Contributed by: JoshuaC, FreeTaxUSA Agent, Tax Pro

Please note that with the passage of the One Big Beautiful Bill Act of 2025, the clean vehicle credit is ended, meaning qualifying and EV purchases must be made before September 30, 2025. This article is to explain how the credit works if you are preparing a prior year tax return with a prior purchase of an EV for the Clean Vehicle Credit.

Facing the decision to purchase an electric vehicle can be daunting. Among the many considerations may be a generally higher purchase price, but there are potential savings in the long term compared to traditional gas-powered vehicles.

To encourage taxpayers to make the jump, the clean vehicle (CV) credit is available as a tax incentive for qualifying purchases of electric or fuel cell vehicles.

The credit is claimed, in most cases, using Form 8936. Additional filing requirements for other forms may exist for businesses claiming a credit for electric commercial vehicles. Keep in mind that this credit is considered a nonrefundable credit, meaning that it reduces your income tax, but cannot generate a tax refund. Any remaining unused credit is not carried forward to another tax return year. See the following article for more information on this distinction:

https://community.freetaxusa.com/kb/articles/219-what-is-the-difference-between-a-refundable-and-nonrefundable-tax-credit

Qualifications

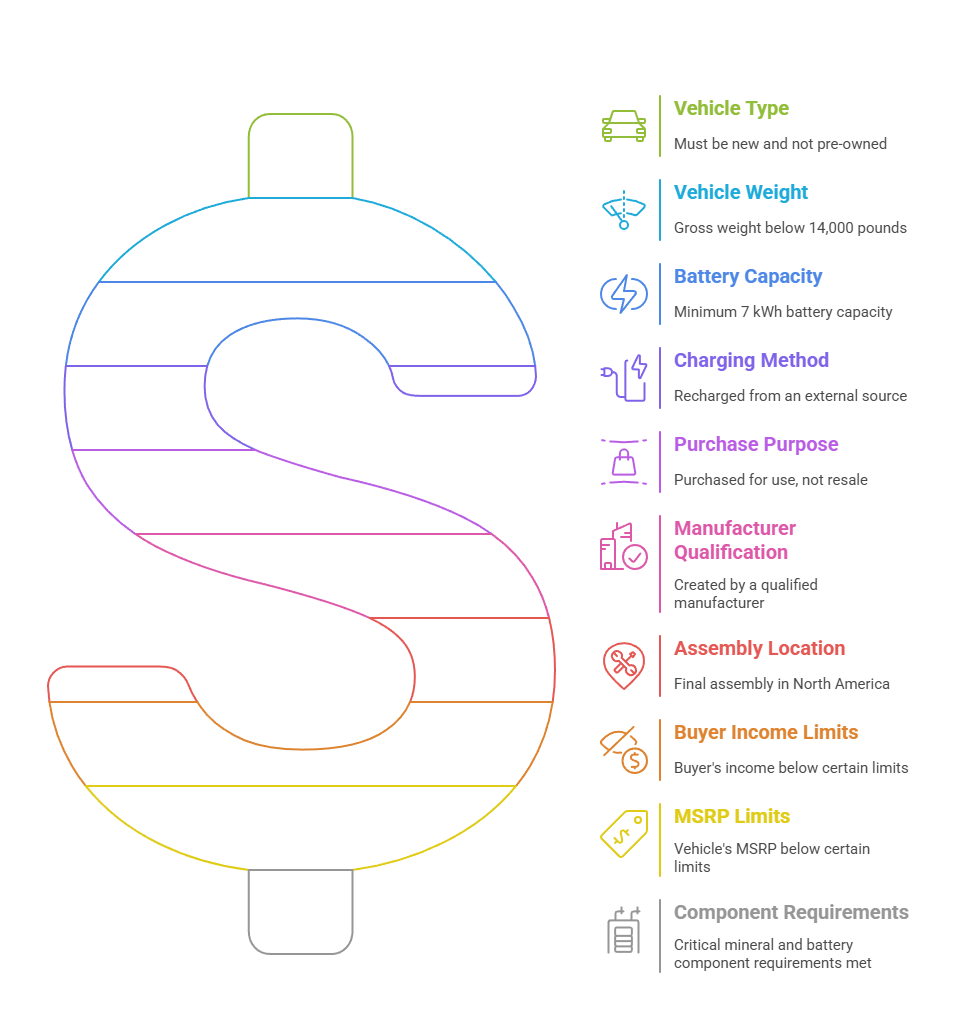

Requirements to qualify for the credit vary based on a number of factors, such as when the vehicle was purchased and put into use. The Inflation Reduction Act of 2022 added some complexity to the rules for purchases made in 2023 and onward. Also, it is important to consider whether the vehicle is new or pre-owned. Its size, specifications, manufacturing, and materials can also change the credit amount. Further, a different credit is available for commercial vehicles used for business than for personal vehicles.

We’ll break down what you need to know to qualify for the credit before making your decision.

The original credit for tax years prior to 2022 was relatively simple. To qualify, the following criteria were established:

- The vehicle must be a new (not pre-owned) clean vehicle.

- The vehicle’s gross weight is below 14,000 pounds.

- The vehicle’s battery capacity was at least 5 kilowatt-hours (kWh) and is recharged from an external source.

- The vehicle was purchased for use (primarily in the United States), not for resale.

- The vehicle was sold by certain low-volume manufacturers.

The credit for these vehicles started at a base amount of $2,500, plus $417 for meeting the minimum kWh requirement and an additional $417 for each additional kilowatt-hour (kWh) battery capacity above five, up to a maximum credit of $7,500. For reference, a model 3 Tesla has a capacity range of 50 – 83 KWh, meaning most models will qualify for the full $7,500 credit, but keep in mind that lower battery capacities may lead to a reduced credit amount.

