Contributed by KeriC, FreeTaxUSA Agent, Tax Pro

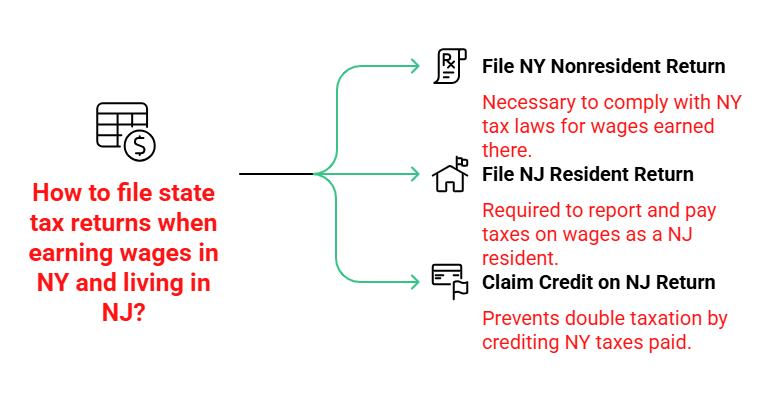

Basics:

- New York taxes all wages earned from NY sources. For a comprehensive list of nonresident income NY taxes, see this article, Do I need to file a New York nonresident return? If you have NY source income, and you’re a nonresident, a nonresident NY state tax return should be filed.

- New Jersey will tax all wages earned while a resident of NJ. You’ll need to file a resident NJ state tax return.

To avoid being double taxed, you can claim a credit for taxes paid to NY on your NJ return. In FreeTaxUSA, enter and complete your NY return information first.

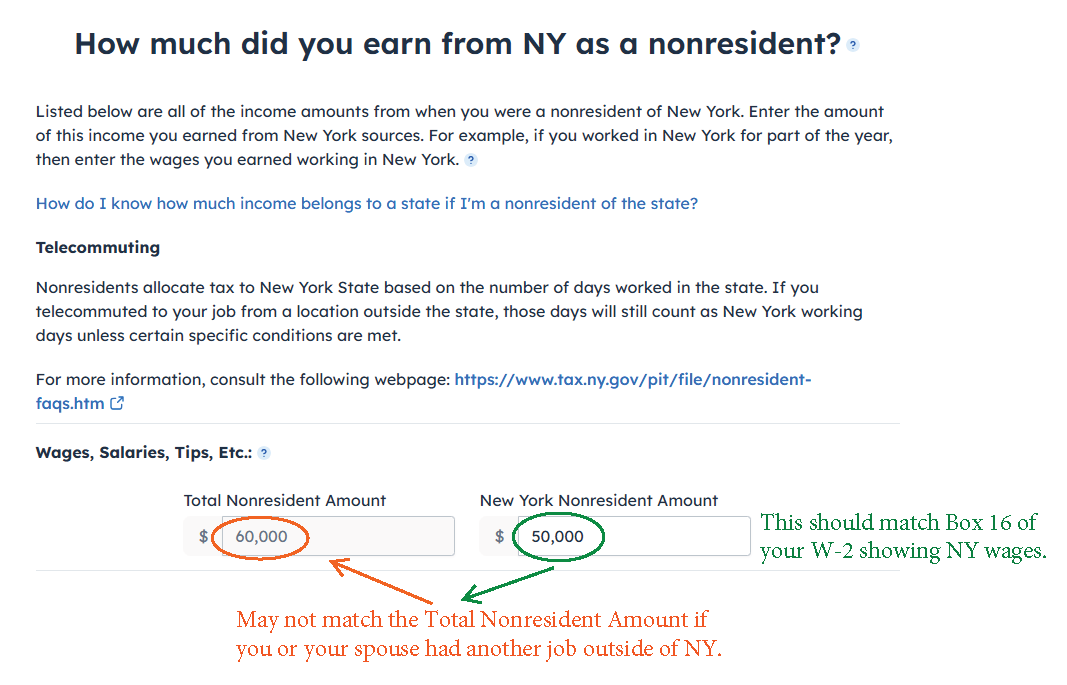

First: Beginning with your NY tax return, you’ll allocate your NY nonresident wages. To start, select State > Your State Tax Returns > New York.

