Contributed by: Tess, FreeTaxUSA Agent

Covering the cost of higher education can be challenging, but tax credits like the American Opportunity Tax Credit and the Lifetime Learning Credit may offer meaningful financial relief. Whether you're a student yourself or supporting a student dependent, the IRS provides valuable education credits that can lower your tax bill — or even boost your refund. Knowing which education expenses qualify is key to filing an accurate return and maximizing your potential tax savings.

What is an education credit?

An education credit is a tax benefit that helps with the cost of higher education by directly reducing the amount of tax owed on your federal tax return. There are two types of education credits: the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC).

American Opportunity Tax Credit (AOTC)

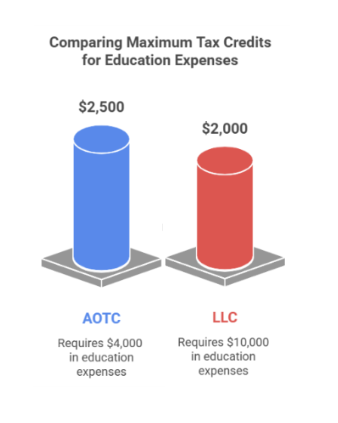

The AOTC provides financial relief for qualified education expenses incurred during a student’s first four years of higher education by lowering the amount of federal tax owed. The credit can be worth up to $2,500 per eligible student each year. If the credit reduces your total tax to zero, you may be eligible to receive the refundable portion of the credit up to $1,000.

To claim the AOTC you must:

- Be working toward a degree or recognized education credential at a qualified post-secondary school.

- Be enrolled during the tax year in a program that leads to a degree, certificate, or other recognized education credential.

- Not have completed the first four years of college before the tax year begins.

- Not have already claimed the AOTC for more than four tax years (these years can be non-consecutive and include any years the credit was claimed).

- Not have a felony drug conviction by the end of the tax year.

Lifetime Learning Credit (LLC)

The LLC helps cover qualified tuition and related expenses for eligible students attending an accredited educational institution. It applies to undergraduate, graduate, and professional degree programs, as well as courses aimed at acquiring or enhancing job skills. There is no limit to how many years you can claim this credit, and it can provide up to $2,000 per tax return.

To claim the LLC you must:

- Be enrolled or taking courses at an eligible educational institution.

- Be pursuing a degree or other recognized credential or taking courses to acquire or improve job skills.

- Be enrolled in at least one academic period that begins during the tax year.

The LLC is equal to 20% of the first $10,000 in qualified education expenses, with a maximum credit of $2,000 per tax return. The LLC is non-refundable, meaning it can reduce the amount of tax you owe, but you won’t receive any portion of the credit as a refund if it exceeds your tax liability.

Income limit for education credits

Whether claiming the AOTC or LLC, your credit will begin to phase out based on your Modified Adjusted Gross Income (MAGI). Phaseout begins if your MAGI is between $80,000–$90,000 ($160,000–$180,000 for joint filers). You can’t claim the credit if your MAGI is $90,000 or more ($180,000 or more for joint filers).

Which credit should I claim?

The AOTC is generally the more beneficial option if you’re eligible. It’s worth more and is partially refundable. However, the LLC is easier to qualify for.

You can’t claim both credits for the same student in the same tax year, so you’ll need to decide which one is best for your situation. FreeTaxUSA software can help you make that determination when you enter the student’s qualified education expenses.

Scenario 1: Karen is an undergraduate student who is claimed as a dependent by her parents. They paid $7,000 in qualified education expenses for her during the year. Their MAGI is below the limit, and they plan to claim an education credit. They want to know how each credit will impact their tax return.

- The AOTC is 100% of the first $2,000 and 25% of the second $2,000. Karen’s parents would most likely be able to claim the full $2,500 as a nonrefundable credit to help reduce their tax liability. If they have no income tax on line 18 of their Form 1040, then they can claim 40% of the credit as a refundable credit ($1,000).

- The LLC is 20% of the first $10,000. Karen’s parents would most likely be able to claim $1,400 as a nonrefundable tax credit on their return.

What are qualified education expenses?

Qualified education expenses are amounts paid for higher education by you, your dependent, or a third party. Expenses must be paid to an eligible educational institution, which includes any college, university, vocational school, or other postsecondary school that qualifies to participate in student aid programs administered by the U.S. Department of Education. The eligibility of some education-related expenses differs slightly between the AOTC and the LLC. To learn more, please review: What are qualified education expenses for claiming an education credit?

Scholarships and grants used to pay for tuition, fees, and other qualified educational expenses reduce the amount of qualified educational expenses that can be used to calculate your potential education credit.

Scenario 2: Chad is a married college student filing a joint return with his wife, and their MAGI is below the limit. Chad has $6,000 in qualified education expenses and a $4,000 scholarship. His scholarship reduces his qualified education expenses for claiming an education credit ($6,000 - $4,000 = $2,000).

- If Chad claims the AOTC, he can claim the full $2,000 to reduce his tax bill, or he may claim up to $1,000 as a refund if he owes less than $2,000 in taxes.

- If Chad claims the LLC, he can only claim 20% of $2,000, which would be $400. This credit could reduce his tax bill by $400 but won’t result in a refund.

You may be able to maximize your education credit by allocating all or part of a scholarship or grant to nonqualified expenses, such as room and board. Just remember, the allocated portion must be reported as income on your tax return. For more information on this tax strategy, please review: How do scholarships and grants affect your ability to claim an education credit?

