Contributed by: Henry, FreeTaxUSA Agent, Tax Pro

Your son recently got married, and you allowed the newlyweds to move into your rental property when it became vacant. Renting to a relative can be a great way to help family members while also earning some income. This option might be particularly appealing if you believe a family member would take better care of the home. However, if you charge rent below fair market value, it can affect how you report income and deduct expenses on your tax return.

What is fair market value?

A fair rental price for your property is typically the amount an unrelated person would be willing to pay for a similar property — comparable in size, condition, and location. If you charge substantially less, the rent isn’t considered a fair rental price for tax purposes.

Tax implications of renting below fair market value

When a dwelling unit is used by anyone at less than a fair rental price, that’s counted as a day of personal use. You must divide expenses between personal and rental use; only the rental portion is deductible on Schedule E. If you itemize your deductions, some of your personal expenses may be deductible on Schedule A.

For example, you have a basement apartment in your home and rent it at a fair rental price during the year. Your parents lived in the apartment rent-free during December. Those 30 days are considered personal use days, and any rental expenses for that month (utilities, property taxes, mortgage interest, repairs, etc.) are not deductible on Schedule E; you can only include the rental expenses for January through November.

When determining the tax treatment of rental expenses, you also need to decide if the dwelling unit is considered a home. The amount of deductible rental expenses may be limited if it's considered a home.

The IRS says you use a dwelling unit as a home during the tax year if you use it for personal purposes more than the greater of:

- 14 days, OR

- 10% of the total days it’s rented to others at a fair rental price

Using our example from earlier, let’s say you rented the basement apartment at a fair rental price for nine months (273 days). The total days rented to others at a fair rental price is 27 days, or 10%. Based on the guidelines above, 27 days is greater than 14 days, so 27 days is the measure you’ll use when determining if the dwelling unit was used as a home during the year. Rent-free use by your parents is 30 days of personal use. Your personal use is greater than 27 days, so you’re considered to have used the apartment as a home, and your deductions may be limited.

The IRS states if you use a dwelling unit as a home and rent it 15 days or more during the year, and your rental expenses are more than your rental income, some or all of the excess expenses can’t be used to offset income from other sources. Any excess expenses are carried forward to the next year and treated as rental expenses for the same property. If this applies to you, you need to use Worksheet 5-1 to determine your deductible rental expenses and any carryover to next year. The good news is that the FreeTaxUSA software will fill out Worksheet 5-1 for you if it’s needed, based on the information you provide.

Let’s look at another example and walk through what needs to be done to report the income correctly.

