Contributed by: BarbaraL, FreeTaxUSA Agent, Tax Pro

What is IRS Form 1099-DA (Digital Asset Proceeds)?

Did you get a brand-new form this year titled Form 1099-DA and wonder what it even means or what you’re supposed to do with it?

Starting in calendar year 2026, you might receive a 1099-DA if you sold, traded, or got rid of cryptocurrency or another digital asset, for tax year 2025. The IRS created Form 1099-DA to help track digital asset activity and make sure taxpayers are reporting their crypto sales correctly. It works a lot like Form 1099-B for stocks, but it’s made just for digital assets.

Whether you’re a casual investor or all-in on crypto, this article will help you understand why you got one, what the 1099-DA reports, and how to handle it when you file your taxes.

Who will receive Form 1099-DA?

If you sold or exchanged a digital asset, like Bitcoin, Ethereum, NFTs, or even stablecoins on a crypto exchange or platform, there’s a good chance you’ll get a 1099-DA in early 2026.

The IRS now requires many digital asset brokers (such as Coinbase, Kraken, and others) to report certain transactions to both you and the IRS. You may get one if:

- You only sold a small amount

- You moved assets between wallets (if they triggered a sale)

- The platform didn’t report the basis (what you paid originally)

Note: As of April 2025, DeFi platforms (like decentralized exchanges) don’t have to send Form 1099-DA, so you won’t get one for trades on those platforms. You still need to report your DeFi sales to the IRS yourself.

What’s reported on the 1099-DA?

Each transaction will be broken down with information like:

- The digital asset name and type

- Date you bought and sold it (if known)

- Gross proceeds from the sale

- Your cost basis (if the platform has it)

- Type of gain (short-term or long-term)

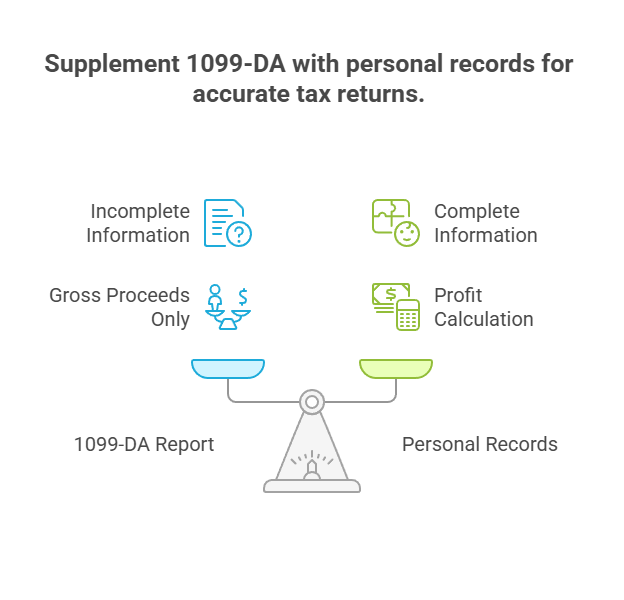

If the broker doesn’t have complete information (like when or how you originally got the crypto), the cost basis box might be blank, which means you’ll need your own records to complete the return accurately.

Note: The 1099-DA is meant to show the gross proceeds of your digital asset transactions. That’s the total amount you received, not necessarily your profit.

Where do I enter a 1099-DA in FreeTaxUSA?

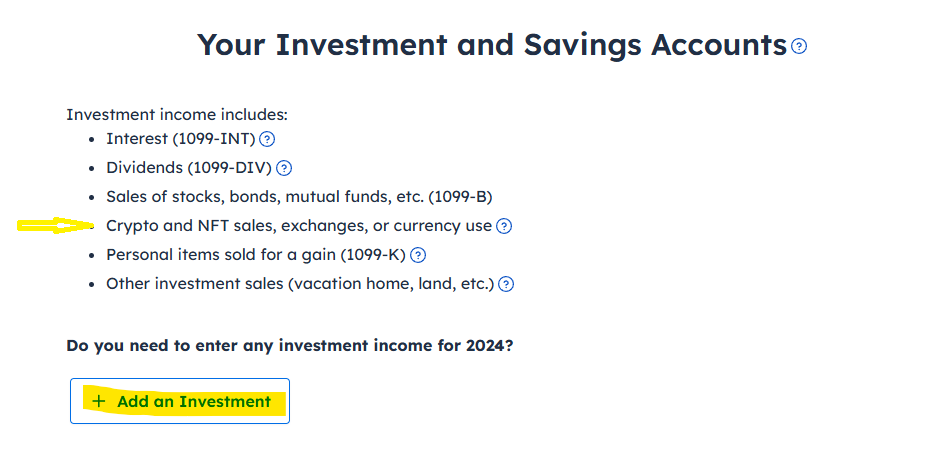

In FreeTaxUSA, digital asset sales are treated just like any other investment sales.

Follow this menu path: Income > Investments and Savings > Crypto and NFT Sales

That’s where you’ll enter your 1099-DA info.

Since Form 1099-DA is new, it may not appear by name yet, but the fields will line up with what’s on the form. You’ll enter:

- The name of the digital asset

- Date acquired and date sold (if listed)

- Sales proceeds (gross amount received)

- Cost basis (if provided, or enter your own if not)

Tip: If you have multiple crypto transactions, you can enter them one at a time or group them if they share the same dates and type of asset.

⚠️ Always double-check the cost basis. Many exchanges don't track your cost basis, especially if you transferred crypto in from a private wallet. If the cost basis is missing, you’ll need to report your original purchase amount to avoid paying tax on the full proceeds.

Example: Reporting a Crypto Sale

Let’s say you bought 0.5 BTC (Bitcoin) for $10,000 in April 2022 and sold it for $15,000 in June 2025. Your 1099-DA shows:

Bitcoin | 04/01/2022 | 06/10/2025 | $15,000 | $10,000 | $5,000 gain

In FreeTaxUSA, you’d go to the Investments and Savings section and enter:

- Asset: Bitcoin

- Date acquired: 04/01/2022

- Date sold: 06/10/2025

- Sales price: $15,000

- Cost basis: $10,000

Since you held it more than one year, it’s a long-term capital gain and will be taxed at a lower rate.

For more information on reporting crypto currency transactions visit our Crypto Currency page.

Common issues to watch out for:

- No 1099-DA? You’re still required to report. If a platform didn’t send you a 1099-DA, the IRS still expects you to report digital asset sales. You’ll use your own transaction records.

- Missing or incorrect basis. Some 1099-DAs might not show cost basis—don’t ignore it! Not entering a cost basis means you’ll pay tax on the entire amount. Use your personal records to determine your cost basis.

- Airdrops, mining, and staking income don’t belong on this form. They’re usually reported as ordinary income, not capital gains.

Tips for staying ahead:

- Track your transactions all year long.

- Use a crypto tax tool like CoinTracker or Koinly.

- Keep a record of all wallet addresses.

- Check your 1099-DA carefully.

Final thoughts

The IRS is getting more serious about crypto, and Form 1099-DA is just the beginning. If you traded, sold, or otherwise got rid of digital assets in 2025 or later, you’ll likely see this form in your mailbox or inbox early in the filing year.

Don’t panic. With a little prep, good records, and FreeTaxUSA’s simple tools, you can get your taxes filed correctly and keep your crypto journey going strong.

Helpful Resources