Contributed by: MatthewD, FreeTaxUSA Agent, Tax Pro

Online businesses, as well as opportunities to start one, continue to grow. One emerging opportunity is conducting online product reviews.

Before making purchases, buyers often look for products with good reviews. To promote their products, retail sellers are constantly looking for ways to generate more reviews. Entrepreneurs are taking advantage of this business opportunity by receiving products at no cost, trying them out, and writing reviews.

Taxable barter transactions

The receipt of goods in exchange for a service is considered a taxable event known as a barter transaction. A barter transaction involves the direct exchange of goods and services without the use of money. Each party to the transaction gets something of value in return for what they provide, whether that’s a product or a service.

To report the barter transaction, an online company will issue a Form 1099-NEC reflecting the value of the products they sent you. You must then report this income on your annual tax return – typically as self-employment income on a Schedule C.

What are you bartering for?

You’re exchanging your time and resources for goods. Think of these goods as the income you receive for the review, except you get paid with a product rather than money. To earn cash, some reviewers choose to sell the products afterward.

Complications

In the process of reviewing and potentially selling products, you may encounter certain complications. For example, some products may arrive damaged, be overvalued, or even turn out to be worthless. Here are some common scenarios:

- Manufacturers report an estimated taxable value on the 1099 for the products they sent you. They may overstate the value and use a high suggested retail price.

- Products may be defective or damaged in shipping.

- Often a reviewer tries out the product, writes a review and then sells it using an online auction house or through an online ad. However, you may have a contract that prohibits reselling the product for a certain period of time, during which the product loses value.

How do you account for complications like these? In such cases, you can make an adjustment expense to reflect the actual value or condition of the items received.

💡Tip: Do not alter the 1099-NEC when you enter it. Make an adjustment as explained later.

Reporting the income

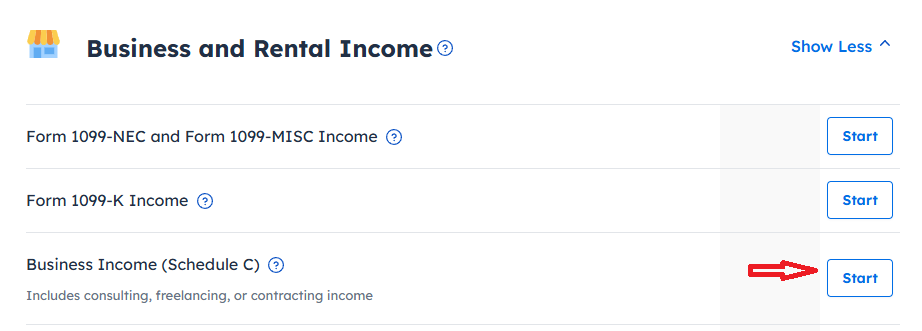

Since you’re self-employed, report the 1099-NEC on a Schedule C.

Although you may enter the 1099-NEC on the Form 1099-NEC and Form 1099-MISC Income page, you’ll still need to link it to your Schedule C. Alternatively, you can skip this page and proceed directly to the Schedule C where you’ll enter the 1099-NEC as part of your business income -- eliminating the need to link it separately.

