Contributed by: AnthonyS, FreeTaxUSA Agent, Tax Pro

So, you’re thinking of starting your own business and forming an LLC. This is an exciting step! But once you’ve filed the paperwork with your Secretary of State, you might wonder: What now?

Whether you’re a solo entrepreneur or forming an LLC with others, it’s important to understand your tax responsibilities right from the start.

How the IRS views an LLC

The IRS doesn’t tax the LLC entity itself in most cases; instead, it looks at how your business is classified for federal tax purposes. The key questions to answer are:

- Is your LLC a single-member or multi-member entity?

- If your spouse is a member, do you live in a community property state?

Single-member LLCs

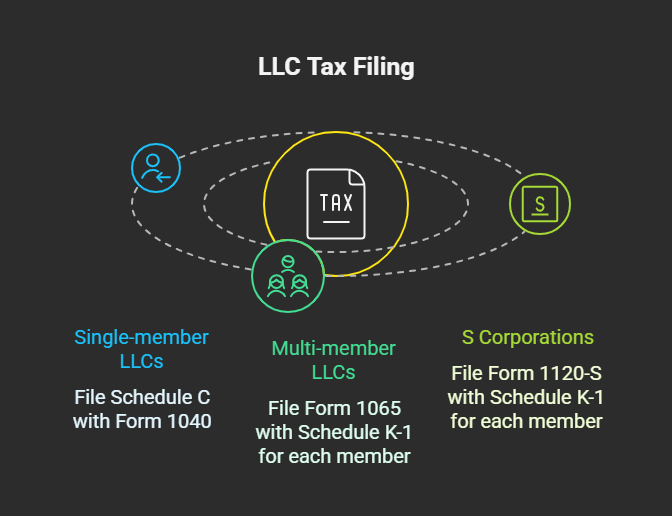

If you’re the only owner, your LLC is treated as a disregarded entity by default for federal tax purposes. That means you’ll file taxes just like a sole proprietor. You’ll report your income and expenses on Schedule C, which is attached to your Form 1040 — unless you elect to be taxed as an S corporation (more on that below). You will also be subject to self-employment taxes; Schedule SE will be used to calculate Social Security and Medicare taxes on your income.

Multi-member LLCs

If your LLC has more than one member, it’s treated as a partnership by default. You’ll need to file Form 1065 by March 15. As part of this process, each member receives a Schedule K-1, which reports their share of the business’ income and deductions.

💡Note: Forming an LLC does not automatically disqualify a married couple from making a qualified joint venture election, but the rules are complex — married couples should consult the IRS guidance or a tax advisor.

Electing S corporation status

Some LLC owners choose to be taxed as an S corporation to potentially reduce self-employment taxes. To make this election, you must file Form 2553 with the IRS. This changes how income and payroll are reported. You’ll typically pay yourself a reasonable salary (subject to payroll taxes) and take additional profits as distributions.

While this setup can offer tax advantages, it also requires more paperwork and IRS compliance. It’s wise to consult a tax professional before making this election.

Real-life examples

Example 1: Alex recently left his full-time job to start a landscaping business and registered “Alex’s Landscaping LLC” in his state. Since Alex is the sole owner, the IRS treats his business as a sole proprietorship. He’ll file Form 1040 and include a Schedule C to report his business income and expenses.

Example 2: Jennifer starts a computer repair business with her friend and forms “Jennifer and Friend Computer Repair LLC.” Because the LLC has two members, the IRS treats it as a partnership. The business must file Form 1065 and provide Schedule K-1s to each member showing their share of the income and expenses.

What you need to keep track of

No matter how your LLC is taxed, here’s what you’ll want to stay on top of:

- EIN (Employer Identification Number): Get an EIN if you will hire employees, have a multi-member LLC, elect corporate tax treatment, or if your bank requires it.

- Business income records: Keep track of every invoice, deposit, and payment.

- Receipts for expenses: You can deduct eligible costs like supplies, advertising, and vehicle expenses.

- Estimated tax payments: If you expect to owe $1,000 or more, make quarterly estimated payments using Form 1040-ES.

- Payroll and withholding: If you elect S corporation status or hire employees, you’ll need a payroll setup.

Filing with FreeTaxUSA

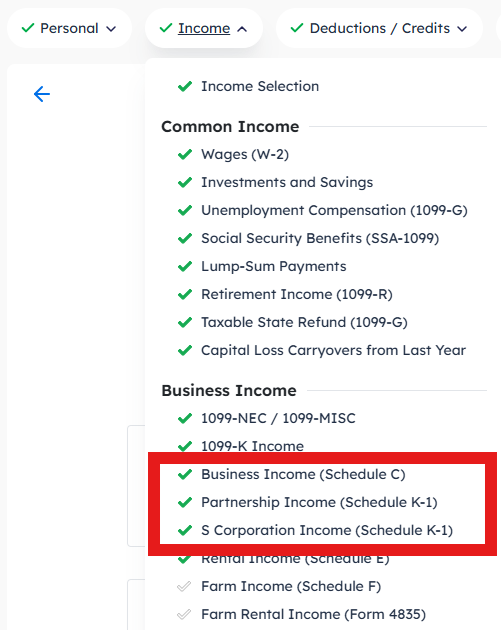

- Single-member LLC: In FreeTaxUSA, follow this menu path: Income > Business Income > Business Income (Schedule C). Follow the prompts to enter your income and expenses.

- Multi-member LLC: If your LLC files a partnership return (Form 1065), you’ll receive a Schedule K-1. Currently, FreeTaxUSA doesn’t support filing Form 1065, but you can report your personal share by following this menu path: Income > Business Income > Partnership Income (Schedule K-1).

- S corporation election: If your LLC makes an S corporation election, it must file a Form 1120-S (S corporation tax return) and issue Schedule K-1s to each member, just like a partnership. You can report your personal share by following this menu path: Income > Business Income > S Corporation Income (Schedule K-1).