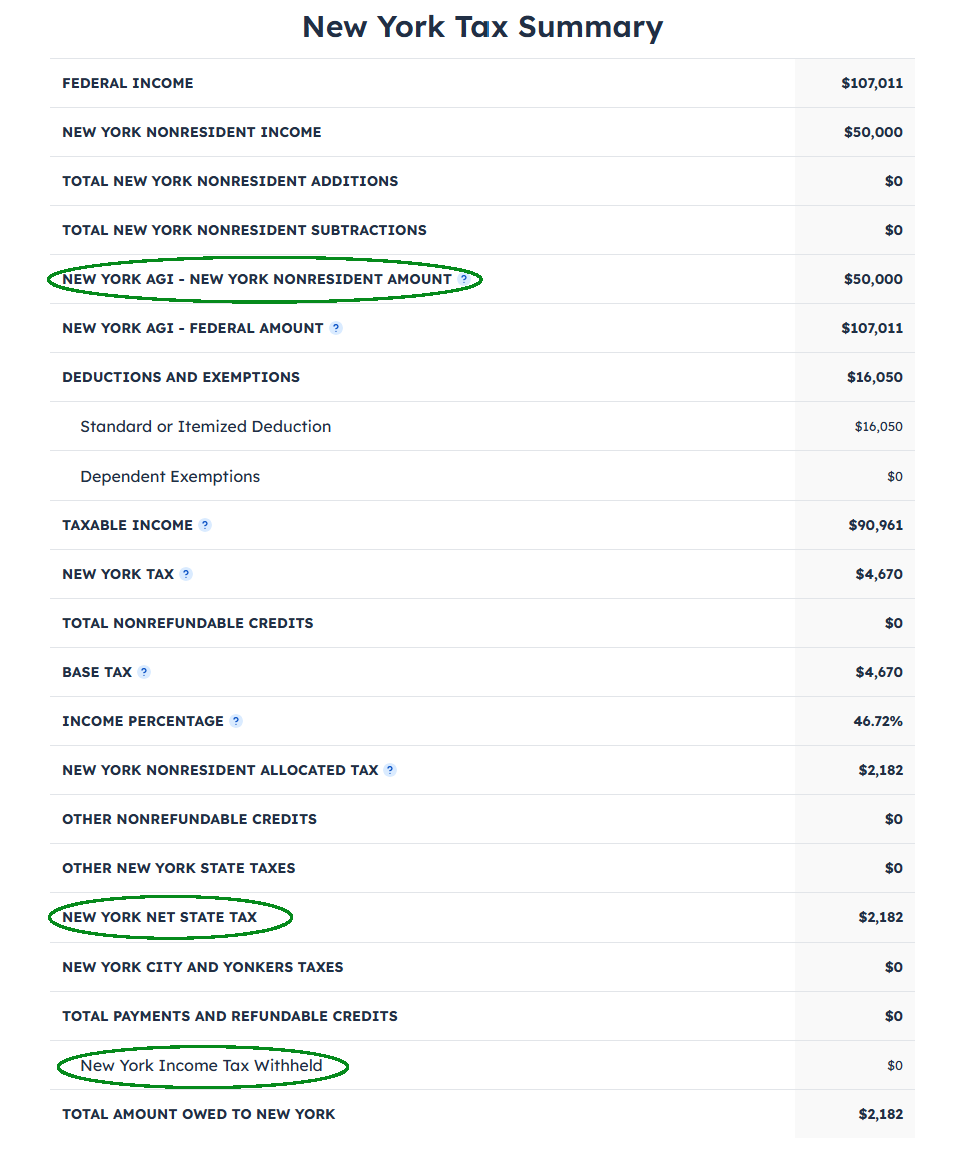

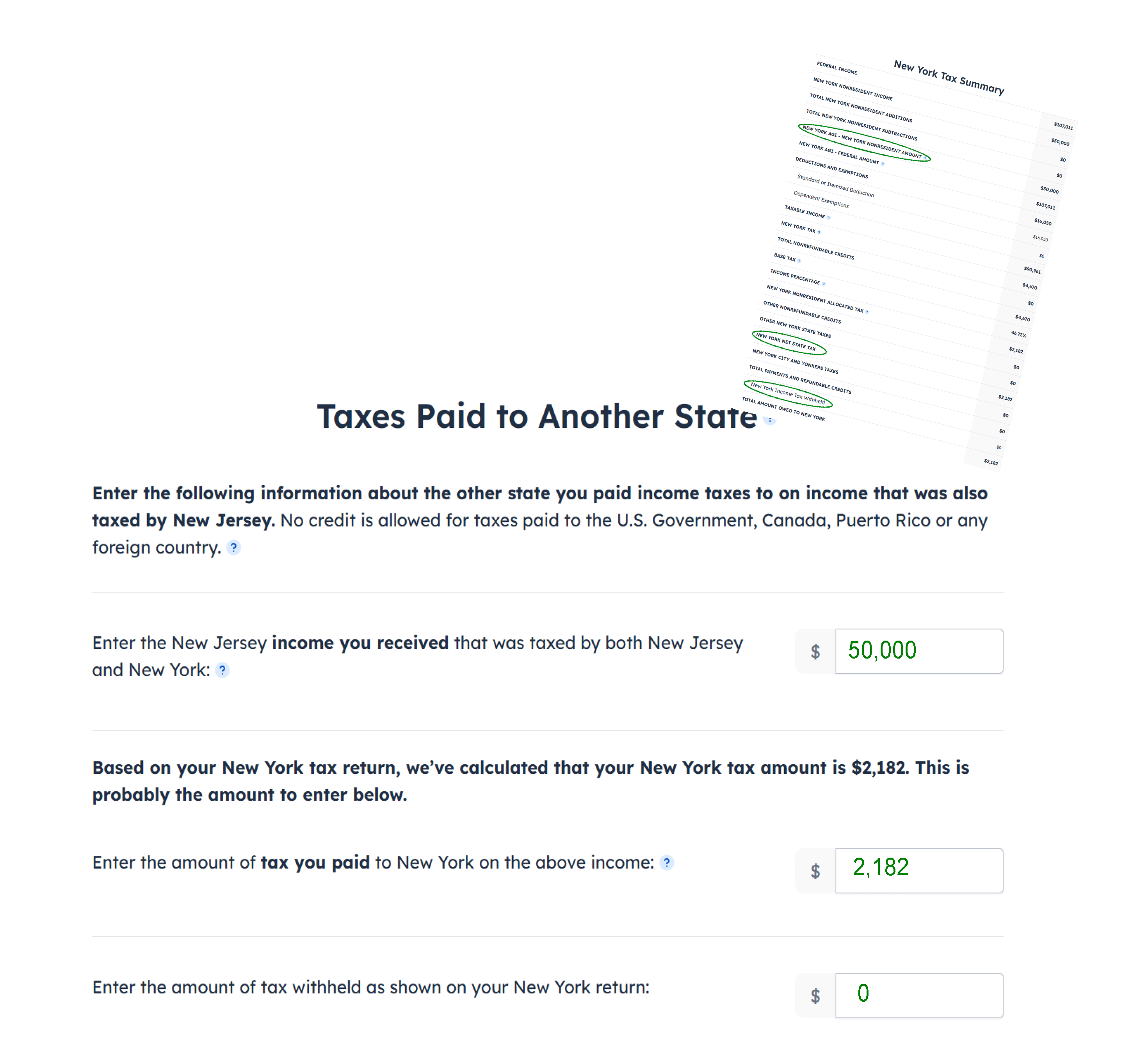

Second: Complete your NY state return entries. Proceed to view your NY state summary and gather information from it. If you need to navigate back to it, follow menu path: State > New York > State Summary.

Write down the following amounts: 1) New York AGI - New York Nonresident Amount, 2) New York Net State Tax, and 3) New York Income Tax Withheld.

