Contributed by: KelliP, FreeTaxUSA Agent, Tax Pro

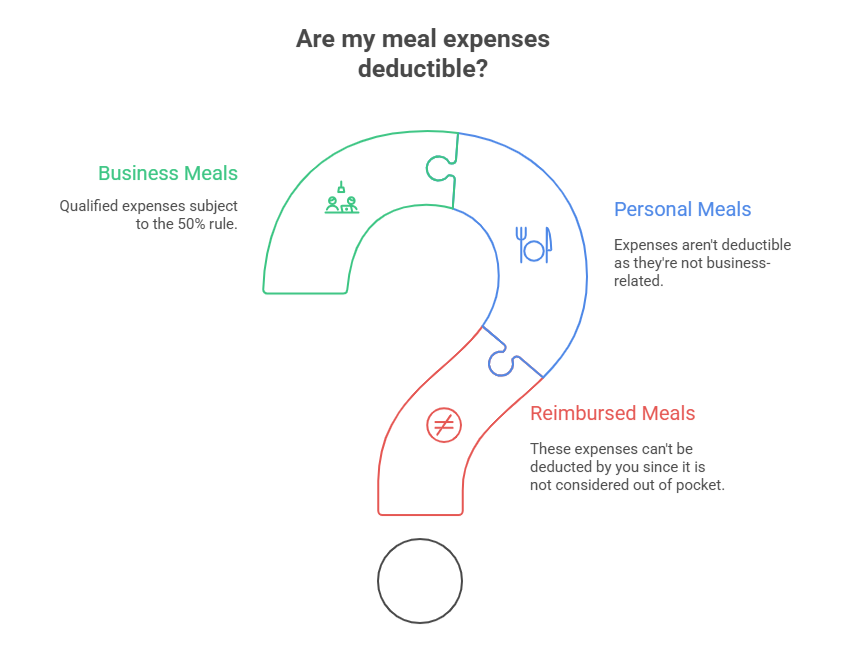

Owning a business and understanding which expenses are deductible can be overwhelming. When you’re self-employed, business related meal expenses are typically deducted and reported on Schedule C, Profit or Loss from Business (Sole Proprietorship)

Most meal expenses are limited to 50% of unreimbursed costs.

According to the IRS, meal expenses must be considered both ordinary and necessary. What does ordinary and necessary mean?

- Ordinary is an expense that’s common and accepted in your trade or business.

- Necessary is an expense that’s helpful and appropriate for your business.

These expenses can’t be extravagant. They must be reasonable based on facts and circumstances.

Requirements

You or your employee must be present at the meal for it to be deductible. Meals can be for an employee, client, current or potential business customer, or consultant.

Meals can be while traveling away from home, at a business convention, or business meeting. Personal meals aren’t deductible.

Examples:

- You’re a Lyft driver and eat while in your car. Meals consumed while driving aren’t deductible and are considered personal expenses, similar to those incurred by any employee commuting to work.

- You’re an Uber driver and meet with other drivers to discuss business strategies; your meal is possibly deductible.

- You drive for Lyft and you’re attending a rideshare event or conference. The meal or meals while at the conference are deductible.

- You’re a marketing business owner meeting a potential client for lunch to discuss your plan for their project. The total cost of the meal is a deductible business expense.

- Your employees have ideas for how to make their department more productive. You take them to lunch to discuss their ideas further. The total lunch cost is a deductible business expense.

Keep in mind, these examples are all subject to the 50% limit.

What is deducible

The amount to be deducted is the total cost of the business meal (minus 50% unless there is an exception). This includes the food, drinks, taxes, and tips.

Keep records

Keeping records of business expenses is important. Maintaining a log provides important details such as date, client, purpose, and amount. Keeping the actual receipts is important. As receipts may fade, it's a good idea to scan them and store a digital copy in a secure location.

Exceptions to the 50% rule

Typically, business meal expenses are subject to the 50% rule, however there are exceptions.