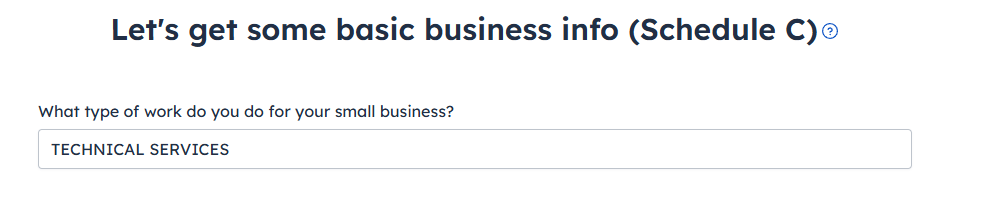

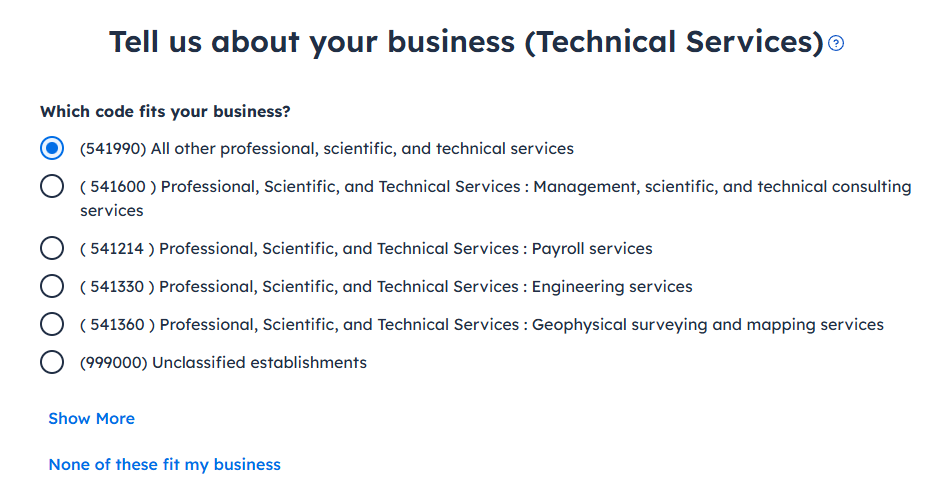

Pick a business code

As you begin your Schedule C, you’ll be asked to enter a business code. On the Let's get some basic business info (Schedule C) page, enter “Technical Services” in the What type of work do you do for your small business? box.

Then on the next page, select code “541990, All Other Professional, Scientific, and Technical Services.” This code is suggested for independent product testers and mystery shoppers.

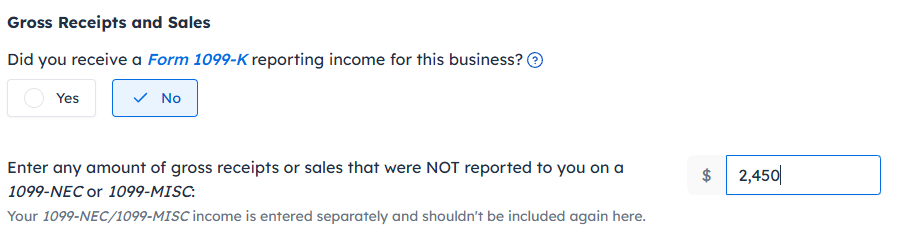

Reporting the sales

In addition to reporting the 1099-NEC for your reviews, you should also report the total income from any goods you’ve sold. This is entered on the "Tell us about your other income" page in the "Income and Returns" section as Gross Receipts and Sales.

Expenses

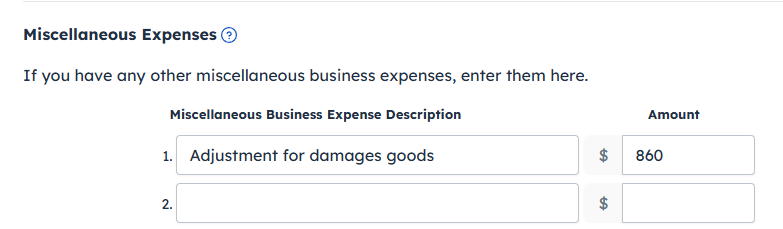

What do you do when you get damaged goods or the estimated taxable value is overinflated? One strategy is to add an adjustment expense. This is a common accounting procedure when a business has to adjust the value of inventory and purchases. Enter the adjusting expense in the Common Expense section of the Schedule C under Miscellaneous Expenses. Use a description like, "Adjustment for damaged goods". If the goods were totally damaged and unsellable, you could enter 100% of the value reported for each good. Taking photos to document the damage is a good business practice should the IRS request verification or proof. This is a subtraction from gross income on your Schedule C and lowers your taxable business income.