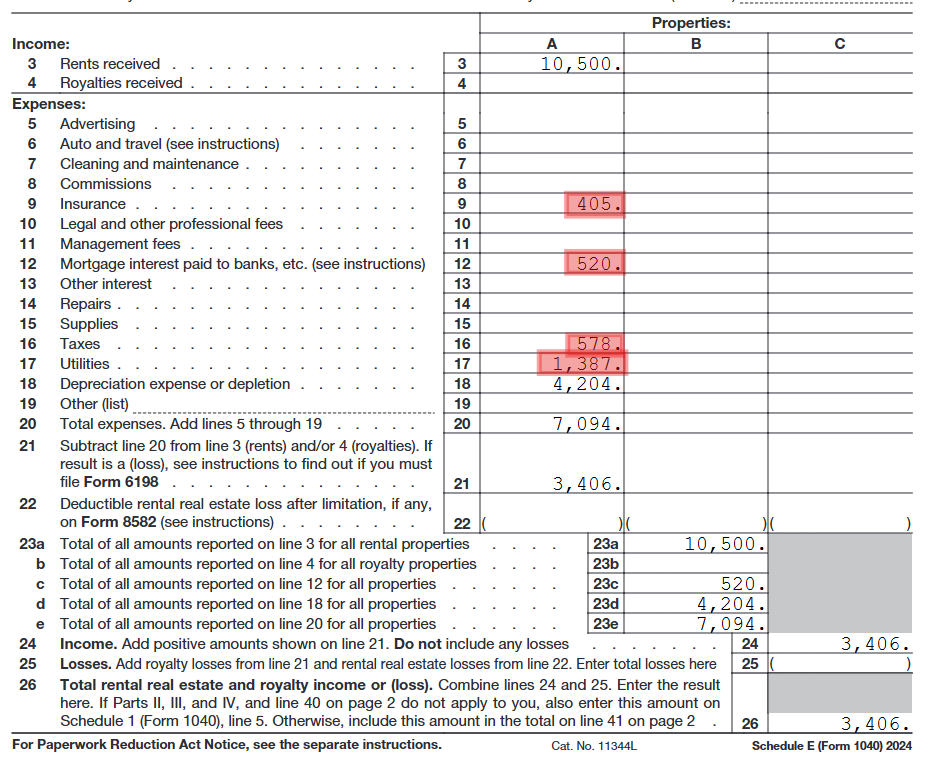

You have an accessory apartment you’ve rented since 2020. This year you rented it for $1,500 per month from January through July. Starting in August, your daughter and her husband moved in at a reduced rate of $900 per month. The $10,500 collected from January through July is rental income. Your income from August through December ($4,500) is not considered rental income for tax purposes because you charged less than a fair rental price.

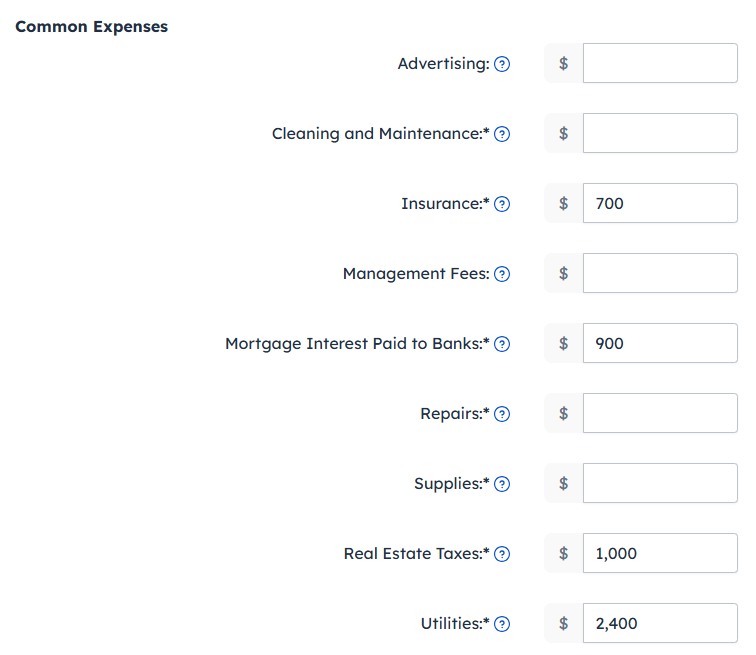

You had the following expenses for the apartment during the year:

- Insurance = $700

- Mortgage interest paid = $900

- Real estate/property taxes = $1,000

- Utilities = $2,400

- Depreciation = $7,273

- Total = $12,273

You need to determine the rental vs personal use of the apartment before you start entering information in FreeTaxUSA software.

