Contributed by KeriC, FreeTaxUSA Agent, Tax Pro

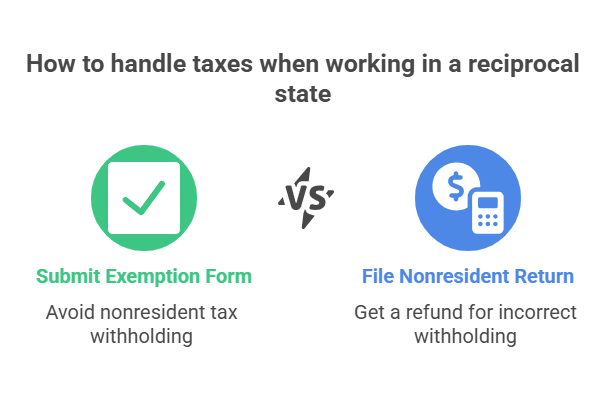

Most states with reciprocal tax agreements require nonresident workers to submit an exemption form. This form tells your employer not to withhold taxes for the work state, since you’ll pay taxes only to your home (resident) state.

If your employer withheld taxes for the state where you work, it’s likely because the exemption form wasn’t submitted. As a result, they withheld taxes for the nonresident state instead of your resident state.

What to do if taxes were withheld by the nonresident state?

- File a nonresident return: File a tax return for the state where you worked (nonresident state).

- Report $0 income in your work state: When asked to allocate your income, enter $0 as wages earned in that state. Since you’re a resident of a reciprocal state, your income shouldn't be taxed there.

- Receive a refund: You’ll receive a full refund of taxes incorrectly withheld by the nonresident state.

- No tax credit needed on your resident return: Because the nonresident state will refund the tax and won’t tax your wages, you don’t need to claim a credit for taxes paid to another state on your resident state tax return.

You might see a yellow alert when reporting $0 wages on the nonresident return. This is only a warning. From the example above, it’s expected and correct — your wages aren’t taxable in the nonresident state due to the reciprocal agreement.

Preventing this issue in the future

If you live in one state and work in a reciprocal state, make sure to complete the nonresident exemption form and give it to your employer. This will prevent them from withholding taxes for the nonresident state in the future.