Contributed by: MatthewD, FreeTaxUSA Agent, Tax Pro

Work can be hard enough on its own. Dealing with an employment dispute adds emotional strain. If you’re at the point where the process is over and a settlement has been paid, you may have to pay taxes on that payment. Your attorney may have explained this, but perhaps not in detail.

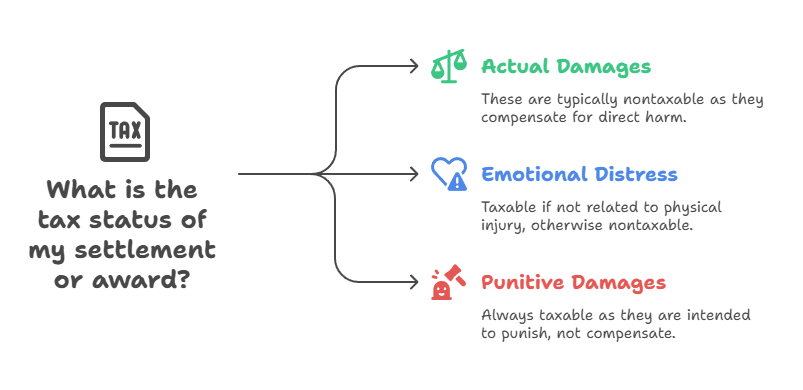

Settlements and awards are either taxable or nontaxable and usually originate from three main sources:

- Actual damages resulting from physical or non-physical injury;

- Emotional distress damages arising from actual physical or non-physical injury; and

- Punitive damages

Payments received for damages are reported on your tax return, except for damages arising from “personal physical injuries or physical sickness.” For more information, see IRS FAQ Tax implications of settlements and judgments.

You should receive a 1099-MISC showing the amount of the payment. The total amount may include your attorney fees. Even if the fees were paid directly to the attorney, they are typically considered part of your settlement, and you report the total amount. If this settlement was an Equal Employment Opportunity Commission (EEOC) settlement, due to unlawful discrimination, you may report the cost of your attorney fees as an adjustment on your tax return.

In the case of a settlement which includes amounts for personal physical injuries or physical sickness, you generally do not get a 1099-MISC or the 1099-MISC will report only the taxable portion of the settlement. If you did receive a 1099-MISC reporting nontaxable income, speak with your attorney to see if that can be corrected.

If your settlement included lost wages, you may also receive a W-2 with employment taxes withheld. Report the W-2 as wage income on your tax return.

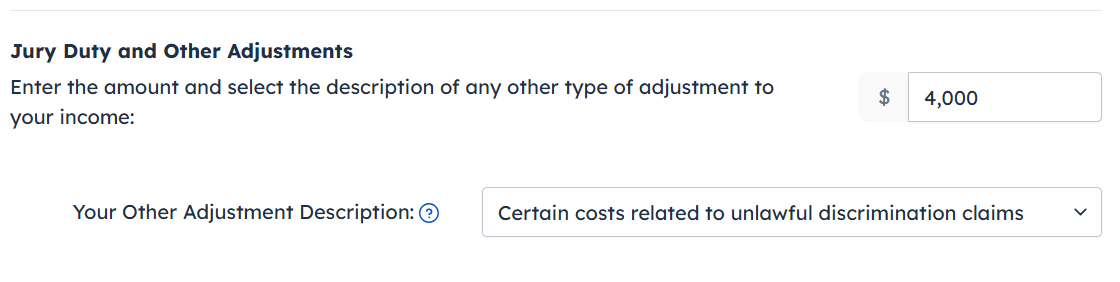

When you have a settlement which includes lost wages and deductible attorney fees related to an unlawful discrimination lawsuit, make sure you prorate the attorney fees. For example, let’s say your settlement amount was $40,000 -- $10,000 was for lost wages, which are taxable, and the other $30,000 is related to a personal injury, which is nontaxable. In this scenario, 25% or ¼ of the attorney fees apply to the portion of the settlement for lost wages ($10,000/$40,000). If the attorney fees are $16,000, then you can deduct $4,000 as an income adjustment.

Entering the income in FreeTaxUSA:

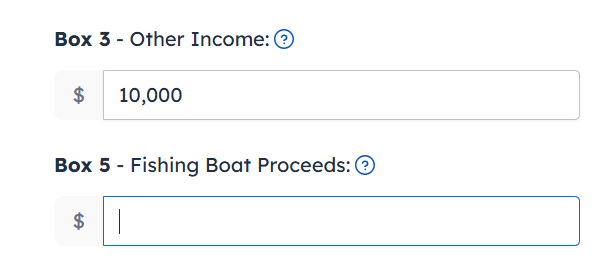

Example: You received a W-2 reporting $20,000 in lost wages and a 1099-MISC reporting $10,000 in attorney fees and punitive damages from an employment lawsuit settlement. You paid attorney fees of $6,000. $20,000 of the $30,000 total or 2/3 of the settlement is attributable to lost wages, so 2/3 of the attorney fees ($4,000) are deductible as an income adjustment.