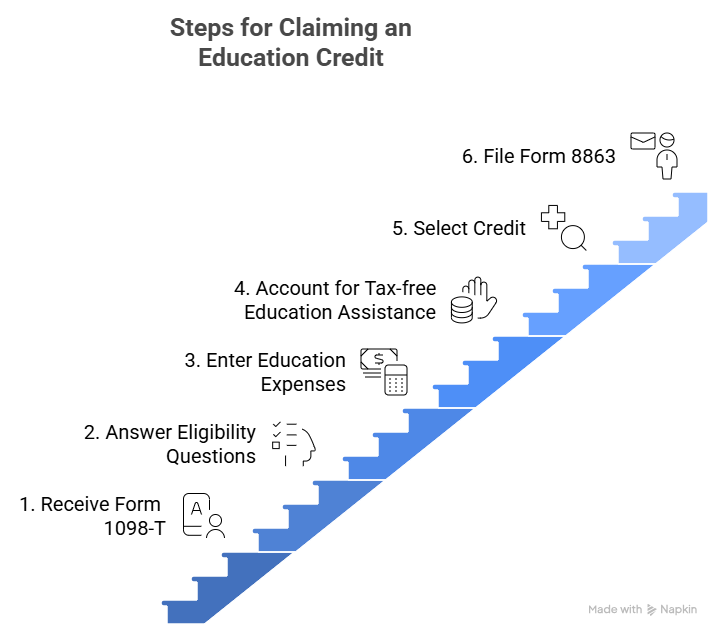

Form 1098-T

Eligible education institutions must file Form 1098-T for each student who is enrolled for any academic period during the tax year. Your educational institution should send you a copy of the 1098-T by Jan 31st of the following year.

The 1098-T reports:

- Amounts billed or paid for qualified education expenses (usually tuition and certain required fees), and

- Total scholarships and grants received during the tax year.

The information on Form 1098-T is used to complete Form 8863 and claim an education credit.

If you didn’t receive a Form 1098-T, you may still be eligible to claim an education credit if you can show that:

- The educational institution wasn’t required to provide Form 1098-T.

- You (or your dependent) were enrolled at an eligible educational institution.

- You can verify payment of qualified tuition and related expenses.

How do I claim an education credit in FreeTaxUSA software?

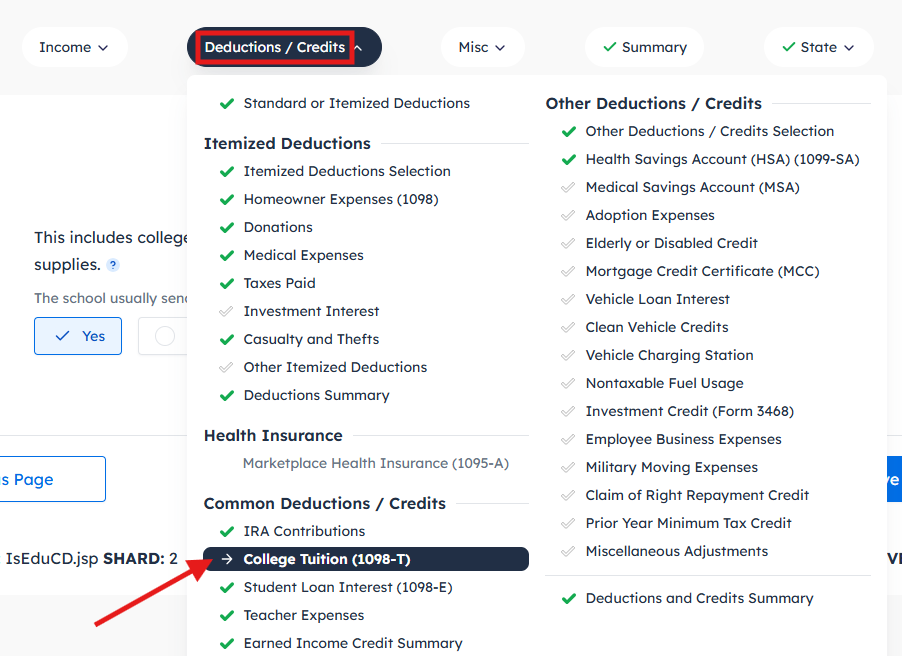

Information for education credits is entered by following the menu path: Deductions/Credits > Common Deductions/Credits > College Tuition (1089-T).

- You’ll be asked if anyone had college expenses. Keep in mind that you can only claim an education credit for yourself, your spouse and your dependents. You’ll be prompted to select who had college expenses during the year.

- Next, you’ll be asked to start entering education expenses for each student, including their school and Form 1098-T information. The software will ask some questions to help determine your eligibility for the AOTC. Be sure to answer appropriately for your situation.

- You’ll need to copy over the information from your student’s 1098-T. Each field in the software corresponds to the numbered boxes on the 1098-T you received. Just enter the information exactly as it appears on your form.

- You’ll be asked if you had additional expenses (such as books, supplies, and equipment) or grants and scholarships not reported on a 1098-T. If you received tax-free education assistance, pay attention to the question that asks, “Do you want to allocate part of [student’s] Pell grants or scholarships to room and board or other noneducational expenses such as travel, research, or certain equipment?” As explained earlier, it may be beneficial to allocate part or all of your scholarship to noneducational expenses to help maximize your benefits.

- After all questions have been answered, the software will recommend the credit which will help you get the largest federal tax refund. You can choose to either take the recommendation or change it.

- You’ll see the amount you can claim, along with the worksheets used to calculate the credit in case you’d like to review any details.

Conclusion

Paying for higher education is no small task—but knowing how to claim the right education credit can make a real difference. Whether you're eligible for the American Opportunity Tax Credit or the Lifetime Learning Credit, understanding your options can help you reduce your tax bill or increase your refund.

Now that you know the basics, review your education expenses, gather your Form 1098-T, and use FreeTaxUSA’s guided software to easily claim the credit that most benefits you.