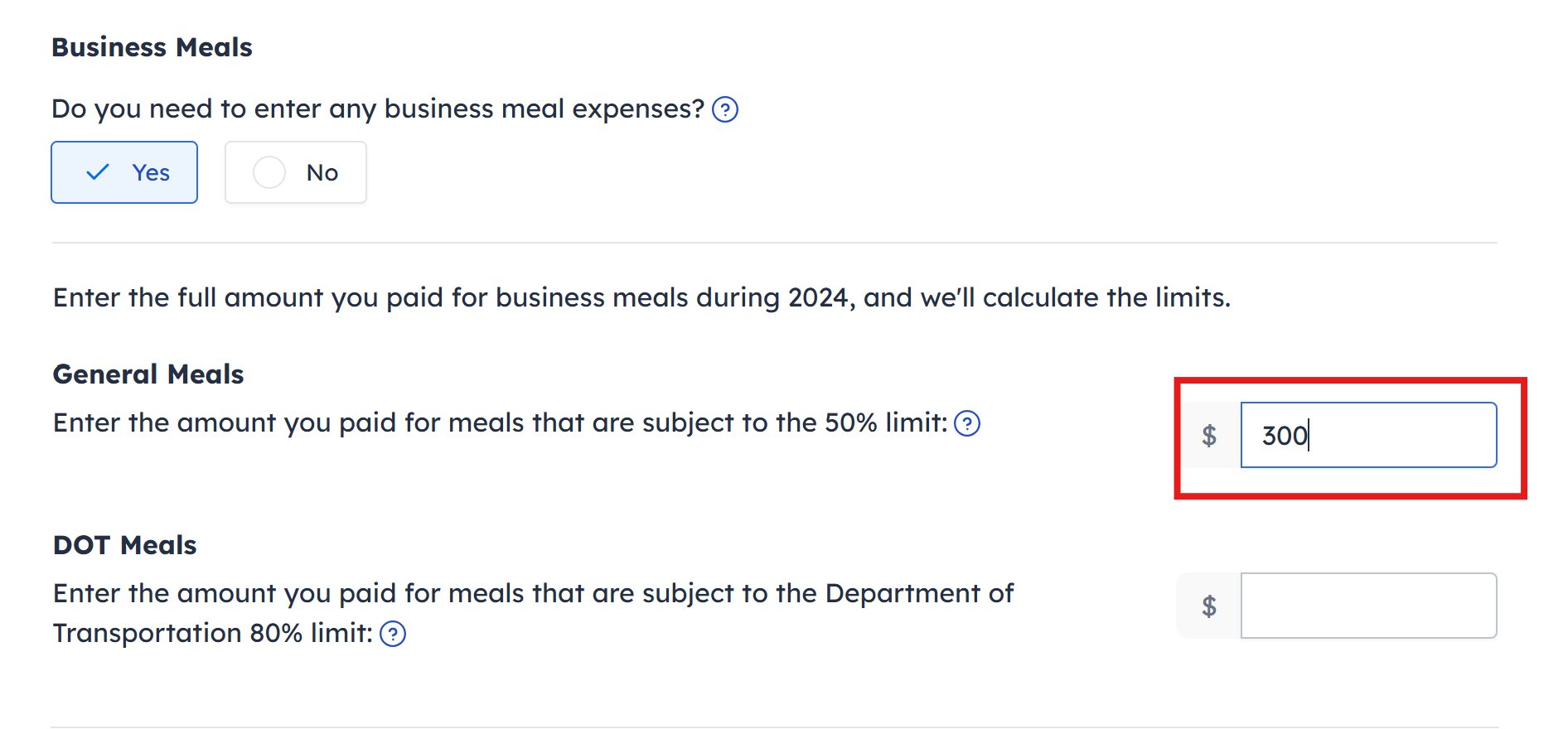

- If you’re subject to the Department of Transportation’s hours of service limits you can deduct 80% of your business related meal expenses.

- If you receive reimbursement from your client for meals, you can't take a deduction, and your client is subject to the 50% limit on meal expenses.

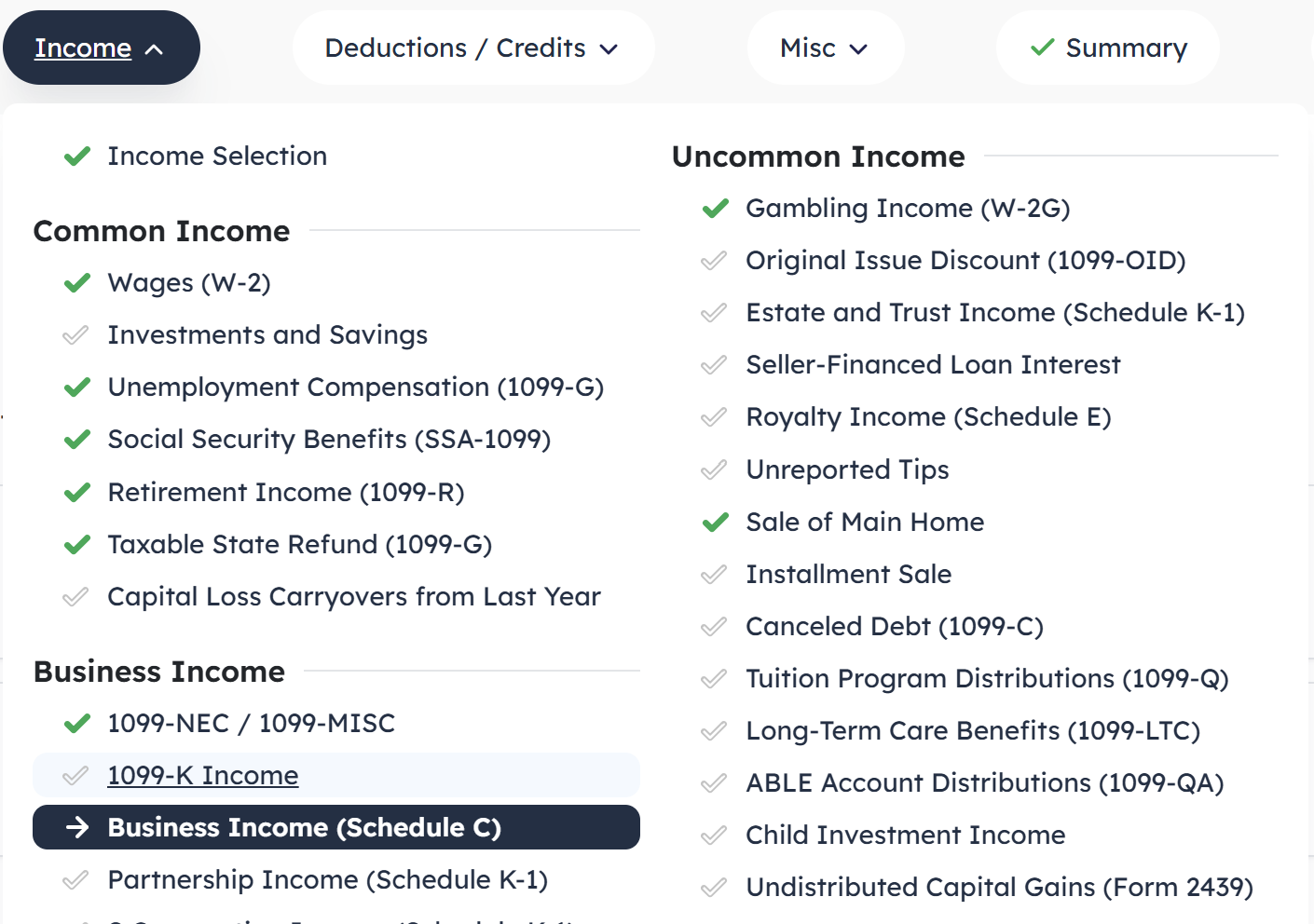

How to enter the meal expenses in FreeTaxUSA software

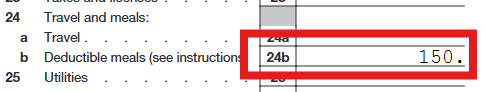

To enter business meal expenses, follow this menu path: Income > Common Income > Business Income > Business Income (Schedule C) > Common Expenses