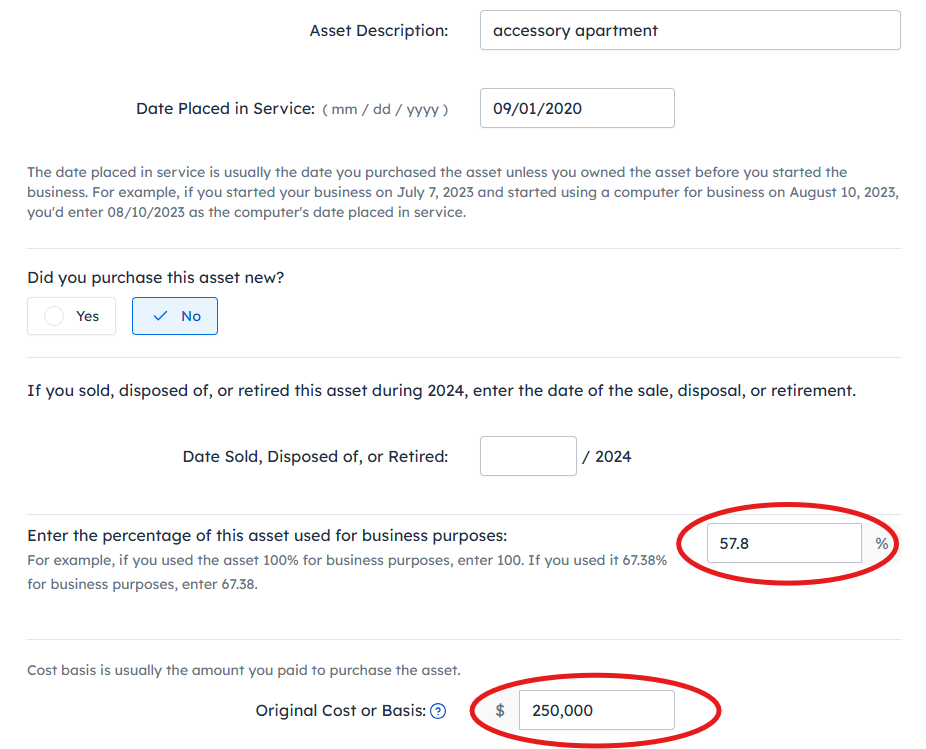

- Rental use: 7 months (211/365 days = 57.8%)

- Personal use: 5 months (154/365 days = 42.2%)

Deductible rental expenses (57.8%):

- Insurance = $405

- Mortgage interest paid = $520

- Real estate/property taxes = $578

- Utilities = $1,387

- Depreciation = $4,204

- Total rental expenses = $7,094

Personal use expenses (42.2%) are not deductible on Schedule E.

