Contributed by KeriC, FreeTaxUSA Agent, Tax Pro

Do you live in one state and work in another? If so, do the two states have a reciprocal tax agreement? Not all states have reciprocal agreements, so it's important to know if your state has one — and if it applies to the state where you work. You can find the list of states with reciprocal agreements in this Community Article.

If you answered yes to both questions above, this article is for you.

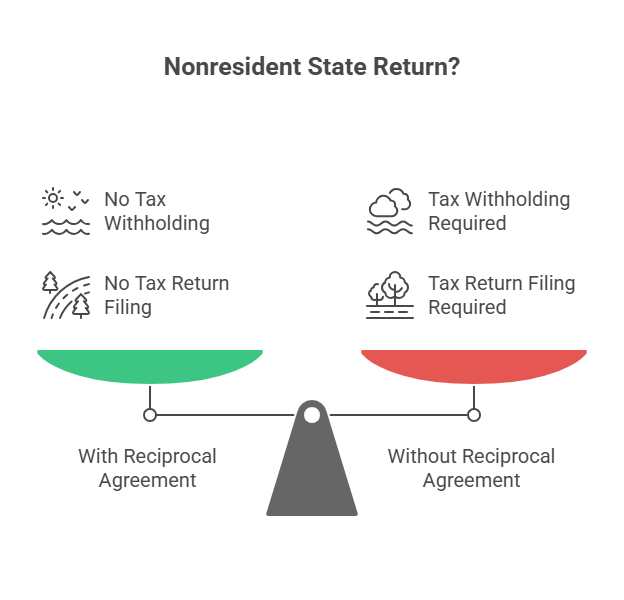

Tax reciprocity, or reciprocal agreement, between two states allows a resident who lives in one state and works as an employee in another state (most often a bordering state) to file only a resident state tax return and have tax withheld solely for their resident state.

Here’s how it works:

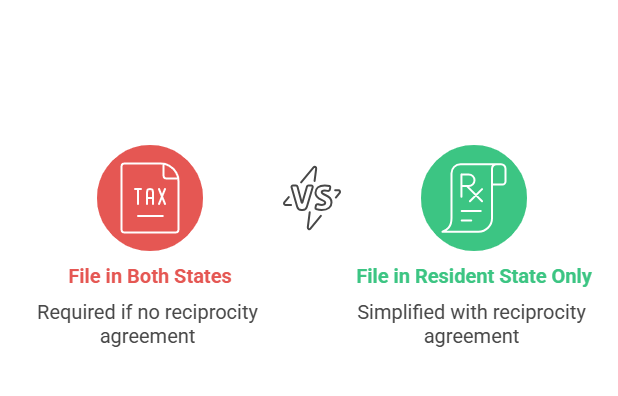

- Typically, if you live in one state and work in another without a reciprocal agreement between the states, you’ll need to file state income tax returns for both states.

- However, with a reciprocal agreement, the nonresident state where you're employed will not require state tax to be withheld or a nonresident tax return to be filed.

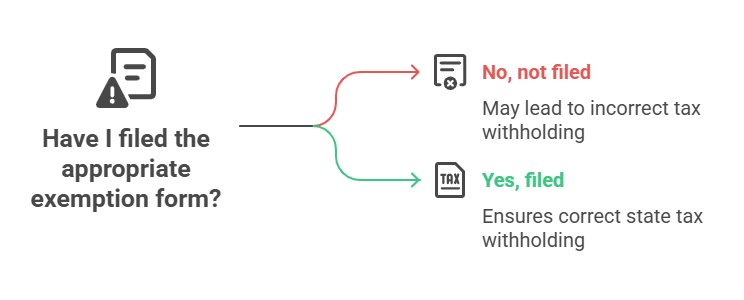

- If you live and work in reciprocal states, make sure you’ve filed the appropriate exemption form with your employer so they can correctly withhold your state tax. Links to exemption forms can be found in this Community Article.

Example:

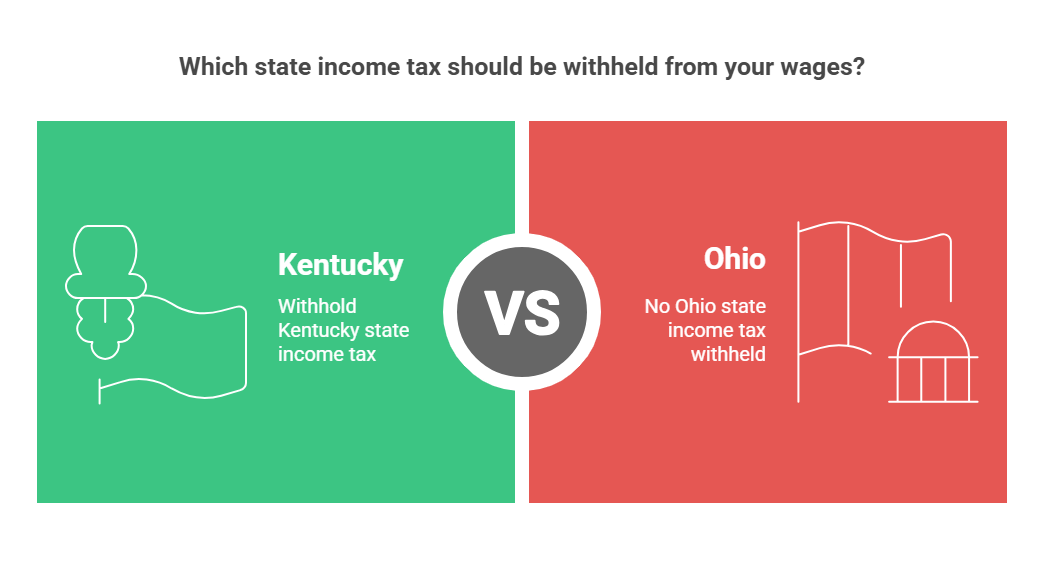

- You live in Kentucky but work in Ohio.

- Kentucky and Ohio have a reciprocity agreement.

- You only pay Kentucky state income tax, not Ohio.

- As long as you’ve filled out the exemption form and provided it to your employer, Ohio state income tax shouldn’t be withheld from your wages by your employer. Instead, they should withhold Kentucky state income tax from your wages.

Key points:

- A reciprocal agreement typically only applies to W-2 wages, not self-employment or other types of income. Additionally, agreements cover state income tax only. Local taxes (such as county or city income tax) for the state where you work may still apply.

- Not all states have reciprocal agreements.

If your resident and employer states don’t have a reciprocal agreement, you’ll file tax returns for both states. You’ll typically receive a credit on your resident state for taxes paid to your work state.