Contributed by: TriciaD, FreeTaxUSA Agent, Tax Pro

If you or a family member receive retirement benefits from the Railroad Retirement Board, you’ll get special tax forms at filing time. Forms to be aware of are:

- Form RRB-1099-R

- Form RRB-1099

- Form RRB-1042S (for some international recipients)

Understanding these forms is key to reporting your railroad retirement benefits (RRB) correctly on your tax return.

What’s Form RRB-1099-R and who receives It?

Form RRB-1099-R reports RRB you received during the year, such as monthly annuity payments, survivor benefits, or lump-sum distributions from retirement plans like pension or 401(k) accounts. It's like Form 1099-R but specifically for railroad workers and their families.

What’s on Form RRB-1099-R?

Key boxes include:

- Income Code (Box 1): This code indicates whether the payments are classified as Social Security Equivalent Benefits (SSEB) or pension payments.

- Employee Contributions (Box 5): Your own contributions to railroad retirement. This amount is the difference between social security taxes that would have been paid and your actual railroad retirement withholding.

- Gross Benefit Paid (Box 10): Total benefits you received before any repayments or taxes.

- Benefit Repaid to RRB (Box 11): Any repayments you made to RRB for overpayments.

- Net Benefit Paid (Box 12): What you received after repayments.

- Federal Tax Withheld (Box 13): Taxes withheld from your benefits during the year.

Form RRB-1099-R generally defaults to distribution code 7 and doesn’t include a box 7 code as seen on Form 1099-R.

Understanding railroad retirement benefit types

The Railroad Retirement Act defines two key categories:

- Tier 1 benefits (Social Security Equivalent Benefits - SSEB):

- These are treated much like Social Security benefits and may be taxable. If you receive or repay SSEB benefits, you’ll get Form RRB-1099, or Form RRB-1042S if you live outside the U.S. For more details, see IRS Publication 915.

- Tier 2 and other non-social security equivalent benefits:

- This includes the rest of tier 1, tier 2 benefits, vested dual benefits (VDB), and supplemental annuity payments. These are treated like regular pension payments and reported on Form RRB-1099-R. If you contributed to these tiers, part of your payments might be tax-free. However, benefits like VDBs are fully taxable. All U.S. and non-U.S. citizens receiving these benefits will get Form RRB-1099-R.

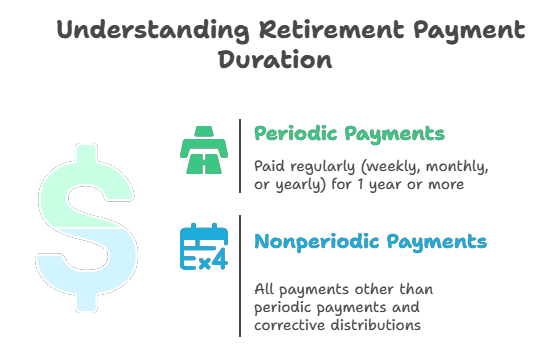

Periodic vs. nonperiodic payments

- Periodic payments: Regular payments (monthly, yearly) usually paid as an annuity, lasting more than one year. Part of these payments include your tax-free contributions; the rest is taxable income.

- Nonperiodic payments: One-time payments, like lump-sum withdrawals, extra earnings (e.g., dividends), or loans from the plan. Nonperiodic distributions are treated differently and may be taxable.

Note: Excess contributions beyond IRS limits may be taxable. See IRS Publication 525 for contribution limits.

How much of your distribution is taxable?

Not all benefits reported on Form RRB-1099-R are taxable. Some or all of your retirement payments could be tax-free, depending on how much you contributed.

Fully taxable payments:

- Payments where you didn’t make contributions or for which your contributions have been repaid from distributions in prior years. Please note that certain exclusions, not limited to cost, may apply.

- Payments from voluntary contributions if those were deducted from your paycheck pre-tax or if received as a lump sum.

Partly taxable payments:

- When contributions are made to a plan, those costs may be recovered tax-free over time. The tax-exempt portion is determined at the beginning of benefit payments and stays the same each year.

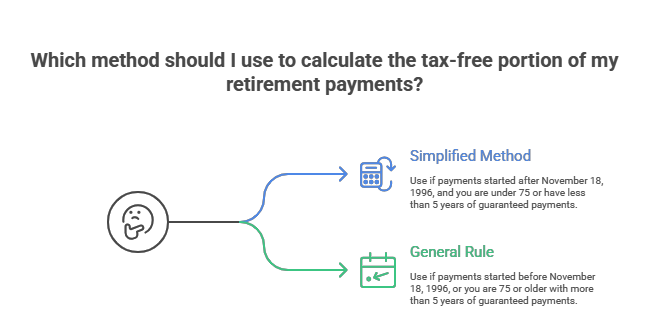

Two methods to calculate the tax-free amount

Simplified method:

Used if you started receiving benefits after November 18, 1996, and your payments are from qualified plans (like annuities or 403(b)s), and you’re under 75 with less than 5 years guaranteed payments. It divides your total contributions by the number of expected payments. Use IRS tables and worksheets for calculations.

General rule:

Used mainly if you started benefits before November 19, 1996, are 75 or older at start, or have guaranteed payments for 5+ years. This method uses actuarial tables to determine taxable amounts. Complete guidance is in IRS Publication 939 (pg. 9).

You must choose a method when you start and stick with it. If you have multiple pensions, calculate each separately.

Use the IRS worksheets (pg. 11) to figure the taxable amount of your distribution.

Reporting railroad retirement benefits on your tax return

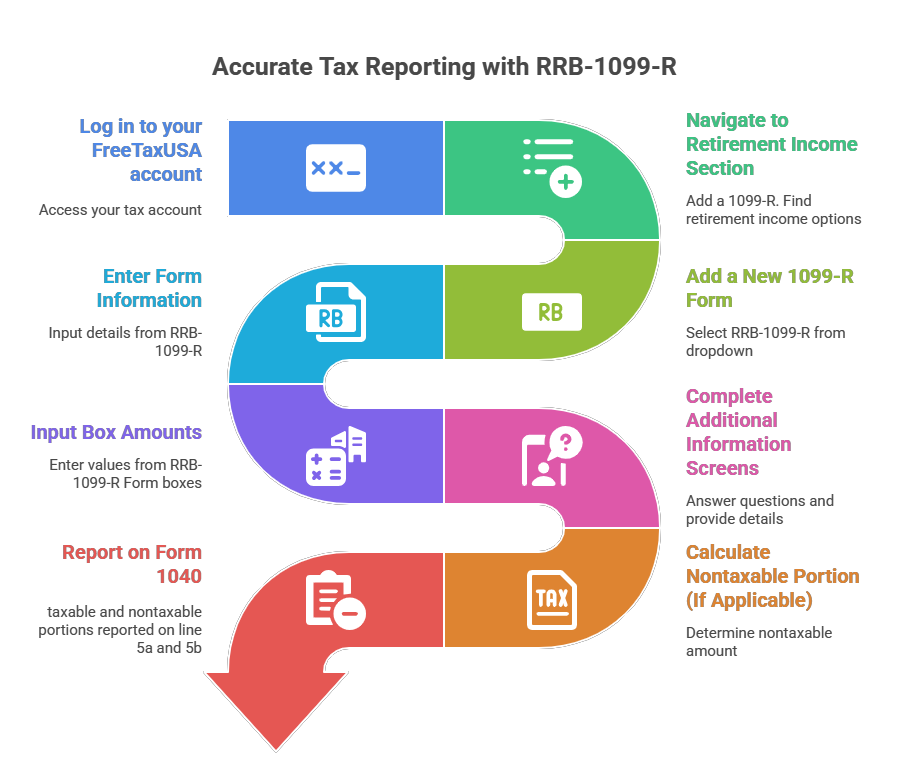

Here’s how to enter Form RRB-1099-R in FreeTaxUSA:

- Follow menu path Income > Common Income > Retirement Income (1099-R).

- Add a new 1099-R and select ‘RRB-1099-R Railroad Retirement Board annuities or pensions.’

- Enter form details exactly as shown on your form.

- Follow prompts—if it’s your first year, you’ll be prompted to calculate any tax-free portion. You’ll also be provided tools to determine the amount.

- The taxable amount will appear on Form 1040, line 5b, and the tax-free portion on line 5a.

Tips for filing

- Keep your Form RRB-1099-R safe—you'll need it each tax year.

- Review IRS Publication 575 for detailed tax rules on railroad benefits.

- Consult a tax professional, when in doubt.

- Double-check your entries and calculations to avoid mistakes.

Summary

Railroad retirement benefits come with unique tax reporting requirements because of the split between social security equivalent and non-equivalent benefits. Form RRB-1099-R is your key document, detailing payments and employee contributions affecting how much you owe in taxes.

By understanding the difference between benefit types, how to calculate taxable portions, and correctly entering data on your return, reporting your RRB benefits becomes manageable.

Understanding your RRB forms and relevant IRS guidance can simplify the tax process, making it less stressful and helping you avoid costly errors.