Contributed by: AndyS, FreeTaxUSA Agent, Tax Pro

The IRS requires you to report digital currency on your tax return each year if you’ve received, sold, exchanged, or otherwise acquired cryptocurrency or other digital assets. If you mine cryptocurrency, there are different reporting requirements when you first acquire the coin and again when you sell the coin. We’ll look at some typical situations to get you on your way to reporting your cryptocurrency activities correctly on your return.

Mining as gig work

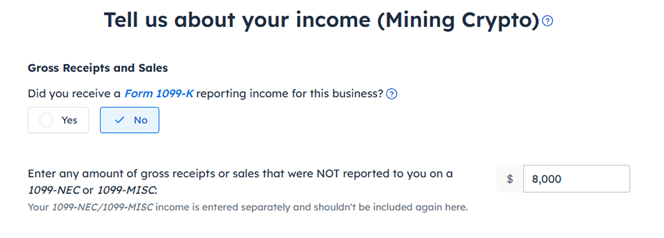

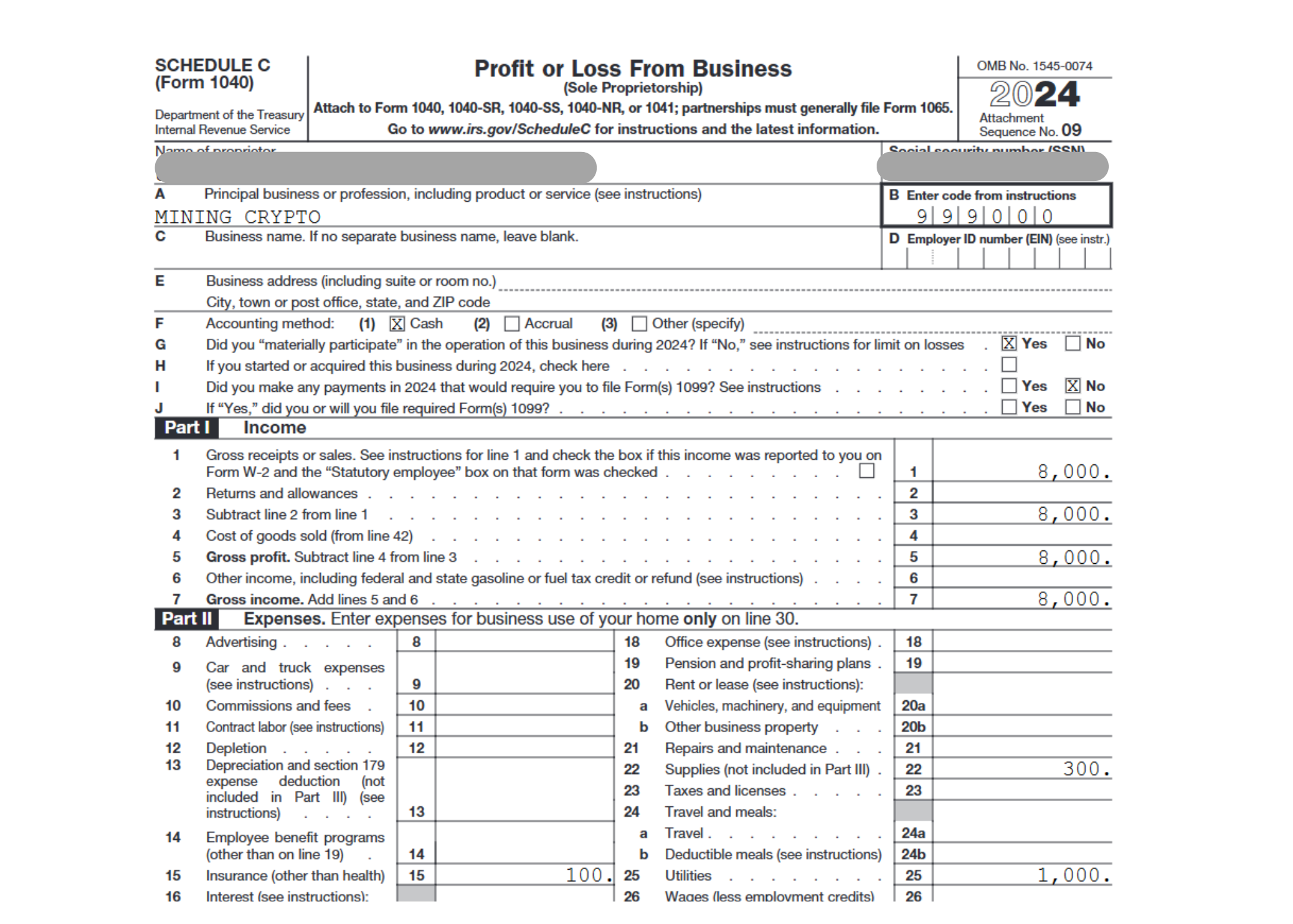

Are you mining cryptocurrency as a side gig or as a small business for profit? If so, you’ll report cryptocurrency sales in FreeTaxUSA software by following menu path: Income > Business Income > Business Income (Schedule C). The earnings will be entered as gross receipts or sales on line 1 of your Schedule C.

To figure out the amount of earnings to report, convert the coin mined to U.S. dollars based on its market value on the day it was mined. You can look at stock reporting history to find the value of your coin the day it was mined. For example: If you mined 4 coins over the course of a year, and they were each worth $2,000 on the day you mined them, you would report $8,000 income on your Schedule C.

When you enter your mining income on Schedule C, it will report as self-employment income on your tax return. One nice thing about reporting your mining income as self-employment income is that you can also deduct business expenses incurred to produce the income.

You can typically expense or depreciate required hardware purchases, as well as other costs—such as electrical costs directly related to mining—to reduce your taxable income. However, you’ll also be assessed self-employment tax on your net profit to cover FICA tax, which is typically withheld by an employer.

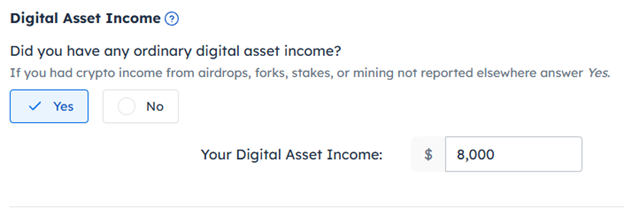

Non-business digital asset income

