Contributed by KiaraB, FreeTaxUSA Agent TaxPro

As FreeTaxUSA support agents, we often get asked questions like, “Why am I not getting the EITC?” and “Why did the Earned Income Tax Credit go down when I had more income?”

Here is a simple explanation so you can understand how the Earned Income Tax Credit (EITC or EIC) works.

What is the EITC?

The Earned Income Tax Credit is a refundable tax credit for taxpayers and families with low to moderate incomes. It is refundable, which means that if a credit is larger than the amount of taxes you owe, you can get the rest as a refund. Having qualifying children usually gives you a bigger credit.

Who qualifies?

- Age: If you don’t have any qualifying children, you need to be at least age 25 and under age 65. (Sometimes the rules change for national disasters, such as the Covid-19 pandemic in 2021.) If you have qualifying children, the age requirement does not apply.

- Earned Income: You must have earned income (wages, salary, tips, or self-employment). Retirement, unemployment benefits, or interest income don’t count as earned income.

- Income Limit: Your adjusted gross income (AGI) must be below the limit set for your filing status and for the number of qualifying children you have. These limits change each year for inflation.

- Investment Income: Your total investment income needs to be below the set limit. For 2024, that limit was $11,600. In 2025, the limit is $11,950. Check the IRS EITC Tables for other years.

- Filing Status: Your filing status can be anything but Married Filing Separately (MFS). There is an exception to this, but most MFS filers would not qualify.

- Citizenship: You need to be a U.S. resident or citizen with a valid Social Security Number. Also, your qualifying child must have a valid Social Security Number.

How the EITC works:

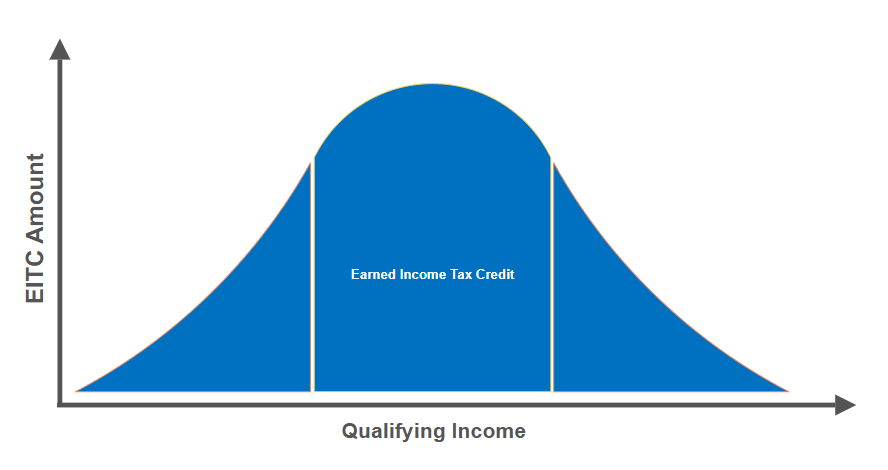

Think of the EITC like a hill. As you earn more money at first, the credit gets bigger. When you reach the top of the hill, you’ll get the largest amount of the credit. After that, as you earn more income, you start going back down the hill and the credit gets smaller until you reach the bottom of the hill where you no longer qualify for the credit.

Let’s use a single filer, age 37, with no children (2024) as an example:

- Earn $2,000 → EITC ≈ $155.

- Earn $10,000 → EITC ≈ $632 (this is higher because you are still climbing the hill).

- Earn $15,000 → EITC ≈ $273 (you are past the peak of the hill, so the credit falls).

- Earn $20,000 → No EITC (you reached the bottom of the hill as you are past the AGI limit).

These numbers will change depending on your filing status and if you have any qualifying children, but the basic idea is the same for every situation.

Why your EITC may go down or disappear:

- Your child no longer qualifies because of age or change in circumstances.

- You added additional income, which raised your AGI passed the peak and lowered your credit.

- Your investment income went over the yearly limit.

What to check if your EITC changes:

- Make sure your dependents are entered correctly.

- Check that you entered all your income, especially earned income.

- Check your investment amounts.

- If you’re still not sure, contact FreeTaxUSA customer support and we’ll look at your account to check the information.

Conclusion:

The EITC is a refundable credit which many taxpayers qualify for. The amount of the credit will depend on filing status, age, earned income, investment income and qualifying children. When one or more of those changes, the EITC will increase, decrease, or be eliminated.