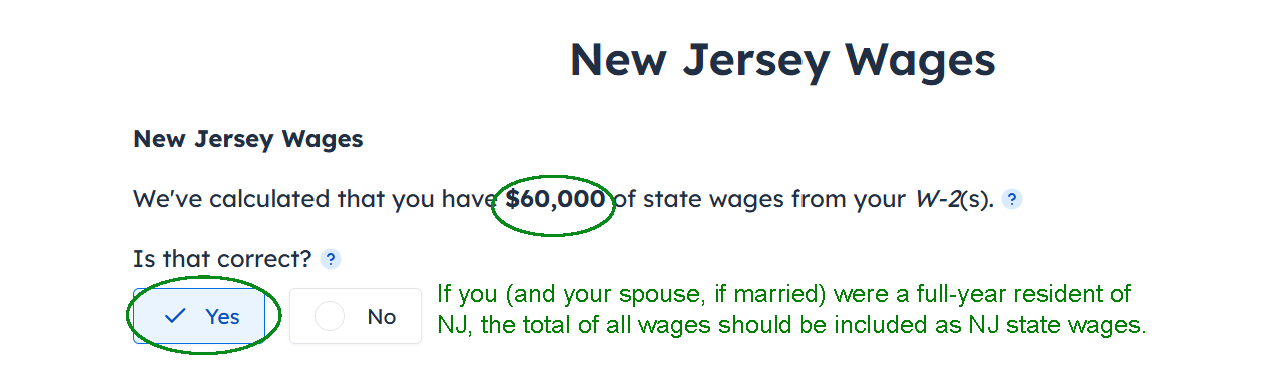

Third: Proceed to enter your New Jersey tax return information. If you haven’t added a New Jersey return to your account, select State > Your State Tax Returns > Add a State Return.