Digital asset income isn’t subject to self-employment tax or filing Schedule C unless it comes from a business. If you mine cryptocurrency casually or as a hobby, enter it as ordinary digital asset income on your tax return. You’ll convert the coin you mine into U.S. dollars on the day you receive it. When preparing your return, report it by following menu path: Income > Uncommon Income > Other Income and selecting Yes to the question about Digital Asset Income. You can’t reduce your income amount by expenses related to the ordinary digital asset income, so you’ll need to report the full amount you earned. Your entry there will flow to Schedule 1, line 8v.

Other cryptocurrency activity reporting

The IRS requires you to report any digital asset activity on your tax return. In FreeTaxUSA software, when you’re ready to finish the income section, you’ll be asked about your cryptocurrency activity throughout the year. This is a yes-or-no question you will find by following menu path: Income > Uncommon Income > Cryptocurrency.

Choose No if your cryptocurrency activities were limited to:

- Holding a digital asset in your wallet or account.

- Transferring a digital asset between your own wallets or accounts.

- Purchasing digital assets using real currency, including purchases using electronic real currency platforms such as PayPal or Venmo.

- Engaging in a combination of holding, transferring, or purchasing digital assets as described above.

Choose Yes if your crypto activities include any of the following:

- The receipt of digital assets as payment for goods or services provided.

- The receipt of digital assets as a result of a reward or award.

- The receipt of new digital assets as a result of mining or staking activities.

- The receipt of digital assets as a result of a hard fork.

- An exchange of digital assets for property, goods, or services.

- An exchange or trade of a digital asset for another digital asset.

- A sale of a digital asset.

- Any other disposition of financial interest in a digital asset.

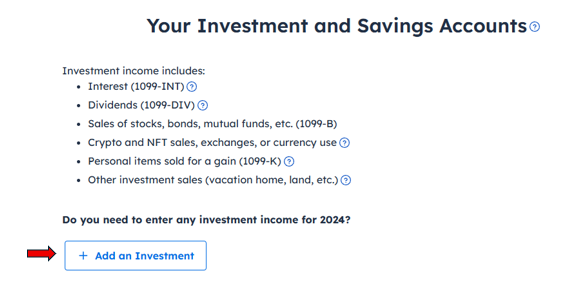

How to report selling mined cryptocurrency

When you’ve sold your cryptocurrency, you’ll need to report the sale to determine any capital gain or loss associated with the sale. You can do this by following menu path: Income > Common Income > Investments and Savings and selecting Add an Investment.