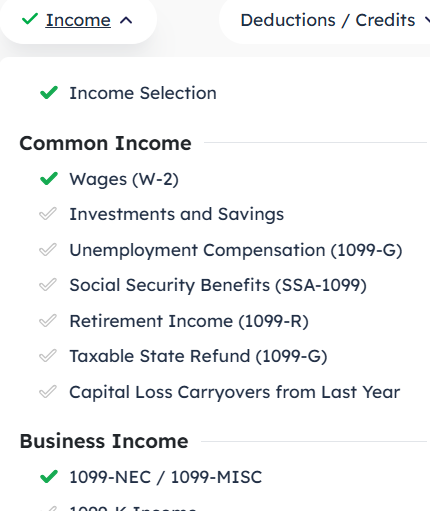

- Follow the menu path: Income > Common Income > Wages (W-2) to enter the lost wages.

- Now you’re ready to enter the 1099-MISC. Follow menu path: Income > Business Income > 1099-NEC / 1099-MISC .

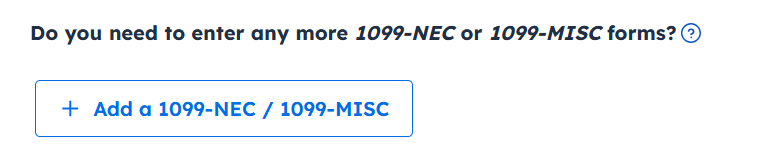

- Click on Add a 1099-NEC / 1099-MISC and choose the option to enter a 1099-MISC. Click Save and Continue.

- Fill out the 1099-MISC. Enter the amount from Box 3 and click Save and Continue.

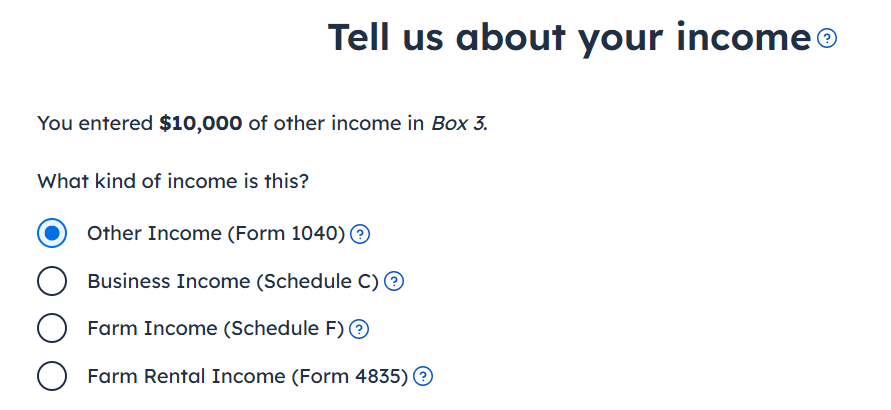

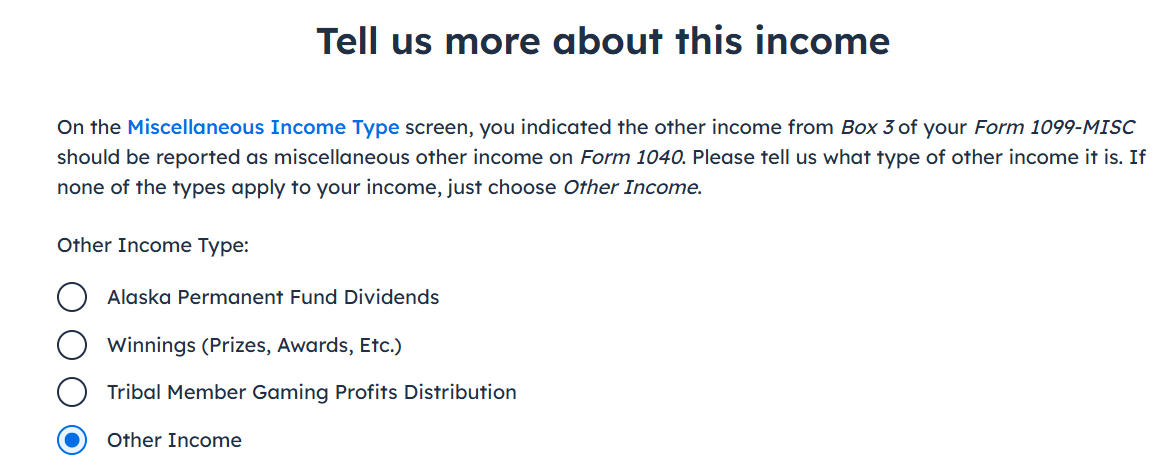

- On the Tell us about your income page, select Other Income (Form 1040). On the next page, select Other Income.