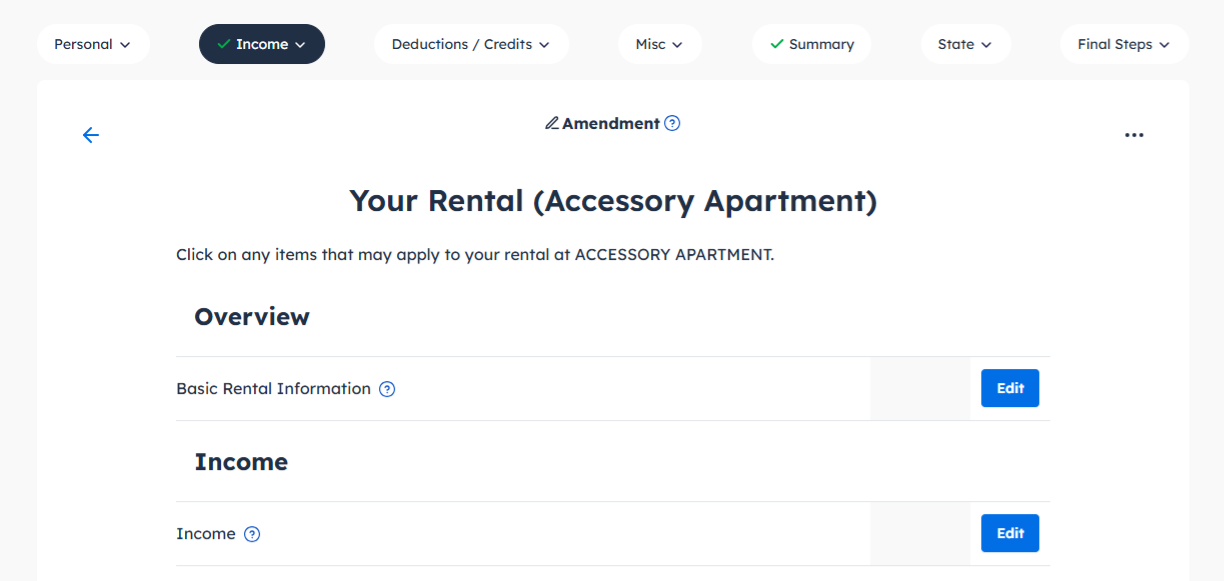

Entering rental income and expenses in FreeTaxUSA

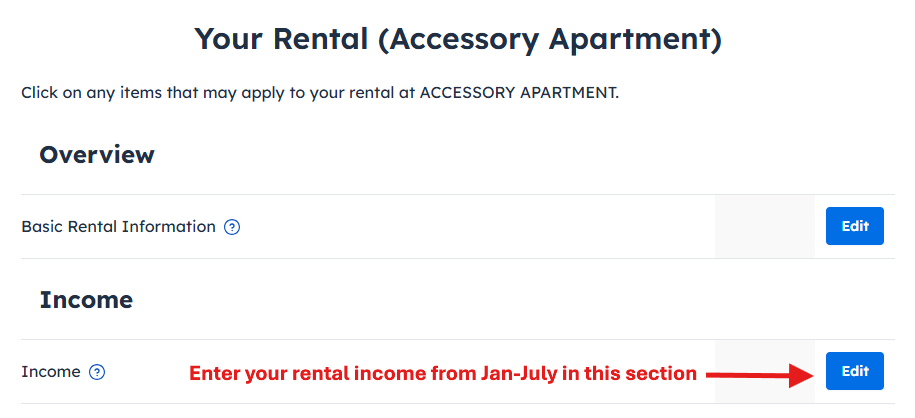

Now you’re ready to report your rental income and expenses (for January through July) on your tax return.

- Follow the menu path: Income > Business Income > Rental Income (Schedule E).

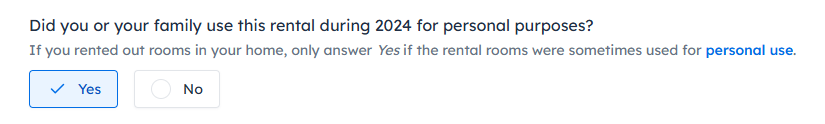

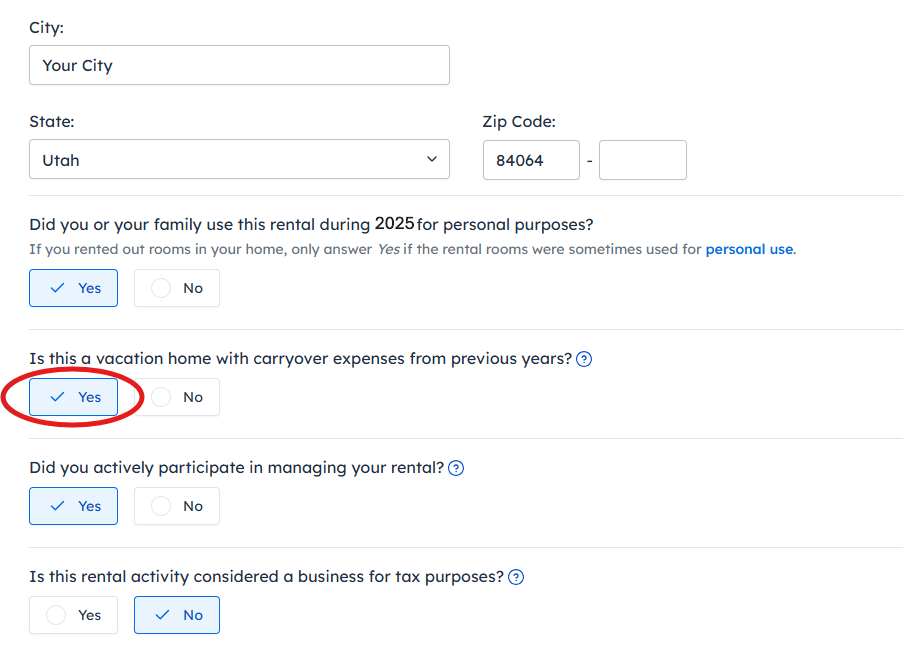

- When entering the basic rental information, be sure to answer Yes when asked if you or your family used this rental during 2024 for personal purposes.

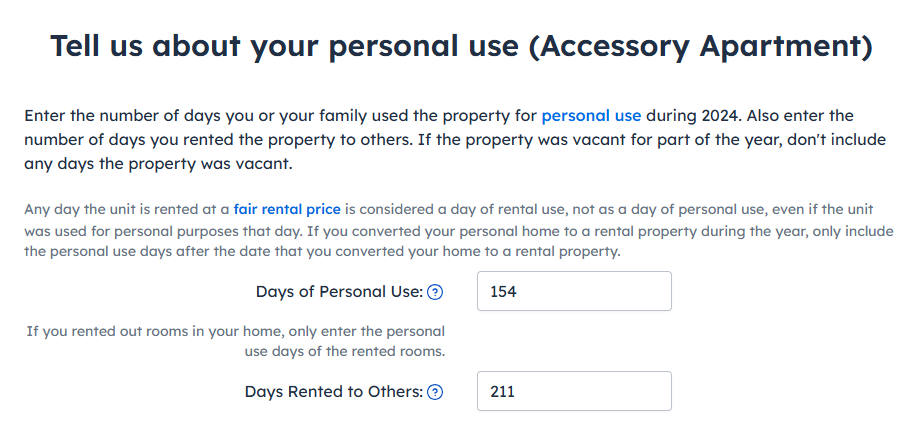

- On the following screen, you’ll be asked to enter the days of personal use and the days rented to others.

