Contributed by: AnthonyS, FreeTaxUSA Agent, Tax Pro

Have you ever donated to a charity only to later realize that it wasn't tax-deductible? I have, and it's frustrating -- especially if you’re counting on that deduction to lower your tax bill. This article will guide you through how to verify an organization’s tax-exempt status before you donate.

What is a 501(c)(3), and why does it matter?

A 501(c)(3) is a non-profit organization that the IRS recognizes as tax exempt. These charities include religious organizations, educational institutions, and some foundations. Only donations made to these organizations can be deducted on your federal tax return if you itemize your deductions.

Basically:

- Giving to a 501(c)(3) = a deduction

- Giving directly to individuals in need or to a GoFundMe, social club, or political group = no deduction

Note: Some states allow political donation deductions, but they’re not deductible federally.

How to verify that your organization qualifies

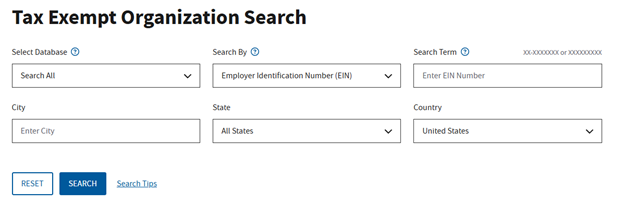

The easiest way to confirm an organization’s status is by using the IRS Tax Exempt Organization Search (TEOS) tool.

Search by organization name, Employer Identification Number (EIN), or city and state.

If your organization appears in the search results and is listed as eligible to receive tax-deductible contributions, your donation should qualify.

Example search

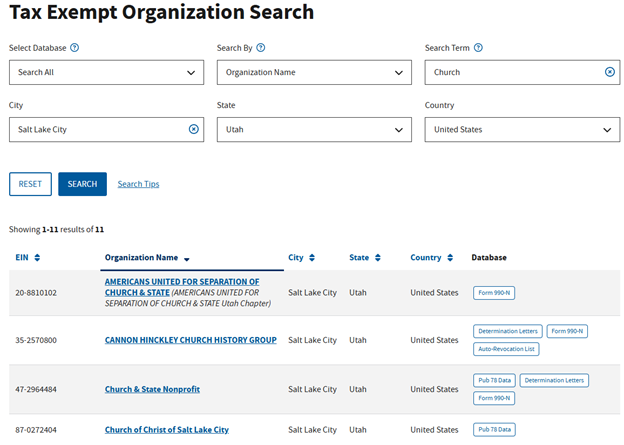

I want to donate to a church in Salt Lake City, Utah.

Here's how I’d search to see if the church is a tax exempt organization:

- Search By: Organization Name

- Search Term: “Church”

- City : “Salt Lake City”

- State : “Utah”

The results will show all 501(c)(3) organizations with "Church" in their name located in Salt Lake City, Utah.

Note: Many organizations have similar names. If you’re unsure, ask your organization for their EIN number and search using that. This will avoid confusion.

Where to enter charitable contributions in FreeTaxUSA

- Follow menu path: Deductions / Credits > Itemized Deductions > Donations.

- Enter your qualified cash or noncash donations.