Contributed by: TriciaD, FreeTaxUSA Agent, Tax Pro

Capital gains and losses play a significant role in determining your tax liability. Whether you’re selling stocks, real estate, or other investment assets, understanding how these transactions are taxed can help you plan smarter and potentially reduce your tax bill. We’ll explain the basics of capital gains and losses, how they’re reported to the IRS, and their effect on your tax return.

What are capital gains and losses?

A capital gain occurs when you sell an asset for more than you paid for it. Conversely, a capital loss arises when you sell an asset for less than your purchase price. Common assets that generate capital gains or losses include stocks, bonds, mutual funds, real estate, and certain collectibles.

Short-term vs. long-term capital gains

Capital gains are classified based on the holding period of the asset:

- Short-term capital gains: Assets held for one year or less. These gains are taxed at your ordinary income tax rate.

- Long-term capital gains: Assets held for more than one year. These gains benefit from lower tax rates, typically 0%, 15%, or 20%, depending on your taxable income.

How gains and losses affect your tax return

Capital gains increase your taxable income, potentially raising your tax liability. Capital losses, however, can offset gains and reduce your tax bill. Here’s how it works:

- Offsetting gains with losses: If you have both gains and losses, you can use your losses to offset your gains. For example, if you have $5,000 in gains and $2,000 in losses, you only pay tax on $3,000.

- Deducting excess losses:There’s a limit on the amount of capital loss you can use to offset ordinary income. You can use up to $3,000 ($1,500 if married filing separately) of net capital losses each year. Any remaining losses can be carried forward to future tax years until fully used.

Special rules and additional taxes for capital gains and losses

The following are common situations that can affect gains, losses, and additional tax:

- Wash Sale Rule: If you sell or trade stock or securities at a loss and buy substantially identical stock or securities within 30 days before or after the sale, you can’t claim the loss on your tax return.

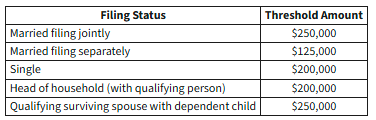

- Net Investment Income Tax (NIIT): High-income taxpayers may owe an additional 3.8% tax on net investment income or modified adjusted gross income (MAGI) over the IRS threshold for your filing status. This includes capital gains.

- State taxes: Many states tax capital gains differently from federal rules. Check your state’s tax laws for details.

- Other investment types: Specific rules can apply to the sale of a primary residence, rental property, inherited assets, or qualified small business stock, which have their own tax treatment.

Example situations:

- Stock sale with gain: You buy 50 shares of Company X for $2,500 ($50 per share) and sell them a year and four days later for $3,500 ($70 per share). You have a $1,000 long-term capital gain, which should be reported on your tax return and may be taxed at the long-term capital gains rate.

- Stock sale with loss: You purchase shares of Company Y for $4,000 but sell them six months later for $2,500. This results in a $1,500 short-term capital loss. You can use this loss to offset other capital gains for the year.

- Offsetting gains and losses: Suppose you had a $3,000 gain from selling real estate and a $2,000 loss from selling stock. You’d pay taxes on only the net $1,000 gain. In other words, the $2,000 loss is used to offset (reduce) the $3,000 gain.

- Deducting net capital losses: Imagine your total losses for the year are $6,000 and total gains are $2,000. The net loss is $4,000 ($6,000 - $2,000 = $4,000). You can deduct $3,000 of that loss from your ordinary income this year and carry forward the remaining $1,000 to next year.

- Wash sale: You sell shares of Company Z at a $700 loss and then buy the same company's shares within 30 days. You can’t claim the $700 loss this year due to the wash sale rule.

Reporting capital gains and losses

When you sell an asset, you must report the transaction on your tax return. The IRS requires you to use Form 8949 to list each capital asset sold, and Schedule D to summarize your total capital gains and losses.

Brokerage firms usually provide Form 1099-B at tax time, detailing your transactions for the year. Double-check these forms for accuracy before filing.

To enter sales of your capital assets in FreeTaxUSA, follow menu path: Income > Common Income > Investments and Savings (1099-B). The software will guide you through the process of entering your information.

Your entries are used to calculate capital gains and losses. Forms 8949 and Schedule D are automatically included with your tax return if required based on the information entered.

Tips for managing capital gains and losses

- Maintain records of asset purchases, sales, related costs, and dates of purchase and sale.

- Consider selling investments at a loss to offset gains and minimize your tax bill.

- Consult a tax professional for complex transactions or if you have significant gains or losses.

Summary

Capital gains and losses can have a major impact on your tax return. By understanding the rules and keeping good records, you can make informed decisions and potentially lower your tax liability. Always review IRS guidelines and seek professional advice when needed to ensure compliance and optimize your tax outcome. And remember, FreeTaxUSA customer support agents are happy to help guide you through the process of entering the information.