To enter deductible attorney fees:

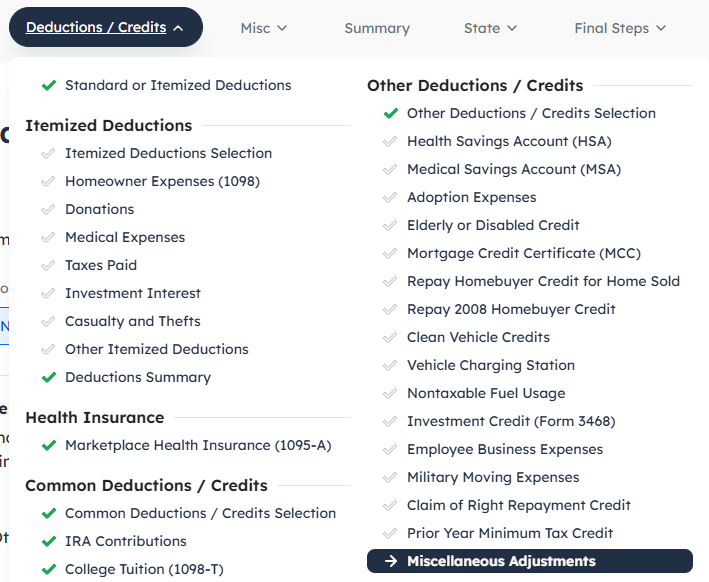

- Follow menu path: Deductions/Credits > Other Deductions/Credits > Miscellaneous Adjustments.

- In the field provided for Jury Duty and Other Adjustments, enter the amount. For the adjustment description, choose Certain costs related to unlawful discrimination claims from the drop-down menu.

Form 1040 results from entries:

When you review your Form 1040, look for these forms and lines:

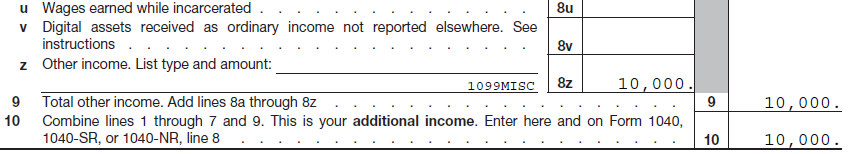

- Schedule 1, Line 8z will show the amount from the 1099-MISC with the total on Line 9 and Line 10.

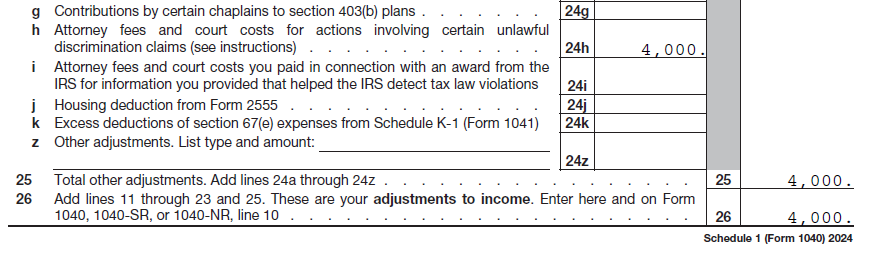

- Schedule 1, Part II, Line 24h will show any qualifying attorney fees and court costs for actions involving certain unlawful discrimination claims. Totals will be listed on Line 25 and Line 26.

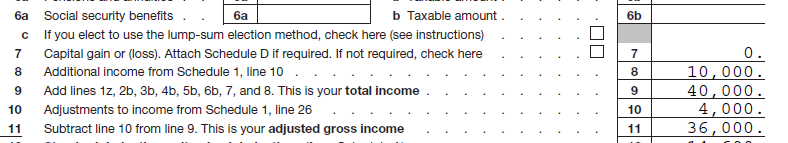

- Form 1040, Line 8 will show the additional income from Schedule 1, Line 10, and Form 1040, Line 10 will show the adjustment to income from Schedule 1, Line 26.

Conclusion

Income relating to employment claims is generally very rare. However, reporting the income on your tax return right the first time will give you peace of mind. If you’re still in the litigation process, consider making an estimated tax payment when the payout comes, since a large settlement can generate an unexpected tax due.