Contributed by JanaA, FreeTaxUSA Agent, Tax Pro

When you live in one state and work in another, this can affect how you file your state taxes. Most commonly, states handle this situation in one of two ways:

1. Reciprocal Agreement-Some states have reciprocal agreements that allow residents to work in neighboring states without being subject to income tax in both states. If such an agreement exists, you’ll only pay income tax and file a return in your state of residence.

2. Credit for Taxes Paid to Another State-If there is no reciprocal agreement, your income may be taxed by both the state you live in (your resident state), and the state where you work (your nonresident state). In these cases, your resident state typically offers a tax credit for taxes paid to the nonresident state you worked in to help reduce this double taxation.

For more information about the credit for taxes paid to another state and how to enter this in our software, please visit our community article, "How to claim the credit for taxes paid to another state."

Special situations

In addition to these options, there are a few select states that handle nonresident income differently.

Arizona

As an Arizona resident, nonresident returns filed with the following states do not qualify for the credit for taxes paid to another state on the Arizona resident return:

Alaska, California, Florida, Indiana, Nevada, New Hampshire, Oregon, South Dakota, Tennessee, Texas, Virginia, Washington and Wyoming.

You may be able to claim a credit for taxes paid to Arizona on the nonresident return filed with any of the states listed above.

Oregon

An Oregon resident is allowed a credit for taxes paid to another state on mutually taxed income if the other state doesn’t allow the credit. For example, if you reside in Arizona and have nonresident income from Oregon, Arizona won’t allow you to claim the credit for taxes paid to another state on your Arizona resident return. Instead, you can claim the credit on your nonresident Oregon return.

Virginia

If you’re a resident of VA and have income from Arizona, California, or Oregon sources, you can't claim a credit for taxes paid to those states on your Virginia income tax return. Claim a credit on the nonresident income tax return for the appropriate state.

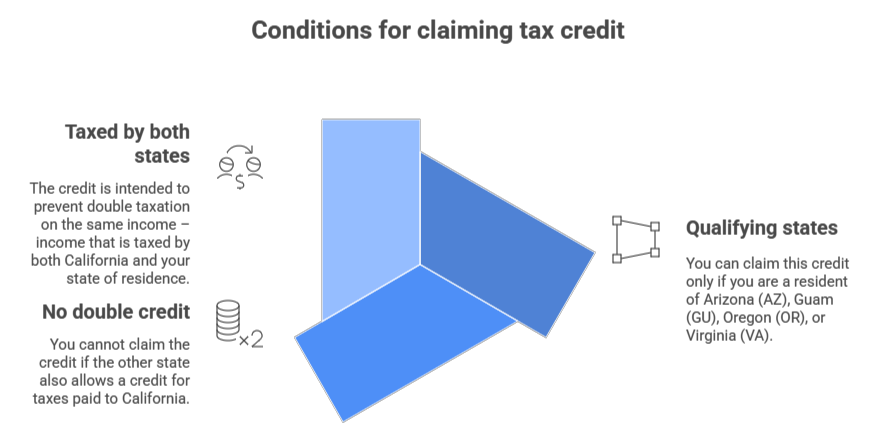

California

If you're a California nonresident who paid income tax to your resident state on income also taxed by California, you may be eligible for the Other State Tax Credit (OSTC) on your California return. Nonresidents of California may claim a credit only for net income tax imposed by, and paid to, their state of residence and only if such states don’t allow their residents a credit for net income taxes paid to California. These states typically include Arizona, Virginia, Oregon, and Guam.

As we most commonly see this credit for California nonresidents, let’s explore the California credit and how you will add this to your return in the FreeTaxUSA software

💡Please note the process is similar for each of the states mentioned above.

Claiming the credit

To claim the OSTC on your CA return, you must:

- File California Form 540NR: Use Schedule S (Other State Tax Credit) and attach it to your California Nonresident or Part-Year Resident Income Tax Return (Form 540NR).

- Attach the other state's tax return: You must include a copy of the tax return you filed with the other state(s).