Based on this information, the software will determine if the apartment was used as a home for tax purposes. Your personal use of the apartment (154 days) is more than the greater of: 14 days or 10% of the total days it was rented to others at a fair rental price (10% of 211 = 21 days). Thus, you’re considered to have used the apartment as a home, and the rental expenses you can deduct this year may be limited. Worksheet 5-1 will be generated, if needed.

Based on this information, the software will determine if the apartment was used as a home for tax purposes. Your personal use of the apartment (154 days) is more than the greater of: 14 days or 10% of the total days it was rented to others at a fair rental price (10% of 211 = 21 days). Thus, you’re considered to have used the apartment as a home, and the rental expenses you can deduct this year may be limited. Worksheet 5-1 will be generated, if needed. - Enter your rental income ($10,500) as prompted.

- When you come to the expenses section, enter the total expenses you paid for the apartment during the year, as shown below.

The software will allocate these expenses between personal use and rental use based on the number of days your property was rented. Only the rental portion will show on Schedule E.

The software will allocate these expenses between personal use and rental use based on the number of days your property was rented. Only the rental portion will show on Schedule E.

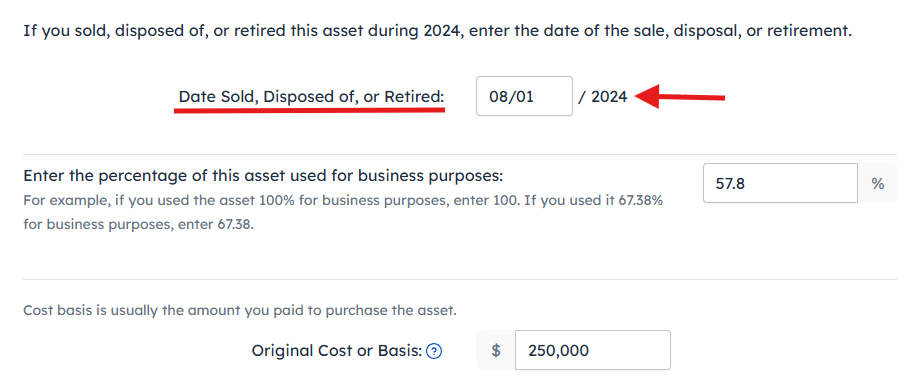

- You may claim depreciation for the time the apartment was used as a rental (January through July). When entering the apartment as a depreciable asset, be sure to include the percentage of this asset used for business purposes (57.8% in our example) and report the full cost basis of the apartment. The software will use this information, along with other details you provide, to calculate the allowable depreciation.

- Since the apartment is considered to have been used as a home for tax purposes, you may wonder whether your expenses need to be limited. Did you have a net gain or loss from the rental? In this scenario, your rental income ($10,500) exceeded your rental expenses ($7,094), so you had a net gain and can claim all the rental expenses. There’s no need to use Worksheet 5-1.

What if you need to use Worksheet 5-1?