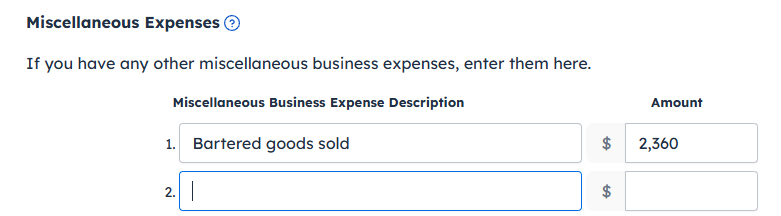

Report the value (cost) of the sold products in the Common Expense section as another Miscellaneous Expenses with a description like, "Bartered goods sold." Even though you didn’t buy the product with cash, you technically paid for it and reported it as income previously with the 1099-NEC. Now you report the cost as an expense.

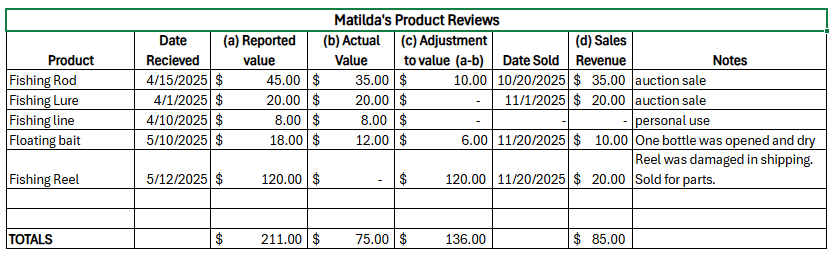

You may need to use a spreadsheet (see below) to track the cost of the products and any damage adjustments or other adjustments to value.

In the spreadsheet example above, the business owner, Matilda, is reviewing fishing equipment. She has columns for reported value, actual value, adjustment to value, and sales revenue.

- The reported value (a) is the value reported to her by the retailer.

- The actual value (b) is an estimate based on a fair market price of current listings.

- The adjustment to value (c) is column (a) minus column (b).

- Then there is a column for sales revenue (d).

- Additional columns for the product, such as date received, date sold and notes, can be used to track other important details.

Keeping good records will save time and help substantiate what you claim on your tax return.

What if you don’t sell the products?

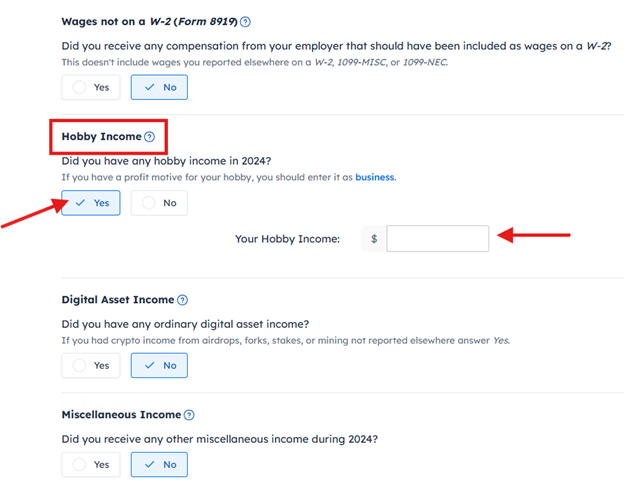

If you’re in the review business just collecting products to use and keep, you may only need to report the 1099-NEC for the barter income you receive. In this case, the products become personal belongings rather than inventory for resale. If your review work is considered a hobby instead of an activity in which you are engaged to generate income, the 1099-NEC income gets reported on Schedule 1 of Form 1040 with no deductible expenses. That’s entered in the software by following the menu path: Income > Uncommon Income > Other Income.

Later, if you donate the products to charity, you may have a noncash donation to claim as an itemized deduction.

Should you use the cost of goods sold?

If you understand how to report the cost of goods sold, you may choose to track your expenses that way. However, to keep your accounting and tax return simple, we recommend using the Common Expense section (as shown above) when reporting value adjustments for damaged or sold items.

Conclusion

Running a business by receiving products at no cost in exchange for reviews is a growing business model. However, even if the products are free, you may still need to report their value as income on your tax return. You’ll need to determine if your activity qualifies as a hobby or a business to report it correctly on your tax return. Our article, “Do I have a business or a hobby?” will be helpful.