Contributed by: KelliP, FreeTaxUSA Agent, Tax Pro

Knowing what travel expenses are deductible can be confusing such as meals, transportation, and lodging. As a self-employed individual, generally most, if not all, travel expenses can be deducted. Business travel expenses are reported on Schedule C.

There are certain restrictions when it comes to claiming expenses as an employee. Job-related travel expenses for employees are no longer deductible except for Armed Forces reservists, qualified performing artists, fee-basis state or local government officials, and employees with impairment-related work expenses. This change occurred with the Tax Cuts and Job Act and applies to 2018-2025 tax years. The recent passing of the One Big Beautiful Bill Act made these changes permanent. Employee travel expenses are claimed on Form 2106.

If you’re self-employed or an eligible employee, you may be able to deduct ordinary and necessary business-related expenses you paid for travel.

An ordinary expense is considered common and accepted in your trade or business. A necessary expense is helpful and appropriate for your business. An expense doesn’t have to be required to be considered necessary.

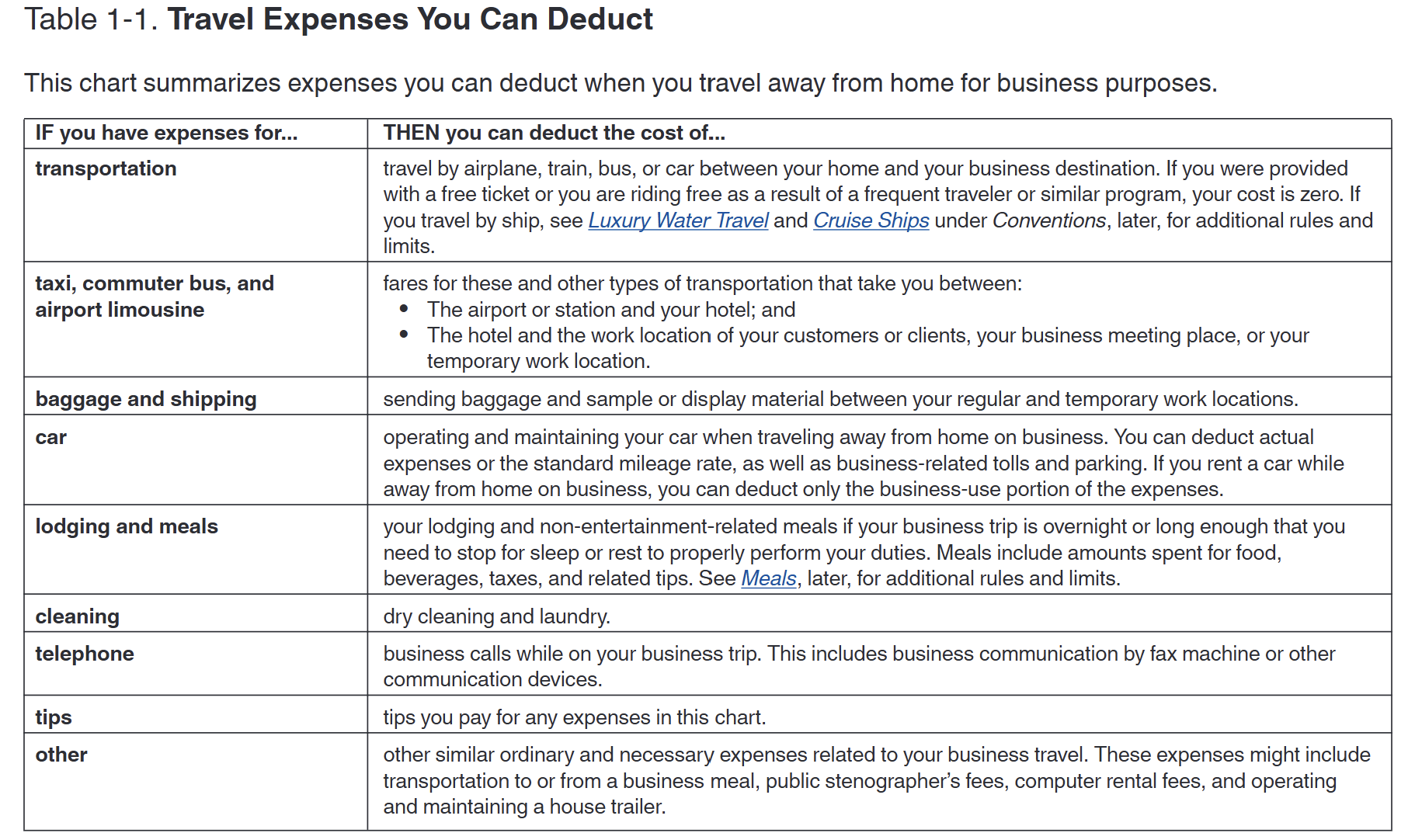

What expenses are deductible?

IRS Publication 463 provides some examples of deductible expenses when traveling away from home for business purposes:

Establish tax home

It is important to determine your tax home to understand what’s considered a travel expense. Generally, your tax home is the city or general area where your main place of business or work is located, regardless of where you maintain your family home.

If you’re traveling outside of your tax home for longer than a typical workday and need sleep or rest, then the travel expenses are deductible.

Example:

- Your family lives in Dallas, Texas and you work in Denver, Colorado. You stay in Denver at a hotel and eat in different restaurants. You travel home to Dallas every weekend. The expenses for travel, meals, and lodging in Denver are not deductible because Denver is your tax home. If you’re only in Denver on a temporary assignment for 6 months, then travel, meals and lodging expenses are deductible.

If you don’t have a specific place of business or work, then your tax home may be the home where you regularly live.

What if you’re paying for someone else’s travel expenses?

