover credits available

4) You had a net operating loss for NY State income tax purposes but didn’t have a similar net operating loss for federal income tax purposes.

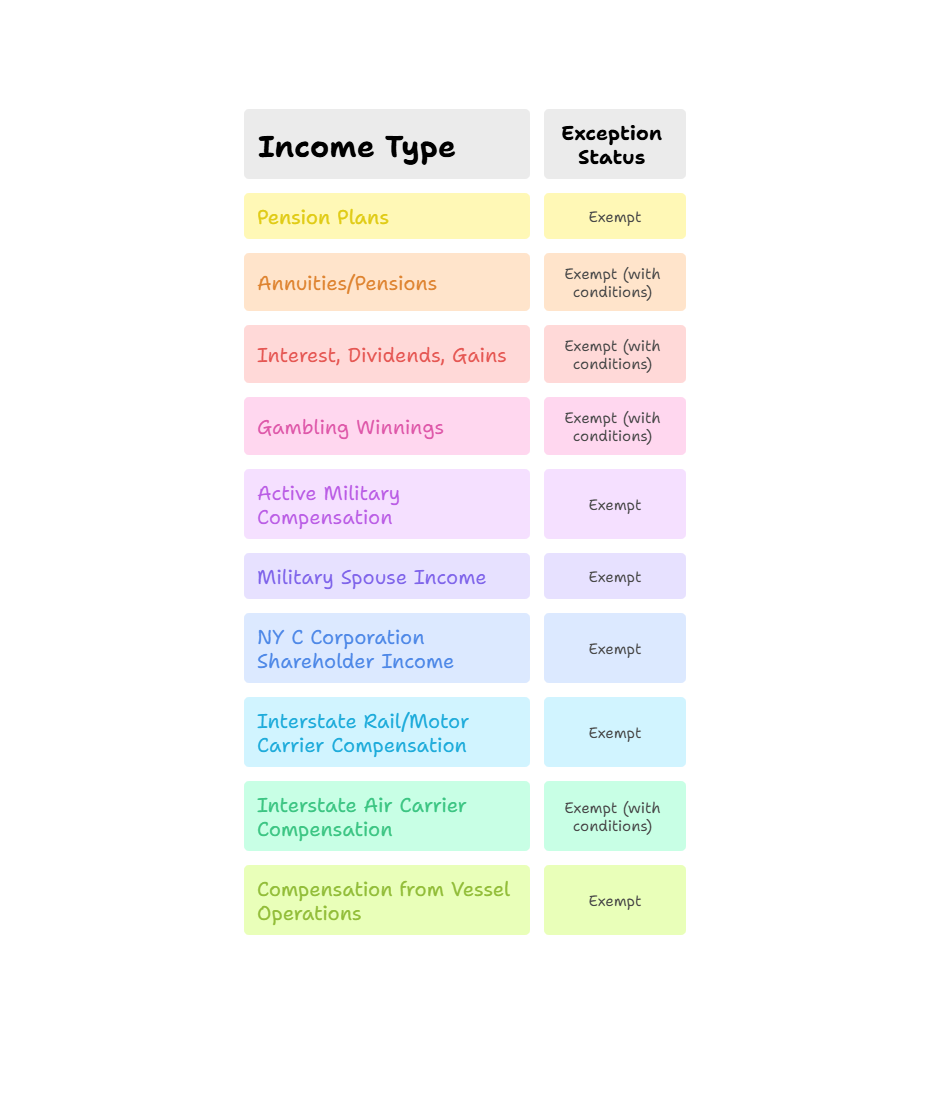

If you’re a nonresident, New York won’t tax you on the following:

In conclusion, if you’re a nonresident of New York state, it's important to determine whether you have any New York–sourced income or specific tax circumstances that require you to file a return. Filing may be necessary if you earned income from New York sources, but also if you're seeking a refund, claiming tax credits, or reporting a state-specific net operating loss. For a comprehensive list of NY sourced income vs. non NY sourced income, review the Nonresidents: New York source income section (NY State Instructions for Form IT-203).

Additional Resources: