Contributed by: BarbaraL, FreeTaxUSA Agent, Tax Pro

If you're an IHSS (In-Home Supportive Services) provider, you might receive a W-2 for your caregiving work, even if that income isn’t taxable. Thanks to IRS Notice 2014-7 some caregivers are allowed to exclude (subtract) this income from their federal Adjusted Gross Income (AGI), reducing their taxable income.

What is IRS Notice 2014-7?

IRS Notice 2014-7 is official guidance published by the IRS. It states Medicaid waiver payments, like IHSS income, are non-taxable if both criteria are met:

- You're paid to care for someone in your home, and

- You live in the same home as the person receiving care.

This applies whether you're related to the person or not.

Do I still report the W-2?

Yes. FreeTaxUSA still requires you to enter the W-2 exactly as it appears, including the full income in Box 1. But don’t worry, you’ll be able to exclude it later.

How do I exclude IHSS income in FreeTaxUSA?

The following are the steps to successfully remove IHSS income from your total taxable income:

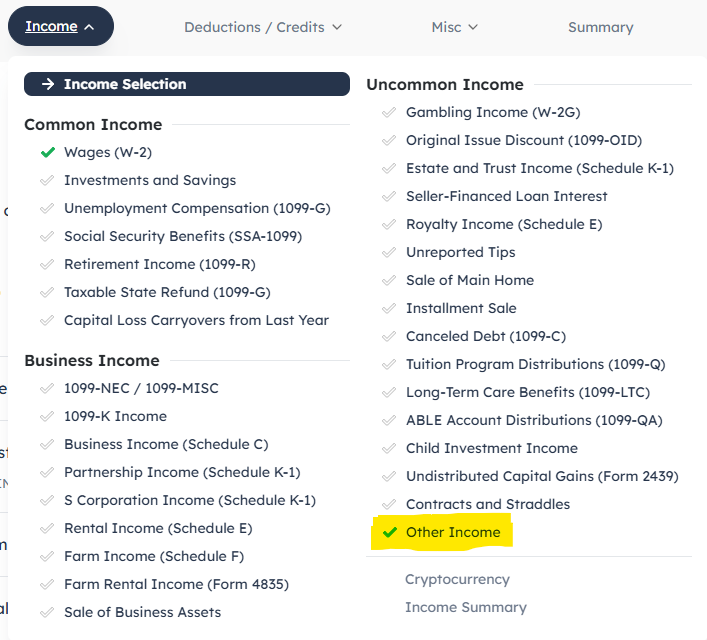

- Enter your W-2 under Income > Wages (W-2)

- Go to Income > Uncommon Income > Other Income

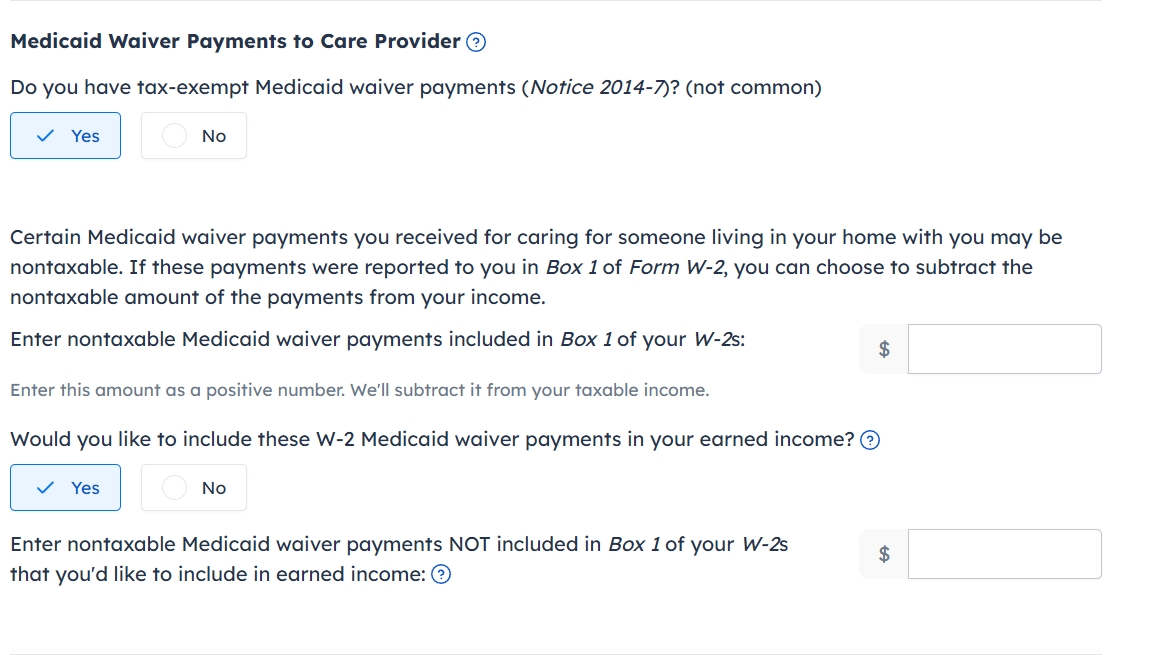

- Select Yes after you scroll down to find the question regarding tax-exempt Medicaid waiver payments

- Enter the amount from Box 1 of your W-2 in the space provided

- Select Yes if you want to include it in earned income for earned income credit purposes (optional)

Report IHSS as earned income for tax credits

Even though the income is non-taxable, you can choose to include it as earned income. Including it as earned income could help you qualify for, or increase your credits, such as the Earned Income Credit (EIC) or the Child Tax Credit (CTC). This won't raise your taxable income, but it can increase your refund.

To do this in FreeTaxUSA, in the example above you can see the box was marked Yes to the question: Would you like to include these W-2 Medicaid waiver payments in your earned income? Check Yes if you want the income included.

If you’re not sure if you should check Yes or No, try each answer and see how it will affect your federal refund.

Do other states have similar programs?

Yes! Most states offer Medicaid waiver programs that serve the same purpose by letting people receive care at home instead of in an institution or other facility. They go by different names, such as:

- Consumer Directed Services (CDS) – Missouri

- Self-Directed Services – New York, Texas

- Personal Care Assistance (PCA) – Minnesota

- Home and Community-Based Waiver (HCBW) – various states

- DD Waivers / Aged & Disabled Waivers – common for developmental disabilities or elder care

Check with your state to find out if they offer Medicaid waiver benefits and whether your caregiving income qualifies for the IRS Notice 2014-7 exclusion.

With these steps, you’re all set to handle your IHSS income like a pro, file with confidence, and make the most of your tax credits!