If you travel with an employee and pay for their expenses, their costs can generally be deducted. This applies if they have a bona fide business purpose for the trip and would otherwise be able to deduct the costs.

Do you ever take your spouse or a dependent on your business trips? If so, be sure to separate the costs. You’re not allowed to deduct their travel expenses, as these would typically be considered personal expenses.

Example:

- You and your family stay in a hotel, but the cost is equal to what an individual would pay alone. The entire hotel expense may be deductible. If the cost of the room(s) exceeds what a single person would pay, only the portion that reflects your expense may be considered deductible.

Per Diem

Per diem is a daily allowance for business travel expenses, calculated based on location. Employers typically use the per diem rate to provide stipend amounts to employees for their travel. While this rate is generally standard, larger and more costly cities may have a higher daily per diem rate.

Self-employed individuals can’t use the per diem rate for lodging but may use it for meals and incidentals, such as tips and fees for hotel staff, porters, and valets.

Meal limitation

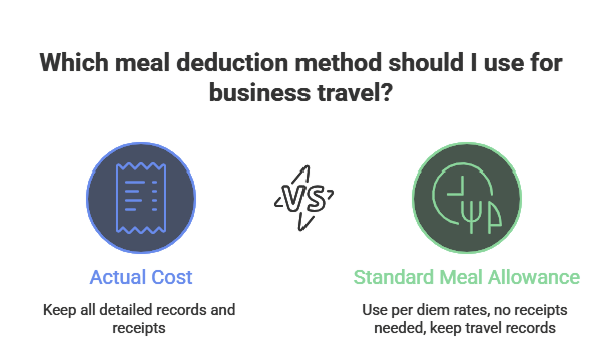

Up to 50% of the cost of meals can be deducted while traveling for business by using either the actual cost of meals or the standard meal allowance.

Actual cost

Determine the actual cost of your meals and then apply the 50% deduction limit. You must keep records and receipts to prove the actual cost. Meal expenses can’t be lavish or extravagant.

Standard meal allowance

Use the per diem rate for the location of travel. You don’t need to keep receipts when using this method. However, you’ll still need to maintain a record of when you traveled, where you traveled, and the purpose of the trip.

On traveling days for a business trip, you generally need to prorate the standard meal allowance in one of the following ways:

- Method 1: Claim 3/4 of the standard meal allowance.

- Method 2: Prorate using any method you consistently apply in accordance with reasonable business practice.

Transportation Worker

There’s a special rate for transportation workers. Transportation workers are in the transportation industry and qualify for the special rate if:

- Your work relates directly to moving people or goods by airplane, barge, bus, ship, train, or truck, AND

- You’re regularly required to travel away from home and during any single trip, you’re required to travel in different areas that have different standard meal allowance rates.