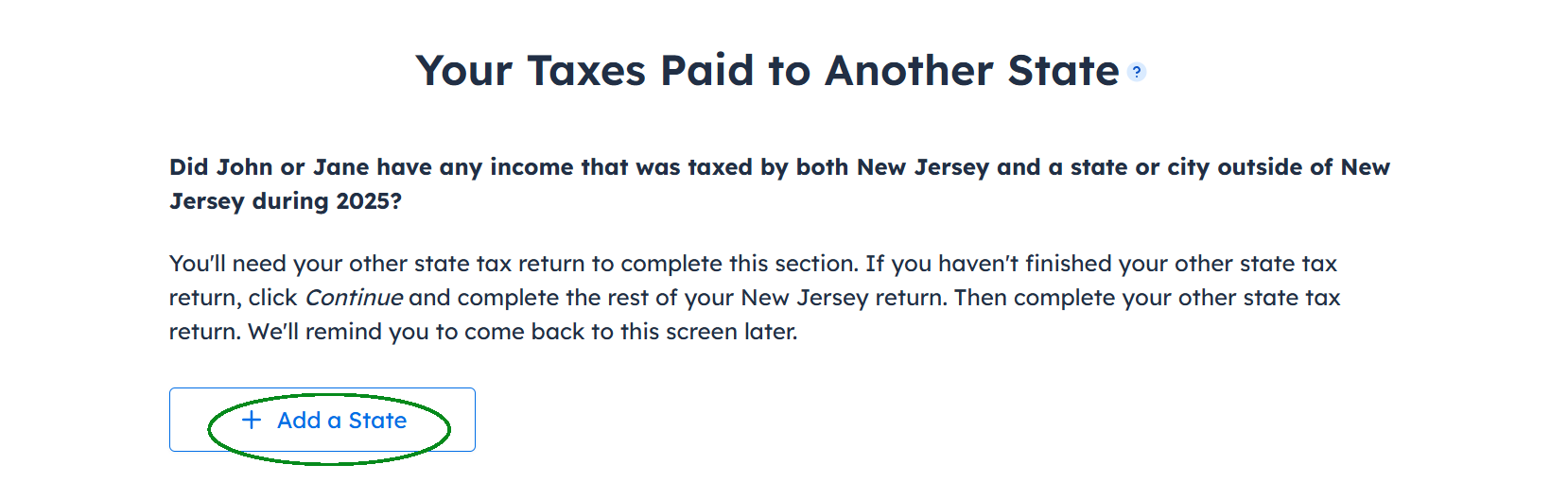

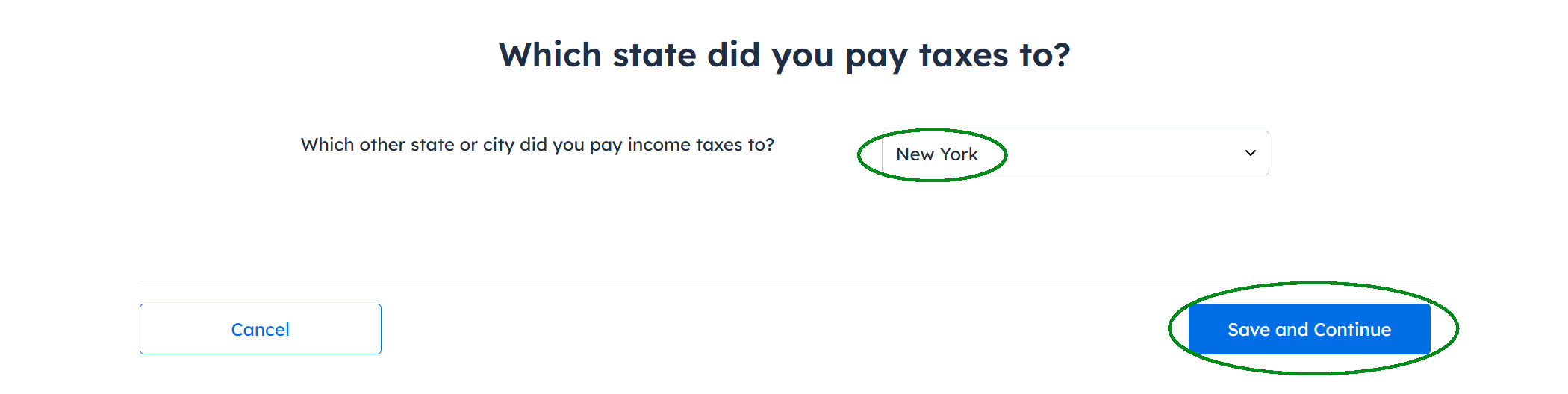

Fourth and finally: Continue to the page titled “Your Taxes Paid to Another State.”

This is where you’ll enter amounts from the NY Tax Summary screen. They’ll be entered in the same order. The software will correctly calculate the credit for you.

What if my W-2 shows both NY and NJ in Box 15?

Enter your federal and first state W-2 information. Select “Add Another State” to list the additional state’s boxes 15-20 information.

What if my W-2 shows “Total State” in Box 15?

Your employer should include several copies of your W-2. Locate the copies showing each specific state listed in Box 15. Your W-2 may have more than one state listed on a particular W-2 copy, or your employer may have each state separately listed on separate W-2s. Only enter your W-2 once and use “Add Another State” to include all states from your W-2.

Key information to remember:

- NY taxes all income earned from NY sources.

- NJ taxes all income as a full-year resident.

- Complete your NY state screens first, and your NJ state screens second.

- Be sure to enter information for your NJ Credit for Taxes Paid to Another State to avoid double taxation on your NY source income.

Other scenarios:

I don’t work in NY. I telecommute from my home in NJ.

- If you’re a nonresident whose primary office is in New York State, your days telecommuting are considered days worked in the state unless your employer has established a bona fide employer office at your telecommuting location.

- In general, unless your employer specifically acted to establish a bona fide employer office at your telecommuting location, you’ll continue to owe New York State income tax on income earned while telecommuting.

I moved during the year. I worked in NY all year but had part-year residency in both NY and NJ.

- For New Jersey: You’ll claim the Credit for Taxes Paid to Another State on your NJ return only for the time living in NJ and working in NY. Allocate your income on your NJ return to indicate how much was earned in NY during the time you were a resident of NJ.

