Contributed by: Henry, FreeTaxUSA Agent, Tax Pro

Paying for higher education can be expensive — but claiming education credits, such as the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC), may provide some relief. Whether you’re a student or have a student dependent, the IRS offers valuable tax credits that can help reduce what you owe or even increase your refund. Understanding which education expenses qualify for a credit is essential to filing an accurate tax return while maximizing your tax benefits.

Determining qualified education expenses

To claim an education credit on your tax return, you must have qualified education expenses for an eligible student. Qualified education expenses are amounts paid for higher education by you, your dependent, or a third party.

- For the AOTC, the education should lead to a degree, certificate, or other recognized education credential.

- For the LLC, the course can also be taken to acquire or improve job skills.

Expenses must be paid to an eligible educational institution, which includes any college, university, vocational school, or other postsecondary school that qualifies to participate in student aid programs administered by the U.S. Department of Education. Some eligible institutions may be located outside the U.S. If you’re unsure whether a school qualifies, the institution should be able to confirm its eligibility.

Qualified education expenses include:

- Tuition and certain related expenses required for enrollment or attendance at an eligible educational institution.

- For the AOTC, course-related books, supplies, and equipment don’t have to be purchased from the school to qualify.

- For the LLC, fees and expenses must be paid to the institution for enrollment or attendance. If the school has no policy about how the course-related materials are obtained, it isn’t a qualified expense.

- For example, Melinda is a sophomore at a university and is required to have certain books to use in her classes this year. The school has no policy about how students should obtain these materials. Melinda buys the books from the university’s bookstore. The cost of the books are a qualified education expense for the AOTC because the books were required for her class enrollment. They aren’t a qualified education expense for the LLC because she wasn’t required to purchase the books from her school.

- Student activity fees, only if they are required as a condition of enrollment.

- Costs related to sports, games, hobbies, or non-credit courses if the course or activity is part of the student’s degree program or, for purposes of the LLC, contributes to acquiring or improving job skills.

- Amounts paid for an academic period that begins either within the tax year or during the first three months of the following tax year. For example, if you prepay tuition in 2025 for a semester starting in January 2026, those expenses count toward your 2025 education credit because the payment was made in 2025.

Qualified education expenses don’t include costs such as insurance, medical expenses (including student health fees), room and board, transportation, or other personal, living or family-related expenses.

Paying for expenses

Qualified education expenses may be paid using:

- Cash

- Check

- Credit or debit card

- Personal savings

- A gift

- An inheritance

- Money from a loan

What about education expenses paid with scholarships and grants?

Qualified education expenses don’t include amounts paid with tax-free funds. You must reduce the amount of expenses paid with tax-free grants, scholarships and/or fellowships, and other tax-free educational assistance.

For example, Scarlet paid $5,000 for tuition and $4,000 for room and board at her university. To help pay these costs, she received a $2,000 scholarship and a $6,000 student loan. The university applied the $2,000 scholarship against Scarlet’s $9,000 total bill, and Scarlet paid the $7,000 balance with the student loan and personal savings. Scarlet doesn’t report any portion of the scholarship as income on her tax return. Her qualified education expenses for claiming an education credit are $5,000 (tuition) - $2,000 (scholarship) = $3,000.

When you prepare your tax return, FreeTaxUSA software will ask you about your qualified education expenses and any tax-free education assistance you received during the year. It will reduce your qualified education expenses accordingly. However, you may be able to increase your education credit by allocating part or all of the student's scholarship or grant to nonqualified expenses, such as room and board. For more information on this tax strategy, refer to our article, How do scholarships and grants affect your ability to claim an education credit?

Who can claim a student’s qualified education expenses?

Only the student or the person eligible to claim the student as a dependent may claim a student’s expenses. This means it doesn’t matter if the expenses were paid by you, a dependent, or someone else (such as a relative or friend). The person who is claiming the education credit for the student treats any expenses paid for the student as if they had paid them.

- If you claim a dependent on your tax return who is an eligible student, only you can claim the education credit based on the student’s expenses. The dependent can’t claim the credit.

- If you’re entitled to claim the student dependent on your tax return but don’t, then the dependent may claim the credit. The student dependent claims all eligible expenses paid on their behalf, even if they were paid by others.

Example 1: Luke’s daughter, Ashley, is attending college. She paid half of her tuition for the year, and Luke paid the other half. Since Luke is claiming Ashley as a dependent on his tax return, he can claim all qualified education expenses paid for her — both his portion and Ashley’s — when claiming an education credit.

Example 2: The facts are the same as in Example 1, except Luke decides not to claim Ashley as a dependent on his tax return this year. This means Ashley may claim an education credit on her tax return. She’ll claim all qualified education expenses paid for her — both her own portion and Luke’s.

Example 3: Ashley’s grandmother, Grace, makes a payment to Ashley’s college for her qualified education expenses. Ashley is treated as having received the money from her grandmother and then paying the expenses herself. Grace can’t use the expenses to claim an education credit on her tax return. If Luke claims Ashley as a dependent, he will claim the expenses paid by Grace. If Luke doesn’t claim Ashley as a dependent, Ashley will claim the expenses paid by Grace.

Entering qualified education expenses in FreeTaxUSA

To enter education expenses for you, your spouse, or your dependent(s), follow the menu path: Deductions/Credits > Common Deductions/Credits > College Tuition (1098-T).

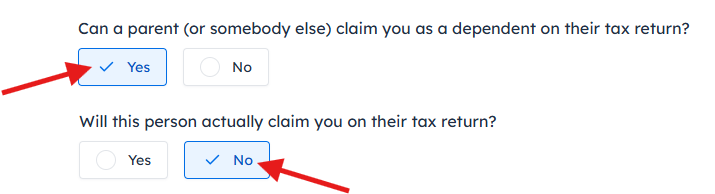

You’ll only be able to enter your expenses if someone else can’t claim you as a dependent or if they can claim you but choose not to. If you’re a dependent student whose parents have chosen not to claim you as a dependent this year, follow the menu path: Personal > Taxpayer Information and be sure these questions are answered correctly:

FreeTaxUSA software will guide you through the process of entering your education expenses to see if you qualify for an education credit. If you have questions, look for the helpful blue question marks and FAQs throughout the software. For additional support, our Customer Support team is ready to assist you.