Contributed by: JanaA, FreeTaxUSA Agent, Tax Pro

What is the energy credit?

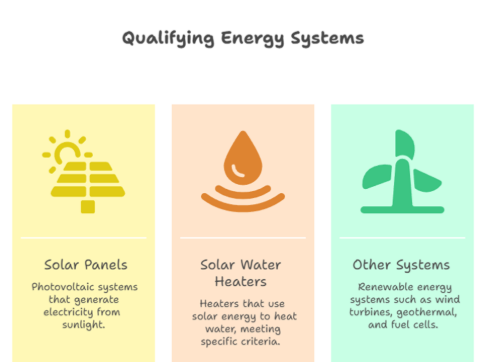

The residential clean energy credit is a tax credit that allows you to deduct a percentage of the cost of installing qualifying solar energy systems. This credit is applied to your federal tax liability to reduce your tax amount due.

Credit amount

- For systems installed in 2022 through 2025, the credit is 30% of the total cost (including equipment and installation).

- Originally, the credit was slated to last through 2034, and the percentage rates were set to drop to 26% for systems installed in 2033 and 22% in 2034. However, with the passing of the One Big Beautiful Bill Act, the credit will no longer be available for expenditures made after 2025.

Eligible costs:

- Equipment

- Labor for installation

- Permitting fees

- Wiring, inverters, and mounting equipment

Who qualifies?

- The credit is for homeowners who install solar systems on their primary or secondary residences in the U.S.

- Rentals and leased systems generally do not qualify (the owner/installer claims the credit).

- The easiest way to know if a purchase meets the energy efficiency criteria is if the manufacturer has a certification statement included in the packaging or a certificate that can be downloaded from the company website where it proves that the material you bought qualifies. Keep the manufacturer's certification document with your tax records.

No cap

- There is no maximum limit on the credit for most systems (except for fuel cells).

Carryforward

- This is a nonrefundable credit, meaning it can reduce your tax bill to zero, but you won’t get a refund above this amount. If your credit exceeds your tax liability, any remaining amount will be carried forward until the full credit has been realized.

How to claim

- File IRS Form 5695 with your federal tax return.

- FreeTaxUSA supports preparing this tax form and will generate all the calculations for you based on the information entered.

Important considerations

- State incentives: Many states offer additional incentives, rebates, or credits. These can be combined with the federal credit.

- Credit will be eliminated in 2026 as per the new OBBBA regulations. For more information, please visit our article, How does the One Big Beautiful Bill Act (OBBBA) impact energy efficient home improvement credits?

- Credit carryforward: If your tax liability is less than your credit, you can carry forward the unused portion to future tax years. Depending on your filing situation, it can possibly take years to realize the full tax credit. This is a common occurrence; let’s explore an example to help illustrate this situation:

Jane installs a solar system at her primary residence for a total cost of $30,000 in 2025. She qualifies for a residential clean energy credit of $9,000 ($30,000 x 30%). When filing her tax return, after deductions and other credits are considered, her tax liability is $5,800. Jane can apply $5,800 of the credit to reduce her tax liability to zero. The remaining $3,200 will be carried forward to Jane’s 2026 tax return.

Hopefully the details of the residential clean energy credit are clearer now! If you still have questions, FreeTaxUSA customer support is available to help as you prepare your tax return.