- For New York: “If you were a resident for only a portion of the year, your income subject to tax will be split, with part taxed according to resident rules and the remainder subject to nonresident rules. To compute tax, first calculate your tax as if you were a full year resident, then determine how much to allocate to New York by an income percentage based on your New York source income and your federal income.” For more information see the NY Personal Income Tax FAQ about, "Frequently Asked Questions about Filing Requirements."

- The software will walk you through the NY allocations and calculate the total tax for you.

I got married during the year. We only lived and worked in NJ and/or NY.

- If you and your spouse have the same full-year residency status in NJ, file your state returns using the process detailed in this article.

- If you and your spouse have different state residency statuses during the year, you must file a joint NJ state return if you filed a joint federal return. You’ll allocate income received while you were a resident of NJ. Your NY return can be handled in various ways. Refer to the New York State Department of Taxation and Finance for additional information on how to file in this situation.

What if no NJ tax was withheld?

- Depending on your total income and other sources of withholding, you may owe NJ tax for your NY sourced income. Remember, anything owed to NJ is generally offset by a credit for taxes paid to NY.

What if both NJ and NY tax were withheld?

- State tax withheld by each state will be applied to your state returns accordingly. The Credit for Taxes Paid to Another State will still be applied to your NJ return for taxes paid to NY.

What is the difference between NEW YORK AGI - FEDERAL AMOUNT and NEW YORK AGI - NEW YORK NONRESIDENT AMOUNT?

- New York AGI – Federal Amount is your federal AGI from Form 1040 and includes all income from all states.

- New York AGI – New York Nonresident Amount is your NY sourced income. As a nonresident of NY, it shouldn’t include income from other states.