When the Inflation Reduction Act was passed in August of 2022, it immediately added an additional requirement (effective August 17, 2022) that the vehicles be assembled in North America. Further changes to the credit took effect in 2023 and remain in force.

Now, vehicles qualifying for the credit no longer need to be made by a low-volume manufacturer, but instead by manufacturers that have qualified for the credit with the IRS. To determine if a certain manufacturer and specific vehicles qualify view the IRS website.

The minimum battery capacity for a vehicle to qualify was also increased, effectively, to 7 kWh (up from 5 kWh). The calculation for the credit remained the same:

- $2,500 base amount

- $417 plus an additional $417 for each kWh above 5 kWh

The weight, external charging, and purpose requirements from the original credit remain the same. However, the Inflation Reduction Act also added a number of new requirements for 2023 forward. They are:

- Modified adjusted gross income must be below the following limits, based on the filing status used on your tax return:

- $300,000 if married filing jointly or surviving spouse,

- $225,000 if filing head of household, or

- $150,000 for all other statuses.

- The vehicle’s MSRP (manufacturer-suggested retail price) must be below:

- $80,000 for a van, SUV, or truck, or

- $55,000 for other vehicles.

One final additional factor came into effect for all vehicles put into service on or after April 18, 2023, requiring the vehicle’s manufacturer met certain critical mineral and battery component requirements.

Used vehicles

The credit and requirements described above apply to new vehicles purchased. But what about pre-owned clean vehicles? There is a tax credit available in those cases as well, though the rules and amounts are a bit different.

Here are the requirements for claiming a credit for a used clean vehicle purchase:

- You can’t have claimed credit for another used clean vehicle purchased in the last three years.

- Your modified adjusted gross income must be within even stricter limits. They are:

- $150,000 if married filing jointly or surviving spouse,

- $112,500 if filing head of household, or

- $75,000 for all other statuses.

- The model year of the vehicle must be at least two years prior to your purchase of the vehicle.

- The sale price of the vehicle must be $25,000 or less, which includes:

- all costs and fees added by the seller, but NOT including government-added costs such as taxes, title, and registration fees.

The credit amount for used clean vehicles is calculated at 30% of the sale price of the vehicle, up to a maximum credit of $4,000.

