Contributed by: Henry, FreeTaxUSA Agent, Tax Pro

Paying for higher education can be expensive, so any financial assistance is helpful. Scholarships and grants are invaluable resources that can reduce the cost of tuition and other educational expenses. Additionally, education credits, such as the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit, can provide further relief. Understanding the impact of financial aid on education credits is crucial for filing an accurate tax return while maximizing your tax benefits.

How education credits work

The AOTC is worth up to $2,500 per eligible student. It’s calculated as 100% of the first $2,000 of qualified education expenses for the year, plus 25% of the next $2,000. This means a student needs $4,000 of qualified education expenses to claim the maximum credit. 40% of the credit is refundable, allowing a taxpayer with no tax liability to receive a refund of up to $1,000 by claiming the AOTC.

The Lifetime Learning Credit offers a smaller amount but is available to more individuals. It’s calculated as 20% of the first $10,000 qualified education expenses for the year, with a maximum credit of $2,000. This credit is nonrefundable, meaning it can only reduce your tax liability to zero and will not result in a refund.

Determining qualified education expenses

To claim an education credit on your tax return, you need to have qualified education expenses for an eligible student. Qualified education expenses are amounts paid for higher education by you, your dependent, or a third party and may include tuition, fees, and course-related books, supplies, and equipment. They can be paid using cash, check, credit or debit card, personal savings, or money from a loan.

Qualified education expenses don’t include amounts paid with tax-free funds. You must reduce the amount of expenses paid with tax-free grants, scholarships and/or fellowships, and other tax-free education assistance.

For example, Jolene paid $4,000 for tuition and $5,000 for room and board at her university. To help pay these costs, she received a $2,000 scholarship and a $4,000 student loan. The university applied the $2,000 scholarship against Jolene’s $9,000 total bill, and Jolene pays the $7,000 balance with the student loan and personal savings. Jolene doesn’t report any portion of the scholarship as income on her tax return. Her qualified education expenses for claiming an education credit are $4,000 (tuition) - $2,000 (scholarship) = $2,000.

Allocating funds to maximize tax benefits

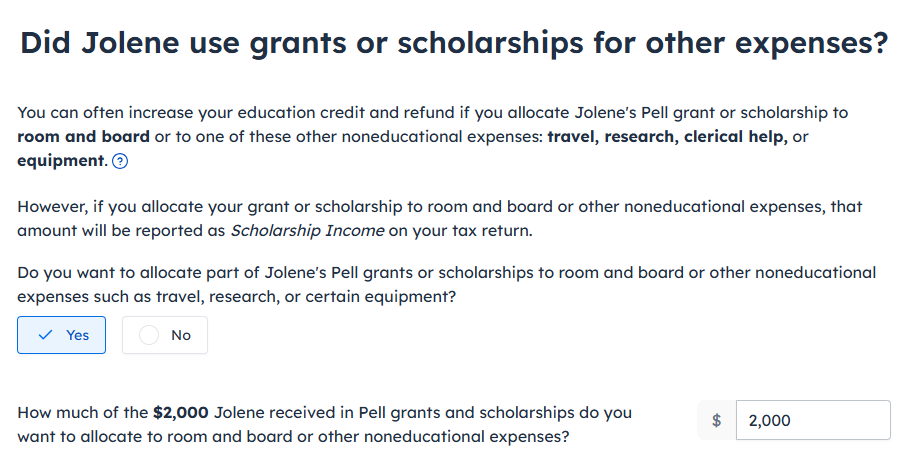

You can often increase your education credit by allocating part or all of the student's scholarship or grant to nonqualified expenses, such as room and board. Just keep in mind that the allocated amount will need to be reported as scholarship income on the student’s tax return. While this strategy may result in additional income tax being owed by the student, the higher education credit often leads to a net benefit.

