Contributed by: AndyS, FreeTaxUSA Agent, Tax Pro

You may have heard that if you take out your retirement money before you turn 59 ½, you must pay a 10% penalty. But did you know there's a special rule called the Rule of 55 (see Separation from service) that lets you get your retirement money a bit earlier without the 10% penalty? Imagine you're 55 and decide to retire early to travel the world. Thanks to the Rule of 55, you can start using your retirement savings to fund your adventures without worrying about that extra penalty!

How does the Rule of 55 work?

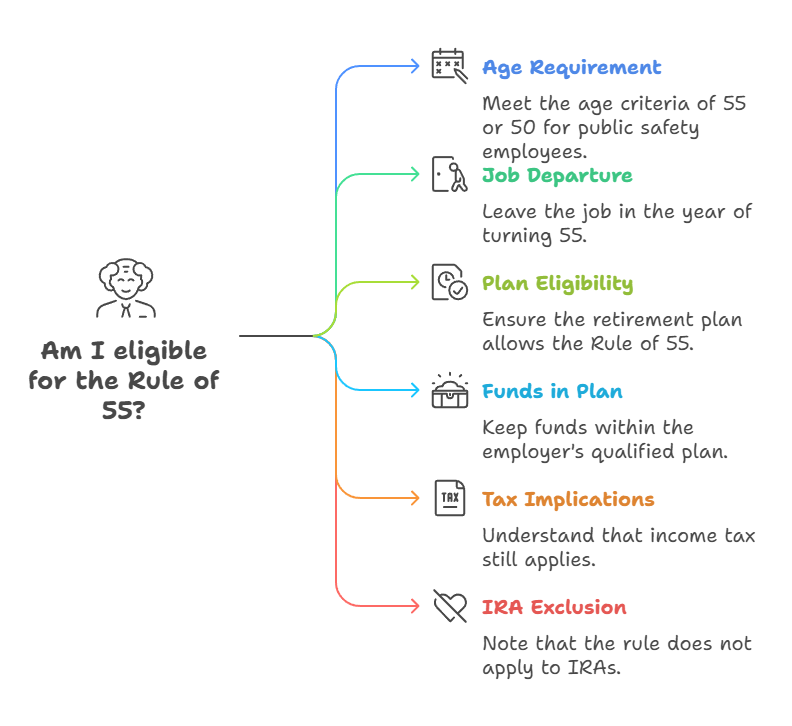

There are a few qualifications you need to meet to be eligible for the Rule of 55:

- Age 55 or older: You must be at least 55 years old or older. However, if you’re a public safety employee such as a police officer, firefighter, EMT, or air traffic controller, the IRS allows you to collect your retirement penalty free the year you turn 50.

- Departure from your employer’s plan: You must leave your job, either voluntarily or involuntarily, during the calendar year you turn 55 (or after 25 years of service under the plan, whichever is earlier).

- Plan eligibility: The rule can only be used with certain employer-sponsored retirement plans such as 401(k) or 403(b) accounts that specifically allow it. You’ll want to verify with your employer that your retirement plan contains a Rule of 55 provision.

- Funds remain in the plan: You can only access funds that are held in your employer’s qualified plan. If you want to roll your retirement out of your previous employer’s plan, it’s no longer eligible for the Rule of 55.

- Income tax still applies: You’ll still pay ordinary income tax on your withdrawals, but you won’t get the additional 10% early withdrawal penalty.

- Not for IRA’s: The Rule of 55 doesn’t apply to traditional or Roth IRAs.

Additional points

As your retirement nears, there are some things you may want to consider:

- The earlier you start to withdraw your retirement funds, the earlier those funds will deplete. You’ll want to make sure you have figured out a yearly budget, so you don’t overdraw.

- You may also want to speak to a financial advisor to see how your retirement income will affect your future tax planning and if it’s the right choice for you.

- Some retirement funds don’t allow partial withdrawals over time and may require a large lump sum payment after you leave your job. This could affect your tax liability.

- You can continue to withdraw funds from your former employer’s account as long as your account remains with them - even if you get a job with a new employer. You can’t roll the plan over to an IRA or another workplace plan. Once you reach 59 ½ you’ll be able to move the funds to a different retirement plan if you wish.

How do I enter this in FreeTaxUSA?

If you receive a Form 1099-R, you’ll enter it as retirement income by following menu path: Income > Common Income > Retirement Income (Form 1099-R). If you’re under age 59 ½ it’s likely the software will detect that you’re subject to the 10% early withdrawal penalty. You’ll see this alert after entering your Form 1099-R information and selecting to continue:

Move through the screens selecting Save and Continue. Make sure to fill in details that apply to you until you get back to the Your Retirement Income (Form 1099-R) starting screen. When you enter your retirement income in FreeTaxUSA, there will be some follow-up questions, click on Continue instead of using the drop-down menus to go to a different part of the software.

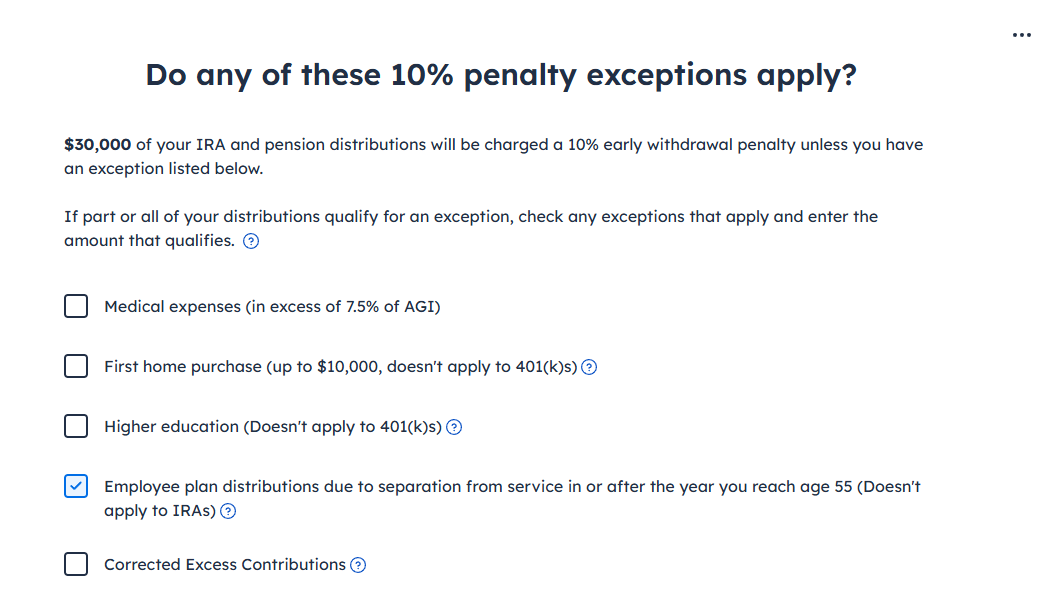

You’ll be able to report that you’re qualified for the Rule of 55 when you reach the screen titled Do any of these 10% penalty exceptions apply?

Look down the list until you see Employee plan distributions due to separation from service in or after the year you reach age 55 (Doesn't apply to IRAs). Check that box and enter the amount of retirement eligible to be exempt and select Save and Continue. The 10% penalty calculated when entering that retirement income will disappear.

The Rule of 55 offers a valuable opportunity for those who wish to access their retirement savings early. However, it's essential to consider the long-term impact on your retirement funds to understand the tax implications for collecting your retirement early. As you approach retirement, careful planning and informed decisions will help ensure a secure and comfortable future.