Commercial vehicles

One final category to mention is vehicles purchased exclusively for business purposes. This is a credit that can be claimed by businesses or tax-exempt organizations but can also be claimed on an individual income tax return filing Schedule C for business income. If you’re interested in this credit, the following conditions must be met:

- The vehicle must be made by a qualified manufacturer.

- The vehicle must be classified as a motor vehicle or as mobile machinery.

- The vehicle must be purchased for use (primarily in the United States), not for resale.

- The vehicle’s battery capacity must be at least 7 kWh if its gross weight is under 14,000 pounds, or 15 kWh for heavier vehicles.

- The purchase must not qualify for the new clean vehicle credit described above.

The amount of the credit also varies, as the calculation is more complicated. The amount is determined as the smallest of:

- A percentage of your basis in the vehicle.

- 15% of your basis for hybrid vehicles (those powered partially by a gas or diesel engine).

- 30% of your basis for fully electric vehicles.

- The additional (or “incremental”) cost of the clean vehicle above that of a similar gas- or diesel-powered vehicle.

- A limit of $7,500 for smaller vehicles (cars, vans, trucks, etc. under 14,000 pounds) or $40,000 for larger vehicles.

What do I need?

To claim a current clean vehicle credit, buyers need specific documentation. At the time of sale, dealers must provide a report confirming the vehicle’s eligibility. This report includes details such as the vehicle identification number (VIN), battery specifications, and manufacturer qualifications.

Vehicles placed in service on or after January 1, 2024, dealers must submit this report through the IRS Energy Credits Online system no later than three calendar days after the sale. As a buyer, you should ensure the dealership will be sending this report, as it is essential for claiming the tax credit with the IRS.