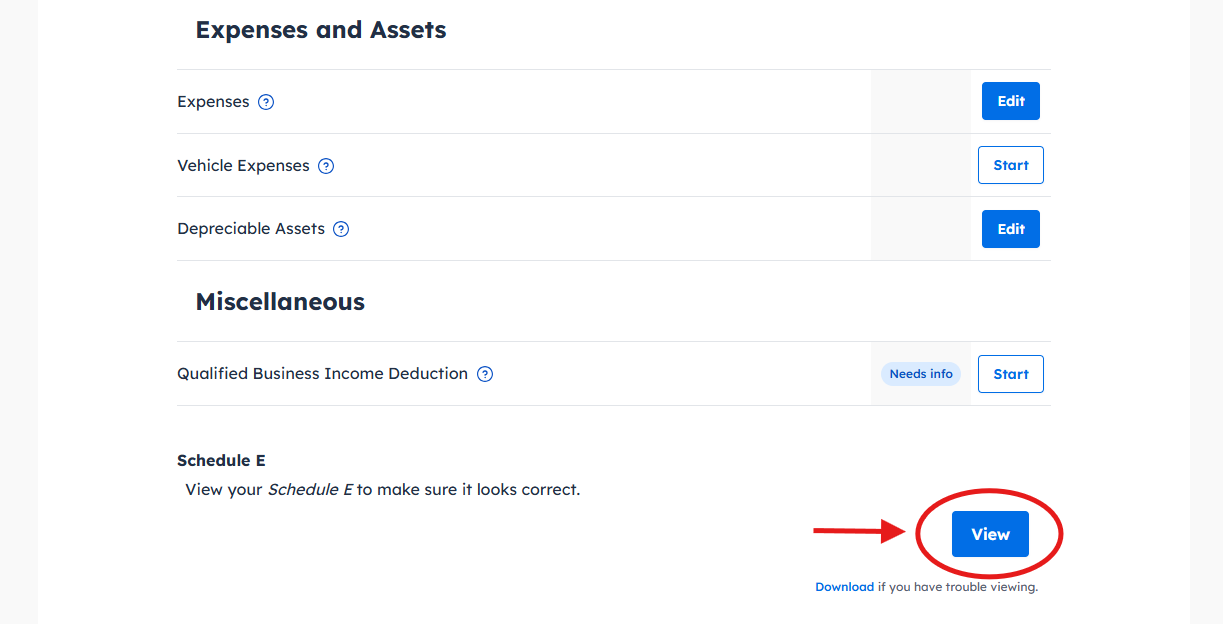

Remember, if you’re in a situation where you do need to use Worksheet 5-1, FreeTaxUSA software does those calculations for you. Based on the rental income and expenses you enter, we’ll fill out the worksheet, apply any applicable limits, and report the appropriate amounts on Schedule E. You’ll be able to see Worksheet 5-1 attached to your Schedule E by scrolling down on the Your Rental page and selecting to view your Schedule E.

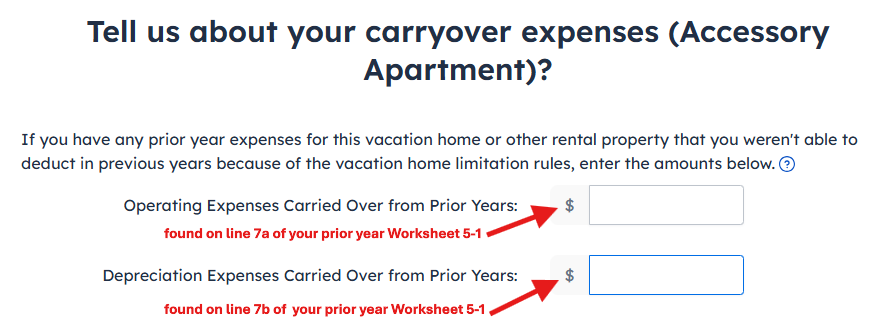

If you have rental expenses that are limited on Worksheet 5-1, they can be accounted for on your tax return the following year. This would be done in the FreeTaxUSA software by going to the Basic Rental Information screen and answering Yes to the question that asks if this is a vacation home with carryover expenses from previous years.

On one of the following screens, you’ll be prompted to enter your carryover expenses as shown below.

What about the income from the time the property was rented below fair market value?