Example:

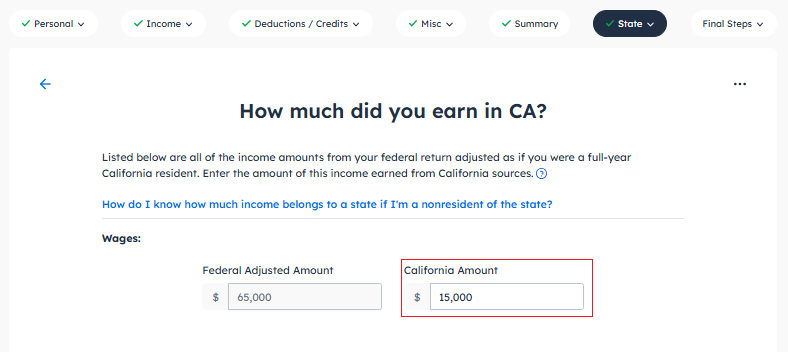

Maria is a resident of Arizona but worked on a temporary project in California during the year, earning $15,000. She also earned $50,000 from her regular job in Arizona. At tax time, Maria filed an Arizona resident tax return, reporting her total income for the year of $65,000. Because she also earned income in California, she is required to file a nonresident California return reporting only the $15,000 income earned in California. Since both Arizona and California are taxing the same income of $15,000, Maria can claim the OSTC on her nonresident California return to help reduce this double taxation.

Entering the information for this credit into our software:

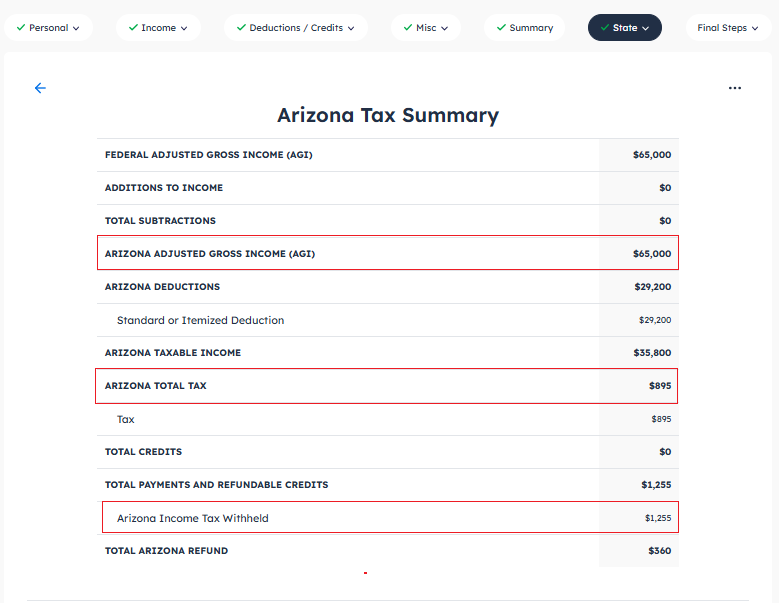

1. Prepare your resident state return. On the state summary screen make note of a few items:

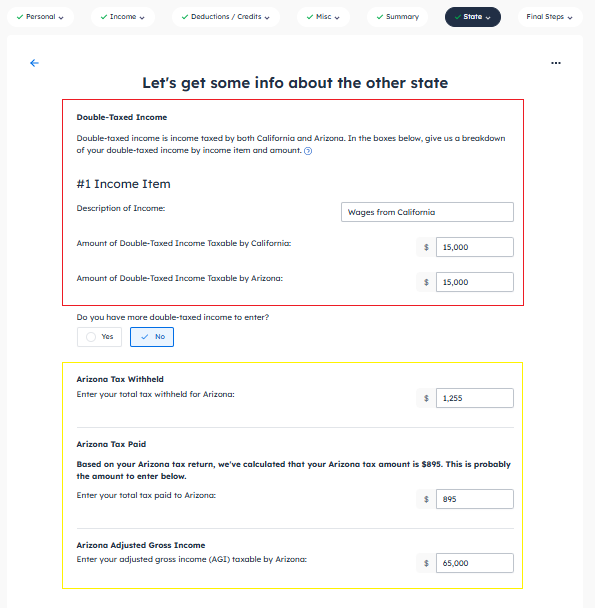

- Adjusted Gross Income (AGI)

- State Tax Withheld

- State Taxes Paid

2. Prepare your nonresident CA return. Proceed through the California state return screens until you reach: State > California > California Income

