Contributed by: LynR, FreeTaxUSA Agent, Tax Pro

Cryptocurrency is an exciting and relatively new investment platform. As with all investments, there are risks, including potential for scams and fraudulent activities and you may become the victim of a cryptocurrency scam. Generally, a financial loss can be a tax deduction, but are these scam losses really tax deductible?

Good news and bad news

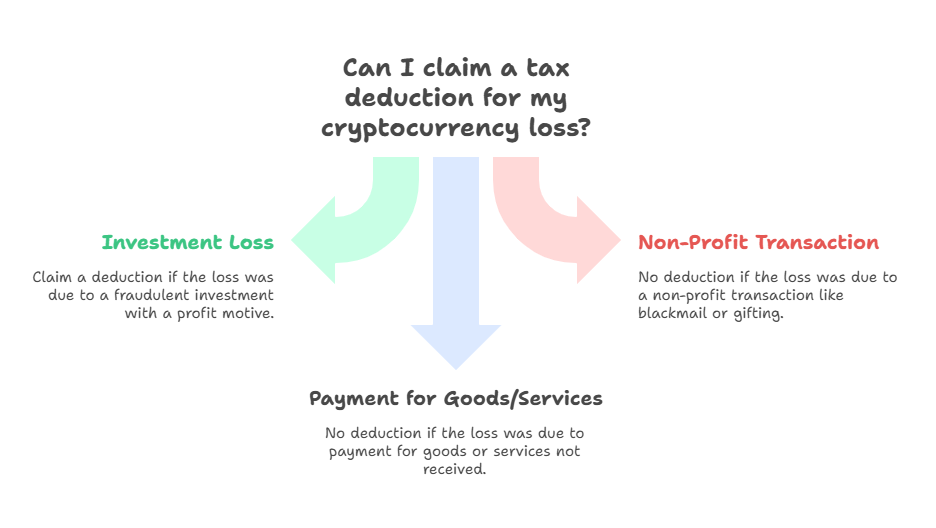

There are times when cryptocurrency losses from scams can be deducted on your tax return and when they can’t. To be eligible for a deduction on your tax return, a cryptocurrency scam must meet the following criteria:

- For-profit motive: The transaction must have the intent of making money.

- The scam must be due to illegal activity according to applicable state law. This includes theft, larceny, or embezzlement.

- There must be no “reasonable prospect of recovery.” This means there is no reasonable way to get your money back.

- Reasonable steps are taken to discover and report the fraud to your local authorities. The theft can also be reported to the FBI on the Internet Crime Complaint Center site.

How to report a loss from theft or scam on your tax return

If you meet the above criteria, you are eligible to report the loss on Form 4684, Section B. Currently, FreeTaxUSA doesn’t support Section B of Form 4684 to report these types of losses. IRS guidance for claiming an allowance of theft losses for victims of scams can be found here.

If you’re eligible to report your loss on Form 4684, Section B, the loss is limited to your basis in the investment. Basis refers to the original value or purchase price of the investment, adjusted for any additional investments or returns. The specific facts and circumstances matter. You must be able to prove that you meet each of the criteria above to take a tax deduction.

Common Scenarios

To better understand when losses resulting from scams are tax deductible, let’s examine a few common scenarios:

Scenario 1: Loss due to fake cryptocurrency

Brock’s friend Tim invests a large sum in Alpha, a new cryptocurrency. Alpha is in its initial stage of coin sales and projects a 30% return in the first year. Brock is interested in making a large profit as well. He visits Alpha’s website, reviews the material, and decides to purchase $5,000 of Alpha. A month later the site is down and turns out this was a fraudulent coin that never existed. Brock loses $5,000.

Brock can claim a loss from the scam because:

- His transaction was for investment purposes

- He had a profit motive

- Selling fake cryptocurrency is illegal

- There is no reasonable prospect of recovering his initial investment

If he reports the fraud to legal authorities, he can claim a loss on his tax return for $5,000.

Scenario 2: Crypto loss due to blackmail, relationship, “pig butchering”, or other not-for-profit transaction

Sue is contacted on social media by an old high school friend. They reconnect and after several weeks of chatting online, the friend confides that she needs a lifesaving surgery she can’t afford. Sue transfers $22,000 of cryptocurrency to her friend to help with the cost. She never hears from the friend again and realizes she has been scammed.

There are many variations in this scenario that fit in the same not-for-profit transaction/scam category. The transaction could be blackmail from phishing type communication on social media. The friend (or person asking for money) could be real or fake. The reason for the transfer of cryptocurrency could be real or fake.

Oftentimes, fraudsters in these types of not-for-profit cryptocurrency scams are using fraudulent profiles on social media. They may use several techniques to gain a relationship of trust with the victim. Once the victim has transferred the cryptocurrency, the fraudster disappears.

Unfortunately, losses from not-for-profit cryptocurrency scams are not tax deductible. In these situations, the victims are essentially giving their money to someone they have decided needs it.

- There is no intention of making a profit

- The transaction is effectively a gift, not an investment

- No tax deduction is allowed

- Victims should still report fraud to local authorities

Scenario 3: Payment of cryptocurrency for goods or services that are never received

Liam is looking for a contractor to remodel his bathroom. He finds a contractor who comes to his home, discusses the project, and gives Liam a bid for the work. The bid is lower than Liam was expecting, and he’s excited to get the job going. The contractor asks for an initial deposit of 50% in cryptocurrency. Liam transfers the amount to the contractor and Liam never hears from the contractor again. The work never gets done.

Liam can’t claim a tax deduction because:

- He used cryptocurrency as a method of payment (currency) rather than intent of earning a profit on an investment

- There was no clear profit motive

- Using cryptocurrency to receive goods or services doesn’t meet the profit motive criteria

Take Aways

Staying watchful and informed is key to keeping your investments safe in this rapidly changing digital landscape. If you ever find yourself victim of a cryptocurrency scam, review these scenarios to determine if your loss is tax deductible. Don't hesitate to take necessary steps to report fraud or a scam and seek help. Your financial security is paramount. With the right knowledge and actions, you can effectively navigate these challenges.