Using the special rate allows you to avoid calculating the standard meal allowance for every place you stop to sleep or rest.

Are conventions deductible?

If you can provide proof that your attendance to a convention benefits your trade or business, travel expenses for the convention are deductible.

Personal vs business expenses

What if I go on a business trip, but I also take extra time for a personal/family vacation?

If your trip is mostly for business, all business-related travel expenses can be deducted. These expenses typically include traveling to and from the business destination and business-related expenses while there.

What if my trip is primarily for personal reasons, such as a vacation, but includes some business activities?

If the trip is mostly personal, you can’t deduct any travel expenses. However, you can deduct expenses you have while on your vacation that are directly related to your business.

Travel outside of the United States

If you travel outside of the U.S., some of the costs for travel to and from your destination may be limited depending on the business purpose of the travel.

- If your travel is entirely business-related, then all travel expenses can be deducted.

- If some of your travel is business-related, then you must allocate your expenses between business and non-business activities. The IRS provides allocation rules for various travel scenarios in Publication 463 .

Where to enter information

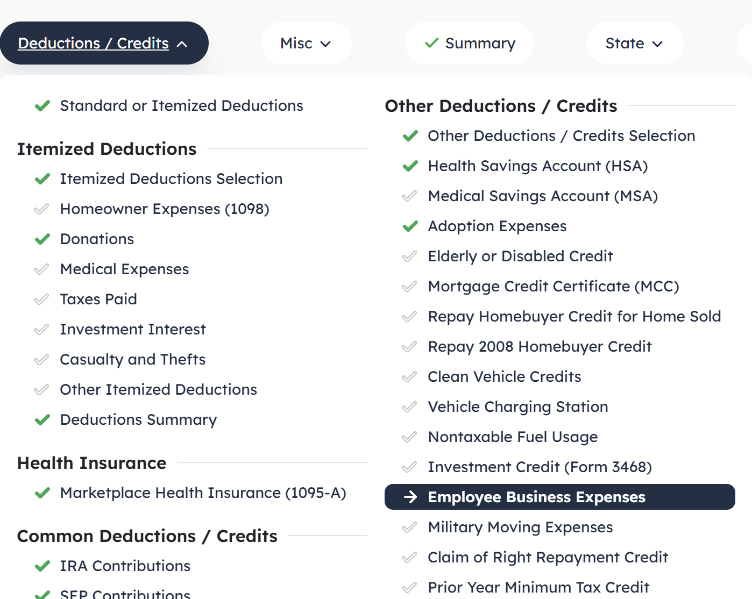

Job-related employee travel expenses

Entering the information into the software is done by following this menu path: Deductions/Credits > Other Deductions / Credits > Employee Business Expenses.

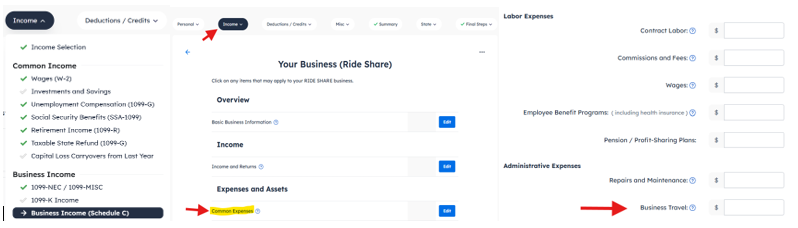

Self-employed travel expenses

Entering the information into the software is done by following this menu path: Income > Business Income > Business Income (Schedule C) > Common Expenses > Business Travel.

Concluding Thoughts

It’s very important to keep detailed records of your travel and expenses in case the IRS asks for proof of what you’ve claimed. As mentioned, if you are using per diem, you don’t have to have the receipts, however, you will still need records of the dates and destinations. As most employee-related travel expenses are no longer deductible on your tax return hopefully your employer provides reimbursement for that. As a sole proprietor you’ll generally be able to deduct all business-related travel expenses. Refer to chapter 5 of Publication 463 for information on how to prove certain business expenses and what are considered adequate records.