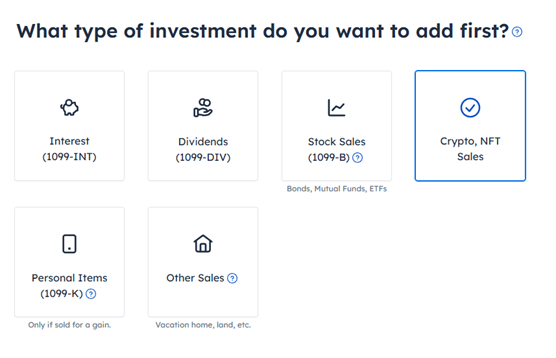

Then select Crypto, NTF Sales and continue.

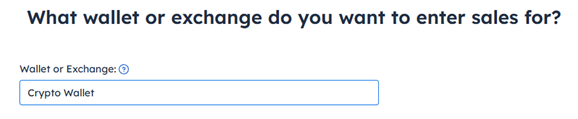

Enter the name of the wallet or exchange that holds your coin and continue.

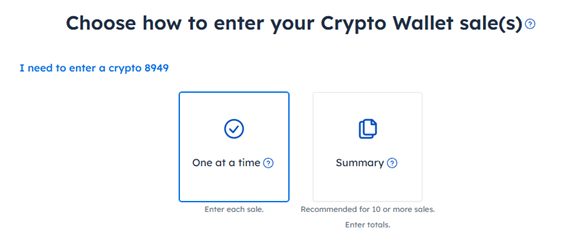

Next, select if you want to enter one sale at a time or a summary of your sales.

- One at a time sale– is chosen if you only have a few sales to report and will enter one sale at a time. If you have additional sales, you’ll need to add another sale.

- Summary– is generally chosen when you have a lot of digital asset sales you’re reporting. A summary allows you to enter short-term and long-term totals from your brokerage statement or 1099-B. For instance, if you have six sales to report—three short-term and three long-term—you only need to enter two sales: one reflecting the total short-term sales and another for the total long-term sales.

If you enter a summary of sales, you’ll need to attach a summary statement to your e-filed return or include it with your paper return if mailing. FreeTaxUSA software will prompt you to upload a PDF of your summary statement before filing your return.

Continuing the example entry, we’ll select One at a time.

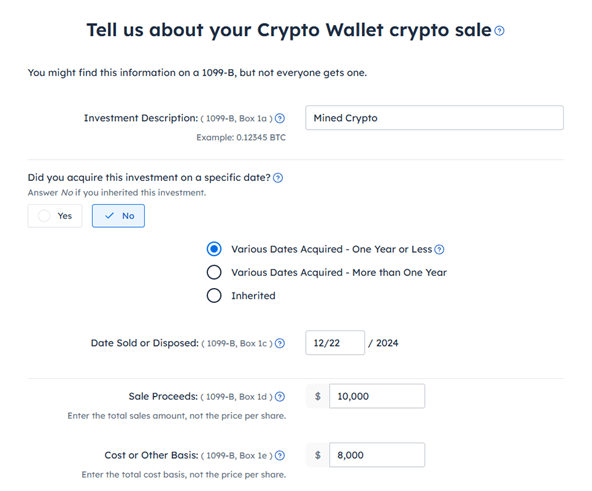

Start by filling out the boxes on this screen with information necessary. For this example, the coin was mined through the year, so it won’t have a specific date acquired. Since it was mined and sold in the same year, you would select Various Dates Acquired - One Year or Less. If you also sold cryptocurrency mined more than a year ago, that will need to be reported separately in a second entry.