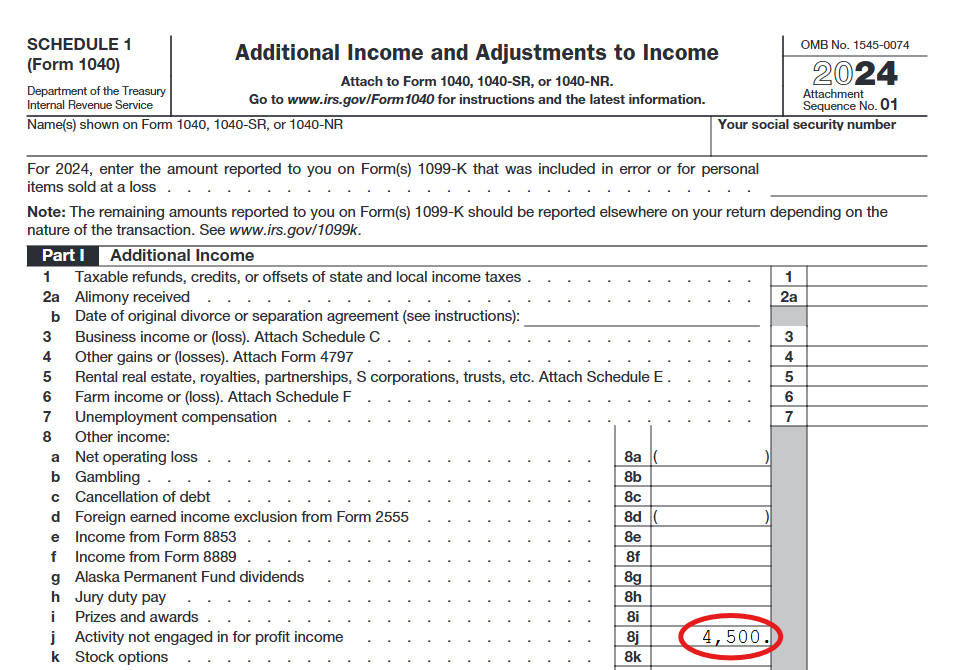

When you charge a rental rate below fair market value, you’re considered to not be renting your property to make a profit. This means you can’t deduct rental expenses for the time the property was rented below the fair rental price. However, this “personal use” rental income still needs to be reported on your tax return. It goes on Schedule 1, line 8j, “activity not engaged in for profit income”.

Note: The IRS has a rule stating that if a property is used as a home and rented less than 15 days, the rental income and related expenses don’t need to be reported. This tax-free treatment applies only to income from renting the home at a fair market value when the home is rented less than 15 days during the year. It typically wouldn’t apply to income from renting below the fair market value.

If you itemize your deductions, you may include the personal use portion of the mortgage interest and real estate taxes when figuring the amount you can deduct on Schedule A. Remember, the IRS considers the apartment to have been used as a home for tax purposes from August through December, allowing you to treat it as a second home when claiming the mortgage interest deduction.

Entering the not-for-profit income from the property in FreeTaxUSA

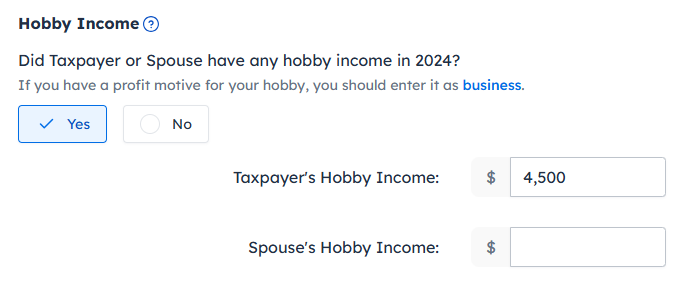

- First, let’s get the August through December income reported. Follow the menu path: Income > Uncommon Income > Other Income. Scroll down the page to the Hobby Income heading. Answer Yes and enter your income from the not-for-profit rental. Then click on Save and Continue.

This income will flow to line 8j of Schedule 1, as the IRS directs.

This income will flow to line 8j of Schedule 1, as the IRS directs.

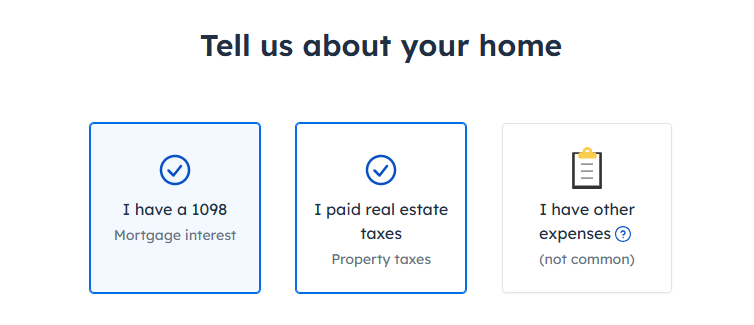

- Now you can account for the personal use portion of the mortgage interest and real estate taxes paid for the apartment. To add them to your itemized deductions, follow the menu path: Deductions/Credits > Itemized Deductions > Homeowner Expenses (1098).