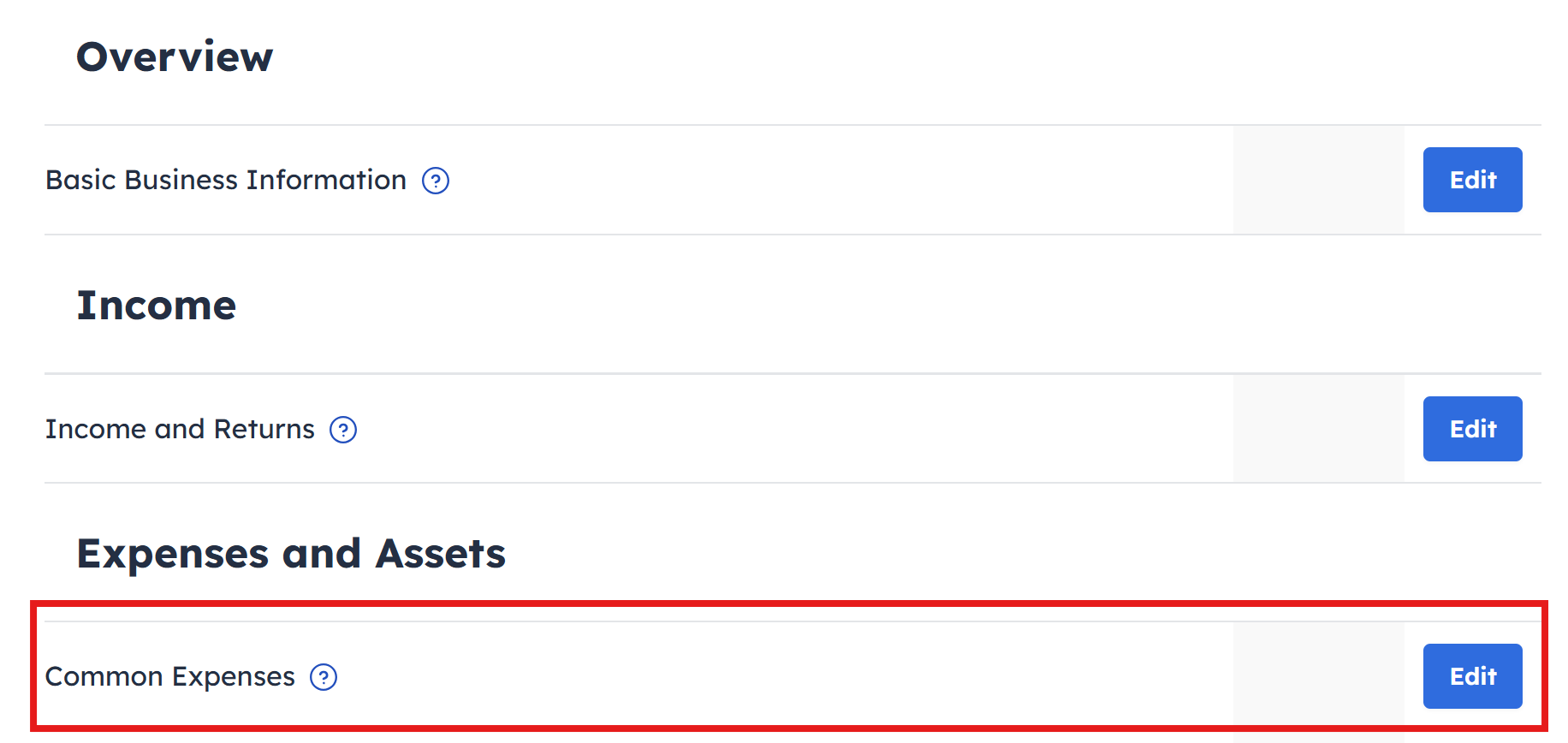

Start entering information about your business as prompted by the software or edit the business you’ve already entered.

The option to add meal expenses can be found in the Common Expenses section.

Here you’ll enter the total business meal expenses for the year. The software will then calculate the expense at the 50% limitation. This amount will be carried to Schedule C.

Conclusion

Business meals can be an effective way to reduce your taxable business income. As you follow IRS guidelines and keep records of qualified expenses, we can help you prepare an accurate Schedule C. If you have questions, our Customer Support team is here to help.