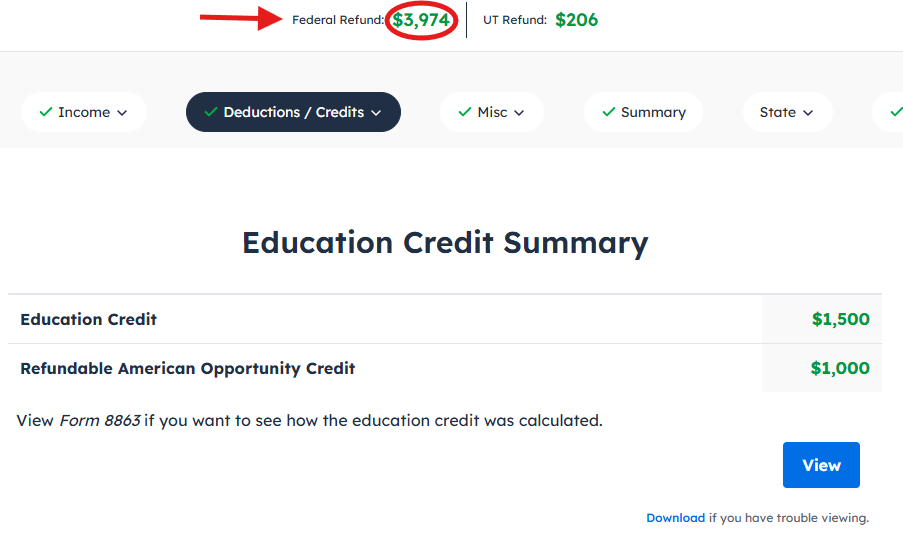

Revisiting the example above, let’s say Jolene reports the entire scholarship as income on her tax return. Because the scholarship is no longer considered tax-free educational assistance, her qualified education expenses don’t need to be reduced. Jolene is treated as having paid $4,000 in qualified education expenses and can now claim the maximum American opportunity credit. Her income tax increases by $150 due to the scholarship income, but her education credit increases by $500. As a result, allocating the scholarship ultimately increases her federal tax refund by $350.

As long as the terms of the tax-free financial aid allow it to be used for expenses other than tuition and fees, you can choose whether to allocate the funds to nonqualified expenses. You may want to try allocating different amounts to see what is most beneficial for your situation.

How to use this strategy in FreeTaxUSA

To enter education expenses for you or your dependent(s), go to Deductions/Credits > Common Deductions/Credits > College Tuition (1098-T). If you report scholarships or grants in Box 5 on Form 1098-T, you’ll be asked on a subsequent screen if you want to allocate part of your grants or scholarships.

You can answer Yes to enter an allocation amount. Then save and continue until you reach the Education Credit Summary screen. Look at the Federal Refund/Federal Due amount at the top of the screen to see how your bottom line has been impacted by the allocation.

If you want to try a different allocation, go back and enter a new amount. Then save and continue until you reach the Education Credit Summary screen again. Check the Federal Refund/Federal Due amount at the top of the screen to see the effect of the new allocation.

Remember you need $4,000 of qualified education expenses to claim the maximum American Opportunity Credit or up to $10,000 to claim the maximum Lifetime Learning Credit. When choosing an allocation amount, you want to find that sweet spot where you get the most benefit while compensating for the added income.

Using our example, if Jolene had tuition expenses of $10,000 and a $7,000 scholarship, that gives her:

$10,000 (tuition) - $7,000 (tax-free scholarship) = $3,000 (qualified education expenses).

In this scenario, she wouldn’t need to allocate more than $1,000 of her scholarship income to claim the maximum American Opportunity Credit, as only up to $4,000 in qualified education expenses is required:

$10,000 (tuition) - $6,000 (tax-free scholarship) = $4,000 (qualified education expenses).

Jolene can experiment with entering various allocation amounts between $0 and $1,000 to determine what gives her the best results.

Conclusion

It’s important to understand that your ability to claim an education credit may be affected by your scholarships and grants. You’ll need to adjust your qualified education expenses to account for tax-free financial aid you received. However, remember you may be able to allocate your scholarships and grants to room and board and other nonqualified education expenses. Doing so will generally increase your taxable income, but a higher education credit may more than compensate for the higher tax.

If you or another student in your family received tax-free financial aid, consider allocating some of the scholarship or grant on your tax return. Your specific circumstances will determine what amount, if any, to include in income to maximize your tax refund or minimize the amount of tax you owe.