The personal use of the apartment was 42.2%, so 42.2% of the mortgage interest ($380) and real estate taxes ($422) can be included in your itemized deductions. Add Form 1098 information for the rental property but only report $380 in Box 1 as the deductible mortgage interest. Then add $422 to the real estate taxes you’re claiming for your main home.

The personal use of the apartment was 42.2%, so 42.2% of the mortgage interest ($380) and real estate taxes ($422) can be included in your itemized deductions. Add Form 1098 information for the rental property but only report $380 in Box 1 as the deductible mortgage interest. Then add $422 to the real estate taxes you’re claiming for your main home.

Converting a rental property to personal use

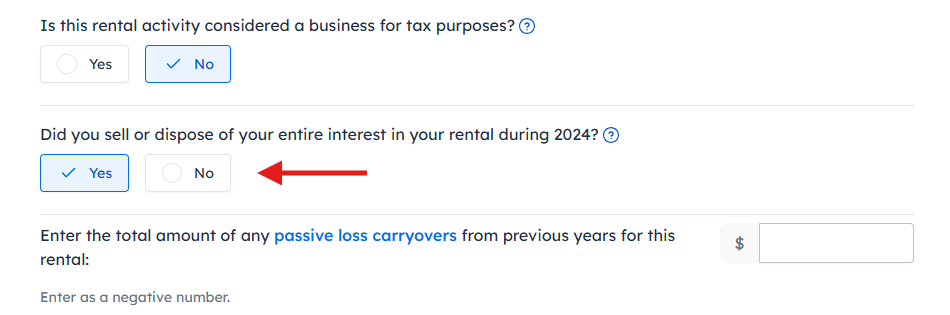

If you rent to a family member at below fair market value for an extended time, the IRS may consider the property converted to personal use and retired from rental service. To report this type of conversion in FreeTaxUSA software:

- Answer Yes to the question on the Basic Rental Information screen which asks if you sold or disposed of your entire interest in your rental during the year.

- When entering the property as a depreciable asset, enter the date it was converted to personal use as the Date Sold, Disposed of, or Retired:

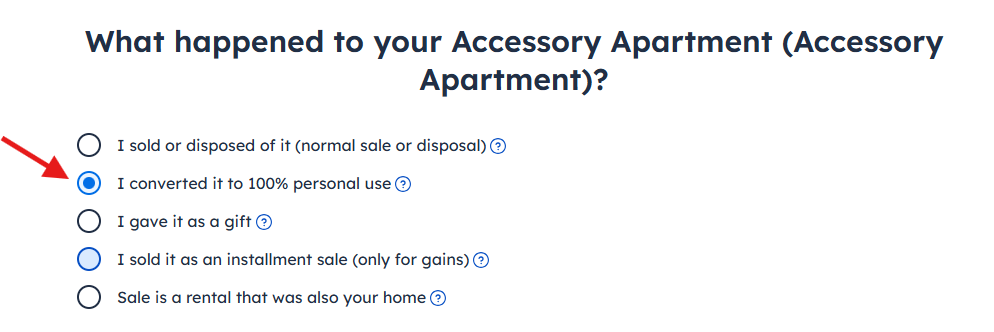

- On a later screen, you’ll be asked whether you sold, disposed of, or retired the property. Select I converted it to 100% personal use.

Converting the property back to rental use

If you later rent the property again at fair market value, treat it as a new rental property. You can depreciate it over a new 27.5-year period using an adjusted cost basis. The date you convert the property from personal use back to rental use should be entered as the date it was placed in service. For guidance on calculating the new adjusted cost basis, refer to our article, How do I report depreciation for a rental that was repeatedly converted between rental and personal use?

Summary

If you have any rental income for the year (when the property was rented at a fair market price), enter it on Schedule E. Remember to separate the rental vs personal use of the property and only claim the rental expenses for the time it was rented at a fair market price.

Enter your income from the not-for-profit rental (when the property was rented below a fair market price) on Schedule 1. No expenses for this use of the property are allowed to be deducted, except for mortgage interest and real estate taxes, which can be claimed as itemized deductions.