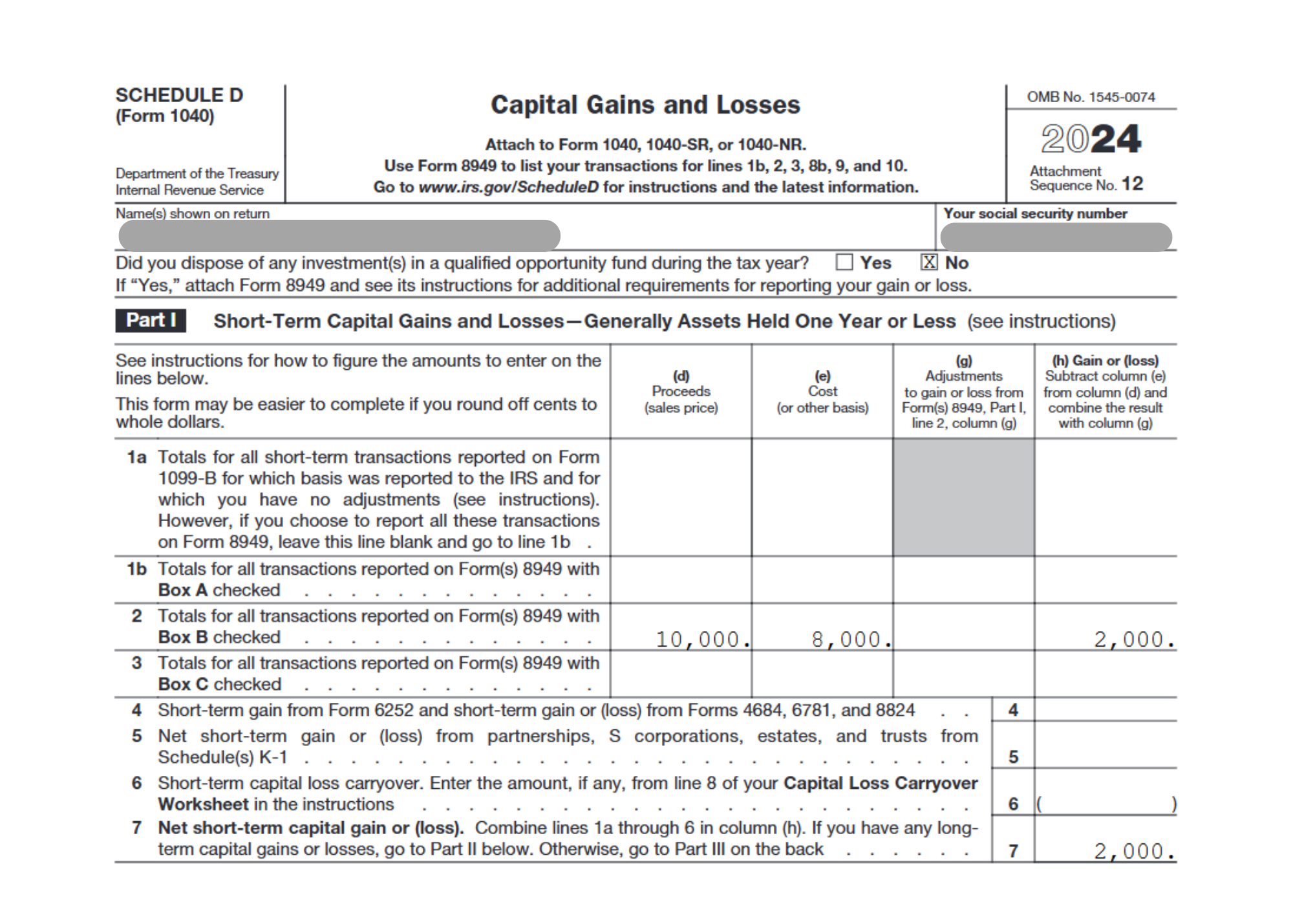

For this example, the value amount of the coin on the day you gained control over it (the U.S. dollar amount on the day you mined each coin) was $8,000. This will be your cost basis. Proceeds are the amount you sold the coin for. In our example, let’s say $10,000. You can then answer the other questions on the screen as they pertain to your situation and continue.

The software will calculate the amount of capital gain or loss from your coin sale and report it on Schedule D.

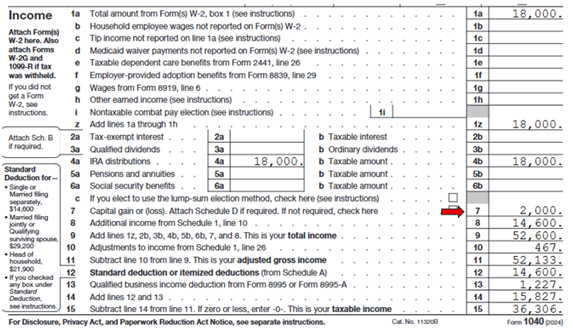

The net capital gain or loss from your Schedule D will flow to Form 1040, line 7.

Reporting mined cryptocurrency can seem daunting at first, but it’s not much different than entering other gig or hobby income. The key is to track the value of the coin on the day it’s mined so you can accurately report the cost basis when you sell it.