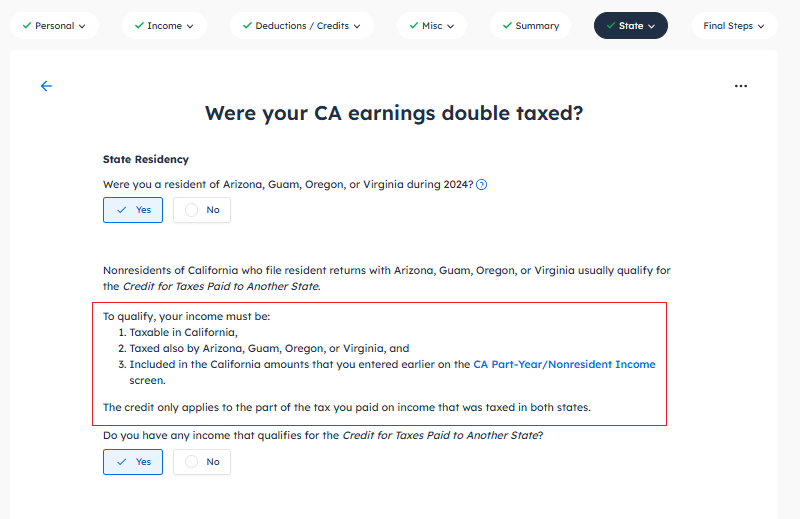

3. As prompted by the software, you'll be guided through entering the information for the OSTC. The first screen in this section lists the qualifications to help you determine if your specific situation qualifies for this credit.

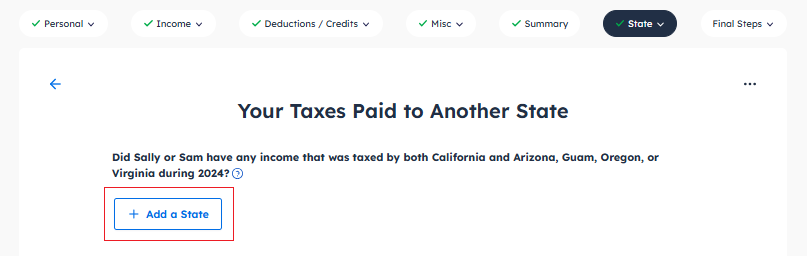

4. You'll then select to add information about your resident state return.

5. The following screen will gather information about the double taxed income. Here you’ll be prompted to enter the information from your resident return as noted from the Arizona Tax Summary shown above.

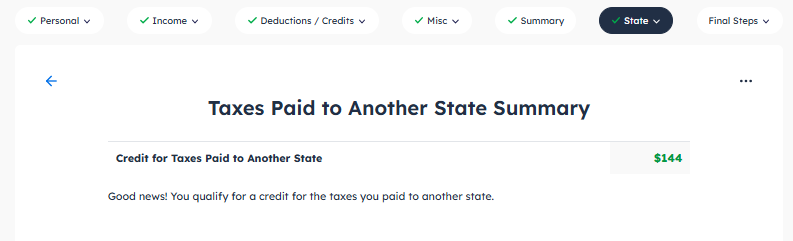

6. The software will calculate the credit based on the information entered.

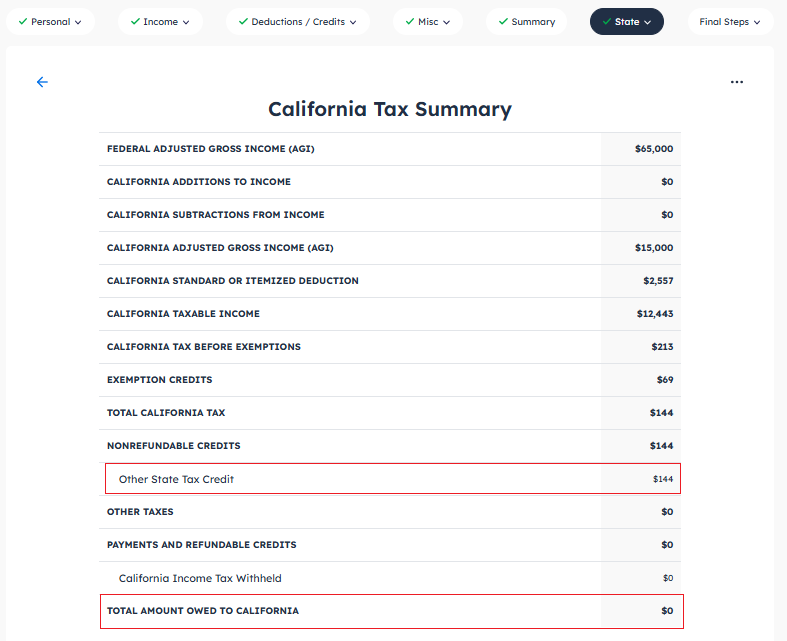

7. On the California Summary screen, you can see how the OSTC has been applied and reduced Maria’s California tax due to $0. While not all situations will result in a total elimination of the double taxation, this example helps illustrate the benefit of this credit.

Key takeaways

Filing taxes for multiple states can be complicated. Thankfully, our software can help. FreeTaxUSA supports the Other State Tax Credit on state returns, as well as the credit for taxes paid to another state, for states that use the more streamlined approach.

If you live in any of the states mentioned in this article, you can follow the information provided to prepare your return correctly. If you need additional assistance our Customer Support team is here to help you through the process.