Contributed by: Daniel_L, FreeTaxUSA Agent

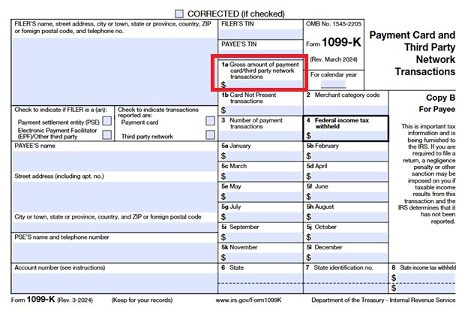

Form 1099-K

Form 1099-K reports electronic payments you received for goods or services through credit cards, debit cards, or any other third-party payment network like Venmo or PayPal.

Your 1099-K filer or issuer records these transactions. When the threshold is met by dollar amount and number of transactions, the issuer sends a copy of the form to you, the IRS, and any necessary state tax entity providing a summary total of the reportable income your account received during the year.

What needs to be reported?

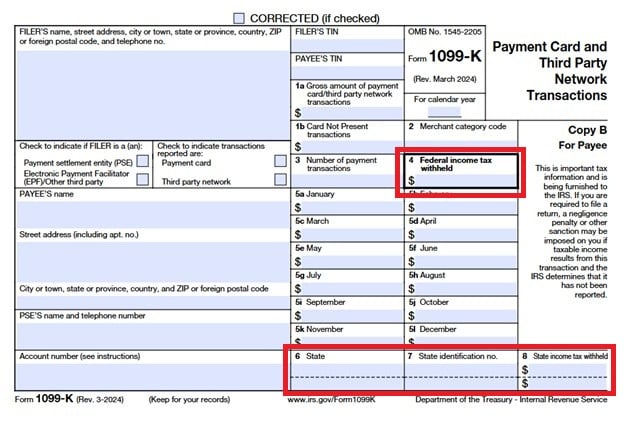

Generally, there are three sections you may need to report:

- Total income reported (box 1a)

- If any income tax was withheld (boxes 6-8)

- If any taxable income reported varied drastically during periods in the year which affected your expected estimated tax payments (box 5)

If you have information reported in these three sections, the information below will cover what to do and where to enter the information in FreeTaxUSA.

Total income box 1a

Box 1a is essentially the most important part of Form 1099-K. You’ll need to account for the full amount reported in box 1a (gross amount of payment card/third party network transactions) on all 1099-K forms you receive. Box 1a is a resource for you, the IRS, and state tax departments to identify taxable income.

Determine the type of income

You’ll rely on any year-end statement from the form issuer along with your knowledge and personal records to determine the type of transactions (personal, business, or rental) that make up the total income reported in box 1a. Once you’ve identified transaction types (they can be all one type or multiple types), you can ensure each type is accounted for in the appropriate place on your tax return. For example, business income is generally included on Schedule C, and most rental income is reported on Schedule E.

Enter the income

After you’ve categorized the income reported on your 1099-K, enter it into the software as follows:

- Personal transactions:

- For Personal items sold for a loss OR incorrect 1099-K payments included in error, select the appropriate option using the screens in the menu path: Income > Business Income > 1099-K.

- For Personal items sold at a gain create an investment entry using the menu path: Income > Common Income > Investments and Savings.

- To enter business transactions, follow menu path: Income > Business Income > Business Income (Schedule C). Select Edit next to the business; select Edit next to Income and Returns. Continue through the screens until you reach the Tell us about your income (Business). Enter income on your 1099-K included with other income NOT on a 1099-NEC/1099-MISC in the Gross Receipts and Sales box.

To enter Rental transactions, use menu path: Income > Business Income > Rental Income (Schedule E). Select Edit next to Income. Continue through the screens until you reach the Rental Income page. Enter the amount on your 1099-K in addition to other income NOT reported on Form 1099-NEC/1099-MISC.

Entering income tax withheld (boxes 6-8) in FreeTaxUSA

It isn’t common to have income tax withheld reported on a 1099-K, but if income tax was withheld and reported in boxes 4 or 8, you’ll want to be sure to report it.

To enter income tax withheld when your 1099-K reports personal items sold at a gain, simply add the federal or state amount on the investment’s entry screen as prompted.

If you’ve had income tax withheld for most other types of transactions on your 1099-K, enter the amount withheld in the corresponding entry line by following menu path: Misc > Payments > Extension and Other Tax Payments.

1099-K box 5

Most of the other information on your 1099-K is informational including amounts in box 5. These amounts are generally useful only if you need to explain to the IRS or state when the income was received during the year for estimated tax payment purposes, as it may help in waiving all/part an underpayment penalty.

If you find yourself facing an underpayment penalty and box 5 shows higher year-end income, you may be able to apply the annualized income installment method. To do so, follow menu path: Misc > Payments > Underpayment Penalty (Form 2210).

Recap

If you receive form 1099-K, be sure to account for the amount in box 1a on your return. This may mean a single entry or multiple entries such as personal, business, and/or rental income entries. If income tax was withheld (boxes 4, and 6-8) be sure to enter those payments.

Finally, if you face an underpayment penalty, be sure to review box 5 for indication that your income was significantly more at year end to see if you qualify to remove part or all of the penalty.