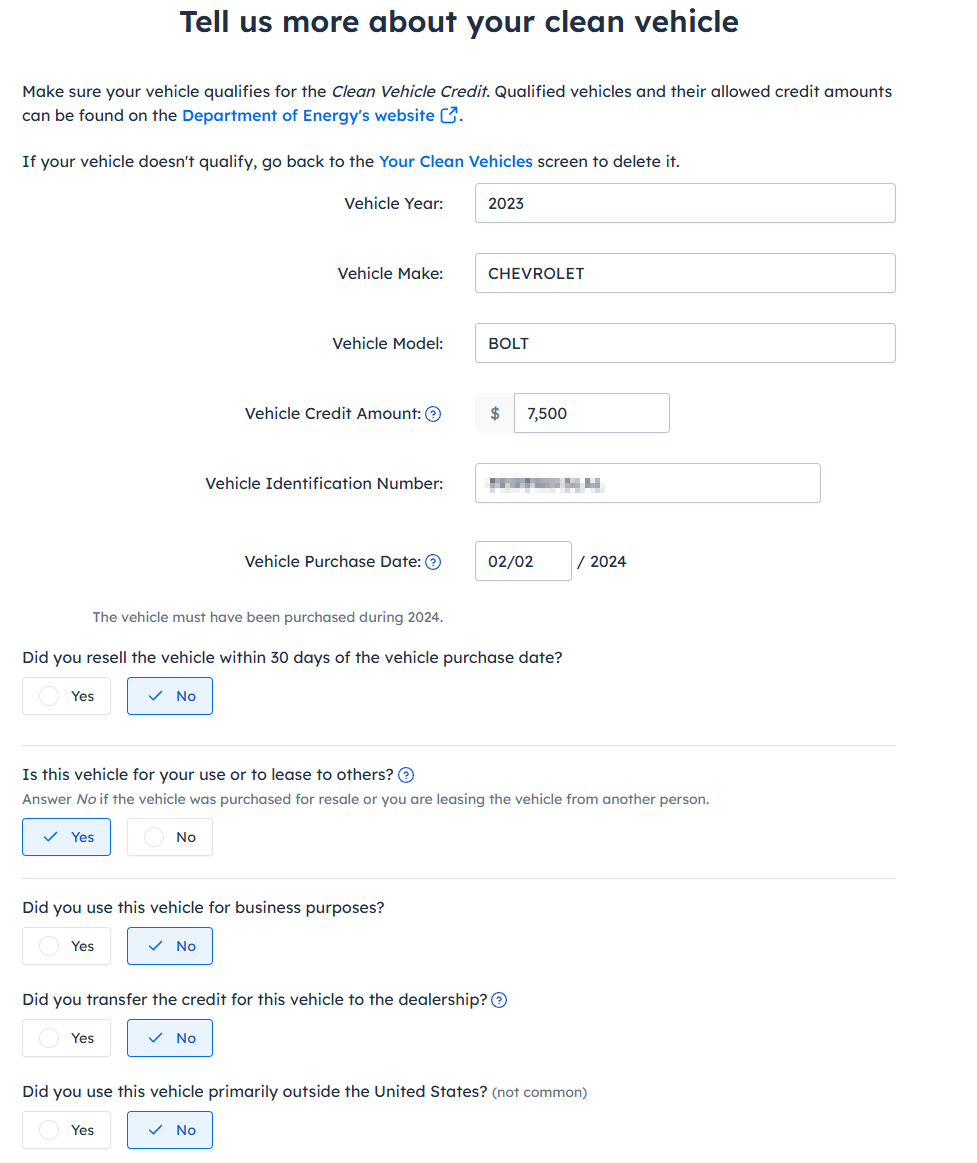

You will also need to decide, in conversation with the dealer, whether you want to take the credit on your income tax return when it is filed, or if you want to transfer the credit amount to the dealer at the time of purchase. This unique option (only available for personal-use vehicles) allows the dealer to receive the tax credit instead, in exchange for equal-value credit toward the purchase, effectively lowering the price you pay for the vehicle.

Whether you transfer the credit to the dealer or not, you will need to report the purchase on your tax return to claim the credit, typically using Form 8936.

How to claim the credit

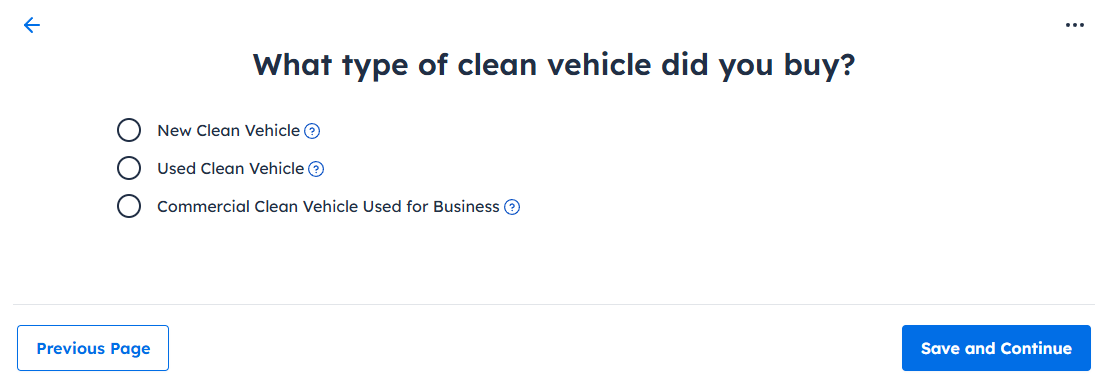

In the FreeTaxUSA software, claim the credit by following this menu path: Deductions / Credits > Clean Vehicle Credits. Click ‘Add a Clean Vehicle’, then simply indicate which type of credit you would like to take and then select ‘Save and Continue’.

Enter the information about your clean vehicle. Depending on the clean vehicle type selected previously, the questions asked will differ somewhat, but will always include basic identifying information, such as the vehicle’s year, make, model, and VIN, your usage of the vehicle, and whether the credit was transferred to the dealer or not.

Complete the requested questions, and the FreeTaxUSA software will fill in the needed forms accordingly. Feel free to reach out to Support with any additional questions during this process.